Organic Starch Market Size

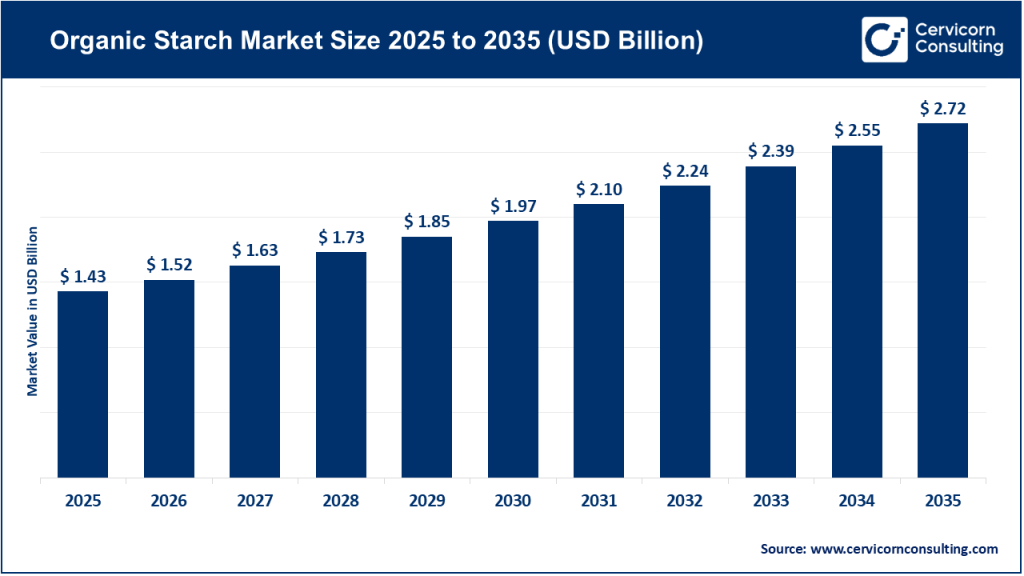

The global organic starch market size was worth USD 1.43 billion in 2025 and is anticipated to expand to around USD 2.72 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% from 2026 to 2035.

Organic Starch Market – Growth Factors

Growth in the organic starch market is primarily fueled by shifting consumer preferences toward organic, clean-label and minimally processed foods, as well as expanding use cases across bakery, dairy, beverages, baby food, and plant-based product categories. Rising health consciousness, concerns over chemical additives, and a global move toward sustainable agriculture have accelerated adoption of certified-organic ingredients. Food manufacturers are increasingly reformulating products to meet organic certification standards, which significantly boosts demand for organic starch as a functional thickener, stabilizer, and texture modifier.

Expansion of organic farming acreage, supply-chain improvements, investments in certification infrastructure, and an increasing number of ingredient processors upgrading lines for organic compliance further support market expansion. Continuous innovation in organic starch derivatives—such as organic maltodextrin, resistant starch, and prebiotic starch blends—broadens applications and enhances profitability. The combination of premium pricing, expanding retail distribution of organic foods, and supportive regulatory frameworks worldwide ensures sustained growth momentum for the organic starch market.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2833

What Is the Organic Starch Market?

The organic starch market comprises the production, processing, certification, and global distribution of starches extracted from organically grown crops such as corn, potato, tapioca/cassava, wheat, rice, and peas. Unlike conventional starches, organic starches are derived from raw materials cultivated without synthetic fertilizers, pesticides, or genetically modified organisms (GMOs), and they must adhere to stringent organic certification standards like USDA Organic, EU Organic, and other national organic programs.

Organic starch is sold in several forms:

- Native organic starch used for thickening, gelling, and stabilizing.

- Organic modified starch, which undergoes physical or enzymatic modification (but not chemical alterations restricted under organic rules) to enhance functional properties.

- Organic starch derivatives such as organic maltodextrin, organic glucose syrups, resistant starch, and prebiotic fibers for specialized applications.

Its customers span food and beverage manufacturers, baby food brands, dietary supplement companies, and natural personal-care producers. As organic product launches grow globally, the organic starch market has become a pivotal ingredient sector supporting the clean-food movement.

Why Is It Important?

1. Critical for Clean-Label and Organic Product Development

Organic starch is essential for organic manufacturers who need functional ingredients that meet certification requirements. Without organic starch, many beverages, dairy products, sauces, and baked goods could not retain the textures, viscosity, stabilization, or shelf-life consumers expect.

2. Consumer Demand for Transparency and Wellness

Consumers increasingly associate organic ingredients with health, safety, fewer chemical residues, and environmentally responsible farming. Organic starch aligns with these expectations and allows brands to meet strict labeling demands.

3. Sustainability and Responsible Agriculture

Organic starch production encourages soil health, biodiversity, reduced chemical usage, lower carbon emissions, and regenerative agricultural practices. This makes it a strategic input for companies focused on ESG goals, sustainability commitments, and carbon reporting.

4. Premium Pricing and Brand Differentiation

Organic-certified ingredients command higher market prices, which benefit producers and create opportunities for value-added product lines, especially in baby food, premium snacks, clean-label sauces, and organic sports nutrition.

Top Companies in the Organic Starch Market

Below are profiles of major players shaping the market, including their specialization, focus areas, notable features, and available 2024 revenue or market position context.

1. Cargill Incorporated

Specialization:

Global leader in agribusiness, commodity processing, and ingredients; major presence in maize and starch processing.

Key Focus Areas:

Food and beverage starches, industrial starches, sweeteners, functional texturizers, sustainable sourcing initiatives.

Notable Features:

One of the world’s largest private companies with extensive supply-chain integration, advanced processing technologies, and the ability to scale organic starch production as demand rises.

2024 Company Revenue:

Approximately USD 160 billion (overall company revenue).

Market Share & Global Presence:

Operates in over 70 countries with massive influence on global grain and starch supply chains, including certified-organic segments.

2. BENEO GmbH

Specialization:

Functional ingredients such as chicory root fiber, rice starch, wheat starch, and specialty carbohydrates.

Key Focus Areas:

Nutrition-forward innovations, digestive health, low-glycemic ingredient solutions, and clean-label starches.

Notable Features:

Houses the BENEO-Institute, which provides scientific research to support health claims. Strong portfolio in clean-label and organic-compatible starches, widely used in baby food, bakery, and sports nutrition.

2024 Revenue Context:

Part of Südzucker Group’s Special Products segment, which records annual revenues in the multi-hundred-million-euro range.

Global Presence:

Facilities and R&D centers across Europe, North America, and Asia, with strong influence in the global functional ingredient market.

3. Ingredion Incorporated

Specialization:

Leading global supplier of starches, sweeteners, texturizers, plant proteins, and specialty ingredients.

Key Focus Areas:

Clean-label starches, plant-based foods, texture systems, organic-compatible starch portfolios, industrial applications.

Notable Features:

Strong technical application centers and formulation services that help brands transition into clean-label and organic product lines.

2024 Revenue:

Approximately USD 7.4 billion (overall company revenue).

Global Presence:

Manufacturing and R&D footprints across North America, South America, EMEA, and APAC, making it a major international supplier.

4. AGRANA Beteiligungs-AG

Specialization:

Major European producer of sugar, fruit preparations, and starches (corn, potato, and wheat).

Key Focus Areas:

Food and industrial starches, organic-compatible processing, regional supply-chain assurance.

Notable Features:

Reports starch segment financials separately, showing the importance of starch to its business model.

2024 Revenue:

Group revenue estimated around EUR 3.5 billion with the starch segment contributing significantly.

Global Presence:

Operates starch factories primarily in Europe with exports reaching global customers.

5. ORGANICWAY Food Ingredients Inc.

Specialization:

Certified organic ingredients provider focusing on organic starches, organic maltodextrin, organic sugars, and plant-based ingredients.

Key Focus Areas:

Certified USDA Organic, EU Organic, and other regional organic standards; supplying organic ingredients to food, beverages, supplements, and cosmetics brands.

Notable Features:

Strong emphasis on certification, purity, and traceability; mid-sized but influential supplier in organic ingredient export markets.

2024 Revenue Context:

Estimated annual sales between USD 10–50 million based on industry directories.

Global Presence:

Exports to over 40 countries, serving North America, Europe, and Asia with certified organic ingredients.

Leading Trends and Their Impact

1. Clean-Label and Organic Product Expansion

As consumers demand simple, recognizable ingredients, organic starch has become essential for reformulated sauces, soups, snacks, beverages, and baby foods.

Impact: Higher demand and premium pricing.

2. Growth of Organic Starch Derivatives

Organic maltodextrin, glucose syrup, resistant starch, and prebiotic fibers are seeing rapid adoption.

Impact: Wider applications in sports nutrition, infant nutrition, and digestive-health products.

3. Traceability and Transparency Technologies

Blockchain, QR codes, and digital traceability systems are increasingly used to verify organic compliance.

Impact: Enhanced consumer trust but higher compliance and operational costs.

4. Regionalization of Organic Supply

Local sourcing and shorter supply chains are gaining preference.

Impact: Rise of regional processors and reduced transportation footprint.

5. Rising Raw-Material Volatility

Organic farming yields are typically lower and weather-sensitive.

Impact: Occasional price spikes and the need for long-term farmer contracts.

6. Sustainability as a Market Driver

Companies are integrating organic sourcing into broader ESG and climate commitments.

Impact: Increased demand for organic starch as a sustainable alternative to conventionally produced ingredients.

Successful Examples Around the World

Europe — BENEO’s Success in Functional Organic Starches

BENEO has successfully positioned its rice and wheat starches within the baby food, gluten-free, and digestive health markets. Its research-driven approach has made it a leader in the premium, health-focused segment of the organic starch market.

North America — Ingredion’s Formulation Platform

Ingredion’s application labs have helped numerous large brands move to organic and clean-label formulations by providing tailored starch solutions and performance-matched organic variants. This has accelerated organic product launches across categories.

Asia — ORGANICWAY’s Certified Organic Supply Network

With strong capabilities in sourcing, certification, and export logistics, Organicway has become a key supplier to global organic brands seeking high-quality, competitively priced organic starch ingredients.

Central Europe — AGRANA’s Starch Integration Model

AGRANA’s vertically integrated starch operations demonstrate how regional processing can meet both industrial and premium organic food-industry needs while maintaining sustainability and efficiency.

Global Regional Analysis and Government Policies Influencing the Market

North America

- USDA Organic regulations ensure strict control over production and labeling.

- Increasing government support for organic farming transition programs.

- Strong retail demand for organic foods fuels continuous growth.

Impact: High-quality organic starch demand from food processors, baby food brands, and health-focused manufacturers.

Europe

- EU organic regulations are among the strictest globally.

- CAP (Common Agricultural Policy) incentives encourage sustainable agriculture and organic transition.

- Europe’s high organic food penetration drives demand for organic starch in bakery, dairy, infant nutrition, and premium snack categories.

Impact: Stable demand environment with strong focus on traceability and sustainability.

Asia-Pacific

- India, China, and Southeast Asia are expanding organic agriculture for both domestic and export markets.

- Governments are promoting organic agriculture through subsidies and certification programs.

- Rapid growth in plant-based foods boosts starch demand.

Impact: APAC becomes a rising source of organic starch feedstock and finished ingredients.

Latin America

- Countries like Brazil and Peru are expanding organic cassava, corn, and specialty crops.

- Export-focused organic farming receives government support through trade incentives.

Impact: Region supplies increasing volumes of organic feedstock for global starch processors.

Middle East & Africa

- Growing urban demand for organic and imported health foods.

- Smallholder-focused organic farming initiatives are expanding certification coverage.

Impact: Gradual development of regional organic ingredient markets with potential for export-oriented cassava and root crops.

Key Policy Themes Affecting the Market

- Subsidies for organic farming transition

- Equivalency agreements between certification bodies

- Government procurement policies favoring organic ingredients

- Trade incentives for organic exports

- Increased scrutiny on sustainability and carbon footprint reporting

These policies collectively create a stable foundation for the growth of organic starch across global value chains.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Skincare Market Growth Drivers, Trends, Key Players and Regional Insights by 2035