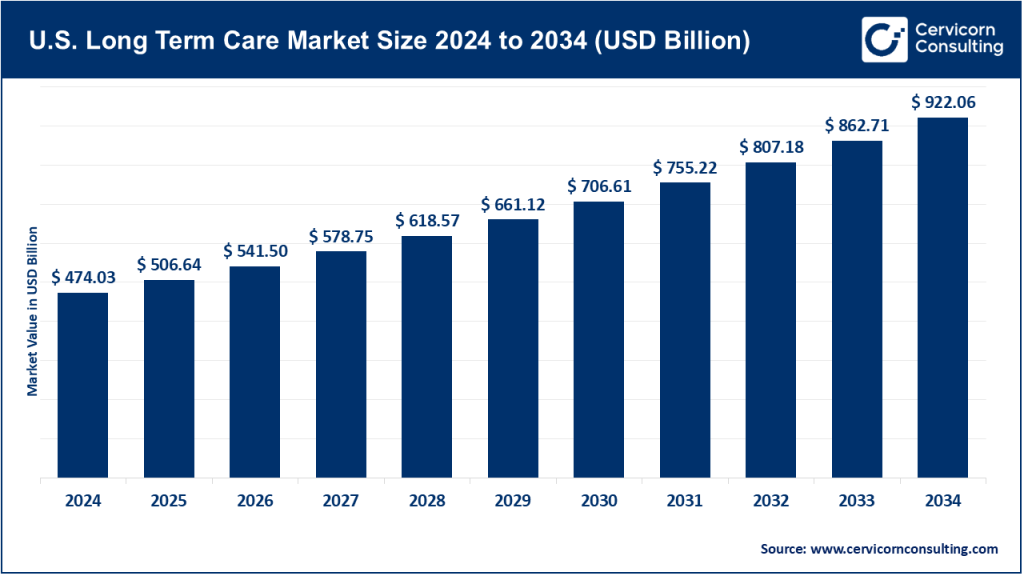

U.S. Long-Term Care Market Size

U.S. long-term care market — Growth Factors

The U.S. long-term care market is being propelled by a persistent demographic tidal wave of aging Baby Boomers, rising prevalence of chronic diseases and dementia, growing preference for home-based care, expansion of Medicare Advantage and value-based payment models that reward lower-cost site-of-care settings, continued workforce and staffing investments (and challenges), and steady technology adoption such as remote monitoring, telehealth, and care coordination platforms. These factors combine with payor shifts including more risk-bearing managed care contracts and bundled payments, regulatory changes that favor home and community-based services, and capital flows into acquisitions and platform roll-ups. Together, they expand demand for skilled home health, hospice, assisted-living and post-acute services while encouraging consolidation and vertical integration across providers and payers.

What is the U.S. long-term care market?

“Long-term care” in the U.S. covers a spectrum of services that support people with chronic illness, disability or functional limitations over extended periods. It includes institutional care such as skilled nursing facilities and nursing homes, assisted living and memory care, home health including skilled nursing, therapy and home health aides, hospice and palliative care, and supportive community services. Payers include Medicare for post-acute skilled home health and some hospice, Medicaid as the major payer for institutional LTC and long-term supports, private pay, and commercial insurers including Medicare Advantage. The industry is highly fragmented, with thousands of small agencies and care homes operating alongside a smaller number of large, multi-state companies and health system-owned operations.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2709

Why is it important?

Long-term care underpins the health, dignity and financial security of older adults and people with chronic conditions. It relieves pressure on hospitals by enabling earlier discharge and home-based recovery, supports family caregivers, and is a major component of public spending since Medicaid is a principal funder of institutional LTC. From a system perspective, effective LTC reduces avoidable rehospitalizations, controls costs by shifting care to lower-cost sites, and improves quality of life. From a societal perspective, LTC policy and capacity influence intergenerational financial burdens, workforce participation due to family caregivers, and public budgets.

U.S. Long-Term Care Market — Top Companies

Brookdale Senior Living, Inc.

Specialization: Large operator of senior living communities including independent living, assisted living, memory care, and continuing care retirement communities.

Key focus areas: Resident services and care quality, asset management and leasing or management fee models, optimizing occupancy and service mix.

Notable features: One of the largest owners and operators of U.S. senior housing, with a mix of asset-heavy and managed properties. It also has exposure to entrance fee or refundable fee models in continuing care retirement communities.

2024 revenue: Approximately 3.13 billion dollars.

Market share and positioning: A leading national senior housing operator with one of the largest footprints in the senior-housing segment, though representing single-digit share of the overall U.S. LTC market.

Global presence: Primarily U.S. focused.

Genesis HealthCare

Specialization: Skilled nursing and rehabilitation services including inpatient skilled nursing facilities, post-acute care, and therapy.

Key focus areas: Short-term post-acute rehab partnerships with hospitals, therapy services, and management of skilled nursing facilities.

Notable features: One of the largest providers of skilled nursing and therapy services with a wide geographic footprint.

2024 revenue: Around 3.33 billion dollars.

Market share and positioning: One of the largest skilled nursing and post-acute chains in the U.S., concentrated in the institutional and post-acute segment.

Global presence: Primarily U.S. operations.

LHC Group, Inc.

Specialization: Home-based services including home health, hospice, and some facility-based post-acute services.

Key focus areas: Scalable home health operations, partnerships with health systems and payers, improving clinical outcomes in the home setting.

Notable features: Known for high density platforms of clustered agencies that enable efficiency and attractiveness to larger payers for home health capacity.

2024 revenue: Approximately 2.28 billion dollars.

Market share and positioning: Leading national home health operator with meaningful share within the home health segment.

Global presence: U.S.-centric.

Amedisys, Inc.

Specialization: Home health and hospice care, along with related home-based services.

Key focus areas: Clinical outcomes in home settings, partnerships with payers including Medicare Advantage, care coordination and post-acute transition management.

Notable features: Large national home health and hospice platform with significant M&A activity and payer partnerships.

2024 revenue: Around 2.35 billion dollars.

Market share and positioning: One of the largest national home health and hospice chains, with significant market share within home health services.

Global presence: Primarily U.S. operations.

Enhabit, Inc. (formerly part of Encompass Health)

Specialization: Home health and hospice, spun out from Encompass Health.

Key focus areas: Tech-enabled home care, scaling via acquisitions and de-novo locations, leveraging EMR and predictive analytics to optimize clinician routing and outcomes.

Notable features: Public company following separation from Encompass Health, with emphasis on market density and digital tools to reduce travel time and cost per visit.

2024 revenue: Approximately 1.035 billion dollars.

Market share and positioning: A top mid-to-large player in home health and hospice with significant regional density.

Global presence: U.S.-focused.

Note: The overall U.S. LTC market is very large and fragmented across institutional care, home health, hospice, and assisted living. Large companies often have meaningful share within a segment such as home health, but represent single-digit percentages of total LTC spending nationally.

Leading trends and their impact

-

Shift to Home and Community-Based Services: Payers and patients prefer home-based care for lower cost and better patient experience. This accelerates growth for home health and hospice players and encourages investments in remote monitoring, routing optimization, and telehealth.

-

Value-based payment and Medicare Advantage expansion: As Medicare Advantage enrollment grows, payers seek home-based providers to manage risk and avoid costly institutional stays, rewarding providers that can demonstrate reduced readmissions and cost per episode.

-

Consolidation and roll-ups: Fragmentation and scale economics have driven M&A, with platform roll-ups of small agencies into regional and national footprints. Larger platforms can invest in technology and compliance.

-

Workforce pressure and tech augmentation: Staffing shortages and wage inflation force operators to use technology such as scheduling, telehealth, and AI-driven routing to preserve margins and care quality.

-

Regulatory focus on quality, transparency, and payment updates: CMS rule-making and state Medicaid policies materially affect margins and service mix, creating both risks and opportunities.

-

Consumer expectations and non-medical supports: Seniors expect more personalized services such as meals, transportation, and social engagement. Payers increasingly recognize social determinants of health, leading to integrated models that combine clinical care with community supports.

Successful examples from the U.S. that influenced global practice

U.S. home-based post-acute bundles and hospital partnerships pioneered tight hospital–home collaborations to shorten length of stay and reduce readmissions. Elements of these transitional care models including comprehensive discharge planning, home visits, and remote monitoring have been adapted in countries seeking to reduce hospital bed pressure.

Value-based contracting pilots with Medicare Advantage bundled post-acute payments and included home health performance metrics, which have been used as blueprints in nations experimenting with capitated payments for elderly care.

Clinical and operational playbooks for hospice in the home, including clinical guidelines and volunteer or family caregiver integration approaches, have informed palliative care development programs in countries expanding community-based end-of-life services.

While institutional and regulatory differences mean U.S. models aren’t copied wholesale, the operational emphasis on home care, measurement of outcomes, and tech-enabled workflows are transferable.

Government initiatives and policy levers shaping the market

Medicaid HCBS enhancements and waivers expand home-care opportunities and create market demand for agencies that can serve Medicaid populations.

CMS home health rules and PDGM adjustments affect reimbursement methodology and force providers to adapt operationally with technology, analytics, and care pathways.

Workforce investments and minimum staffing regulations raise labor costs but can improve quality and reduce turnover, changing franchise economics for facilities and home health networks.

Value-based payment incentives and Medicare Advantage growth favor home-based providers and integrated care models, reducing reliance on institutional post-acute stays.

Regulatory standards for assisted living and memory care, including licensing and quality reporting, shape the competitive landscape for senior housing operators.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Clinical Decision Support Systems Market Growth Drivers, Trends, Key Players & Regional Insights by 2034