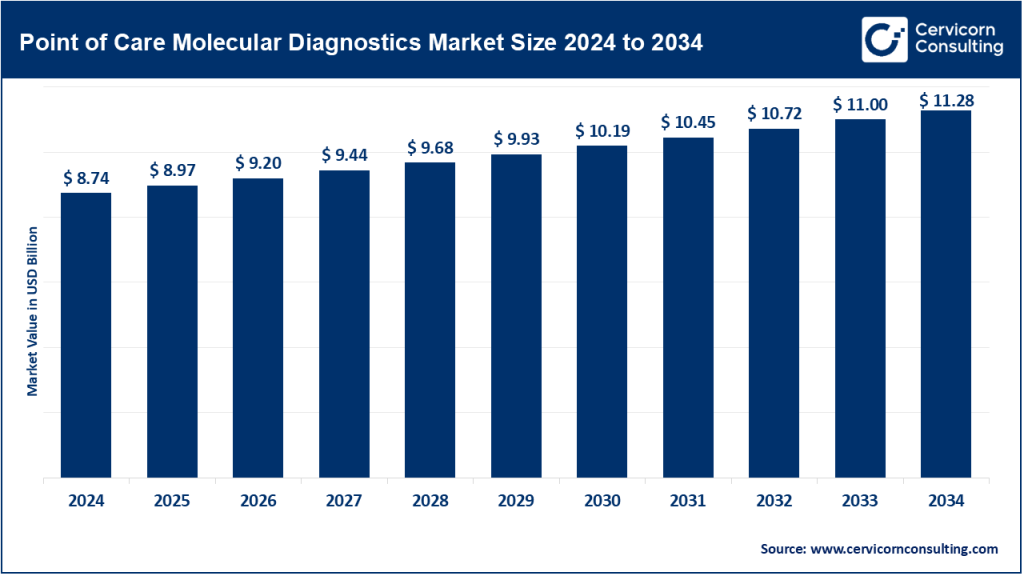

Point of Care Molecular Diagnostics Market Size

The global point of care molecular diagnostics market size was worth USD 8.74 billion in 2024 and is anticipated to expand to around USD 11.28 billion by 2034, registering a compound annual growth rate (CAGR) of 2.58% from 2025 to 2034.

What is the Point-of-Care Molecular Diagnostics Market?

Point-of-care molecular diagnostics (POC MDx) refers to diagnostic technologies that detect genetic material—DNA or RNA—at or near the site of patient care. Unlike traditional laboratory-based testing that can take hours or even days, POC MDx delivers fast and accurate results within minutes to a few hours, often in decentralized settings such as emergency rooms, clinics, pharmacies, or even homes. These tests employ molecular biology techniques, including polymerase chain reaction (PCR), isothermal amplification, and CRISPR-based methods, allowing clinicians to rapidly diagnose infectious diseases, monitor chronic conditions, and guide therapy decisions with high sensitivity and specificity.

Why Is It Important?

The importance of point-of-care molecular diagnostics lies in their ability to improve patient outcomes through timely and accurate decision-making. In critical care scenarios—such as detecting sepsis, respiratory pathogens, sexually transmitted infections, or drug-resistant tuberculosis—early diagnosis can mean the difference between life and death. These systems reduce the burden on centralized labs, expedite care delivery, limit the spread of infectious diseases, and are especially vital in rural or resource-limited settings. Additionally, POC MDx is central to the global push toward personalized and precision medicine.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2603

Growth Factors Driving the Market

The growth of the point-of-care molecular diagnostics market is fueled by a combination of rapid technological advancements (e.g., miniaturization of PCR platforms, integration of AI in diagnostics), the growing demand for decentralized healthcare, rising prevalence of infectious diseases and antimicrobial resistance, increased government funding and public-private partnerships, the surge in self-monitoring and home-testing culture (boosted by COVID-19), regulatory push for rapid diagnostics, and rising awareness about early disease detection. Additionally, the demand for rapid diagnostics in developing countries and the global trend toward value-based healthcare are acting as catalysts for long-term market expansion.

Top Companies in the Point-of-Care Molecular Diagnostics Market

1. F. Hoffmann-La Roche AG

- Specialization: Infectious diseases, respiratory infections, and women’s health.

- Key Focus Areas: PCR-based technologies, automation, syndromic panels.

- Notable Features: Cobas® Liat® System—a CLIA-waived device offering rapid PCR diagnostics with results in under 20 minutes.

- 2024 Revenue: Approx. $4.8 billion (from molecular diagnostics segment).

- Market Share: ~23% of global POC MDx market.

- Global Presence: Operations in over 100 countries, with strong footprints in North America, Europe, and APAC.

2. Abbott

- Specialization: Infectious disease diagnostics, molecular point-of-care platforms.

- Key Focus Areas: Isothermal nucleic acid amplification, COVID-19, influenza, HIV.

- Notable Features: ID NOW™ platform—rapid molecular diagnostics in 13 minutes or less.

- 2024 Revenue: ~$2.6 billion from rapid and molecular diagnostics combined.

- Market Share: ~15% in global POC MDx.

- Global Presence: Robust supply chain in North America, South America, Southeast Asia, and Africa.

3. QIAGEN

- Specialization: Sample-to-insight solutions in molecular diagnostics, TB testing, HPV, and HIV.

- Key Focus Areas: Syndromic testing, decentralized testing, tuberculosis screening.

- Notable Features: QIAstat-Dx® platform offering multiplexed syndromic testing.

- 2024 Revenue: ~$2.1 billion (total molecular diagnostics revenue).

- Market Share: ~10% in POC segment.

- Global Presence: Widely used in Europe, Latin America, and emerging markets like India and South Africa.

4. Bayer AG

- Specialization: Although not historically dominant in POC MDx, Bayer has invested in integrated diagnostic platforms through strategic partnerships and acquisitions.

- Key Focus Areas: Oncology diagnostics, companion diagnostics.

- Notable Features: Collaborative molecular diagnostics programs with biotech innovators.

- 2024 Revenue: ~$800 million related to diagnostics.

- Market Share: ~4% (emerging player in POC MDx).

- Global Presence: Primarily in Europe and North America with R&D ties in Asia.

5. Nova Biomedical

- Specialization: Blood-based diagnostics, glucose, and ketone testing.

- Key Focus Areas: Hospital and ICU-based POC diagnostics.

- Notable Features: StatStrip® Lactate and StatSensor® Creatinine analyzers for acute and chronic conditions.

- 2024 Revenue: Estimated ~$700 million (majority from POC diagnostics).

- Market Share: ~3% in molecular POC.

- Global Presence: North America, Europe, and expanding in Latin America and Asia.

Leading Trends and Their Impact

1. Miniaturization and Integration of AI

AI-powered diagnostics enable automated interpretation of molecular results, reducing human error and empowering less-trained personnel to perform complex tests. Miniaturized, battery-operated systems enhance mobility and remote deployment.

2. Shift Toward Syndromic Testing

Syndromic panels detect multiple pathogens in a single test—crucial for respiratory infections where symptoms overlap. This trend improves diagnosis accuracy and accelerates treatment.

3. CRISPR-based Diagnostics

New CRISPR tools like SHERLOCK and DETECTR are disrupting the market by enabling ultra-fast, low-cost nucleic acid detection, especially for emerging infectious diseases.

4. Home-Based Molecular Testing

Fueled by the pandemic, consumer-friendly molecular platforms (e.g., Cue Health, Lucira) have become mainstream, encouraging self-testing and remote care models.

5. Regulatory Acceleration and Funding

Agencies like the FDA and EMA are streamlining emergency authorizations and fast-track approvals for POC MDx tools, while governments worldwide are increasing funding for decentralization of healthcare.

Successful Examples Around the World

1. United States: ID NOW by Abbott

Used across Walgreens and CVS pharmacies, ID NOW became a cornerstone of the U.S. COVID-19 response. It also supports flu and strep diagnostics in urgent care settings.

2. United Kingdom: Cobas Liat System in NHS

Deployed in National Health Service (NHS) hospitals for flu and RSV detection, reducing unnecessary antibiotic prescriptions and shortening isolation times.

3. India: Truenat by Molbio Diagnostics

A WHO-approved, battery-operated, real-time PCR platform used for tuberculosis and COVID-19 detection in rural and tribal regions. It exemplifies successful diagnostics in low-resource settings.

4. Sub-Saharan Africa: GeneXpert by Cepheid

Though not portable, GeneXpert is used as a POC solution in Africa for TB, HIV, and COVID-19. It integrates with solar-powered labs and mobile clinics.

5. Japan: Loopamp™ by Eiken Chemical

Utilizes Loop-mediated Isothermal Amplification (LAMP) for rapid molecular testing of infectious diseases like malaria and SARS-CoV-2.

Regional Analysis and Government Initiatives

North America

- Market Share: ~40%

- Drivers: High disease burden, favorable reimbursement policies, advanced healthcare infrastructure.

- Key Policies: Operation Warp Speed (USA), CDC investments in rapid testing programs, CMS reimbursement for home-based diagnostics.

Europe

- Market Share: ~25%

- Drivers: Strong healthcare system, emphasis on antimicrobial stewardship.

- Key Policies: Horizon Europe funding for molecular diagnostics innovation; EMA’s fast-track diagnostics approvals.

Asia-Pacific

- Market Share: ~20%

- Drivers: Rising infectious disease prevalence, rapid urbanization, unmet diagnostic needs.

- Key Policies:

- India’s National Tuberculosis Elimination Programme supporting POC molecular platforms like Truenat.

- Japan’s “Health and Productivity Management” program encouraging tech integration in diagnostics.

- China’s Healthy China 2030 policy emphasizing early disease detection.

Latin America

- Market Share: ~8%

- Drivers: Government-backed diagnostic initiatives and WHO-supported programs for TB and Zika.

- Policies: Brazil and Colombia supporting molecular POC tools via national health insurance reimbursements and regional mobile diagnostic labs.

Middle East & Africa

- Market Share: ~7%

- Drivers: Need for decentralized diagnostics, partnerships with NGOs, donor funding.

- Key Initiatives: PEPFAR and Global Fund investments for HIV and TB molecular diagnostics; mobile health centers in Kenya and Nigeria using POC PCR.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Breast Cancer Drugs Market Growth Trends, Size & Revenue Outlook 2025–2034