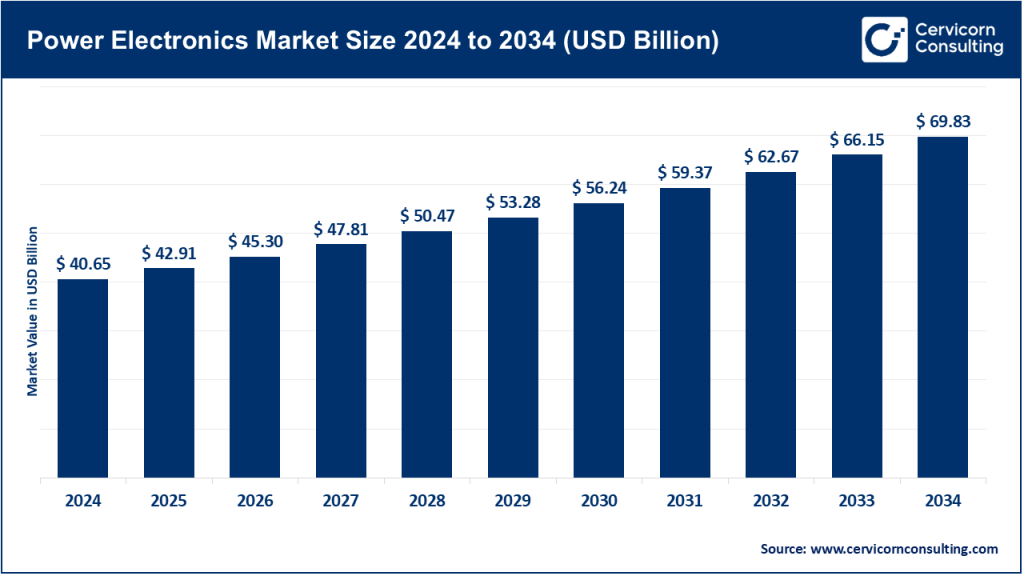

Power electronics market size

Power electronics market — Growth Factors

The power electronics market is being driven by a convergence of decarbonization and electrification trends (EVs, e-mobility, rail and marine electrification), rapid expansion of renewable energy (PV inverters, wind converters, storage inverters), industrial automation (variable speed drives, robotics), data center power conditioning and high-efficiency power supplies, and the rising adoption of wide-bandgap semiconductors (SiC, GaN) which enable higher efficiency and smaller form factors. Additional growth comes from the electrification of commercial and residential buildings (heat pumps, smart inverters), stricter energy-efficiency regulations worldwide (driving replacement and retrofit cycles), increased demand for high-density power conversion in telecom and 5G infrastructure, and regional industrial policies and incentives that stimulate local semiconductor and power-electronics manufacturing.

Finally, ongoing cost declines in power semiconductors and improved integration (power modules, intelligent power ICs) make system upgrades more attractive across automotive, industrial, and renewable applications.

What is the power electronics market?

Power electronics is the industry that designs and manufactures devices and systems that convert, control, and condition electrical power using semiconductor devices and associated passive components. This includes power semiconductors (IGBTs, MOSFETs, SiC and GaN devices), power modules, converters and inverters (AC-DC, DC-DC, DC-AC), motor drives (VFDs), UPS systems, power supplies for consumer and industrial electronics, chargers for electric vehicles, and thermal management and packaging technologies. The market spans semiconductor vendors, module assemblers, system integrators, and OEMs that deploy power electronics in transportation, energy, industrial automation, data centers, appliances and consumer electronics.

Why it is important

Power electronics is the “electrical heart” of modern electrification: it determines energy conversion efficiency, power density, reliability and cost for virtually every electrified system. Improvements in power electronics directly lower system losses (and operating costs), shrink device footprints, enable faster charging and higher performance in vehicles, smooth renewable energy integration to grids, and reduce total system cost of ownership in factories and data centers. In short, advances here unlock decarbonization at scale, enable new product features (e.g., bidirectional EV charging), and materially affect national energy security and industrial competitiveness.

Power Electronics Market — Top Companies

Infineon Technologies AG

- Specialization: Power semiconductors (IGBTs, MOSFETs), SiC & Si MOSFETs, power modules, automotive powertrain chips, industrial power solutions.

- Key focus areas: Automotive electrification, renewable energy inverters, industrial drives, and SiC adoption.

- Notable features: Strong automotive footprint, robust modules, accelerating SiC wafer capacity.

- 2024 revenue: ~€15.0 billion.

- Market share & global presence: Leading supplier of automotive and industrial power semiconductors with global fabs and design sites.

Mitsubishi Electric Corporation

- Specialization: Power electronics systems (industrial drives, inverters, power conditioning), rail and building automation, industrial motor control.

- Key focus areas: Industrial automation, building electrification, factory automation systems, and infrastructure.

- Notable features: Broad systems integration capability, long history in heavy industrial electrification.

- 2024 revenue: Group consolidated revenue in fiscal 2024 exceeded previous records.

STMicroelectronics N.V.

- Specialization: Analog & power semiconductors, gate drivers, discrete devices, and modules.

- Key focus areas: Automotive powertrain, industrial drives, power ICs for consumer/IoT, wide-bandgap devices.

- Notable features: Broad analog portfolio, strong automotive design wins.

- 2024 revenue: ~$13.27 billion.

Texas Instruments Incorporated (TI)

- Specialization: Analog power ICs, power management ICs, motor drivers, and PMICs across industrial and automotive.

- Key focus areas: Analog PMICs, industrial drives, integrated control and power solutions.

- Notable features: Scale in analog products, strong OEM relationships.

- 2024 revenue: ~$15.64 billion.

ON Semiconductor Corporation (onsemi)

- Specialization: Power semiconductors, MOSFETs, SiC devices, modules, integrated power solutions.

- Key focus areas: Automotive electrification, EV charging, industrial power.

- Notable features: Focus on EVs and powertrain systems.

- 2024 revenue: ~$7.08 billion.

Toshiba Corporation

- Specialization: Power systems, IGBT modules, inverters, power management systems.

- Key focus areas: Utility power, industrial drives, energy storage integration.

- Notable features: Strong presence in infrastructure and heavy electrical systems.

NXP Semiconductors N.V.

- Specialization: Power management ICs, automotive power systems, industrial IoT power solutions.

- Key focus areas: Automotive electrification, secure power management.

- Notable features: Strong automotive and IoT ecosystem.

- 2024 revenue: ~$12.61 billion.

ABB Ltd.

- Specialization: Power and automation systems, industrial drives, grid solutions, power conversion systems.

- Key focus areas: Electrification, industrial automation, grid modernization.

- Notable features: Global systems integrator with strong utility and industrial presence.

Fuji Electric Co., Ltd.

- Specialization: Power semiconductors, inverters, renewable energy power electronics, automation equipment.

- Key focus areas: Industrial drives, renewable power conversion.

- Notable features: Efficiency-focused solutions and strong industrial reputation.

Renesas Electronics Corporation

- Specialization: Microcontrollers and power ICs for automotive and industrial domains.

- Key focus areas: Automotive subsystems, MCUs, power devices for EVs.

- Notable features: Strong automotive base.

- 2024 revenue: ~1,348.5 billion JPY.

Wolfspeed, Inc. (Cree Inc.)

- Specialization: Silicon carbide (SiC) power devices and wafers.

- Key focus areas: SiC wafers, MOSFETs, EV inverters and fast chargers.

- Notable features: Pioneer in SiC, expanding U.S. fab capacity.

Rohm Semiconductor

- Specialization: Discrete semiconductors, SiC devices, ICs, and modules.

- Key focus areas: Automotive, industrial power systems.

- Notable features: High reliability and automotive focus.

Leading trends and their impact

- Wide-bandgap semiconductors (SiC & GaN): Transforming EV inverters, fast chargers, and data-center PSUs. Impact: smaller, faster, more efficient systems.

- Integration & modules: Intelligent power modules reduce design complexity and speed up time-to-market.

- Electrification of transport: EVs, e-buses, and heavy vehicles drive demand for power semiconductors.

- Renewable integration & storage: Advanced inverters with grid-support features enable better renewable grid integration.

- Energy efficiency regulations: Mandatory efficiency standards create constant upgrade cycles.

- Localization & policy push: National subsidies and semiconductor policies influence where fabs are built, reshaping global supply chains.

Successful examples of power-electronics deployment

- EVs: Tesla, BYD, VW, Toyota hybrids use advanced inverters and modules from Infineon, ST, onsemi, and Wolfspeed.

- Renewables: Europe’s solar and storage projects showcase inverter-driven grid services such as reactive power and frequency response.

- SiC adoption: Automakers worldwide shifting to SiC traction inverters for higher charging speeds and efficiency.

Global regional analysis — market shape and government initiatives

North America

- Drivers: EV adoption, data centers, industrial automation, defense.

- Policies: CHIPS and Science Act funding domestic fabs and SiC expansion.

Europe

- Drivers: Renewable integration, strict efficiency standards, industrial base.

- Policies: EU Green Transition and semiconductor strategies backing clean tech and power semiconductor development.

Asia-Pacific

- Drivers: Massive electronics demand, China’s EV leadership, renewable expansion.

- India: Production-Linked Incentive (PLI) schemes pushing EV, power electronics, and chip manufacturing.

- Japan & Korea: Strong industrial automation and semiconductor ecosystems.

Latin America, Middle East & Africa

- Drivers: Solar, microgrids, electrification projects.

- Policies: Government renewable energy incentives and infrastructure financing.

Policy shaping the market

Government programs like the U.S. CHIPS Act, EU clean-tech subsidies, and India’s PLI programs are accelerating wafer and fab construction, particularly in SiC and wide-bandgap technologies. These incentives reshape supply chains and drive localization, but also introduce execution risks if funding is delayed or withdrawn.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Operational Technology Cybersecurity Market Growth Drivers, Key Players, Trends and Regional Insights by 2034