Protein Market Size

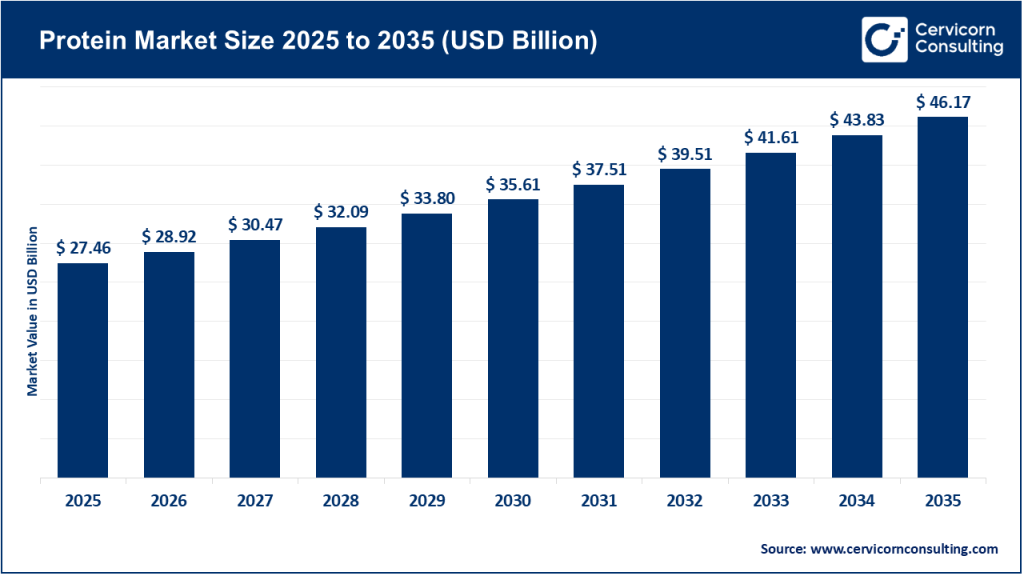

The global protein market size was worth USD 27.46 billion in 2025 and is anticipated to expand to around USD 46.17 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% from 2026 to 2035.

Protein Market Growth Factors

The global protein market is flourishing due to a combination of rising health awareness among consumers, shifts in dietary preferences toward high-protein foods and sustainable alternatives, innovation in processing technologies, and increasing disposable incomes—particularly in emerging economies across Asia-Pacific and Latin America. Demand is powered by trends in sports nutrition, weight management, aging populations looking for muscle retention, and expanding uses of specialty and functional proteins in food and beverages. Plant-based proteins are gaining traction driven by sustainability concerns, while precision fermentation and novel protein sources such as microbial, insect-derived, and algae proteins are attracting investment. Government policies promoting nutrition, fortified foods, and research funding for alternative proteins are further catalyzing growth.

Meanwhile, advances in membrane filtration, enzymatic hydrolysis, and flavor enhancement technologies are enhancing protein performance and broadening applications across food, feed, and health sectors, all contributing to substantial market expansion and diversified revenue streams for industry participants.

What Is the Protein Market?

The protein market refers to the global industry that produces, processes, distributes, and sells proteins derived from animal, plant, and novel sources for use in food and beverage, dietary supplements, sports nutrition, infant formula, functional foods, and animal feed applications. These proteins include dairy-based proteins (e.g., whey, casein), meat and poultry proteins, plant proteins (soy, pea, rice), and emerging proteins such as microbial, insect, and algae-based varieties. The market also encompasses protein ingredients used by manufacturers to enhance nutritional profiles, improve texture, and develop specialty health products, forming a multi-billion-dollar ecosystem that bridges agriculture, food science, and consumer nutrition.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2886

Why Is the Protein Market Important?

The protein market’s significance lies in nutrition, public health, economic value, and food security:

- Nutrition & Health: Protein is essential for muscle growth, immunity, hormone regulation, and overall metabolism, fueling demand for protein-fortified diets worldwide.

- Consumer Trends: Increasing awareness of fitness and wellness, coupled with diets like high-protein, ketogenic, and flexitarian lifestyles, has boosted protein consumption.

- Food Security: Proteins are central to global efforts to address malnutrition and dietary deficiencies, especially in developing regions.

- Economic Impact: Protein products represent a major share of food and beverage markets, generating significant employment and economic activity across agriculture, processing, and retail segments.

- Innovation & Sustainability: Investments in alternative proteins promise reduced environmental footprints and new solutions to meet growing population demands.

In essence, the protein market is foundational to how societies nourish their populations, innovate food systems, and transition toward healthier, sustainable lifestyles.

Key Players in the Global Protein Market

Below is a detailed look at some influential companies shaping the protein industry — their specialization, focus areas, notable features, 2024 revenue estimates, market share or positioning, and global presence.

1. Cargill, Incorporated

Specialization & Focus Areas:

Cargill is a diversified agribusiness leader producing meat, poultry, and a wide range of protein ingredients for food manufacturers, foodservice, and consumer products. It has capabilities in commodity proteins and advanced protein solutions, serving global food industry needs. The company also trends into specialty proteins, including plant and pulse protein segments and protein innovation hubs in Europe.

Notable Features:

Cargill’s research highlights the dramatic increase in global protein consumption, signaling strong demand growth. The company’s innovation centers and protein profiling series underscore shifting consumer behavior toward protein-rich diets.

2024 Revenue & Market Position:

Cargill’s overall revenue was approximately US$160 billion in 2024, making it one of the largest players influencing protein supply chains worldwide.

Global Presence:

With operations in more than 70 countries and products sold in over 125 markets, Cargill maintains enormous reach across North America, Europe, Asia, Latin America, and Africa.

2. CHS Inc.

Specialization & Focus Areas:

CHS Inc. engages in agricultural supply, including protein ingredients like soy and pulse proteins. It operates processing plants and trade networks supplying protein products for food and feed markets.

Notable Features:

CHS brings cooperative-owned scale to the protein ingredients market, integrating farming supply with protein processing.

2024 Revenue & Market Position:

As a major agricultural cooperative, CHS’s financial footprint supports significant revenue flows from protein commodity operations, although segmented protein figures are proprietary.

Global Presence:

The company’s operations span the U.S. and export markets, providing protein ingredients internationally.

3. Arla Foods Ingredients Group P/S

Specialization & Focus Areas:

Arla Foods Ingredients focuses on milk-based proteins, including whey and specialized protein products for nutrition applications. It continuously expands capacity for high-value proteins and new production infrastructure.

Notable Features:

In 2024, Arla reported a 5.4% revenue increase to €1,015 million driven by strong demand for specialized protein products. Investments in new capacities and strategic production shifts highlight its commitment to nutrient-dense proteins and value-added ingredients.

2024 Revenue & Market Position:

The protein business is a core growth segment within Arla’s ingredients portfolio, contributing significantly to its multi-billion-euro dairy business.

Global Presence:

Arla Foods operates globally, with production units in Europe, joint ventures in South America, and distribution across major food markets worldwide.

4. Kerry Group plc

Specialization & Focus Areas:

Kerry Group is a leading provider of food, flavor, and nutrition solutions, including protein systems for food and beverage applications. It operates Taste & Nutrition segments delivering dairy, plant, and hybrid proteins.

Notable Features:

Kerry’s global technology centers focus on functional proteins, flavor optimization, and allergen-free solutions, making the company a strategic innovator in protein ingredient platforms.

2024 Revenue & Market Position:

Kerry reported revenues of €8.02 billion in 2023, supported by strong growth in ingredients and nutrition solutions.

Global Presence:

Headquartered in Ireland, Kerry supplies products to more than 140 countries, reinforcing a substantial global footprint.

5. Fonterra Co-operative Group Limited

Specialization & Focus Areas:

Fonterra is a prominent dairy cooperative focused on milk, whey, and dairy protein concentrates used across food, infant nutrition, and functional ingredient sectors.

Notable Features:

As one of the largest dairy exporters, Fonterra integrates high-value protein solutions into global supply chains. Its specialty proteins articulate premium quality for diverse applications.

2024 Revenue & Market Position:

In 2024, Fonterra reported revenue exceeding NZ$22.82 billion, reflecting strong market demand for dairy and protein inputs.

Global Presence:

Fonterra’s products are distributed worldwide, with strong positions in Asia, the Middle East, and the Americas.

Leading Trends in the Protein Market and Their Impact

The global protein market is evolving rapidly due to several key trends:

- Demand for Plant-Based and Alternative Proteins:

Consumer interest in plant-based proteins is fueling innovation in soy, pea, and novel sources like algae and microbial proteins. This shift reflects health, environmental, and ethical considerations. - Specialty and Functional Proteins:

Specialty proteins with targeted functional properties—such as hydrolysates, lactose-free proteins, and bioactive peptides—are gaining traction. These products meet specific nutritional and performance needs, especially in sports nutrition, clinical foods, and infant nutrition. - Innovation in Processing Technologies:

New processing processes like precision fermentation, membrane filtration, and enzymatic modification are improving protein quality, sustainability, and applications. These technologies enable cost-efficient protein production and enhanced flavor profiles, supporting broader adoption. - Sustainability & Ethical Sourcing:

Environmental pressures and sustainability targets are driving investment in low-impact protein sources and ethical production practices. Companies incorporating sustainable sourcing and reduced water/energy footprints are poised to capture eco-conscious consumers. - Personalized Nutrition:

Customization of protein diets—particularly for aging populations and athletes—is expanding the scope of protein products to include tailored formulations that address specific nutritional goals.

Successful Examples of Protein Markets Around the World

- United States – High-Protein Foods and Supplements:

The U.S. market is driven by sports nutrition, fortified foods, protein bars, and ready-to-drink beverages. High consumer awareness of protein’s health benefits drives significant demand. - Europe – Dairy and Specialty Proteins:

Europe emphasizes dairy-derived proteins (whey, casein) with strong regulatory frameworks ensuring quality and safety. Government support promotes protein crop production and plant-based offerings. - Asia-Pacific – Rapid Growth and Diversification:

Asia-Pacific is the fastest growing regional protein market, driven by rising incomes, nutrition awareness, and urbanized lifestyles. Government programs promote dietary diversification and enhanced protein intake. - Latin America – Protein in Public Health Programs:

Brazil and surrounding markets use government initiatives to promote sustainable agriculture and protein-rich diets, boosting both domestic demand and exports. - Africa – Protein Security and Fortification Programs:

Several African countries integrate protein fortification into public health policy to address nutritional shortfalls, while affordable plant protein products support dietary improvement.

Global Regional Analysis: Market & Government Initiatives

- North America:

Dominant due to high consumer demand for protein-rich foods, advanced processing infrastructure, and regulatory frameworks. Programs promote innovation in alternative proteins and fortified products. - Europe:

EU policies support protein crop production and plant-based foods, driving innovation through sustainability and nutritional standards. Public funding encourages healthier food systems. - Asia-Pacific:

Fastest growing region. National nutrition plans in China and India emphasize protein to combat malnutrition and chronic diseases, boosting market growth in fortified foods and supplements. - Latin America:

Sustained demand for protein-rich diets and government programs promoting sustainable agriculture support production of protein crops and fortified foods. - Middle East & Africa:

Government efforts focus on food security and nutrition enhancement through protein fortification, public-private partnerships, and innovation in cost-effective protein sources to reduce dependency on imports.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Recycled PET Market Revenue, Trends, and Strategic Insights by 2035