Structural Steel Market Overview

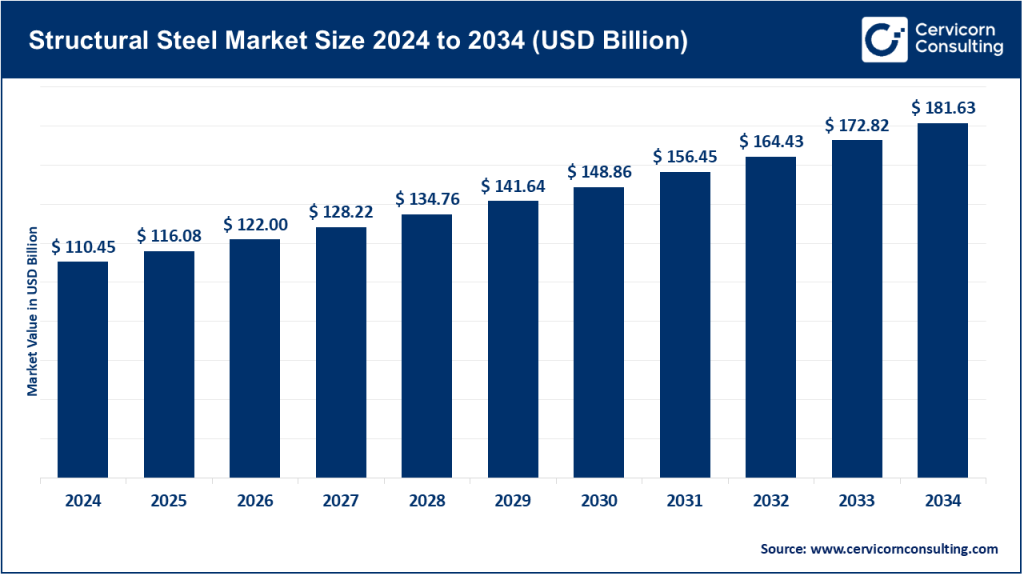

In 2024, the global structural steel market size is valued at USD 110.45 billion and is expected to hit around USD 181.63 billion by 2034, growing at a CAGR of around 5.1% from 2025 to 2034. Rising demand for durable, cost-efficient, and sustainable construction materials, along with government-backed infrastructure projects, continues to drive market expansion.

What is the Structural Steel Market?

The structural steel market encompasses the production, distribution, and utilization of steel products used in load-bearing applications such as beams, columns, channels, angles, girders, and plates for construction and manufacturing industries. Structural steel is prized for its high strength-to-weight ratio, versatility, recyclability, and cost-effectiveness compared with alternative materials like concrete or wood.

It is widely applied in residential, commercial, and industrial construction, along with transportation infrastructure (bridges, railways, airports, and highways), energy (oil & gas platforms, power plants, wind turbines), and advanced manufacturing. Thanks to its ability to withstand high stress, resist corrosion (with coatings/alloys), and support prefabrication and modular methods, structural steel remains indispensable to modern urbanization.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2699

Why is Structural Steel Important?

- Strong and Lightweight: High load-bearing capacity with optimized foundations.

- Versatile: From skyscrapers and stadiums to factories and bridges.

- Durable: With appropriate design and coatings, resists fire, fatigue, and harsh environments.

- Eco-Friendly: 100% recyclable, integral to circular economy and low-carbon construction goals.

- Efficient: Enables modular and prefabricated construction, shortening timelines and reducing labor costs.

Governments and industries increasingly rely on structural steel to meet sustainability targets, infrastructure modernization, and renewable energy expansion, solidifying its status as a backbone of industrial progress.

Structural Steel Market Growth Factors

Growth in the structural steel market from 2025 to 2034 is propelled by rapid urbanization and infrastructure upgrades worldwide; rising construction investments in commercial real estate, industrial parks, and affordable housing; and a broad policy push for resilient, low-carbon infrastructure. Technology improvements—such as prefabrication and modular building, Building Information Modeling (BIM) integration, automation/robotics in fabrication, and advanced protective coatings—are boosting quality, speed, and lifetime performance.

Demand is further supported by renewable energy expansion (onshore/offshore wind), logistics and warehousing growth, and resilient manufacturing build-outs. The shift toward green steel (EAF, hydrogen, scrap optimization) dovetails with ESG commitments and green procurement, while higher building standards and seismic requirements favor high-strength low-alloy (HSLA) steels and innovative connection systems. Despite raw-material price volatility and competition from reinforced concrete, the combination of public spending, private investment, and sustainability mandates positions structural steel to expand steadily through the decade.

Structural Steel Market Top Companies

Tata Steel

- Specialization: High-strength structural and long steel for construction, automotive, and industrial applications.

- Key Focus Areas: Sustainability, digital operations, circularity, and green steel pilots.

- Notable Features: Strong product innovation in low-carbon steels and value-added sections.

- 2024 Revenue: ~USD 30 billion (group).

- Market Share: ~5.5% (structural/long steel positioning in core markets).

- Global Presence: Operations across India, the UK, the Netherlands, and SEA with service centers near key construction hubs.

ArcelorMittal

- Specialization: Broad portfolio in flat and long products, including high-strength grades for construction and infrastructure.

- Key Focus Areas: Low-carbon steelmaking (EAF, DRI/H2), advanced high-strength steels, and digitalized production.

- Notable Features: Vertically integrated from iron ore/scrap to finished steel; strong R&D and customer engineering support.

- 2024 Revenue: ~USD 68 billion (group).

- Market Share: ~9% globally across multiple steel segments.

- Global Presence: Extensive footprint across Europe, North and South America, and Asia with distribution networks serving EPCs and fabricators.

Evraz PLC

- Specialization: Structural steels, rails, pipe, and semi-finished products supported by mining integration.

- Key Focus Areas: Infrastructure-grade steels, energy transport, and heavy industry.

- Notable Features: Vertical integration enabling cost control and supply assurance for long products.

- 2024 Revenue: ~USD 12 billion (group).

- Market Share: ~2% in global long/structural segments.

- Global Presence: Activity across Russia, North America, and CIS/Europe with focus on rail and construction markets.

Baogang Group

- Specialization: Structural steels and rare-earth-enhanced steel products.

- Key Focus Areas: Metallurgical innovation, alloy development, and efficiency upgrades.

- Notable Features: Strong R&D base with integration to rare-earth materials for performance enhancements.

- 2024 Revenue: ~USD 18 billion (group).

- Market Share: ~3.5% in core regional markets.

- Global Presence: Concentrated in China with exports across Asia-Pacific and project-based global supply.

Gerdau S.A.

- Specialization: Long and structural steel via mini-mills and integrated facilities.

- Key Focus Areas: Scrap recycling, EAF efficiency, and product/value-added service centers.

- Notable Features: High circularity profile (significant share of production from scrap) and strong regional distribution.

- 2024 Revenue: ~USD 15 billion (group).

- Market Share: ~3% across the Americas.

- Global Presence: Robust presence in Brazil, North America, and Latin America with deep ties to local builders and fabricators.

| Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue | Market Share | Global Presence |

|---|---|---|---|---|---|---|

| Tata Steel | High-strength structural & long products | Sustainability, digital, circularity | Innovation in low-carbon steels | ~USD 30B | ~5.5% | India, UK, NL, SEA |

| ArcelorMittal | Flat & long for construction & infra | DRI/H2, EAF, AHSS | Vertical integration, strong R&D | ~USD 68B | ~9% | EU, Americas, Asia |

| Evraz PLC | Structural, rails, pipe | Infrastructure & energy | Mine-to-mill integration | ~USD 12B | ~2% | Russia, NA, CIS/EU |

| Baogang Group | Structural & rare-earth steels | Alloy innovation, efficiency | Rare-earth integration | ~USD 18B | ~3.5% | China & APAC exports |

| Gerdau S.A. | Long & structural via mini-mills | Scrap recycling, EAF | High circularity profile | ~USD 15B | ~3% | Brazil, NA, LatAm |

Leading Trends and Their Impact

- Green Steel Transition: EAF and hydrogen-ready DRI reduce CO2 intensity; green procurement and CBAM-style measures reward low-carbon supply, improving long-term competitiveness for early movers.

- Digitalized Steelmaking: AI/IoT-enabled mills and automated fabrication enhance yield, cut downtime, and improve traceability—key for large EPC projects with tight QA/QC.

- High-Strength, Lightweight Steels: HSLA and performance coatings enable longer spans, slimmer profiles, and superior seismic performance, supporting taller, lighter structures.

- Prefabrication & Modular Construction: Pre-engineered steel buildings (PEBs) and modular assemblies compress project schedules and reduce on-site waste, particularly for logistics, data centers, and healthcare.

- Circularity & Scrap Optimization: Rising scrap utilization and closed-loop jobsite returns align with ESG targets and reduce input cost volatility over time.

What Are Some Successful Examples of Structural Steel Around the World?

- Burj Khalifa, UAE: High-strength steel frameworks for extreme wind and height demands.

- One World Trade Center, USA: Steel selected for resilience, safety, and blast performance.

- Shanghai Tower, China: Composite steel systems delivering seismic resistance and efficiency.

- Millennium Bridge, UK: Innovative steel design balancing strength and dynamic response.

- Sydney Harbour Bridge, Australia: Enduring proof of structural steel durability in marine environments.

These projects highlight structural steel’s adaptability to architectural ambition and diverse environmental challenges—while demonstrating lifecycle value through maintainability and reuse potential.

Global Regional Analysis Including Government Initiatives and Policies

Asia-Pacific

The largest regional market driven by urbanization in China, India, and Southeast Asia. Massive outlays for transport corridors, metro/rail, airports, ports, and affordable housing sustain demand. Policies like national infrastructure pipelines, smart city missions, and industrial corridor programs accelerate steel-intensive construction. Environmental standards are raising adoption of EAF capacity, better coatings, and quality certification.

North America

Infrastructure modernization, energy transition, and reshoring of manufacturing support steady demand. Federal and state measures fund bridges, highways, ports, and grid upgrades, while Buy-America provisions and green-procurement preferences encourage local, lower-carbon steel. Prefabrication and design-build contracts are expanding steel’s share in logistics, data centers, and healthcare facilities.

Europe

Decarbonization leadership drives investment in hydrogen-based DRI and EAFs, alongside stricter building codes and circularity mandates. Carbon pricing and border adjustments reward lower-emission steel and recycled content. Retrofit programs for aging buildings, plus offshore wind build-out, underpin demand in structural sections and fabricated components.

India

A dedicated growth engine with strong policy backing: national infrastructure pipelines, freight corridors, industrial parks, and housing schemes. Standards and quality control orders favor certified structural products, while EPR and scrap policy reforms improve circularity. Rapid adoption of pre-engineered steel buildings is visible in warehousing, retail, and manufacturing.

Latin America

Brazil leads with robust mini-mill capacity and high scrap utilization, supporting construction, mining, and energy. Public-private partnerships for transport and utilities add visibility to the project pipeline. Regional volatility exists, but near-term warehousing and industrial projects are supportive.

Middle East & Africa

Mega-projects in the GCC—spanning smart cities, tourism, and energy—create significant demand for structural sections and heavy plate. In Africa, government-backed housing and transport projects, coupled with industrialization agendas, are increasing steel intensity per capita. Harsh climate requirements reinforce the need for performance coatings and corrosion-resistant grades.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Polyvinyl Chloride Market Top Companies, Trends, Growth Drivers & Global Analysis by 2034