Pharmaceutical CDMO Market Size

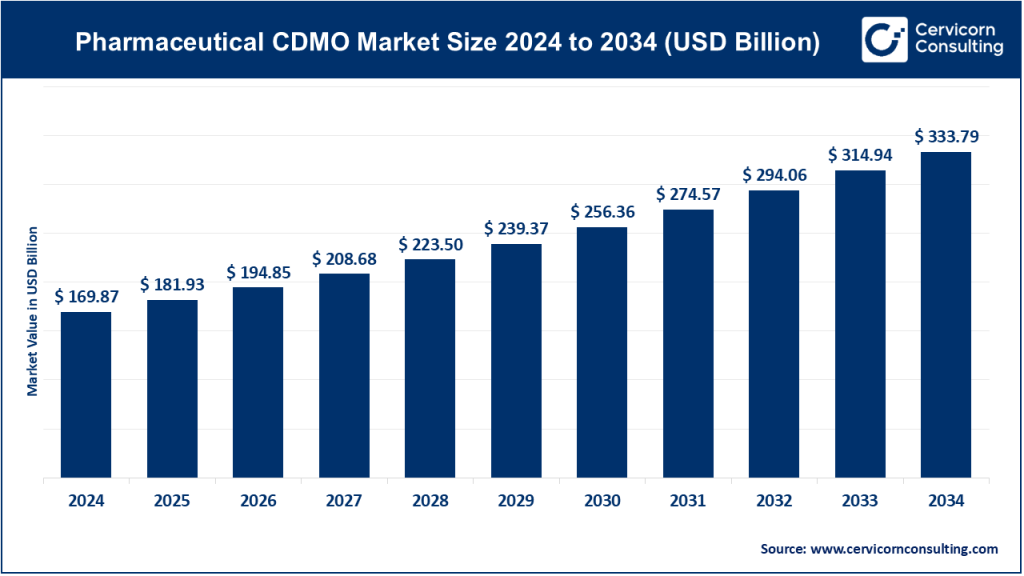

The global pharmaceutical CDMO market size was worth USD 169.87 billion in 2024 and is anticipated to expand to around USD 333.79 billion by 2034, registering a compound annual growth rate (CAGR) of 7.10% from 2025 to 2034.

Pharmaceutical CDMO Market — Growth Factors

The pharmaceutical CDMO market is growing rapidly due to a confluence of industry trends including increasing outsourcing by pharmaceutical companies to reduce capital expenditure; rising R&D investments and clinical trial volumes; expansion of biologics, biosimilars and advanced therapeutics that require sophisticated manufacturing; heightened regulatory complexity that favors experienced CDMOs; greater need for flexible, small-batch and personalized medicine manufacturing; globalization and supply chain diversification efforts post-pandemic; growing prevalence of chronic diseases globally; advances in automation, continuous manufacturing and single-use bioprocessing technologies; and increased government support for localized pharmaceutical manufacturing. Collectively, these factors fuel the expansion of CDMO demand across all therapy modalities and production scales.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2379

What Is the Pharmaceutical CDMO Market?

A Pharmaceutical Contract Development and Manufacturing Organization (CDMO) is a specialized service provider that assists pharmaceutical and biotech companies with outsourced drug development and manufacturing activities. CDMOs offer a broad spectrum of services, including:

- Preclinical formulation and analytical method development

- API (Active Pharmaceutical Ingredient) synthesis and scaling

- Drug product development and optimization

- Sterile manufacturing and fill-finish operations

- Clinical trial material production and packaging

- Commercial-scale manufacturing

- Quality control, quality assurance and regulatory support

CDMOs bridge gaps between early innovation and commercial drug supply, allowing companies to access specialized equipment, technologies and regulatory expertise without needing to build extensive internal manufacturing infrastructure.

Why Is the Pharmaceutical CDMO Market Important?

The pharmaceutical CDMO market plays an indispensable role in strengthening global pharmaceutical innovation and supply chains. Its importance is rooted in several critical advantages:

- Accelerated Time-to-Market: CDMOs have established manufacturing platforms, enabling quicker development and scale-up of new therapies.

- Cost Efficiency: Outsourcing reduces the need for pharmaceutical companies to invest heavily in expensive facilities and GMP-compliant systems.

- Expertise Access: CDMOs offer deep scientific, analytical and manufacturing expertise, especially for complex modalities like biologics and sterile injectables.

- Supply Chain Flexibility: They provide scalable capacity that allows pharma companies to adjust production levels based on market demand and product lifecycle.

- Regulatory Strength: CDMOs maintain strict compliance with global regulatory standards, reducing risk for sponsors.

- Global Reach: Many CDMOs maintain manufacturing facilities across regions, supporting diversified supply chains and market access.

In today’s therapeutically diverse and innovation-driven pharma industry, CDMOs act as strategic partners, not just suppliers.

Top Companies in the Pharmaceutical CDMO Market (2024 Overview)

Below is a refined company-by-company breakdown, covering specialization, focus areas, notable features, 2024 revenue, market share and global presence — with reference links removed.

1. Lonza Group AG

- Specialization: Biologics development and manufacturing, mammalian and microbial biomanufacturing, high-value APIs, cell and gene therapy manufacturing, sterile fill-finish.

- Key Focus Areas: Large-scale biologics, end-to-end development, modular manufacturing expansions, innovative bioprocessing technologies.

- Notable Features: Among the world’s top biologics CDMOs; strong regulatory track record; extensive global manufacturing network; leadership in antibody and advanced therapy production.

- 2024 Revenue: Approximately CHF 6.6 billion.

- Market Share: One of the leading global CDMOs with significant share in biologics.

- Global Presence: Operations across Switzerland, the U.S., the U.K., China and Singapore, with multiple FDA- and EMA-approved facilities.

2. Catalent, Inc.

- Specialization: Drug development, biologics, gene therapy, sterile injectables, oral drug delivery technologies, clinical supply chain solutions.

- Key Focus Areas: Fill-finish capacity, biologics growth, formulation innovation and packaging technologies.

- Notable Features: Known for fill-finish excellence; strong partnerships with top pharma and biotech firms; major player in sterile manufacturing and delivery technologies.

- 2024 Revenue: Approx. USD 4.38 billion.

- Market Share: Large, diversified global CDMO with leading share in advanced drug delivery and fill-finish.

- Global Presence: Facilities across North America, Europe and Asia, supporting clinical and commercial clients worldwide.

3. Recipharm AB

- Specialization: Development and manufacturing for small molecules, oral solid dosage forms, injectables, APIs and biologics support services.

- Key Focus Areas: Flexible small- and large-scale manufacturing, sterile injectables, and end-to-end development pathways.

- Notable Features: European CDMO known for quality, strong regulatory compliance and broad manufacturing capabilities.

- 2024 Revenue: Approximately €827 million.

- Market Share: Mid-tier but widely respected CDMO serving global clients in generics and specialty pharma.

- Global Presence: Manufacturing and development facilities across Sweden, France, India, the U.K. and other European markets.

4. Alcami Corporation

- Specialization: Analytical development, formulation, stability storage, clinical manufacturing, parenteral production support.

- Key Focus Areas: Small-scale clinical manufacturing, analytical services, controlled temperature storage and specialty lab services.

- Notable Features: Highly specialized U.S. CDMO with strengths in analytical testing and stability studies, supporting early clinical-stage programs.

- 2024 Revenue: Estimated in the range of USD 300–350 million (private company).

- Market Share: Smaller but strong niche player in analytical and stability services.

- Global Presence: Primarily U.S-based, serving domestic and global clients.

5. Samsung Biologics Co., Ltd.

- Specialization: Large-scale biologics manufacturing, CDMO services for monoclonal antibodies, development services, bioanalytical testing, and fill-finish.

- Key Focus Areas: Mega-scale biologics plants, end-to-end biologics development, expansion into next-generation therapies.

- Notable Features: Largest single-site biologics manufacturing capacity globally; rapid scale expansion; strategic alliances with top pharma companies.

- 2024 Revenue: Approx. KRW 4.55 trillion.

- Market Share: One of the fastest-growing and largest biologics CDMOs globally.

- Global Presence: Headquarters in South Korea with global partnerships, exports and client networks across North America, Europe and Asia-Pacific.

Leading Trends in the Pharmaceutical CDMO Market & Their Impact

1. Growth of Biologics and Advanced Therapies

With monoclonal antibodies, cell therapies, gene therapies and RNA-based medicines expanding, CDMOs with high-tech biological capabilities are in strong demand. This trend elevates the value of CDMOs with mammalian cell culture expertise, viral vector production and sterile fill-finish capacity.

Impact:

- Increased investment in biologics capacity.

- Higher barriers to entry for new CDMOs.

- Strong long-term client relationships driven by product complexity.

2. Rising Demand for Fill-Finish and Sterile Manufacturing

Fill-finish bottlenecks became evident during the pandemic and remain a critical constraint for injectable biologics, vaccines and oncology drugs.

Impact:

- Higher pricing power for CDMOs with sterile lines.

- Increased M&A as pharma companies secure fill-finish capacity.

- Fast-track facility expansions.

3. Regionalization and Supply Chain Diversification

Pharma companies and governments seek greater supply chain resilience by distributing manufacturing across multiple regions.

Impact:

- More CDMO investments in North America and Europe.

- Favorable government incentives for domestic production.

- Greater competition among Asian CDMOs to retain global business.

4. Continuous and Digital Manufacturing

Advanced manufacturing technologies, including process automation, AI-driven analytics and continuous flow chemistry, are becoming mainstream.

Impact:

- Enhanced productivity and reduced costs.

- Faster development cycles.

- Strengthened regulatory compliance and quality control.

5. CDMO Consolidation and Vertical Integration

Mergers, acquisitions and strategic alliances are reshaping the CDMO landscape.

Impact:

- Larger CDMOs are offering end-to-end services.

- Smaller CDMOs focus on niche specializations.

- Sponsors benefit from streamlined supply chains.

Successful Pharmaceutical CDMO Case Examples

1. Lonza’s Long-Term Biologics Partnerships

Lonza has partnered with several large pharmaceutical companies to provide end-to-end biologics manufacturing, enabling blockbuster monoclonal antibodies to scale globally without the sponsor building new plants.

2. Catalent’s Fill-Finish Support for High-Demand Therapies

Catalent’s sterile fill-finish capabilities helped major pharma companies rapidly scale production for high-demand biologics, including metabolic disease therapies and oncology biologics.

3. Samsung Biologics’ Mega-Plant Expansion

Samsung Biologics’ construction of multiple large-scale manufacturing plants enabled rapid production scale-up for global biologics leaders, reducing supply gaps and ensuring continuity across markets.

4. Alcami’s Analytical and Clinical Manufacturing Support

Alcami’s specialized analytical testing and cold-chain storage solutions have enabled small and mid-size biotech companies to accelerate clinical trials while maintaining robust regulatory readiness.

Global Regional Analysis and Government Initiatives Shaping the Market

North America (U.S. & Canada)

Government Initiatives

- Strong incentives for pharmaceutical onshoring and biomanufacturing.

- Federal support for advanced manufacturing technologies.

- Regulatory modernization by the FDA for continuous manufacturing.

Impact on CDMOs

- Increased biologics and API manufacturing investments.

- Growing partnerships between government and CDMOs for critical drug production.

- Expansion of cell and gene therapy manufacturing hubs.

Europe

Government Initiatives

- EU policies supporting local pharmaceutical production and supply chain resilience.

- Funding for R&D innovation, sustainable processes and regional production.

- EMA’s regulatory alignment facilitating smooth multi-country operations.

Impact on CDMOs

- Strong market for quality-focused CDMOs like Recipharm and Lonza Europe.

- Growth in niche biologics and high-potency API manufacturing.

- Increased demand for environmentally sustainable manufacturing processes.

Asia-Pacific (South Korea, China, India, Japan)

Government Initiatives

- National biotech industrialization strategies in South Korea and China.

- India promoting large-scale API and generic manufacturing self-sufficiency.

- Japan supporting advanced therapy and vaccine manufacturing.

Impact on CDMOs

- Rapid expansion of biologics capabilities, especially in South Korea.

- Competitive manufacturing costs driving global outsourcing to Asia.

- Increased presence of multinational pharma companies seeking regional diversification.

Latin America & Africa

Government Initiatives

- Local production incentives for essential medicines.

- Public–private partnerships to build regional manufacturing capability.

- Investments in vaccine and biologics infrastructure (early stage).

Impact on CDMOs

- Emerging opportunities for small and mid-size CDMOs to serve regional markets.

- Gradual development of GMP-compliant manufacturing hubs.

- Need for strong regulatory support and technology transfers.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Automotive Internet of Things (IoT) Market Revenue, Global Presence, and Strategic Insights by 2035