Red Biotechnology Market Size

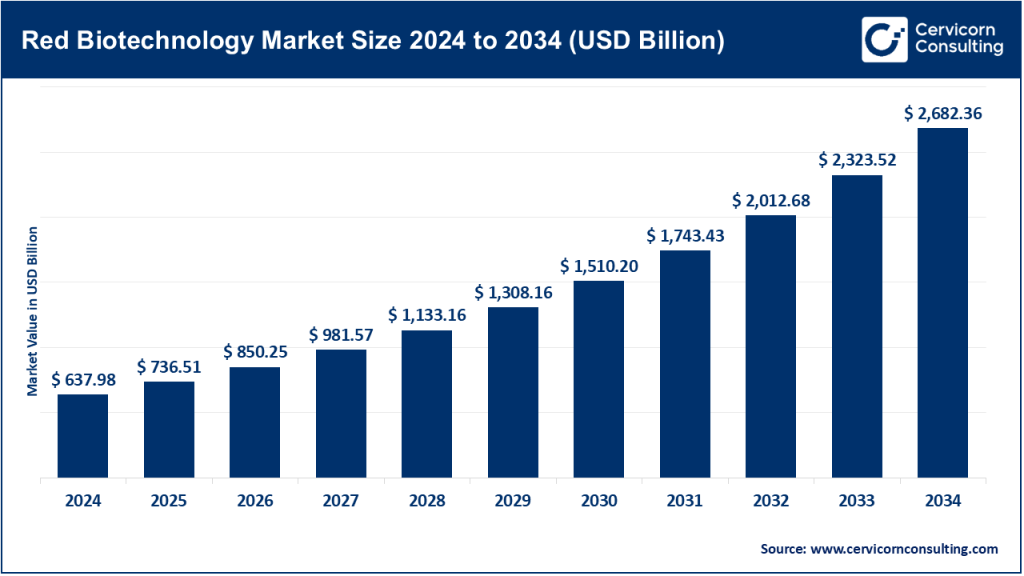

The global red biotechnology market size was worth USD 637.98 billion in 2024 and is anticipated to expand to around USD 2,682.36 billion by 2034, registering a compound annual growth rate (CAGR) of 15.44% from 2025 to 2034.

Red Biotechnology Market Overview

The red biotechnology market refers to the use of biotechnology in medical and pharmaceutical applications. It involves the development of biopharmaceuticals, vaccines, gene therapies, regenerative medicine, and diagnostic tools. With rising demand for personalized therapies and a surge in chronic and rare diseases globally, red biotech has emerged as one of the fastest-growing sectors in life sciences.

Why Is Red Biotechnology Important?

Red biotechnology plays a vital role in transforming global healthcare systems. It enables precision medicine, improves treatment efficacy, shortens recovery time, and reduces side effects. From producing life-saving monoclonal antibodies and mRNA vaccines to engineering gene therapies for once-incurable conditions, red biotech enhances the quality of life and healthcare access globally.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2667

Growth Factors

The red biotechnology market is being propelled by an increase in chronic illnesses, a growing elderly population, technological advancements in molecular biology and genomics, rising investments in R&D, an uptick in personalized and precision medicine, and government incentives. Moreover, strategic collaborations, rapid regulatory approvals for biologics, and the success of mRNA vaccine platforms are accelerating adoption and commercialization of red biotechnology solutions worldwide.

Market Size and Forecast

- 2024 Market Valuation: Approx. $546.6 billion

- 2030 Forecast: Expected to reach nearly $1 trillion

- CAGR (2024–2030): ~10.5%

North America leads the market due to advanced biotech infrastructure and strong R&D, while Asia-Pacific is the fastest-growing region driven by increasing government support and healthcare reforms.

Top Red Biotechnology Companies

1. Amgen Inc.

- Specialization: Monoclonal antibodies, biologics

- Key Areas: Oncology, cardiovascular, inflammation

- Notable Products: Prolia, Repatha, Enbrel, Evenity

- 2024 Revenue: ~$33.4 billion

- Global Presence: Active in over 100 countries

2. Gilead Sciences, Inc.

- Specialization: Antivirals, oncology, immunotherapy

- Key Areas: HIV/AIDS, HCV, COVID-19, cell therapy

- Notable Products: Biktarvy, Veklury, Yescarta

- 2024 Revenue: Strong antiviral portfolio performance

3. Biogen

- Specialization: Neurological disorders

- Key Areas: Alzheimer’s, multiple sclerosis, ALS

- Notable Products: Tecfidera, Aduhelm, Spinraza

- 2024 Revenue: ~$9.8 billion

4. Pfizer Inc.

- Specialization: Vaccines, gene therapies, biologics

- Key Areas: Oncology, rare diseases, infectious disease

- Notable Products: Comirnaty, Ibrance, Vyndaqel, Paxlovid

- 2024 Revenue: ~$58.5 billion

5. Novartis AG

- Specialization: Gene therapy, biosimilars, oncology

- Key Areas: Rare diseases, ophthalmology, immunology

- Notable Products: Zolgensma, Cosentyx, Kymriah

- 2024 Revenue: Robust pipeline in gene and cell therapy

Leading Trends in Red Biotechnology

- Monoclonal Antibodies (mAbs): Making up over 40% of biotech drug revenue, widely used in cancer and autoimmune diseases.

- Gene & Cell Therapy: Transformative therapies like CAR-T and CRISPR-based edits offer one-time cures for complex diseases.

- mRNA Technology: Applied beyond COVID-19 in flu, cancer vaccines, and other infectious diseases.

- Companion Diagnostics: Increasing adoption to guide targeted therapy decisions.

- AI in Biotech: Used in drug discovery, genome sequencing, and clinical trial prediction.

- Rise of Biosimilars: Cost-effective biologic alternatives gaining traction worldwide.

Successful Red Biotech Examples Worldwide

- Zolgensma (Novartis): Gene therapy for spinal muscular atrophy — considered the most expensive single-dose drug ($2.1M), but curative.

- Comirnaty (Pfizer-BioNTech): First mRNA-based COVID-19 vaccine — generated over $100 billion in combined revenue since launch.

- Spinraza (Biogen): Breakthrough antisense therapy for spinal muscular atrophy.

- Yescarta (Gilead): CAR-T cell therapy for large B-cell lymphoma — one of the first FDA-approved cell therapies.

Global & Regional Market Insights

🌎 North America

- Dominates the global red biotech market (~35–38% share)

- High R&D expenditure, favorable regulatory pathways (e.g., FDA Accelerated Approval)

- National Institutes of Health (NIH) funding supports rare disease, oncology, and genomic medicine research

🇪🇺 Europe

- Strong presence of biopharma giants and biotech clusters (e.g., Germany, Switzerland)

- European Medicines Agency (EMA) supports orphan drugs and fast-track reviews

- Horizon Europe program funds cross-border biotech research

🌏 Asia-Pacific

- Fastest-growing red biotech region (projected CAGR ~12–14%)

- China’s “Made in China 2025” & India’s biotechnology policy stimulate domestic innovation

- Expansion of gene therapy trials and local vaccine manufacturing

🌍 Latin America & Middle East & Africa (MEA)

- Emerging interest in biotech partnerships, tech transfer, and clinical research

- Brazil’s ANVISA and South Africa’s SAHPRA modernizing regulatory structures

- Increased investment in biologic manufacturing capabilities

Government Initiatives & Policies Shaping the Market

- USA: Biden Cancer Moonshot, Orphan Drug Act incentives, NIH & BARDA funding

- EU: Horizon Europe, European Innovation Council, orphan designation support

- China: National Biotech Development Plan, Biopharmaceutical Industry Action Plan (2021–2025)

- India: National Biotechnology Development Strategy, Biotech Parks initiative

Key Takeaways

- The red biotechnology market is a cornerstone of modern medicine.

- Monoclonal antibodies, gene therapy, and mRNA tech are revolutionizing treatment paradigms.

- Top companies like Amgen, Pfizer, and Novartis are investing billions in R&D and pipeline expansion.

- Supportive regulations and public funding globally are driving regional innovation and access.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Pharma 5.0 Market Size to Reach USD 92.65 Billion by 2034