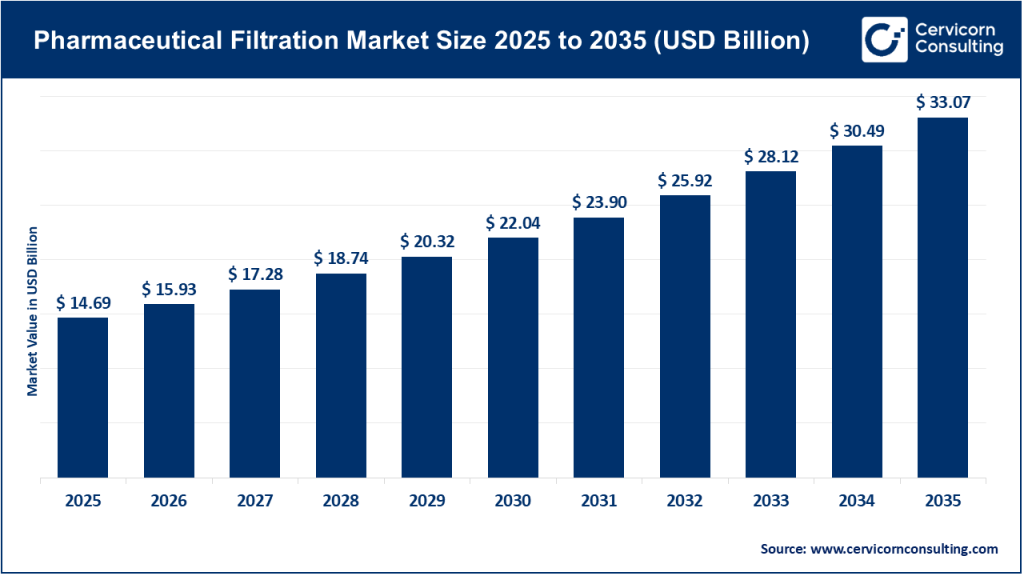

Pharmaceutical Filtration Market Size

The global pharmaceutical filtration market size was worth USD 14.69 billion in 2025 and is anticipated to expand to around USD 33.07 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% from 2026 to 2035.

Understanding the Pharmaceutical Filtration Market

The pharmaceutical filtration market represents a critical segment of the global pharmaceutical manufacturing ecosystem, encompassing technologies, systems, and consumables used to remove particulates, microorganisms, viruses, and other contaminants from liquids and gases during drug production. Filtration plays a vital role across multiple stages of pharmaceutical manufacturing, including raw material purification, active pharmaceutical ingredient (API) production, formulation, filling, and packaging. The market includes various filtration technologies such as membrane filtration (microfiltration, ultrafiltration, nanofiltration), depth filtration, and sterile filtration, which are applied extensively in both small-molecule drug manufacturing and the rapidly expanding biopharmaceutical sector.

With the growing complexity of modern therapeutics — including monoclonal antibodies, vaccines, biosimilars, and cell and gene therapies — pharmaceutical filtration has become an indispensable process for ensuring product purity, safety, and regulatory compliance. As pharmaceutical companies increasingly focus on scalable, efficient, and contamination-free manufacturing environments, the demand for advanced filtration solutions continues to rise globally.

Pharmaceutical Filtration Market Growth Factors

The growth of the pharmaceutical filtration market is driven by the rapid expansion of biopharmaceutical and biologics manufacturing, increasing global demand for high-quality and sterile pharmaceutical products, and stringent regulatory requirements mandating contamination-free production environments; additionally, the rising adoption of single-use filtration technologies, growing investments in pharmaceutical research and development, increased vaccine production, and the shift toward advanced therapies such as monoclonal antibodies and cell and gene therapies have significantly accelerated demand for high-performance filtration systems, while capacity expansions, technological innovation, and strategic collaborations among key industry players further support sustained market growth.

Why Pharmaceutical Filtration Is Important

Pharmaceutical filtration is essential for maintaining drug safety, efficacy, and consistency, as even minor contamination can compromise product quality and pose serious health risks to patients. Filtration ensures the removal of particulate matter, bacteria, endotoxins, and viruses that can enter the manufacturing process through raw materials, equipment, or environmental exposure. Regulatory authorities across the globe enforce strict quality standards that require validated filtration processes to ensure sterility and compliance throughout drug manufacturing.

Beyond regulatory compliance, pharmaceutical filtration enhances manufacturing efficiency by minimizing batch failures, reducing downtime, and improving process reliability. For high-value biologics and vaccines, where production costs are substantial, effective filtration helps safeguard investments and ensures uninterrupted supply. As pharmaceutical manufacturing increasingly adopts continuous and high-throughput production models, advanced filtration technologies are becoming even more critical for sustaining operational excellence.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2877

Key Companies in the Pharmaceutical Filtration Market

Sartorius AG

Specialization:

Sartorius AG specializes in filtration and bioprocess solutions for the pharmaceutical and biotechnology industries, with a strong emphasis on membrane filtration, depth filtration, and single-use technologies designed for biologics manufacturing.

Key Focus Areas:

- Sterile and bioprocess filtration

- Single-use filtration assemblies

- Solutions for monoclonal antibodies, vaccines, and advanced therapies

Notable Features:

The company is known for its scalable and integrated filtration platforms that support both research-scale and commercial-scale manufacturing. Sartorius places strong emphasis on regulatory compliance, automation, and process optimization.

2024 Revenue:

Approximately USD 1.95 billion from filtration-related operations.

Market Share:

Estimated to hold a leading share among pharmaceutical filtration providers, particularly in the bioprocessing segment.

Global Presence:

Headquartered in Germany, Sartorius operates manufacturing and distribution facilities across Europe, North America, and Asia-Pacific, serving pharmaceutical manufacturers worldwide.

Merck KGaA (MilliporeSigma)

Specialization:

Merck’s life science division delivers a wide portfolio of filtration products, including sterilizing-grade membrane filters, tangential flow filtration systems, and virus removal filters for pharmaceutical and biopharmaceutical applications.

Key Focus Areas:

- Sterile filtration consumables

- Single-use filtration components

- Biologics and vaccine manufacturing support

Notable Features:

Merck focuses on sustainability, process efficiency, and innovation, with investments in advanced membrane technologies and climate-conscious manufacturing operations.

2024 Revenue:

Approximately USD 1.72 billion from filtration and related life science solutions.

Market Share:

Maintains a strong competitive position within the global pharmaceutical filtration landscape.

Global Presence:

Based in Germany, Merck has a broad international footprint with operations and customers across North America, Europe, Asia, and emerging markets.

Thermo Fisher Scientific

Specialization:

Thermo Fisher Scientific provides a broad range of filtration solutions, including capsule filters, membrane filters, and integrated systems used in pharmaceutical manufacturing, quality control, and research environments.

Key Focus Areas:

- Capsule and vacuum filtration systems

- Single-use filtration technologies

- Integration with end-to-end bioprocess workflows

Notable Features:

The company’s strength lies in its ability to combine filtration products with complementary analytical and bioprocessing solutions, offering comprehensive manufacturing support.

2024 Revenue:

Estimated at approximately USD 1.05 billion from pharmaceutical filtration and purification offerings.

Market Share:

Holds a significant share due to its diversified product portfolio and global reach.

Global Presence:

Thermo Fisher Scientific operates globally, with strong manufacturing, sales, and service networks across major pharmaceutical markets.

Danaher Corporation

Specialization:

Through its life sciences brands, Danaher provides advanced filtration solutions including membrane filters, depth filters, and single-use systems tailored for biopharmaceutical production.

Key Focus Areas:

- Sterile and depth filtration

- Single-use bioprocessing solutions

- High-volume biologics manufacturing

Notable Features:

Danaher emphasizes process reliability, scalability, and contamination control, making its filtration technologies suitable for large-scale commercial production.

2024 Revenue:

Estimated at approximately USD 2.30 billion from filtration-related operations.

Market Share:

One of the leading contributors to the global pharmaceutical filtration market.

Global Presence:

Headquartered in the United States, Danaher maintains extensive operations across the Americas, Europe, and Asia-Pacific.

Repligen Corporation

Specialization:

Repligen focuses on niche filtration technologies, particularly tangential flow filtration (TFF) systems and hollow-fiber membrane solutions for bioprocessing applications.

Key Focus Areas:

- TFF systems for biologics

- Hollow fiber filtration

- High-value bioprocess consumables

Notable Features:

The company is recognized for its expertise in fluid management and membrane technologies that support efficient protein purification.

2024 Revenue:

Approximately USD 420 million.

Market Share:

Holds a smaller but strategically important share within specialized filtration segments.

Global Presence:

Repligen serves customers worldwide, with operations spanning North America, Europe, and Asia.

Becton, Dickinson and Company (BD)

Specialization:

BD provides sterile filtration and fluid management solutions used in pharmaceutical manufacturing, laboratory processes, and aseptic filling operations.

Key Focus Areas:

- Sterile filtration systems

- Depth filtration products

- Aseptic processing consumables

Notable Features:

BD emphasizes reliability, sterility assurance, and consistent product performance across pharmaceutical applications.

2024 Revenue:

Filtration represents a smaller portion of BD’s overall revenue but remains strategically important.

Market Share:

Recognized as a key participant, particularly in sterile filtration consumables.

Global Presence:

BD operates globally with manufacturing and distribution facilities across multiple regions.

Leading Trends and Their Impact on the Pharmaceutical Filtration Market

One of the most influential trends shaping the pharmaceutical filtration market is the widespread adoption of single-use filtration technologies, which reduce cleaning and validation requirements while minimizing cross-contamination risks. These systems offer enhanced flexibility and are particularly well-suited for multiproduct facilities and biologics manufacturing. Another key trend is the integration of automation and digital monitoring, enabling real-time process control, predictive maintenance, and improved quality assurance.

The growing use of nanofiltration and virus filtration technologies is also reshaping the market, driven by increased biologics and vaccine production. Additionally, heightened regulatory scrutiny around sterility and contamination control has compelled pharmaceutical manufacturers to invest in validated, high-performance filtration systems. Sustainability considerations, including waste reduction and energy efficiency, are increasingly influencing filtration product design and procurement strategies.

Successful Examples of Pharmaceutical Filtration Market Applications Worldwide

Globally, pharmaceutical manufacturers have successfully implemented advanced filtration solutions to improve productivity and compliance. Large biologics manufacturers have transitioned from traditional stainless-steel systems to single-use membrane filtration, significantly reducing turnaround times and contamination risks. Vaccine manufacturers have expanded filtration capacity to support rapid scale-up during global immunization initiatives, ensuring consistent quality at high volumes.

Several pharmaceutical companies have also partnered with filtration technology providers to co-develop customized solutions for complex biologics, leading to improved yields and reduced processing costs. Capacity expansions and localized manufacturing of filtration consumables have strengthened supply chain resilience, particularly during periods of heightened global demand.

Global Regional Analysis and Government Initiatives Shaping the Market

North America

North America represents a dominant share of the pharmaceutical filtration market, supported by a strong biopharmaceutical industry, advanced manufacturing infrastructure, and rigorous regulatory frameworks. Government enforcement of strict quality and safety standards has driven widespread adoption of advanced filtration technologies across pharmaceutical facilities.

Europe

Europe remains a key region due to its robust pharmaceutical R&D ecosystem and harmonized regulatory environment. Regulatory alignment across countries supports consistent filtration standards, while innovation initiatives encourage the adoption of automated and sustainable filtration solutions.

Asia-Pacific

The Asia-Pacific region is witnessing the fastest growth, fueled by expanding pharmaceutical production, increasing healthcare investments, and government support for manufacturing modernization. Countries such as China and India are strengthening regulatory frameworks and investing in high-quality drug manufacturing, accelerating demand for pharmaceutical filtration technologies.

Latin America and Middle East & Africa

These regions are gradually expanding their pharmaceutical manufacturing capabilities. Government initiatives focused on improving healthcare access, local drug production, and quality standards are driving incremental adoption of filtration systems.

Government Policies and Initiatives

Globally, regulatory policies emphasizing good manufacturing practices, sterility assurance, and quality control are shaping the pharmaceutical filtration market. Harmonization of standards and increased oversight have elevated filtration performance requirements, compelling manufacturers to invest in advanced and validated filtration technologies.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: No-Code AI Platforms Market Growth Drivers, Trends, Key Players and Regional Insights by 2035