Polypropylene Market Size

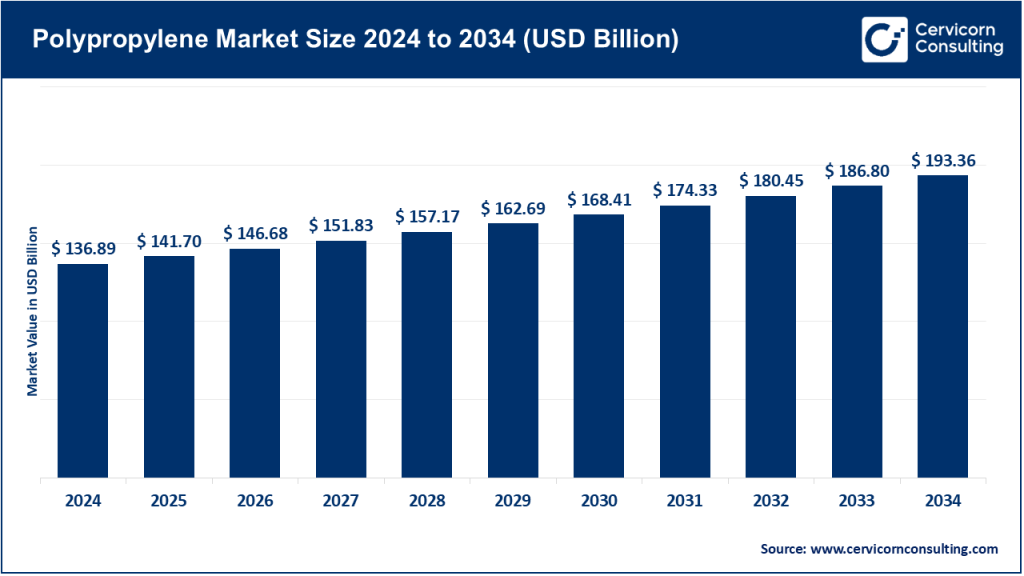

The global polypropylene market was worth USD 136.89 billion in 2024 and is anticipated to expand to around USD 193.36 billion by 2034, registering a compound annual growth rate (CAGR) of 4.6% from 2025 to 2034.

What is the Polypropylene Market?

The polypropylene (PP) market refers to the global trade, production, and utilization of polypropylene, a thermoplastic polymer widely used in packaging, textiles, automotive components, electrical appliances, and industrial applications. Derived from the polymerization of propylene monomer, polypropylene is known for its lightweight, high chemical resistance, excellent insulation, and durability. It is one of the most widely produced plastics globally, second only to polyethylene, with increasing applications across rapidly evolving industries such as automotive, healthcare, construction, and electronics.

Why is the Polypropylene Market Important?

Polypropylene is an essential material driving innovation and sustainability across multiple industries. It supports lightweight vehicle manufacturing, reducing fuel consumption and emissions. In packaging, its recyclability aligns with global sustainability targets. Polypropylene’s role in medical-grade products such as syringes and face masks was particularly highlighted during the COVID-19 pandemic, reinforcing its indispensability in critical applications. Economically, the market sustains a large global supply chain involving resin producers, converters, and end-product manufacturers. With circular economy and environmental regulations gaining traction, polypropylene’s compatibility with mechanical and chemical recycling techniques further solidifies its relevance in future material economies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2665

Polypropylene Market Growth Factors

The polypropylene market is witnessing robust growth due to a combination of factors, including rising demand in flexible and rigid packaging, increasing applications in automotive lightweighting, the rise of electrical and electronic appliances, and expanding infrastructure and construction activities in developing economies. Additionally, global trends towards sustainability and recyclable plastics are accelerating research and adoption of bio-based and chemically recycled polypropylene. The growing preference for nonwoven polypropylene in hygiene products, the expansion of e-commerce which drives packaging demand, and government-backed industrialization policies in Asia and the Middle East are also significant contributors. Further, innovation in polymer blends and composites continues to expand the material’s use cases in advanced applications.

Polypropylene Market Top Companies: Overview

Let’s explore key players leading the polypropylene market, including their company background, specialization, key focus areas, notable features, 2024 revenues, market share, and global presence.

1. SABIC (Saudi Basic Industries Corporation)

- Specialization: A global petrochemical giant, SABIC specializes in producing chemicals, polymers, and industrial solutions, including high-performance polypropylene grades.

- Key Focus Areas: Circular economy initiatives, product sustainability, medical-grade and automotive polypropylene, and partnerships for advanced recycling.

- Notable Features: SABIC launched its TRUCIRCLE™ portfolio—one of the most comprehensive sets of circular polypropylene solutions.

- 2024 Revenue (Polypropylene Segment): Estimated at USD 10.4 billion.

- Market Share: Approximately 12.6% of the global polypropylene market.

- Global Presence: Operates in 50+ countries, with major manufacturing hubs in Saudi Arabia, Europe, and Asia.

2. Exxon Mobil Corporation

- Specialization: Integrated energy and chemical company producing a broad range of polypropylene resins used in packaging, automotive, and consumer goods.

- Key Focus Areas: High-performance polymer development, sustainability through advanced recycling, and infrastructure solutions.

- Notable Features: ExxonMobil’s Achieve™ Advanced PP product line is widely used in high-performance packaging and automotive applications.

- 2024 Revenue (Polypropylene Segment): Estimated at USD 7.9 billion.

- Market Share: Approximately 9.7% globally.

- Global Presence: Operations span six continents, with key production facilities in the U.S., Singapore, and Belgium.

3. Borealis AG

- Specialization: A European leader in polyolefins, including polypropylene, with a strong focus on circular solutions and material innovation.

- Key Focus Areas: Mechanical recycling (via its mtm and Ecoplast subsidiaries), automotive solutions, and pipe systems.

- Notable Features: Borealis co-developed Borcycle™, an advanced recycling technology converting waste into high-performance PP.

- 2024 Revenue (Polypropylene Segment): Estimated at USD 5.2 billion.

- Market Share: Roughly 6.4%.

- Global Presence: Headquartered in Austria, with operations in over 120 countries and production hubs in Europe and the Middle East.

4. BASF SE

- Specialization: While not a leading producer of base polypropylene resins, BASF is a major player in polypropylene-based compounds, additives, and engineered plastics.

- Key Focus Areas: Automotive, construction, and consumer goods with a strong emphasis on innovative compounding and lightweight materials.

- Notable Features: BASF’s Ultramid® and Ultradur® lines often incorporate PP to enhance product performance and sustainability.

- 2024 Revenue (Polypropylene-based products): Estimated at USD 3.6 billion.

- Market Share: Around 3.5% in downstream applications.

- Global Presence: BASF operates in 90+ countries, with manufacturing sites across Europe, Asia, and North America.

5. INEOS Group

- Specialization: One of the largest chemical companies globally, INEOS produces a wide range of polypropylene products for packaging, automotive, healthcare, and electrical applications.

- Key Focus Areas: High-clarity packaging, pipe systems, automotive dashboards, and circular economy partnerships.

- Notable Features: Partnered with Plastic Energy and other firms to expand chemical recycling capacity across Europe.

- 2024 Revenue (Polypropylene Segment): Estimated at USD 6.1 billion.

- Market Share: Approximately 7.8%.

- Global Presence: 180+ sites across 26 countries, especially prominent in Europe and North America.

Leading Trends and Their Impact

The polypropylene market is being shaped by several transformative trends:

1. Sustainability and Circular Economy

- Impact: Transition from virgin resin to recycled and bio-based polypropylene. Companies are investing in chemical recycling infrastructure, such as ExxonMobil’s advanced recycling facilities and SABIC’s TRUCIRCLE™ platform.

2. Lightweighting in Automotive and Aerospace

- Impact: Polypropylene is increasingly replacing heavier materials, leading to improved fuel efficiency and emissions reductions. Companies like Borealis are pushing boundaries in high-strength, low-density PP compounds.

3. Nonwoven Polypropylene in Healthcare

- Impact: Post-pandemic demand for hygiene-related nonwovens continues. Polypropylene remains dominant in surgical masks, gowns, and wipes.

4. Smart Packaging and E-commerce Growth

- Impact: Surge in e-commerce drives demand for durable, flexible, and sustainable PP-based packaging. Advanced polypropylene variants now feature barrier coatings, transparency, and reusability.

5. Digitalization and Polymer Informatics

- Impact: Use of AI and data analytics for product formulation and performance forecasting is helping optimize production efficiency and minimize waste.

Successful Global Examples in the Polypropylene Market

1. SABIC’s TRUCIRCLE in Europe

- Introduced certified circular polypropylene, enabling brands like Unilever and Tupperware to use recycled content in consumer packaging without compromising performance or safety.

2. Borealis and Reclay’s Recyclable PP in Germany

- Created a closed-loop system for packaging waste using the Borcycle™ technology, producing high-quality recycled PP resins suitable for food-contact packaging.

3. INEOS and Petroineos Expansion in Scotland

- Investment in new PP capacity aligned with UK’s plastic packaging tax reforms and sustainability regulations, meeting growing demand for locally sourced sustainable polymers.

4. ExxonMobil in Singapore

- Operates one of the world’s largest PP plants in Jurong Island, with innovations like Achieve™ Advanced PP exported to Asia-Pacific markets for automotive and industrial use.

5. BASF’s Collaboration in China

-

BASF and Chinese automotive suppliers are using polypropylene compounds in next-gen electric vehicles (EVs) for dashboard, battery casing, and structural parts, reinforcing lightweighting goals.

Global Regional Analysis and Government Policies Shaping the Market

North America

- Key Countries: U.S., Canada, Mexico

- Drivers: Advanced recycling, high packaging demand, EV manufacturing

- Policies: U.S. Plastics Pact targets 100% reusable/recyclable packaging by 2025; significant tax credits for chemical recycling infrastructure under Inflation Reduction Act.

Europe

- Key Countries: Germany, France, Italy, UK

- Drivers: Circular economy, bans on single-use plastics, automotive lightweighting

- Policies: EU Green Deal, Circular Plastics Alliance, and Extended Producer Responsibility (EPR) are pushing for recycled content mandates in polypropylene packaging and automotive parts.

Asia-Pacific

- Key Countries: China, India, Japan, South Korea

- Drivers: Booming construction, packaging, and automotive sectors

- Policies: China’s “Plastic Ban 2025” encourages biodegradable and recyclable plastic alternatives. India is promoting bio-polypropylene through tax exemptions under its Sustainable Polymer Program.

Latin America

- Key Countries: Brazil, Mexico, Argentina

- Drivers: Infrastructure development, growing consumer goods sector

- Policies: Brazil’s National Solid Waste Policy supports the circular economy and mandates recycling of post-consumer packaging including PP.

Middle East & Africa

- Key Countries: Saudi Arabia, UAE, South Africa

- Drivers: Rapid industrialization, resin exports, petrochemical investments

- Policies: Saudi Arabia’s Vision 2030 aims to make the kingdom a global petrochemicals leader; SABIC is driving innovation in circular PP from this region.

Government Initiatives

- EU Circular Plastics Alliance: Promotes use of 10 million tonnes of recycled plastics by 2025.

- U.S. DOE Plastics Innovation Challenge: Funding startups and research focused on recyclable polyolefins.

- China’s Five-Year Plan: Targets plastic waste reduction and promotes green polymers.

- India’s Plastic Waste Management Rules (2022 Amendment): Enforces EPR for polypropylene packaging and incentivizes recycled content use.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Cosmetics Market Size USD 803.33 Billion by 2034, Stunning Growth