Metal Casting Market Size

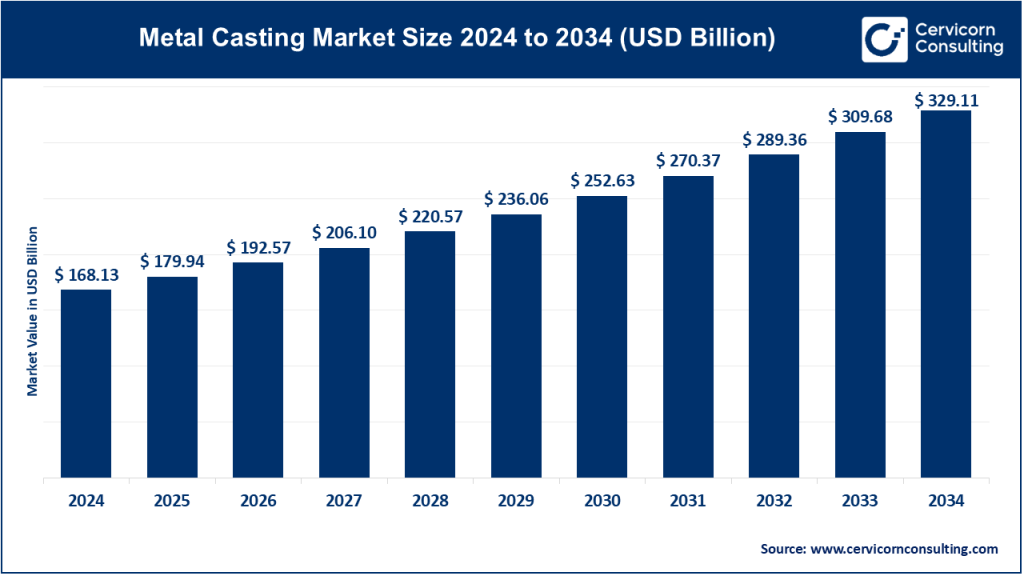

The global metal casting market size was worth USD 168.13 billion in 2024 and is anticipated to expand to around USD 329.11 billion by 2034, registering a compound annual growth rate (CAGR) of 6.95% from 2025 to 2034.

What Is the Metal Casting Market?

The metal casting market includes all industrial activities related to producing cast metal components using processes such as sand casting, die casting, investment casting, permanent mould casting, centrifugal casting and shell moulding. It encompasses:

- Foundries (ferrous and non-ferrous)

- Die-casting companies

- Casting equipment manufacturers (furnaces, moulding lines, core shooters, ladles)

- Tooling and pattern makers

- Refractory and chemical suppliers (binders, coatings, resins, additives)

- Machining, finishing, heat treatment and inspection service providers

The market caters to automotive, aerospace, industrial machinery, construction equipment, energy, rail, marine, defense, agriculture and consumer electronics sectors.

Metal casting remains essential because it can produce complex, durable, high-strength components at a cost and scale that few other processes can match.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2400

Why Is the Metal Casting Market Important?

The importance of the metal casting industry lies in its:

1. Production of Critical Components

From engine blocks to turbine housings, pump bodies, valve casings, aircraft brackets, structural automotive parts and medical device housings — casting enables the mass production of high-performance metal parts.

2. Cost Efficiency and Scalability

Casting allows precise, complex shapes to be produced with minimal machining, drastically reducing manufacturing costs, especially for high-volume or heavy parts.

3. Material Diversity

Casting works with a broad spectrum of metals — aluminium, steel, iron, copper alloys, magnesium, superalloys — meeting the demands of almost every industrial sector.

4. Design Flexibility

Casting enables thin walls, complex geometries, integrated features and net-shape manufacturing.

5. Sustainability Contribution

Casting processes facilitate recycling and remelting, supporting circular economy targets and reducing industrial waste.

Metal Casting Market Growth Factors

The metal casting market is expanding due to increasing automotive production (including the rapid rise of electric vehicles), growing demand for lightweight non-ferrous castings, global infrastructure and industrial development, modernization of foundries with automation and digital simulation tools, stronger emphasis on energy-efficient and eco-friendly processes, rising adoption of aluminium and magnesium for weight reduction, rapid expansion of industrial machinery, government-led manufacturing incentives, and technological advancements such as 3D-printed sand cores and real-time process monitoring. However, the industry faces challenges such as volatility in raw material prices, stringent environmental regulations requiring expensive upgrades, competition from alternative manufacturing methods, and the need for skilled labor—all of which influence long-term investment cycles.

Top 5 Companies in the Metal Casting Market

Detailed company profiles including specialization, key focus areas, notable features, estimated 2024 revenue, market share and global presence.

1. Alcoa Corporation

Specialization

A global leader in aluminium production, refining and smelting. Supplies aluminium used extensively in casting operations worldwide.

Key Focus Areas

- Low-carbon aluminium production

- Alumina refining and bauxite mining

- Lightweighting solutions for automotive and aerospace

- Sustainable metallurgy and production efficiency programs

Notable Features

- Pioneer in environmentally improved smelting technologies

- Strong upstream influence on aluminium availability for die-casting markets

- Long-standing innovation in alloy development

2024 Revenue

Approximately USD 11.9 billion.

Market Share & Global Presence

Alcoa maintains a significant share in the global aluminium supply chain, operating across the U.S., Canada, Australia, Brazil and several European regions. Although not a direct casting company, its leadership in aluminium production heavily influences pricing, availability and supply stability for casting industries.

2. Bühler Group (Buhler)

Specialization

An industrial engineering giant offering high-pressure die-casting machines, foundry automation systems, melting systems and digital casting solutions.

Key Focus Areas

- High-pressure die-casting machinery for automotive and industrial applications

- IoT-enabled foundry automation

- Advanced process monitoring and simulation tools

- High-performance moulding and melting technologies

Notable Features

- Strong R&D investments

- Equipment widely used for structural automotive castings

- Emphasis on energy-efficient and low-emission technology

2024 Revenue

Approximately CHF 3.0 billion (group-wide turnover).

Market Share & Global Presence

Bühler has a strong footprint in Europe, Asia and North America, serving OEMs and major foundries. It is a market leader in high-pressure die-casting machinery, with installations spanning automotive hubs worldwide.

3. Castrol Limited

Specialization

Industrial lubricants, die-casting fluids, metal-working oils, coolants and specialty formulations used in foundries and machining.

Key Focus Areas

- High-temperature die lubricants

- Industrial fluids for casting and machining

- Energy-efficient lubrication systems

- Sustainable packaging and recycling initiatives

Notable Features

- Globally recognized brand with strong OEM partnerships

- Essential for maintaining die life, reducing porosity and improving casting finish

- Plays a major supporting role in casting process efficiency

2024 Revenue

Castrol India reported approximately ₹5,365 crore (≈ USD 650–700 million), with global revenues significantly higher at parent-company level.

Market Share & Global Presence

Castrol has an extensive global distribution network across over 120 countries and remains a top supplier of lubricants for foundries, die-casters and machining industries.

4. Dynacast

Specialization

A global leader in precision die casting of zinc, aluminium and magnesium components.

Key Focus Areas

- High-precision small and medium-sized die-cast components

- Thin-wall designs for consumer electronics

- Magnesium die casting for lightweighting

- Post-processing, finishing and machining

Notable Features

- Advanced tooling and automation capabilities

- Highly consistent, tight-tolerance production

- Strong global manufacturing network

2024 Revenue

As a privately held company, exact revenues are not public. Industry estimates place Dynacast’s annual revenue in the hundreds of millions to low billions (USD).

Market Share & Global Presence

Dynacast has operations across North America, Europe and Asia, serving electronics, automotive, medical and industrial customers. It is considered one of the biggest precision die-casting specialists in the world.

5. Eagle Alloy Inc.

Specialization

Custom steel castings using shell moulding and investment casting processes.

Key Focus Areas

- Medium and heavy steel cast components

- High-mix, low-volume industrial parts

- Machining and finishing services

- Quality assurance through in-house NDT and inspection

Notable Features

- Known for high-quality custom steel castings

- Offers end-to-end services from pattern design to machining

- Strong capabilities in pump, valve, mining and industrial equipment sectors

2024 Revenue

As a private company, estimated to be in the multi-million USD annual revenue range.

Market Share & Global Presence

Primarily focused on the U.S. market with strong capabilities in customized industrial castings.

Leading Trends in the Metal Casting Market and Their Impact

1. Rise of EVs and Lightweight Alloys

The shift to electric vehicles is boosting demand for aluminium and magnesium castings for structural parts, battery enclosures and motor housings. This is reducing the requirement for some traditional engine castings while accelerating growth in non-ferrous casting sectors.

2. Automation and Smart Foundries

Foundries are integrating robotics, digital twins, AI-based defect analysis and real-time monitoring. Automated gating, pouring and handling significantly reduce scrap rates and labor dependency.

3. Environmental Regulations and Decarbonization

Governments are tightening emissions rules for foundries. This is driving investment in:

- Induction furnaces

- Heat recovery systems

- Filtered exhaust systems

- Low-emission melting technologies

This helps modern foundries compete better while older ones face consolidation pressure.

4. Expansion of 3D Printed Sand Moulds/Cores

Additive manufacturing is revolutionizing casting through:

- Rapid tooling

- Complex internal features

- Faster prototyping cycles

- Lower development costs

This is particularly beneficial for aerospace and energy castings.

5. Supply Chain Re-shoring

The need for resilient supply chains is pushing reshoring initiatives, especially in the U.S. and Europe. Casting of critical components (defense, energy, automotive) is increasingly being brought closer to end-use locations.

6. Circular Economy and Metal Recycling

The metal casting industry is central to metal recycling, with many foundries increasing their share of scrap-based inputs to reduce cost and emissions.

Successful Examples of Metal Casting Around the World

1. Automotive Aluminium Castings in Europe and Japan

Large, structural castings are used for battery housings, front-end modules and lightweight chassis parts. German and Japanese automakers have adopted advanced high-pressure die-casting equipment to produce thin-wall, high-strength components.

2. Aerospace Investment Castings in the U.S. and Europe

Investment cast nickel and titanium components are used for turbine blades, engine housings and critical flight hardware. These parts meet exceptionally tight tolerances and performance requirements.

3. Heavy Industrial Castings in India and China

Foundries produce large pump bodies, mining equipment parts, industrial housings and heavy engineering components. Industrial clusters in Coimbatore, Rajkot, Shandong and Hebei supply global markets.

4. Precision Die-Cast Electronics Components in Southeast Asia

Thin-wall zinc and aluminium castings used in smartphones, laptops, cameras and medical devices are produced using high-speed automation systems.

Global Regional Analysis

1. Asia Pacific (APAC)

APAC is the largest and fastest-growing metal casting region. China and India dominate through large-scale foundry clusters, strong domestic demand and lower production costs.

Drivers

- Rapid industrialization and urbanization

- Large automotive and heavy machinery sectors

- Extensive non-ferrous casting capacity

- Availability of raw materials

Government Initiatives

- China’s industrial modernization programs encouraging clean production

- India’s “Make in India,” MSME foundry support, energy-efficiency schemes and skill-development programs

- Incentives for cleaner furnaces and pollution control upgrades

2. North America

North America focuses on high-value, precision engineering castings for aerospace, defense, EVs and industrial machinery.

Drivers

- Strong aerospace and automotive industries

- Adoption of automation and simulation

- Supply chain reshoring efforts

Government Initiatives

- Support for domestic manufacturing and clean-energy components

- Federal and state programs for modernizing foundries

- Workforce skill development initiatives

3. Europe

Europe has a highly advanced casting industry driven by automotive OEMs, aerospace manufacturers and machinery exporters.

Drivers

- High engineering standards

- Emphasis on lightweight design

- Strong investment in sustainable manufacturing technologies

Government Initiatives

- Strict environmental regulations encouraging modernization

- Funding for industrial digitalization and energy-efficient foundries

- Support for R&D and green manufacturing transitions

4. Latin America

The region shows steady demand led by construction, mining and agricultural machinery sectors.

Drivers

- Availability of raw materials

- Regional infrastructure projects

- Growing industrial base

Government Initiatives

- Encouraging foreign investment

- Development of industrial clusters in Brazil and Mexico

5. Middle East & Africa (MEA)

Though still developing, MEA has potential due to its energy sector, mining activities and emerging manufacturing bases.

Drivers

- Resource availability

- Heavy industry growth

- Increasing foreign investment in manufacturing centres

Government Initiatives

- Industrial diversification programs

- Infrastructure expansion

- Policies encouraging local manufacturing capabilities

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Diagnostic Testing Market Growth Drivers, Trends, Key Players and Regional Insights by 2034