Minimally Invasive Surgery Market Size

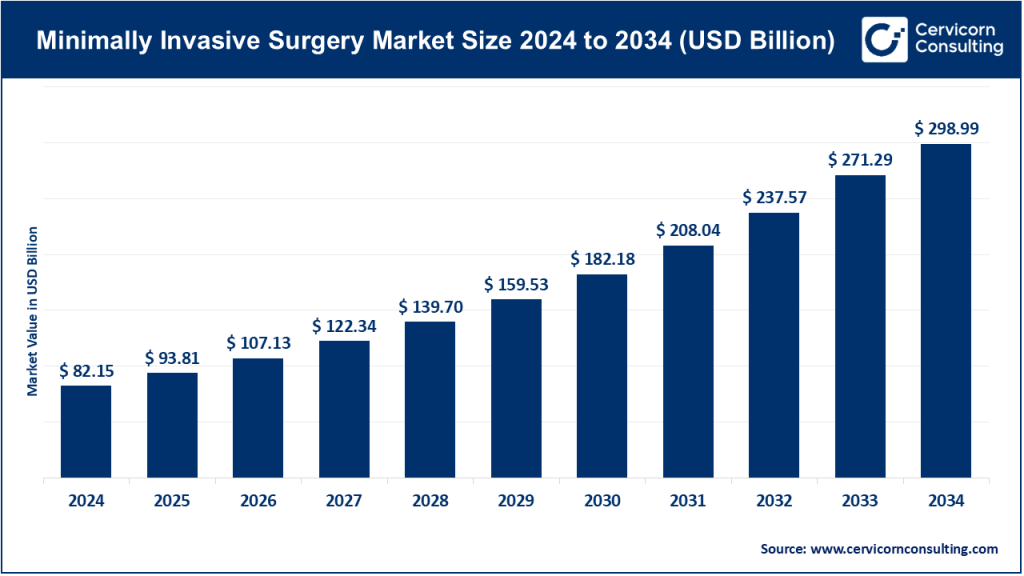

The global minimally invasive surgery market size was worth USD 82.15 billion in 2024 and is anticipated to expand to around USD 298.99 billion by 2034, registering a compound annual growth rate (CAGR) of 13.79% from 2025 to 2034.

What Is the Minimally Invasive Surgery Market?

The minimally invasive surgery market encompasses medical devices, instruments, imaging systems, consumables, and robotic platforms that enable surgical procedures through small incisions rather than large open ones. Product categories include laparoscopic and endoscopic instruments, electrosurgical and ultrasonic energy devices, insufflators, staplers, trocars, visualization towers, surgical robots, and single-use surgical disposables.

Key end users are hospitals, ambulatory surgical centers (ASCs), and specialized surgical clinics, with applications across multiple specialties such as general surgery, urology, gynecology, orthopedics, cardiothoracic surgery, and ENT.

Why the Minimally Invasive Surgery Market Is Important

Minimally invasive surgery has revolutionized modern healthcare by improving both patient outcomes and hospital efficiency. Clinically, MIS offers less blood loss, reduced pain, smaller scars, and shorter recovery times. These benefits translate into lower complication rates and faster return to normal activity.

For healthcare systems, shorter hospital stays reduce operational costs and increase patient throughput, making MIS a key strategy in optimizing healthcare delivery. From a business perspective, MIS represents a combination of high-value capital equipment sales (like robotic systems) and recurring disposable revenues—creating a lucrative market for medical device manufacturers and investors. Overall, MIS improves patient experience while enhancing hospital profitability and health-system sustainability.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2448

Growth Factors

The minimally invasive surgery market is experiencing robust growth driven by multiple converging forces: the rising global prevalence of chronic diseases, aging populations requiring more surgical procedures, and the growing clinical preference for minimally invasive approaches due to their superior patient outcomes. Technological innovations—such as enhanced imaging, robotics, artificial intelligence, and smart surgical instruments—are expanding MIS capabilities into complex surgeries previously done through open techniques. Patient demand for faster recovery and better aesthetics, along with increased investments in hospital infrastructure and training programs, are propelling adoption.

Additionally, favorable government policies, improved reimbursement frameworks, and expanding access to healthcare in emerging economies are accelerating the global shift toward minimally invasive techniques. Together, these factors ensure that MIS continues to gain prominence across surgical specialties worldwide.

Top Companies in the Minimally Invasive Surgery Market

Below is an overview of major players shaping the global MIS landscape, including their specialization, focus areas, 2024 revenue, and global presence.

Abbott Laboratories

Specialization: Abbott is a global leader in healthcare and medical devices, with a significant presence in interventional cardiology and structural heart solutions that align closely with MIS.

Key Focus Areas: The company focuses on cardiovascular interventions, structural heart devices, vascular closure systems, electrophysiology, and diagnostic technologies that complement surgical procedures.

Notable Features: Abbott’s strength lies in its integration of diagnostics and therapeutics, giving surgeons real-time data during minimally invasive procedures. The company has a strong global supply chain and extensive R&D investment in imaging and catheter-based interventions.

2024 Revenue: Approximately USD 42 billion, reflecting a diversified portfolio across diagnostics, devices, nutrition, and pharmaceuticals.

Global Presence: Abbott operates in over 160 countries with robust manufacturing and distribution networks supporting both developed and emerging markets.

Arthrex

Specialization: Arthrex is a privately held medical device company specializing in orthopedic and sports medicine products, particularly those enabling arthroscopic and minimally invasive joint procedures.

Key Focus Areas: Arthroscopic systems, orthopedic implants, surgical visualization, and surgeon training programs.

Notable Features: The company is renowned for its innovation in orthopedic MIS, surgeon education initiatives, and extensive R&D focused on biologic and implant technologies.

2024 Revenue: Estimated at USD 3.2 billion, primarily driven by orthopedic devices and surgical instruments.

Global Presence: Arthrex operates in more than 100 countries and has training facilities worldwide to support surgeons adopting new MIS techniques.

Asensus Surgical

Specialization: Asensus focuses on digital laparoscopy and robotic-assisted surgical technologies designed to enhance surgeon performance.

Key Focus Areas: The Senhance Surgical System, digital integration, real-time analytics, and AI-powered visualization tools for laparoscopic surgery.

Notable Features: Asensus emphasizes surgeon augmentation rather than full automation, allowing greater control with intelligent digital assistance. Its AI-driven “Performance-Guided Surgery” platform is designed to standardize procedures and reduce variability.

2024 Revenue: In the low single-digit millions, reflecting its growth phase as it expands system installations and partnerships.

Global Presence: The company is headquartered in North Carolina, with commercial operations in Europe, Asia, and North America.

CONMED Corporation

Specialization: CONMED provides a broad range of surgical instruments and consumables used in minimally invasive procedures across general surgery, orthopedics, and endoscopy.

Key Focus Areas: Electrosurgical devices, laparoscopic instruments, visualization systems, and single-use consumables for MIS.

Notable Features: CONMED is known for high-quality, cost-effective devices that make MIS accessible for both hospitals and ASCs. The company’s emphasis on disposable solutions aligns with the growing trend toward infection control and workflow efficiency.

2024 Revenue: Approximately USD 1.35 billion, with strong growth across orthopedic and endoscopic divisions.

Global Presence: CONMED operates in over 90 countries, with a well-distributed sales network in North America, Europe, and emerging markets.

Becton, Dickinson and Company (BD)

Specialization: BD is one of the world’s largest medical technology companies, with offerings spanning diagnostics, biosciences, and surgical devices that play a vital role in MIS workflows.

Key Focus Areas: Surgical instruments, interventional devices, infusion systems, and procedural disposables.

Notable Features: BD’s vast manufacturing scale, integrated supply chain, and strong focus on safety and sterility make it a trusted name in surgical disposables. Its innovations in catheter-based and minimally invasive access devices are transforming procedural efficiency.

2024 Revenue: Approximately USD 20.2 billion, with a significant portion attributed to the medical segment.

Global Presence: BD operates in more than 190 countries and maintains manufacturing and R&D centers in key healthcare markets across the globe.

Leading Trends and Their Impact

- Rise of Robotic-Assisted Surgery:

Robotic systems are revolutionizing MIS by enhancing precision, dexterity, and visualization. The growing number of FDA-approved robotic platforms is fostering competition, reducing costs, and expanding access. Hospitals increasingly adopt robotics for urology, gynecology, thoracic, and general surgery, leading to consistent improvements in outcomes. - Integration of Artificial Intelligence (AI) and Data Analytics:

AI is transforming surgical planning and intraoperative guidance. Algorithms analyze imaging data in real time to assist surgeons with tissue differentiation and anatomical mapping. Predictive analytics also help hospitals optimize surgical workflows and training. - 3D and Augmented Reality Visualization:

Enhanced imaging systems, including 3D cameras and AR overlays, enable better depth perception and real-time anatomical guidance. These innovations reduce errors, shorten learning curves, and increase the complexity of procedures that can be done minimally invasively. - Single-Use and Hybrid Instruments:

To combat infection risks and simplify sterilization, the demand for single-use instruments is increasing. Manufacturers are also developing hybrid models—part reusable, part disposable—to balance cost and sustainability. - Shift Toward Outpatient Surgery Centers:

With improvements in anesthesia, device miniaturization, and patient monitoring, many MIS procedures are now performed in ambulatory surgery centers. This decentralization drives demand for portable and cost-efficient equipment. - Evolving Regulatory and Reimbursement Environment:

Governments and payers are increasingly recognizing the long-term cost benefits of MIS through reduced hospital stays and complications. Streamlined approval pathways for innovative MIS devices encourage manufacturers to invest in R&D.

Successful Examples of Minimally Invasive Surgery Around the World

- Robotic Surgery Programs in the U.S. and Europe:

Hospitals equipped with advanced robotic systems, such as da Vinci, have expanded the scope of MIS in complex procedures, reducing hospital stays and postoperative complications. - CMR Surgical’s Versius System in the UK:

The Versius robotic system’s modular design has made robotic surgery more accessible to medium-sized hospitals. Its adoption in NHS facilities demonstrates how flexible robotic solutions can enhance surgical efficiency and patient outcomes. - Government Hospital Initiatives in India:

Public institutions like AIIMS have introduced robotic and laparoscopic surgical programs to improve access to advanced surgical care in regional hospitals. These initiatives promote surgeon training and reduce patient dependence on private tertiary centers. - Asia-Pacific Expansion:

Countries such as Japan, South Korea, and China are adopting MIS technologies rapidly, supported by government funding, favorable policies, and local medtech innovation. Domestic companies are also emerging to provide cost-effective robotic and endoscopic systems. - Centers of Excellence in Europe:

Specialized MIS centers in countries like Germany and France integrate training, research, and patient care to deliver consistent surgical outcomes and serve as global reference sites.

Global Regional Analysis — Government Initiatives and Policies Shaping the Market

North America

The United States leads in MIS technology adoption, supported by a favorable regulatory framework and strong healthcare infrastructure. The FDA has accelerated the approval process for robotic and digital-assisted devices, encouraging competition and innovation. Reimbursement models increasingly recognize the cost-effectiveness of MIS, motivating hospitals to invest in modern equipment. In Canada, government-funded healthcare systems are gradually integrating MIS technologies into public hospitals, emphasizing value-based care.

Europe

The European Union’s Medical Device Regulation (MDR) has strengthened safety and quality standards, ensuring high device reliability but also increasing compliance costs for manufacturers. Countries like Germany, the UK, and France are investing heavily in robotic and digital surgery training centers. National healthcare systems are promoting MIS adoption as part of broader efficiency and patient-outcome initiatives.

Asia-Pacific

Asia-Pacific is the fastest-growing MIS market. Japan and South Korea have mature infrastructures with high robotic adoption rates, while China and India are rapidly expanding access through government-backed modernization programs. Public-private partnerships in India are driving the establishment of robotic surgical suites in both urban and rural hospitals. The growing middle class and increasing insurance coverage are expanding the patient base for MIS procedures.

Latin America

Countries like Brazil and Mexico are early adopters of MIS in private hospitals, though public sector implementation is limited due to cost constraints. Nonetheless, regional training centers and partnerships with global device makers are improving access to MIS technologies.

Middle East & Africa

Wealthier Gulf countries such as the UAE and Saudi Arabia are investing in healthcare modernization projects that include robotic and laparoscopic surgery programs. African nations are gradually adopting MIS in specialized hospitals with support from international collaborations and NGOs focused on healthcare capacity building.

Key Policy Drivers Worldwide

- Regulatory Evolution: Streamlined approval processes and robust post-market surveillance encourage innovation while ensuring patient safety.

- Reimbursement Incentives: Governments and insurers offering higher reimbursements for MIS procedures accelerate hospital investment.

- Training and Education: National programs that fund surgeon training and simulation labs build long-term capacity for MIS.

- Local Manufacturing Support: Incentives for domestic production of surgical instruments reduce costs and strengthen regional supply chains.

- Public-Private Partnerships: Collaborations between device manufacturers, hospitals, and governments enhance technology transfer and accessibility.

Final Summary (excluding conclusion)

The minimally invasive surgery market continues to expand as technology, clinical outcomes, and economic incentives align. The integration of robotics, AI, and advanced visualization is transforming surgical practice across specialties, while governments and healthcare providers worldwide are recognizing the long-term value of these innovations. With continued investment, supportive regulation, and global collaboration, MIS is set to define the next era of surgical excellence and accessibility.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: U.S. Digital Biomarkers Market Revenue, Global Presence, and Strategic Insights by 2034