Peer-to-Peer (P2P) Lending Market Size

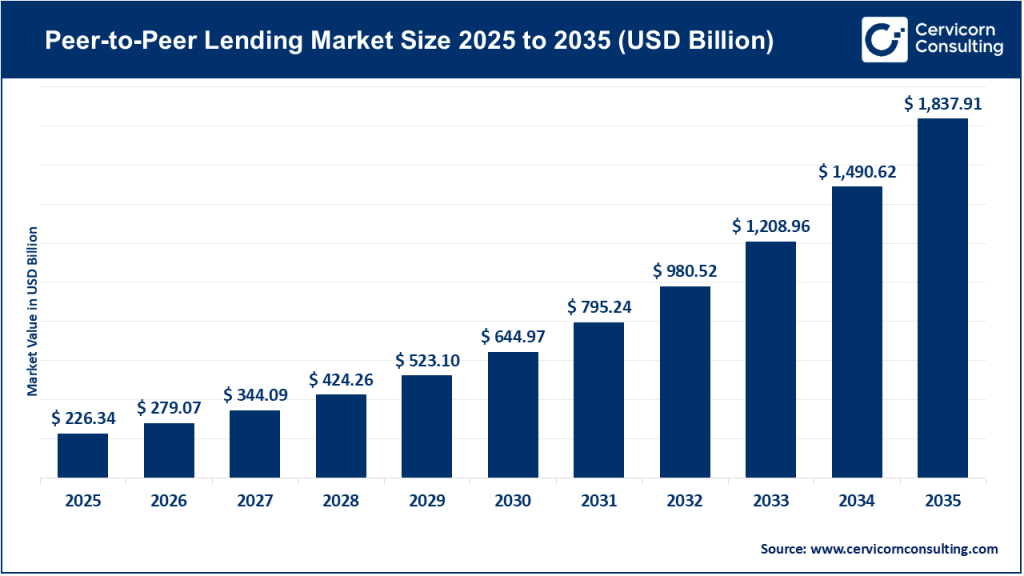

The global peer-to-peer (P2P) lending market size was worth USD 226.34 billion in 2025 and is anticipated to expand to around USD 1,837.91 billion by 2035, registering a compound annual growth rate (CAGR) of 23.3% from 2026 to 2035.

What Is the Peer-to-Peer (P2P) Lending Market?

The peer-to-peer lending market consists of online platforms that directly connect lenders—ranging from retail investors and high-net-worth individuals to hedge funds, wealth managers, and banks—with borrowers who seek personal loans, student loans, SME loans, auto loans, or even real-estate-based financing. Instead of borrowing from a bank, individuals and businesses list their loan requests on these platforms, and investors fund them either partially or fully.

P2P platforms handle all the operational aspects of lending—loan origination, borrower onboarding, credit scoring, risk evaluation, loan servicing, and collections. Initially, these marketplaces focused on retail investors funding consumer loans. Today, the ecosystem is far more complex and institutionalized. Many platforms work with banks, insurance companies, sovereign funds, and asset managers who purchase large loan pools or fund entire loan portfolios. Some P2P firms have also transitioned into digital banks, offering deposits and payments to reduce their cost of capital.

In essence, the P2P lending market is the intersection of technology, alternative finance, and modern credit risk modeling—designed to make lending faster, more inclusive, and more transparent.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2818

Why It Is Important

The importance of P2P lending is rooted in its ability to deliver financial inclusion and efficiency at scale. It expands access to credit for individuals with limited traditional banking options and for small businesses that often face lengthy approval processes or collateral requirements. For lenders and investors, P2P platforms provide new asset classes that offer predictable returns, portfolio diversification, and more direct exposure to consumer and SME credit.

For financial systems, P2P lending introduces technological innovation—such as AI-driven underwriting, automated risk scoring models, open banking integrations, alternative data scoring, and digital KYC/AML processes. By reducing operational friction and enabling personalized risk pricing, P2P platforms redefine the fundamentals of borrowing and lending.

Moreover, the industry challenges long-standing concentration in financial services, increasing competition and pushing banks to accelerate digital transformation. As these platforms scale, they encourage more responsible lending, improve financial transparency, and reshape the future architecture of credit markets.

P2P Lending Market Growth Factors

The P2P lending market is expanding rapidly due to rising demand for quicker, accessible alternative credit among consumers and SMEs; growing investor appetite for higher-yield, diversified portfolios; advancements in AI-driven credit scoring and big-data underwriting that reduce default risks; increased partnerships between P2P platforms and institutional investors that deliver funding scale; rapid digitalization and smartphone penetration in emerging economies; and product diversification into areas like BNPL, SME financing, digital banking, embedded finance, and automated lending engines—collectively propelling the sector into mainstream financial services and driving robust global growth.

Top P2P Lending Companies — Detailed Profiles

Below are detailed profiles for the major companies shaping the global P2P lending market. Information includes specialization, focus areas, features, and where publicly available, 2024 financial figures.

1. Zopa Bank Limited

Company: Zopa Bank Limited, originally one of the world’s first P2P lenders.

Specialization: Consumer lending, digital banking, personal loans, and savings products.

Key Focus Areas: Risk-based consumer lending, deposit-funded loan products, customer-centric digital banking services.

Notable Features: Zopa evolved from a P2P lender into a fully licensed digital bank. This shift helped reduce funding costs and scale loan origination profitably.

2024 Revenue: Approximately £303.4 million in 2024.

Market Share: Significant share of UK’s digital banking and consumer-lending segments.

Global Presence: Primarily UK-focused but influential globally as a pioneer in P2P-to-bank transitions.

2. Avant LLC

Company: Avant LLC (Avant Inc.), a leading U.S.-based fintech lender.

Specialization: Unsecured personal loans for mid-prime borrowers.

Key Focus Areas: Consumer loans, risk-based underwriting, automated application processing.

Notable Features: Known for its strong proprietary credit scoring models and partnerships with institutional investors.

2024 Revenue: As a private company, Avant’s detailed 2024 revenue is not publicly disclosed.

Market Share: Holds a sizable position in the U.S. mid-prime consumer digital lending segment.

Global Presence: Primarily U.S.-based with digital reach through partnerships.

3. Funding Circle

Company: Funding Circle Holdings plc, one of the largest SME P2P lending platforms.

Specialization: Small and medium enterprise (SME) lending.

Key Focus Areas: Term loans, SME lines of credit, asset finance, institutional funding partnerships.

Notable Features: Funding Circle is recognized globally as a leader in SME lending, offering fast approvals using advanced risk models.

2024 Revenue: Reported around £160.1 million in 2024.

Market Share: Holds a strong share in the UK SME lending market and has influenced marketplace lending models worldwide.

Global Presence: Operations in the UK and select international regions.

4. Kabbage Inc. (Now Part of American Express)

Company: Kabbage Inc., acquired by American Express.

Specialization: Small-business loans, automated credit lines, and working capital financing.

Key Focus Areas: Embedded lending, digital SME financing, AI-powered credit decisioning.

Notable Features: Renowned for its automated underwriting engine that enabled near-instant lending decisions.

2024 Revenue: Not reported independently after acquisition; part of American Express’s broader financial results.

Market Share: Strong presence in U.S. SME lending through American Express’s integrated business.

Global Presence: Operates within American Express’s global SME customer ecosystem.

5. Social Finance Inc. (SoFi)

Company: Social Finance Inc. (SoFi), a diversified consumer finance and technology platform.

Specialization: Personal loans, student loan refinancing, mortgages, deposits, and investment products.

Key Focus Areas: End-to-end digital financial services, cross-product integration, and financial wellness.

Notable Features: One of the fastest-growing fintech lenders in the U.S., with a technology platform supporting external financial institutions.

2024 Revenue: Approximately $2.7 billion in 2024, with strong profitability.

Market Share: Holds one of the largest shares in the U.S. digital consumer-lending sector.

Global Presence: Primarily U.S.-based but expanding via partnerships and platform licensing.

Leading Trends in the P2P Lending Market and Their Impact

1. AI and Machine Learning–Driven Underwriting

P2P platforms increasingly deploy AI models and alternative data sources—such as transactional data, spending behavior, mobile usage patterns, and psychometric inputs—to evaluate borrower risk more accurately. The impact is transformative:

- Higher approval rates

- Lower default ratios

- Faster, often instant, loan decisions

- Stronger portfolio performance

This trend is shaping the competitive advantage of technologically advanced platforms.

2. Institutionalization of Funding

While P2P started as retail investor–driven, institutional investors now form the majority of lending capital in many markets. Pension funds, hedge funds, banks, and asset managers purchase large volumes of loans or fund platforms directly.

Impact:

- Enables massive scaling

- Reduces funding volatility

- Encourages more sophisticated risk management

- Increases platform stability

However, it also reduces the “pure P2P” structure and makes platforms resemble digital originators for institutional portfolios.

3. Expansion into Digital Banking and Fintech Ecosystems

Many P2P firms now offer:

- Savings accounts

- Debit cards

- Payments

- Budgeting apps

- Investment products

This creates a unified customer experience and reduces dependence on wholesale/institutional funding. The impact is higher customer lifetime value and diversified revenue streams.

4. Regulatory Tightening and Compliance Transformation

As P2P lending grows, regulators worldwide are enforcing stricter guidelines around:

- Consumer protection

- Lending transparency

- Risk disclosures

- Platform governance

- Minimum capital buffers

The impact is twofold: while compliance costs rise, market stability improves, and investor trust strengthens.

5. Securitization and Creation of Secondary Markets

More P2P lenders package loans into asset-backed securities (ABS), enabling liquidity and attracting sophisticated investors.

Impact:

- Lower funding costs

- Faster capital cycling

- Broader investor participation

This trend is gradually merging P2P markets with mainstream capital-market structures.

6. Growth in Emerging Markets

Regions like India, Southeast Asia, Latin America, and Africa are seeing rapid adoption due to:

- Underbanked populations

- Mobile-first financial behavior

- Government-supported fintech innovation

These markets offer significant growth potential for P2P platforms.

Successful Examples of P2P Lending Around the World

LendingClub (USA)

One of the earliest and best-known P2P lenders, LendingClub pioneered large-scale online consumer lending and later transitioned into a hybrid lender with banking operations.

Prosper Marketplace (USA)

Prosper offers a wide range of consumer loans and remains a major retail investor–driven lending marketplace.

Funding Circle (UK)

A global leader in SME lending, proving the scalability of P2P lending for small businesses.

Zopa (UK)

A pioneer of the P2P model that successfully evolved into a profitable digital bank.

Lufax (China)

Once a major P2P player, Lufax transitioned into a major fintech and wealth management platform after China tightened regulations.

These examples demonstrate different evolutionary paths—pure retail P2P, institutional P2P, hybrid lending, and full digital banking models.

Global Regional Analysis and Government Initiatives

United Kingdom & Europe

The UK remains one of the world’s most mature and structured P2P lending markets. Regulators have introduced strict rules on borrower assessment, platform transparency, investor risk disclosure, and governance. These steps ensure market stability and prevent consumer harm. Europe overall has embraced fintech innovation through initiatives like digital-finance frameworks and harmonized lending regulations.

United States

The U.S. regulatory environment is highly fragmented. Marketplace lenders must comply with multiple layers of federal and state oversight. Recent scrutiny has focused on:

- Bank-fintech partnerships

- “True lender” rules

- Consumer protection

- Fair lending practices

Despite this complexity, the U.S. remains one of the largest and most innovative P2P ecosystems.

India and the Asia-Pacific Region

India has emerged as a rapidly expanding P2P market. The Reserve Bank of India (RBI) issued detailed regulations governing:

- Lender exposure limits

- Platform neutrality

- Prohibition of guaranteed returns

- Risk disclosure mandates

Other APAC nations, such as Singapore, Indonesia, and Malaysia, operate regulatory sandboxes that support responsible fintech experimentation.

China and Emerging Markets

China once dominated global P2P lending volumes but implemented sweeping regulatory reforms that shuttered many platforms due to fraud and systemic concerns. While pure P2P models have largely disappeared, many surviving platforms transitioned into licensed lenders or wealth management platforms.

In emerging markets across Africa and Latin America, P2P lending is growing rapidly due to unmet credit demand and mobile-first consumer behavior.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Health and Wellness Coach Market Growth Drivers, Trends, Key Players, and Regional Insights by 2034