Molecular Diagnostics Market Size

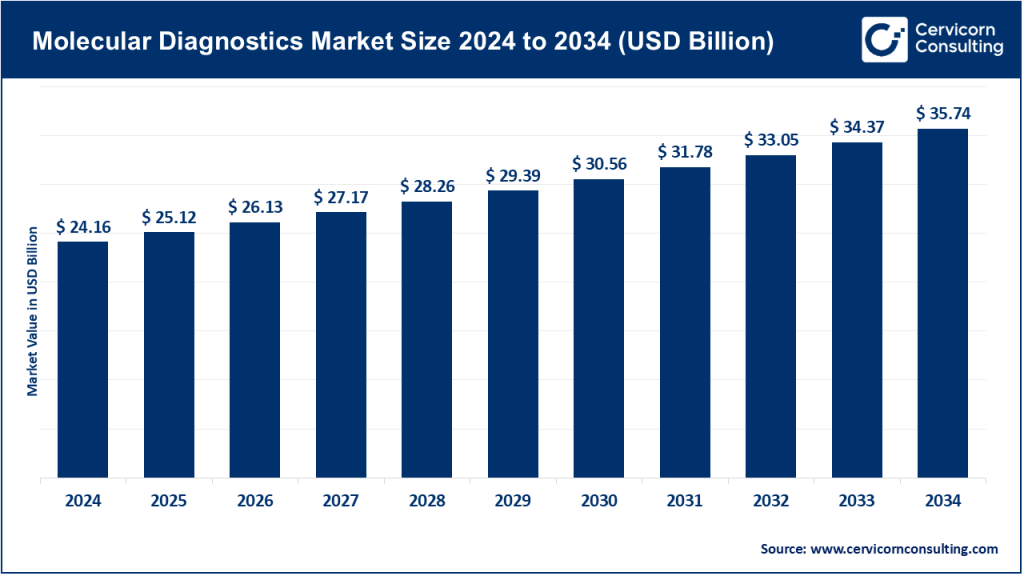

The global molecular diagnostics market size was worth USD 24.16 billion in 2024 and is anticipated to expand to around USD 35.74 billion by 2034, registering a compound annual growth rate (CAGR) of 3.99% from 2025 to 2034.

What is the Molecular Diagnostics Market?

Molecular diagnostics (MDx) refers to a category of medical testing that detects specific sequences in DNA or RNA—such as mutations, insertions, deletions, or pathogen genomes—to identify disease, guide therapy, and monitor treatment outcomes. Unlike traditional diagnostic tests that focus on proteins or biochemical markers, molecular diagnostics analyze genetic material, offering highly specific and sensitive results. Common technologies include polymerase chain reaction (PCR), next-generation sequencing (NGS), isothermal amplification, and microarray analysis. These tools enable precise identification of pathogens, genetic disorders, and cancer-related mutations, making MDx a cornerstone of personalized medicine.

Why Molecular Diagnostics Is Important

Molecular diagnostics has revolutionized modern healthcare by enabling early and accurate disease detection. It allows clinicians to identify the root genetic or infectious cause of disease rather than relying solely on observable symptoms. This precision leads to targeted treatment decisions, better patient outcomes, and improved cost-effectiveness. MDx is essential in oncology for identifying actionable mutations, in infectious diseases for pathogen detection and antimicrobial resistance profiling, and in genetic testing for inherited disorders. Moreover, its role in public health—particularly in genomic surveillance and outbreak tracking—was highlighted during the COVID-19 pandemic, when rapid molecular testing became central to global containment and response strategies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2790

Growth Factors

The molecular diagnostics market is expanding rapidly, driven by increasing incidences of infectious diseases and cancers, a rising focus on precision medicine, and continuous advancements in technologies like NGS and PCR. The growing adoption of point-of-care molecular platforms, improvements in automation, and decreasing per-test costs have further accelerated demand. Post-pandemic investments in genomic surveillance infrastructure have strengthened MDx adoption in both developed and emerging economies. Moreover, rising healthcare spending, favorable reimbursement policies in many countries, and the integration of molecular testing into hospital workflows are fueling market growth. Challenges such as regulatory complexity, reimbursement variability, and skilled workforce shortages remain but are being addressed through innovation and public-private partnerships.

Molecular Diagnostics Market — Top Companies

Below are profiles of five global leaders in the molecular diagnostics space, including their specializations, key focus areas, notable features, 2024 revenue, market share, and global presence.

Roche Diagnostics

- Company: F. Hoffmann-La Roche AG

- Specialization: Roche is a global leader in in-vitro diagnostics (IVD) with strong capabilities in molecular diagnostics, immunoassays, and tissue diagnostics.

- Key Focus Areas: Companion diagnostics for oncology, high-throughput PCR and NGS platforms, and integrated laboratory automation.

- Notable Features: Roche’s diagnostics arm is uniquely integrated with its pharmaceutical division, enabling rapid co-development of companion diagnostics. Its Cobas platform is widely used in clinical laboratories for PCR-based testing.

- 2024 Revenue: The Roche Diagnostics Division reported approximately CHF 14.3 billion in revenue in 2024.

- Market Share: Roche holds one of the largest global shares in molecular and companion diagnostics.

- Global Presence: Active in over 100 countries, Roche maintains extensive R&D, manufacturing, and service operations in Europe, North America, and Asia.

Abbott Laboratories

- Company: Abbott Laboratories

- Specialization: Abbott’s diagnostics portfolio includes molecular, core laboratory, and point-of-care systems, with platforms such as Alinity, ARCHITECT, and ID NOW.

- Key Focus Areas: Infectious-disease molecular testing, rapid diagnostics, and integrated laboratory solutions.

- Notable Features: Abbott has a strong presence in decentralized and point-of-care molecular diagnostics. Its ID NOW platform gained global attention during the COVID-19 pandemic for delivering rapid molecular results.

- 2024 Revenue: Abbott reported total company sales of approximately USD 42 billion, with its Diagnostics division contributing a significant share.

- Market Share: Abbott is one of the top three global diagnostics companies, leading in rapid and molecular point-of-care testing.

- Global Presence: Operates in over 160 countries with extensive distribution and manufacturing networks across North America, EMEA, and emerging markets.

Thermo Fisher Scientific

- Company: Thermo Fisher Scientific Inc.

- Specialization: A diversified life sciences leader providing instruments, reagents, consumables, and diagnostic solutions for research and clinical use.

- Key Focus Areas: NGS platforms, PCR reagents, molecular assay kits, and specialty diagnostics for infectious and genetic diseases.

- Notable Features: Thermo Fisher is a key enabler of molecular testing globally, supplying reagents and sequencing platforms to laboratories and hospitals. Its Ion Torrent and Applied Biosystems lines are central to NGS and PCR testing.

- 2024 Revenue: Total 2024 revenue was approximately USD 42.9 billion, with the Specialty Diagnostics segment contributing around USD 4.3 billion.

- Market Share: One of the largest global suppliers of clinical and research-grade molecular testing instruments and consumables.

- Global Presence: Operations in over 50 countries with R&D, production, and service centers in the U.S., Europe, and Asia-Pacific.

QIAGEN N.V.

- Company: QIAGEN N.V.

- Specialization: A pioneer in sample and assay technologies for molecular diagnostics, QIAGEN focuses on nucleic acid purification, PCR assays, and bioinformatics.

- Key Focus Areas: Sample preparation, molecular diagnostic consumables, and companion diagnostic collaborations with pharmaceutical companies.

- Notable Features: QIAGEN’s QIAstat-Dx platform provides multiplex PCR testing for infectious diseases. The company’s consumables and reagents are integral to laboratories worldwide.

- 2024 Revenue: Reported approximately USD 1.98 billion in 2024.

- Market Share: A leading player in molecular reagents and consumables with high recurring revenue.

- Global Presence: Serves more than 25 countries, with major hubs in the U.S., Germany, and Singapore.

bioMérieux S.A.

- Company: bioMérieux S.A.

- Specialization: A French multinational specializing in clinical microbiology and molecular diagnostics, particularly in infectious-disease testing.

- Key Focus Areas: Syndromic molecular panels, microbiology automation, and industrial microbiological testing.

- Notable Features: Its BIOFIRE and SPOTFIRE molecular testing platforms offer rapid multiplex PCR panels that detect multiple pathogens simultaneously.

- 2024 Revenue: Achieved total sales of approximately €3.98 billion in 2024.

- Market Share: A major player in infectious-disease molecular diagnostics and clinical microbiology automation.

- Global Presence: Strong presence in Europe and North America with growing operations in Asia and emerging markets.

Leading Trends and Their Impact

- Next-Generation Sequencing (NGS) Becomes Mainstream

NGS technology, once confined to research, is now widely used for clinical applications such as comprehensive tumor profiling and non-invasive prenatal testing. Falling costs, faster turnaround times, and improved bioinformatics are accelerating clinical adoption, enabling more precise treatment strategies in oncology and rare diseases. - Point-of-Care Molecular Testing Expands Rapidly

Portable and automated molecular systems are transforming diagnostics by enabling testing closer to patients. Platforms such as ID NOW and GeneXpert deliver rapid results in emergency rooms and clinics, reducing time to diagnosis and improving treatment outcomes. - Liquid Biopsy and Minimal Residual Disease (MRD) Testing Grow

Liquid biopsies analyze circulating tumor DNA to detect cancer earlier and monitor therapy response. These tests minimize invasive procedures and enable continuous patient monitoring, marking a shift toward precision oncology. - Syndromic Multiplex Panels Gain Momentum

Multiplex molecular panels that identify multiple pathogens in a single test, such as respiratory or gastrointestinal panels, enhance diagnostic accuracy and speed. This trend supports better infection management and antimicrobial stewardship. - Automation and Cloud Integration Enhance Efficiency

Laboratories are increasingly adopting fully automated, extraction-to-result workflows supported by cloud-based data analytics and artificial intelligence. This reduces manual errors, accelerates test turnaround times, and supports scalable operations. - AI and Data Analytics Revolutionize Interpretation

Artificial intelligence assists in variant interpretation and reporting, particularly for NGS-based tests. AI-driven platforms improve diagnostic accuracy and streamline complex data analysis, making molecular testing more accessible and efficient.

Successful Global Examples of Molecular Diagnostics

South Korea’s COVID-19 Response

South Korea demonstrated the power of molecular diagnostics through its rapid deployment of nationwide PCR testing during the early months of the COVID-19 pandemic. The country’s coordinated public-health strategy, supported by domestic diagnostic manufacturers, enabled efficient testing, contact tracing, and outbreak control.

United Kingdom’s Genomic Surveillance (COG-UK)

The COVID-19 Genomics UK Consortium (COG-UK) showcased how molecular diagnostics and large-scale sequencing can guide public-health policies. By rapidly sequencing SARS-CoV-2 genomes, the UK was able to identify emerging variants and adjust containment strategies in real time.

Oncology Companion Diagnostics

Companion diagnostics, developed alongside targeted cancer therapies, have redefined personalized medicine. For instance, tests identifying HER2, EGFR, and BRCA mutations guide treatment selection in breast, lung, and ovarian cancers. Such molecular tools have become standard in oncology practice worldwide.

Global Regional Analysis: Drivers and Government Initiatives

North America

North America remains the largest and most mature market for molecular diagnostics. The U.S. leads due to its robust healthcare infrastructure, research funding, and strong presence of key industry players. The Centers for Disease Control and Prevention (CDC) continues to invest in genomic surveillance and molecular testing infrastructure. Reimbursement frameworks under Medicare and private insurers have also facilitated clinical adoption of molecular assays for cancer, infectious diseases, and genetic conditions.

Europe

Europe’s molecular diagnostics market is shaped by strong national health systems and centralized laboratory networks. The European Union’s In Vitro Diagnostic Regulation (IVDR) has redefined compliance and performance standards, emphasizing test validation and patient safety. The regulation’s transitional extensions granted in 2024 provide companies more time to adapt, while still ensuring higher quality benchmarks. European governments are also investing in genomic medicine initiatives, including national cancer genome projects and antimicrobial resistance monitoring.

Asia-Pacific (APAC)

The Asia-Pacific region represents the fastest-growing market segment. Countries like Japan, South Korea, China, and India are investing heavily in molecular testing infrastructure. Post-pandemic preparedness has strengthened local manufacturing and supply-chain resilience. Governments in the region are expanding screening programs for infectious diseases and cancer, while encouraging domestic innovation through funding and favorable regulations. Rising middle-class healthcare spending and urbanization further drive test adoption.

Latin America and the Middle East & Africa

In Latin America, countries such as Brazil and Mexico are witnessing steady growth as healthcare systems modernize and prioritize molecular testing for infectious diseases like HIV, hepatitis, and tuberculosis. However, limited infrastructure and budget constraints still pose challenges. In Africa, molecular testing capacity is expanding through global health partnerships, donor-funded initiatives, and regional collaborations that strengthen diagnostic networks for disease surveillance and outbreak management.

Government Initiatives and Policies Shaping the Market

- Regulatory Modernization:

Governments worldwide are revising diagnostic regulations to improve test accuracy and transparency. The EU’s IVDR and the U.S. FDA’s focus on laboratory-developed test (LDT) oversight are examples of evolving frameworks ensuring safety and efficacy. - Public Funding for Genomic Programs:

National genomic initiatives, such as the U.S. All of Us Research Program and the UK’s Genomics England project, are integrating molecular data into healthcare systems, stimulating demand for sequencing and data-analytics tools. - Pandemic Preparedness and Surveillance:

Many countries are investing in molecular testing infrastructure to prepare for future pandemics. National sequencing centers and public-health laboratories are increasingly equipped for real-time genomic monitoring of emerging pathogens. - Reimbursement Reforms:

Reimbursement for molecular tests is expanding, especially in oncology and infectious disease diagnostics. Clear payment pathways encourage hospitals to adopt advanced molecular platforms, improving market penetration. - Public-Private Collaborations:

Governments are partnering with diagnostics companies to accelerate innovation. Joint initiatives in cancer genomics, antimicrobial resistance, and public-health surveillance are driving long-term molecular diagnostics capacity building.

Key Takeaways from Successful Implementations

- Speed and Scale Drive Impact: Countries with robust molecular infrastructure can respond faster to health crises, demonstrating the strategic importance of MDx in pandemic preparedness.

- Integration Across Health Systems: The combination of clinical data, genomics, and public-health reporting enhances real-time decision-making.

- Supportive Policy Frameworks Matter: Regulatory clarity, funding for innovation, and reimbursement support are crucial for sustainable growth in the molecular diagnostics market.

- Technology Accessibility and Training: Expanding MDx in emerging markets requires not only equipment but also investment in workforce training and supply-chain resilience.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Floating Solar Panels Market Revenue, Global Presence, and Strategic Insights by 2034