Starch Derivatives Market Size

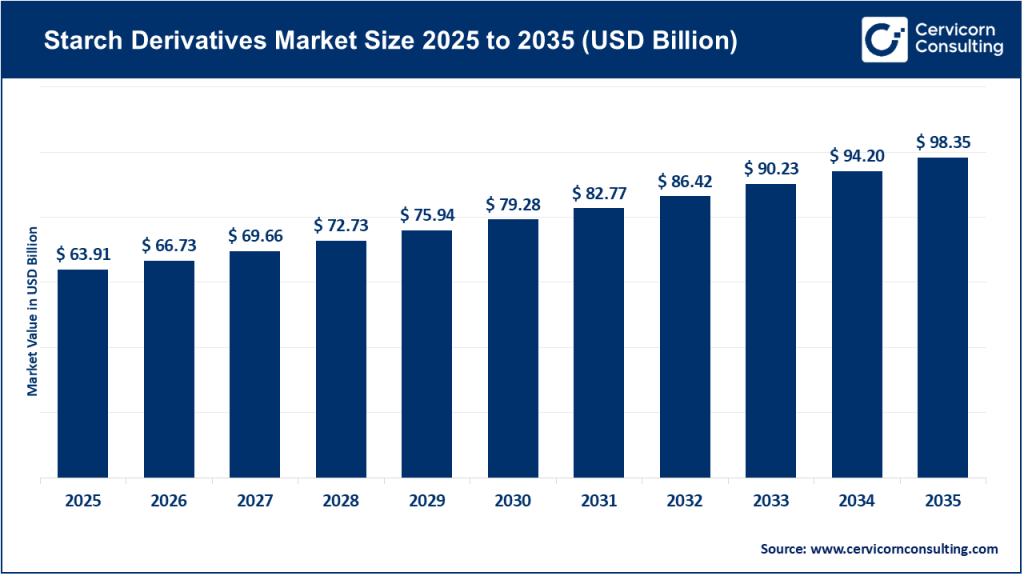

The global starch derivatives market size was worth USD 63.91 billion in 2025 and is anticipated to expand to around USD 98.35 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% from 2026 to 2035.

Growth Factors

Growth in the starch derivatives market is propelled by rising consumption of processed foods, increased reliance on clean-label and low-sugar formulations, and expanding applications in pharmaceuticals and nutraceuticals. Industrial users are also shifting toward bio-based binders and polymers due to sustainability mandates, while advancements in enzymatic, chemical, and physical modification technologies create higher-function, lower-energy derivatives suitable for advanced applications. Government incentives for food processing, agro-processing, and bio-based manufacturing — especially in the EU, US, and Asia — further accelerate investment. Additionally, diversification of feedstocks (corn, potato, tapioca, pea) and improved supply-chain integration among leading producers enhance resilience and market competitiveness. Collectively, these forces create strong demand pull from downstream industries and steady supply-side innovation.

What Is the Starch Derivatives Market?

The starch derivatives market covers companies that process native starch — typically extracted from corn, potato, wheat, tapioca, and pea — into functional ingredients through modification techniques such as hydrolysis, cross-linking, oxidation, esterification, and enzymatic treatment. These modifications transform standard starch molecules into derivatives with enhanced performance attributes. Key products include glucose syrups, maltodextrins, cyclodextrins, dextrins, modified starches, and starch-based hydrolysates used across food, beverage, pharmaceutical, chemical, paper, and industrial manufacturing sectors.

Each derivative is engineered to achieve specific functions: stabilizing sauces, improving tablet disintegration, enhancing adhesive tackiness, strengthening paperboard, or acting as biodegradable binders in packaging. Because the applications are so diverse, the starch derivatives sector spans multiple industries, making it one of the most versatile ingredient markets in the world.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2831

Why Is It Important?

Starch derivatives are essential to modern manufacturing. In food processing, they determine texture, process stability, shelf life, viscosity, and mouthfeel. In pharmaceuticals, they serve as excipients — binders, disintegrants, fillers, and controlled-release agents — playing an indispensable role in tablet and capsule formulation. In paper and packaging, they improve printability, paper strength, and coating performance while providing bio-based alternatives to petrochemical binders. In adhesives and construction, they offer low-toxicity, biodegradable, and cost-effective binding solutions.

Their growing importance also stems from the global transition to bio-based materials. As sustainability and circular-economy pressures intensify, starch derivatives have become key enablers for companies looking to replace fossil-derived polymers with renewable, biodegradable substitutes. This makes starch derivatives not just functional ingredients but critically strategic components in global decarbonization and sustainable manufacturing initiatives.

Top Companies in the Starch Derivatives Market (2024 Overview)

Below is a structured overview of leading global companies active in the starch derivatives market, including specialization, focus areas, notable features, 2024 revenue, market share indicators, and global presence.

1. Cargill Inc.

Specialization: Comprehensive portfolio of starches, sweeteners, modified starches, texturizers, and industrial derivatives.

Key Focus Areas: Food and beverage solutions, industrial starches for adhesives and paper, sustainability-driven ingredient innovation, vertically integrated sourcing.

Notable Features: One of the world’s largest privately held ingredient companies with deep expertise in enzymatic and process modifications.

2024 Revenue: Approx. USD 160 billion (total company revenue).

Market Share: Among the top global suppliers of starch derivatives.

Global Presence: Operations in more than 70 countries, extensive R&D and food innovation centers.

2. Emsland Group

Specialization: Potato-based starch derivatives, potato flakes, granules, and pea-based products.

Key Focus Areas: Clean-label solutions, industrial applications such as adhesives and paper, and value-added potato derivatives.

Notable Features: One of Germany’s largest potato starch processors with strong technological capability in specialty derivatives.

2024 Revenue: Estimated between €800 million and €900 million (company historical reporting range).

Market Share: Leading European potato starch derivative supplier.

Global Presence: Strong footprint across Europe with exports to North America and Asia.

3. Avebe U.A. (Royal Avebe)

Specialization: Potato starch derivatives for food, industrial, and specialty applications.

Key Focus Areas: High-value functional potato starches, clean-label texturizers, and cooperative farming integration.

Notable Features: Farmer-owned cooperative ensuring secure raw material supply and long-term innovation.

2024 Revenue: Estimated €700 million to €780 million based on recent annual reporting trends.

Market Share: One of Europe’s major potato starch derivative players.

Global Presence: Strong in the EU with growing exports to Asia and North America.

4. Tate & Lyle PLC

Specialization: Food and beverage ingredients — modified starches, sweeteners, dietary fibers, stabilizers.

Key Focus Areas: Reduced-sugar formulations, dietary fibers, starch-based texturizers for beverage and food manufacturing.

Notable Features: Publicly traded company with strong application development capabilities and a large global customer base.

2024 Revenue: Approximately £1.65 billion.

Market Share: Recognized as one of the leading global producers of specialty starch derivatives.

Global Presence: Presence in 120+ countries with manufacturing plants across Europe, the US, Asia, and Latin America.

5. Roquette Frères

Specialization: Plant-based ingredients — modified starches, cyclodextrins, maltodextrins, and pharmaceutical excipients.

Key Focus Areas: Pharma-grade starch derivatives, plant proteins, clean-label texturizers, sustainable bio-based materials.

Notable Features: Family-owned multinational known for advanced R&D and strong pharma excipient portfolio.

2024 Revenue: Approximately €4.5 billion.

Market Share: A global leader in both food and pharmaceutical starch derivatives.

Global Presence: Manufacturing and innovation hubs across Europe, North America, and Asia.

Leading Trends and Their Impact

1. Clean-Label, Natural, and Reduced-Sugar Products

Consumers continue to demand natural, transparent ingredient lists. Starch-based thickeners and maltodextrins are replacing artificial stabilizers.

Impact: Companies innovate enzymatically modified clean-label starches with improved heat and shear stability.

2. Growth in Pharmaceutical Excipients

Starch-based binders and disintegrants are critical in oral dosage forms.

Impact: Companies expand pharma-grade manufacturing, driven by stricter quality certifications and higher profit margins.

3. Shift to Bio-Based and Biodegradable Materials

Global pressure to reduce fossil-based plastics is boosting interest in starch-based films, adhesives, and coatings.

Impact: R&D investments target biodegradable starch polymers and industrial formulations.

4. Feedstock Diversification

With corn and potato supplies facing volatility, many processors are exploring tapioca, rice, and pea starches.

Impact: Diversification reduces supply risk and caters to regional ingredient preferences.

5. Advanced Modification Technologies

Cutting-edge enzymatic, thermal, and physical techniques enhance functional performance while reducing chemical use.

Impact: Enables penetration into high-value sectors like biopharma, packaging, and specialty chemicals.

6. Sustainability and Transparency

Manufacturers increasingly require environmental footprint data for compliance and branding.

Impact: Companies invest in lifecycle assessments, traceability platforms, and regenerative agricultural sourcing.

Successful Examples of Starch Derivatives Applications Worldwide

• Pharmaceutical Excipients Expansion (Roquette)

Roquette’s specialty cyclodextrins and starch-based excipients are widely used in drug delivery systems across Europe and North America. This reflects the success of transitioning from commodity derivatives to high-value, tightly regulated pharmaceutical markets.

• Cooperative-Driven Innovation (Avebe, Netherlands)

Avebe’s cooperative model enables farmers to supply high-quality potatoes and co-develop derivatives such as specialty modified starches used in clean-label food applications. This integrated approach is a benchmark for supply-chain efficiency.

• Integrated Ingredient Platforms (Cargill)

Cargill’s global processing and application labs help food companies reformulate sauces, snacks, baked goods, and beverages using modified starches and sweeteners. Their global scale makes them a reference model in starch derivative commercialization.

• EU Bio-Based Packaging Initiatives

European paper and packaging companies increasingly use starch derivatives to strengthen paperboard, improve coatings, and develop biodegradable packaging. This demonstrates the synergy between sustainability policy and industry innovation.

• Cassava-Based Starch Growth in Southeast Asia and India

Asian manufacturers continue to scale tapioca-based glucose syrups and modified starches to serve domestic food processing as well as international export markets. India’s growing processed food demand also boosts local production of starch syrups and industrial starches.

Global Regional Analysis — Market Dynamics and Government Policy Influence

Europe

Market Dynamics:

Europe has a mature starch industry with dominant potato and wheat starch segments. Growing demand for clean-label food ingredients, and innovative bioplastics and specialty derivatives, drives steady growth.

Government Initiatives:

- EU Green Deal and Farm-to-Fork Strategy encourage sustainable materials and bio-based ingredient adoption.

- Environmental labeling regulations favor naturally derived ingredients with low carbon footprints.

- R&D funding supports biodegradable packaging and industrial starch innovations.

Impact:

EU policy creates strong incentives for starch producers to innovate in bioplastics, adhesives, and functional food ingredients.

North America (US & Canada)

Market Dynamics:

The US hosts some of the world’s largest corn-based starch processing facilities. Starch derivatives are embedded in food, beverage, pharmaceuticals, and industrial manufacturing.

Government Initiatives:

- USDA bio-based product certification programs promote renewable industrial materials.

- Federal grants support biorefinery development and scale-up of bio-based polymers.

- Trade policies and agricultural support ensure stable corn supply chains.

Impact:

Strong R&D infrastructure and investment incentives keep North America at the forefront of specialty starch innovation.

Asia Pacific (China, India, ASEAN)

Market Dynamics:

Asia Pacific is the fastest-growing region. Rapid urbanization, expanded processed food markets, and growing pharmaceutical manufacturing fuel demand.

Government Initiatives:

- India’s Production-Linked Incentive Scheme for Food Processing supports large-scale ingredient processing.

- China’s industrial modernization policies emphasize bio-based materials and domestic ingredient production.

- Southeast Asian nations promote cassava/tapioca processing for export competitiveness.

Impact:

Demand growth, supportive policies, and abundant feedstocks make APAC the global growth engine of starch derivatives.

Latin America

Market Dynamics:

Regions like Brazil and Mexico leverage abundant corn and cassava supplies. Growth is driven by food processing and industrial applications.

Government Initiatives:

- Agro-industrial development programs encourage domestic processing rather than raw commodity export.

- Incentives for biodegradable materials and packaging stimulate R&D collaboration.

Impact:

Latin America is becoming an increasingly important exporter of starch derivatives and intermediate products.

Middle East & Africa

Market Dynamics:

Starch derivative usage is rising with expansion in food manufacturing and industrialization efforts. Cassava-rich African economies are exploring local processing capabilities.

Government Initiatives:

- Industrial diversification programs encourage import substitution by supporting local agro-processing units.

- International development agencies fund cassava processing and food-ingredient value chains.

Impact:

While still emerging, MEA shows strong potential, especially in tapioca-based derivatives and industrial applications.

How Government Policies Shape the Industry

1. Sustainability Regulations

Environmental legislation in Europe, North America, and parts of Asia pushes companies toward biodegradable starch derivatives, reducing dependency on petrochemical ingredients.

2. R&D and Biorefinery Support

Policies that fund bio-based materials accelerate technological innovation, allowing companies to develop higher-value derivatives.

3. Agricultural Policies

Subsidies and support programs for potato, corn, cassava, and pea farming secure raw material availability — critical for stable production.

4. Food-Processing Incentives

Programs such as India’s PLI and EU’s food innovation grants promote the expansion of ingredient processing industries, creating new market opportunities for starch derivatives.

5. Trade and Export Policies

Export incentives and trade agreements help regional players scale globally, especially in Asia and Latin America.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report:Artificial Intelligence (AI) in Defence Market Revenue, Global Presence, and Strategic Insights by 2034