Silicon Carbon Battery Market Size

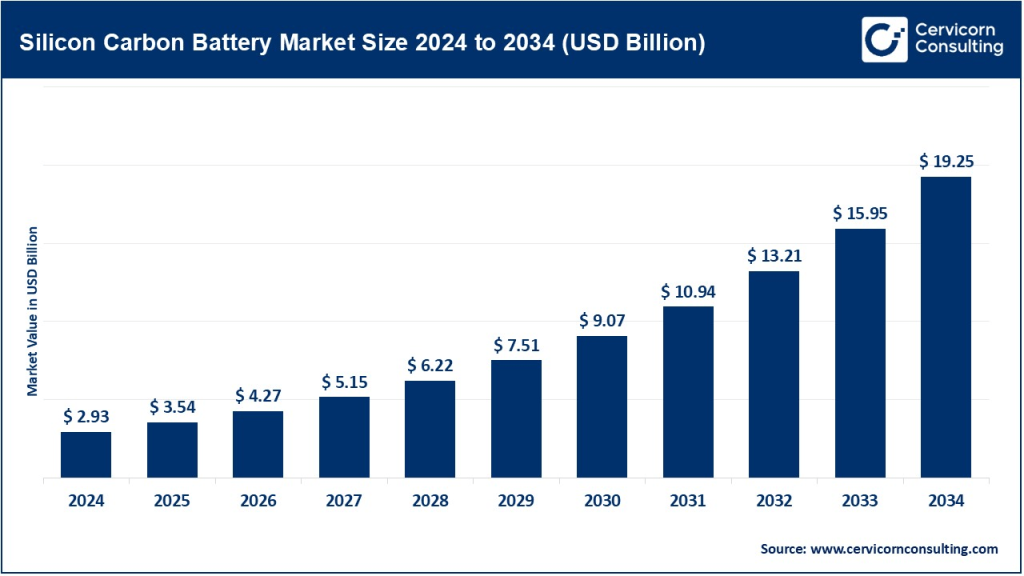

The global silicon carbon battery market size was worth USD 2.93 billion in 2024 and is anticipated to expand to around USD 19.25 billion by 2034, registering a compound annual growth rate (CAGR) of 20.71% from 2025 to 2034.

What Is the Silicon Carbon Battery Market?

The silicon carbon battery market refers to the ecosystem of batteries that integrate silicon–carbon composite anodes—where silicon is combined with carbon materials—to enhance the storage, energy density, and performance attributes of lithium-ion cells. These batteries leverage silicon’s high theoretical capacity (~3,600 mAh/g vs. 372 mAh/g for graphite) but mitigate its volume expansion issues by embedding it into conductive, carbon-based matrices. As EVs, portable electronics, and grid storage systems demand higher energy density and faster charging, silicon carbon batteries are gaining prominence due to their ability to boost range, reduce charge times, and extend calendar life—while still being compatible with existing lithium-ion manufacturing lines.

Silicon Carbon Battery Market Growth Factors

The silicon carbon battery market is witnessing rapid expansion driven by soaring demand for high-energy-density batteries in electric vehicles, consumer electronics, and energy storage systems; breakthroughs in silicon-anode materials and production techniques that reduce costs and mitigate volume expansion; continuous capital inflows from auto OEMs and tech firms; government incentives and mandates accelerating EV adoption; sustainability pressures pushing for cleaner, longer-lasting batteries; and improved supply-chain resilience via localized material sourcing and innovative partnerships—which together forecast global market growth.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2601

Why It’s Important

- Enhanced Energy Density & Range: Silicon carbon anodes can store significantly more energy than graphite, enabling EVs to achieve longer driving ranges.

- Faster Charging: These batteries support higher charge rates, increasingly favored by consumers and fleet operators.

- Extended Lifespan: Hybrid silicon–carbon structures reduce silicon’s volume expansion—boosting cycle life.

- Manufacturing Compatibility: They can be integrated into existing lithium-ion cell production lines with limited upgrades.

- Environmental Benefits: Use of locally sourced silicon, reduced material needs, and improved battery longevity contribute to sustainability goals.

- Strategic Leverage: OEMs adopting these batteries can secure competitive advantages in performance, cost, and green credentials.

Market Top Companies

Tesla, Inc.

- Specialization: Cutting-edge 4680 cells with silicon-carbon anodes; vertical integration across battery design, production, and EV deployment.

- Key Focus Areas: High-performance EV cells; cost reduction via gigafactory scale; mass-market energy storage (Powerwall).

- Notable Features: 4680 format enables 16% higher energy density and simplified assembly.

- 2024 Revenue: Tesla Energy segment reported ~$5 billion+; overall firm revenue >$90 billion.

- Market Share & Presence: Leading position in global EV and battery markets with manufacturing in US, China, Germany, and Texas.

Contemporary Amperex Technology Co. Ltd. (CATL)

- Specialization: Supplementing graphite with silicon–carbon composites across product lines.

- Key Focus Areas: Automotive cells, energy storage, battery recycling, and battery swapping infrastructure—1,000 stations in China, expanding into Europe.

- Notable Features: 100% key-mineral recycling, large-scale manufacturing.

- 2024 Revenue: Estimated >USD 60 billion; leading share in global EV battery capacity.

- Market Share & Presence: Dominates global EV battery supply; rapidly expanding emission-controlled swapping and recycling networks.

LG Energy Solution

- Specialization: Next-gen batteries (silicon, solid-state, sodium-ion).

- Key Focus Areas: Advanced anodes, supply chain integration via upstream investments.

- Notable Features: Producing 4680 cells; 14.5% share of global EV battery market.

- 2024 Revenue: ~$25 billion+; strong global OEM partnerships.

- Market Share & Presence: Manufacturing hubs in South Korea, Europe, U.S., China; participating in large-scale U.S. gigafactories.

Innovative Battery Technologies

- Specialization: Silicon-carbon composite materials and next-gen cell prototypes for niche applications.

- Key Focus Areas: Material R&D, flexible form factors, pilot projects.

- Notable Features: Customizable silicon–carbon blends, BMS-level optimization.

- 2024 Revenue: Likely in low-to-mid tens of millions; strategic engagements with battery companies.

- Market Share & Presence: Global R&D operations; key tech partner for OEMs and material suppliers.

Samsung SDI

- Specialization: Silicon-enhanced lithium-ion cells; leading role in energy storage systems.

- Key Focus Areas: High-power automotive cells, solid-state pilot lines.

- Notable Features: 2023 revenue of USD 17.2 billion; 5% market share in EV batteries; U.S. Indiana gigafactory via Stellantis joint venture.

- 2024 Revenue: ~USD 18 billion; operating income USD 1.25 billion.

- Market Share & Presence: Facilities in South Korea, Hungary, Indonesia; expanding U.S. capacity.

Leading Trends & Their Impact

- Silicon–Carbon Composite Scaling

R&D breakthroughs now allow scalable silicon-carbon composite integration into anodes, offering better cycle life and cost efficiency compared to pure silicon—driving OEM adoption. - 4680 Cell Format Standardization

Tesla’s 4680 cells with silicon carbon anodes have sparked industry-wide momentum for uniform, high-performance EV battery formats. - Strategic Supply-Chain Localization

Companies like Samsung SDI, LG, and CATL are investing in domestic gigafactories (U.S., Europe, APAC) to meet policy demands and reduce geopolitical risk. - Recycling & Circularity

CATL’s full-cycle recycling commitment complements efforts to develop bio-based or highly recyclable silicon materials, reducing upstream carbon footprints. - Government Support & Standards

Policies like IRA in the U.S., EU battery passport regulation, and national EV battery alliances incentivize silicon-carbon technology and domestic production. - Rising EV & Energy Storage Demand

The broader push for electrification across automotive, renewable energy, and consumer electronics accelerates silicon carbon adoption for meeting performance and longevity expectations.

Successful Examples Around the World

- Tesla: Scaling up silicon-carbon 4680 cells at its Texas and Germany gigafactories to increase energy density and reduce manufacturing costs.

- Samsung SDI–Stellantis JV: Developing two Indiana gigafactories producing high-performance cells, likely using silicon-enhanced chemistries.

- CATL: China’s battery giant expanded silicon–carbon and recycling tech, with 1,000 swap stations domestically and Europe entry planned.

- Panasonic–Sila Nanotech: Though focused on silicon powder anodes, their work demonstrates the global shift toward silicon-enhanced chemistries in EV batteries.

Regional Analysis & Government Initiatives

North America

- Market Size: Silicon anode battery segment hit USD 91.8 million in 2024; growth at ~50.9% CAGR to 2030.

- Initiatives: U.S. DOE provided USD 7.54 billion funding for Stellantis/Samsung SDI gigafactories; supports IRA incentives for domestic, low-carbon battery tech.

- Impact: Encourages silicon–carbon cell production at scale, reduces Chinese dependency.

Europe

- Trends: EU battery regulation encourages high-performance, traceable chemistries.

- CATL Expansion: Plans 10,000 swap stations across Europe, aligned with EU decarbonization goals.

- Outcome: Rise in silicon carbon adoption in EVs, supported by infrastructure growth.

Asia‑Pacific

- Innovation Hub: China, South Korea, Japan, and India lead R&D and production of silicon–carbon technology.

- Strategic Alliances: South Korea’s battery alliance aligns production with national EV ambitions.

- Market Dominance: Asia‑Pacific region accounts for 54% of silicon anode battery revenue in 2024.

Latin America / MEA

- Emerging Market: Investments in EV sharing projects, mining, and assembly lines augment demand.

- Government Role: Incentives for renewable storage and smart grids are pushing silicon-carbon adoption in the region.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Nuclear Power Market Analysis & Forecast to 2034