Small Modular Reactor Market Overview

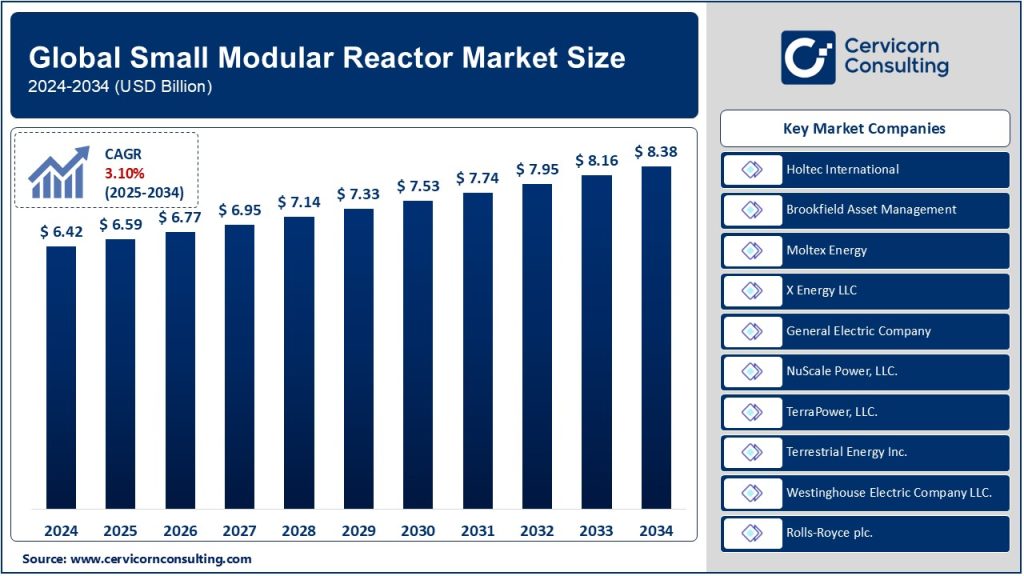

The global small modular reactor market was worth USD 6.42 billion in 2024 and is anticipated to expand to around USD 8.38 billion by 2034, registering a compound annual growth rate (CAGR) of 3.10% from 2025 to 2034.

The growth of the small modular reactor market is driven by several factors, including the global push for decarbonization to mitigate climate change, increasing energy demand in developing countries, advancements in nuclear reactor technology, and supportive government policies and funding. Rising concerns over energy security and the need to replace aging fossil fuel-based power infrastructure further propel market growth. Additionally, the modular and scalable nature of SMRs allows for cost-effective deployment in remote and off-grid locations, making them attractive for various industrial and utility-scale applications.

What is the Small Modular Reactor (SMR) Market?

The small modular reactor market refers to the sector involved in the development, production, and deployment of small-scale nuclear reactors that generate up to 300 megawatts (MW) of electricity per unit. Unlike traditional large nuclear reactors, SMRs are designed for modular construction, meaning they can be built in factories and transported to sites for assembly. This approach offers flexibility in scaling energy production, cost reductions through mass production, and enhanced safety features due to advanced passive safety systems. SMRs are increasingly viewed as a pivotal solution for clean and reliable energy generation, especially in remote areas and regions with limited energy infrastructure.

Importance of the Small Modular Reactor Market

The significance of the SMR market lies in its potential to address the global energy transition towards low-carbon and sustainable energy solutions. SMRs offer a scalable and cost-effective alternative to conventional nuclear power plants, enabling countries to meet decarbonization targets and enhance energy security. Their smaller footprint and modular nature make them suitable for diverse applications, including grid stability, industrial heating, and desalination. Additionally, SMRs are designed with advanced safety features, reducing the risk of catastrophic failures and making nuclear energy more socially acceptable. They are essential in bridging the gap between intermittent renewable energy sources and consistent baseload power.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2490

Top Companies in the Small Modular Reactor Market

Holtec International

- Specialization: Nuclear reactor design and manufacturing

- Key Focus Areas: SMR-160 design, spent fuel management, and decommissioning services

- Notable Features: Passive safety systems, modular construction

- 2023 Revenue (approx.): $1.2 billion

- Market Share (approx.): 12%

- Global Presence: North America, Europe, Asia-Pacific

Brookfield Asset Management

- Specialization: Asset management and investment in infrastructure and energy sectors

- Key Focus Areas: Investment in nuclear energy assets through Westinghouse Electric Company

- Notable Features: Financial backing for nuclear projects, portfolio diversification

- 2023 Revenue (approx.): $100 billion (total), nuclear-specific revenue undisclosed

- Market Share (approx.): 8%

- Global Presence: North America, Europe, Asia-Pacific

Moltex Energy

- Specialization: Advanced nuclear reactor technologies

- Key Focus Areas: Stable Salt Reactor (SSR) technology

- Notable Features: Use of molten salt as coolant, waste recycling

- 2023 Revenue (approx.): $150 million

- Market Share (approx.): 5%

- Global Presence: Canada, UK, Europe

X Energy LLC

- Specialization: High-temperature gas-cooled reactors (HTGR)

- Key Focus Areas: Xe-100 reactor development, TRISO fuel technology

- Notable Features: High thermal efficiency, advanced fuel safety

- 2023 Revenue (approx.): $200 million

- Market Share (approx.): 6%

- Global Presence: North America, Europe

General Electric Company (GE Hitachi Nuclear Energy)

- Specialization: Energy solutions, including nuclear power technologies

- Key Focus Areas: BWRX-300 SMR design

- Notable Features: Simplified design, cost-effective deployment

- 2023 Revenue (approx.): $76 billion (total), nuclear-specific revenue undisclosed

- Market Share (approx.): 10%

- Global Presence: Global, with a strong presence in North America, Europe, and Asia

Leading Trends and Their Impact

- Advanced Reactor Designs: Innovations such as molten salt reactors and high-temperature gas-cooled reactors are enhancing safety, efficiency, and waste management capabilities.

- Public-Private Partnerships: Governments are collaborating with private companies to fund and accelerate SMR deployment.

- Decentralized Energy Generation: SMRs are enabling localized power generation, reducing transmission losses, and improving grid resilience.

- Integration with Renewable Energy: SMRs are being integrated with renewable sources to provide grid stability and balance intermittent supply.

- Export-Oriented Strategies: Countries are positioning themselves as global leaders by exporting SMR technologies and expertise.

Successful Examples of SMR Deployment Worldwide

- NuScale Power (USA): Developed the NuScale Power Module, the first SMR design to receive U.S. Nuclear Regulatory Commission (NRC) approval.

- Russia’s Akademik Lomonosov: The world’s first floating nuclear power plant, providing energy to remote regions in the Arctic.

- China’s Linglong One: China National Nuclear Corporation (CNNC) is constructing the ACP100 reactor, the country’s first SMR under development.

- Canada’s SMR Roadmap: Canada is advancing various SMR projects, including partnerships with Moltex Energy and X Energy.

Regional Analysis: Government Initiatives and Policies Shaping the Market

North America

- United States: The U.S. Department of Energy (DOE) supports SMR projects with funding and regulatory reforms. NuScale Power received significant backing.

- Canada: The Canadian government is heavily investing in SMR technology to meet clean energy goals, with provinces like Ontario leading deployments.

Europe

- United Kingdom: The UK government supports SMRs through its Nuclear Sector Deal, aiming to deploy advanced reactors for decarbonization.

- France: France is exploring SMR technology as part of its strategy to renew its nuclear fleet.

Asia-Pacific

- China: Strong government support with projects like Linglong One to diversify its energy mix.

- Japan: Japan is revisiting nuclear energy, including SMRs, to enhance energy security post-Fukushima.

Rest of the World

- Russia: Leads in deploying floating SMRs, with plans to expand in remote Arctic regions.

- Middle East: Interest is growing in SMRs for desalination and power generation, particularly in Saudi Arabia and the UAE.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: RFID Printers Market Trends, Growth, and Key Players and Future Outlook by 2034