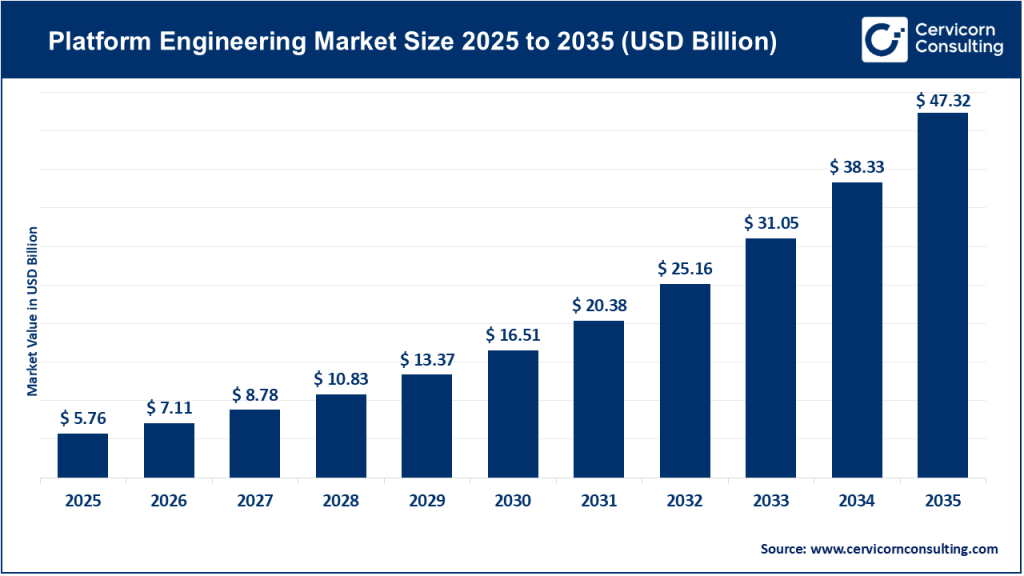

Platform Engineering Market Size

The global platform engineering market size was worth USD 5.76 billion in 2025 and is anticipated to expand to around USD 47.32 billion by 2035, registering a compound annual growth rate (CAGR) of 23.4% from 2026 to 2035.

What is the Platform Engineering Market?

The platform engineering market refers to the ecosystem of products, services, methodologies, and platforms designed to enable organizations to build and manage internal developer platforms (IDPs), self‑service toolchains, automated workflows, and shared infrastructure that accelerate the delivery of software and digital services. Platform engineering teams combine software engineering, cloud technologies, DevOps practices, and infrastructure automation to create standardized, scalable, and secure environments that reduce cognitive load on developers, promote consistency, and ensure operational resilience. Platform engineering is tightly tied to modern software delivery practices and supports the creation of reusable platforms that internal teams depend on to deploy applications effectively.

Why Is It Important?

Platform engineering plays a pivotal role in today’s digital economy by boosting developer productivity, reducing deployment friction, and standardizing operational practices within complex IT environments. By abstracting away infrastructure overhead and providing self‑service capabilities, platform engineering enables developers to focus on delivering business value with minimal manual intervention. It accelerates time‑to‑market, ensures consistency across environments, reduces errors, and supports continuous integration and continuous delivery (CI/CD) workflows. Furthermore, enterprise adoption of cloud, microservices, and DevOps means that the creation of reusable internal platforms is now critical for scaling development efforts and maintaining competitive advantage.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2856

Key Companies in the Market

Here are some of the leading global players in the platform engineering and broader platform services/cloud infrastructure domain, structured with key attributes:

Amazon Web Services, Inc. (AWS)

- Specialization: Comprehensive cloud infrastructure and platform services including compute, storage, DevOps, and platform‑level offerings like internal tooling for platform deployment and automation frameworks.

- Key Focus Areas: IaaS, PaaS, serverless computing, managed container services, AI/ML platform integration.

- Notable Features: Highest global cloud market share as a foundation for platform engineering services; strong ecosystem of developer tools and global regions.

- 2024/2025 Revenue & Market Share: AWS holds ~30% of the global cloud infrastructure market in 2025, with cloud revenues running at an annual ~$132 billion run‑rate in Q3 2025.

- Global Presence: Operations spanning dozens of global regions with hundreds of cloud availability zones.

Google LLC (Google Cloud)

- Specialization: Cloud platform infrastructure with a strong emphasis on AI services, data analytics, and multi‑cloud connectivity.

- Key Focus Areas: AI/ML integration, big data platform services, Kubernetes and container orchestration, serverless.

- Notable Features: Fastest relative growth among major cloud providers; winning large enterprise deals that boost platform usage opportunities.

- 2024/2025 Revenue & Market Share: Google Cloud’s revenue run rate ~$61 billion (annualized) with ~12–13% global cloud market share in 2025.

- Global Presence: Extensive global data centers across key regions.

Microsoft Corporation (Azure/Intelligent Cloud)

- Specialization: Hybrid cloud, enterprise software, and platform services with deep integration of Azure cloud and AI tooling.

- Key Focus Areas: Cloud infrastructure, PaaS offerings, developer platform support, and IDP facilitation.

- Notable Features: Broad enterprise adoption due to strong legacy software penetration and hybrid cloud focus.

- 2024/2025 Revenue & Market Share: Azure cloud revenues surpassed $75 billion annually in 2025, with Microsoft’s Intelligent Cloud division generating ~$30.9B in one quarter alone and ~20% global cloud share.

- Global Presence: Presence across 100+ cloud regions globally.

IBM Corporation

- Specialization: Enterprise platform engineering frameworks, AI‑driven engineering suites, integration with hybrid clouds and enterprise systems.

- Key Focus Areas: Large enterprise system integration, hybrid cloud platform solutions, automation.

- Notable Features: Strong focus on regulated industries and AI operational tooling; growing platform engineering solution suite adoption.

- 2024 Revenue/Market Share: IBM’s overall cloud and platform engineering suite contributes to enterprise digital transformation engagements (specific engineering figures less publicly disclosed).

Cisco Systems, Inc.

- Specialization: Networking and security‑first platform engineering solutions that integrate with cloud and on‑prem systems.

- Key Focus Areas: Secure platform services, networking automation, hybrid infrastructure unification.

- Notable Features: Core strengths in enterprise networking platforms; expanding presence in cloud connectivity and platform orchestration.

Key Focus Areas & Notable Features

Across leading platform engineering providers, several focus areas and features define the competitive landscape:

Self‑Service Internal Developer Platforms (IDPs)

These provide standardized, reusable toolchains and workflows that help development teams deploy solutions without the overhead of infrastructure setup — crucial for scalability and consistency.

Cloud & Hybrid Integration

Support for hybrid cloud, multi‑cloud orchestration, and seamless integration with serverless and container ecosystems allows enterprises to build platforms that span various environments.

AI & AIOps Integration

AI-powered operational analytics and intelligent automation increasingly underpin platform capabilities, enabling insights into anomalies, predictive scaling, and reduced downtimes.

Security, Compliance, and Governance

Especially in regulated industries, platform engineering must embed governance, identity management, and security controls as core capabilities.

Observability & Monitoring Toolchains

Integrated systems for monitoring performance, logging, and diagnosing issues are central to robust platform architectures.

Leading Trends and Their Impact

Several major trends are shaping the future of platform engineering:

Cloud‑Native and Serverless Adoption

Adoption of managed services, microservices, and serverless computing enables developers to decouple infrastructure management and focus on delivering value.

Edge Computing Platforms

Bringing compute closer to data sources (especially for IoT and real‑time analytics) drives the need for platform solutions that can orchestrate distributed workflows across edge nodes.

AI/ML Integration & AIOps

Embedding AI into operations and engineering workflows optimizes reliability and automates routine tasks at scale.

Developer Experience Focus

Tools that enhance developer productivity, such as integrated IDEs, automated pipelines, and self‑service dashboards, are in higher demand.

Regulatory & Compliance Pressures

Industry and government policies encourage secure engineering practices and drive adoption in finance, healthcare, and government sectors.

Successful Examples Around the World

Netflix’s Internal Developer Platform (IDP)

Netflix built a proprietary internal platform that provides self‑service workflows and infrastructure automation, enabling massive scale content delivery with high reliability and rapid deployment cadence.

Hyperscale Cloud Provider Platforms

AWS, Azure, and Google Cloud offer embedded platform engineering capabilities (e.g., AWS CDK, Azure DevOps services, GCP’s CI/CD pipelines) that empower enterprises globally to build tailored platform layers.

Enterprise Digital Transformation Initiatives

Large banks and healthcare systems have deployed internal engineering platforms to unify disparate IT teams and accelerate digital service delivery.

Global Regional Analysis & Policies

North America

North America dominates the platform engineering market, driven by established tech ecosystems, early cloud adoption, and strong R&D investments. The U.S. particularly benefits from a mature DevOps and cloud landscape and robust private sector demand.

Government Initiatives: Federal digital strategies and investments in cybersecurity, cloud modernization, and digital government services have bolstered platform engineering adoption.

Europe

Europe is the second largest regional market with increasing adoption of platform engineering solutions, especially in regulated sectors. Regulatory frameworks around data privacy (e.g., GDPR) and digital sovereignty have influenced platform strategies.

Policies: EU’s Digital Europe Programme and national cloud initiatives emphasize security, interoperability, and digital transformation.

Asia Pacific

Asia Pacific is emerging as a high-growth region, with rapid digitalization in economies like China, India, Japan, and Southeast Asia. Investments in IT infrastructure and cloud adoption are accelerating platform engineering uptake.

Government Initiatives: National digital missions, smart city programs, and cloud adoption incentives are spurring platform investments.

Latin America & MEA

While trailing behind mature markets, Latin America and Middle East & Africa are steadily adopting platform engineering to modernize IT operations.

Local Policies: Increased focus on digital literacy and connectivity, with public and private partnerships supporting cloud and platform modernization initiatives.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Generative AI in the Automotive Market Growth Drivers, Trends, Key Players and Regional Insights by 2035