Medical Devices Market Size

Medical Devices Market Growth Factors

The medical devices market is experiencing strong growth driven by several interconnected factors. These include a rapidly aging global population, increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer, and the rising adoption of digital health and remote monitoring technologies. Enhanced healthcare spending in emerging economies, frequent replacement and upgrade cycles for hospital infrastructure, and favorable regulatory policies supporting innovation in AI-based medical devices and software-as-a-medical-device (SaMD) also play crucial roles. Additionally, significant private and public R&D investments, the demand for minimally invasive procedures, and post-pandemic supply chain localization efforts are shaping the market landscape. Together, these elements are accelerating innovation, improving interoperability and cybersecurity, and promoting value-based healthcare outcomes globally.

What is the Medical Devices Market?

The medical devices market encompasses all instruments, apparatus, machines, implants, diagnostic reagents, and software used for diagnosing, preventing, monitoring, or treating diseases and medical conditions. It includes a wide range of product segments such as diagnostic imaging (CT, MRI, ultrasound), in-vitro diagnostics (IVD), cardiovascular and orthopedic devices, surgical instruments and robotics, infusion and respiratory equipment, and digital health tools like wearables and remote monitoring devices. This market spans hospitals, ambulatory surgery centers, clinics, and home healthcare providers, serving both clinical professionals and consumers.

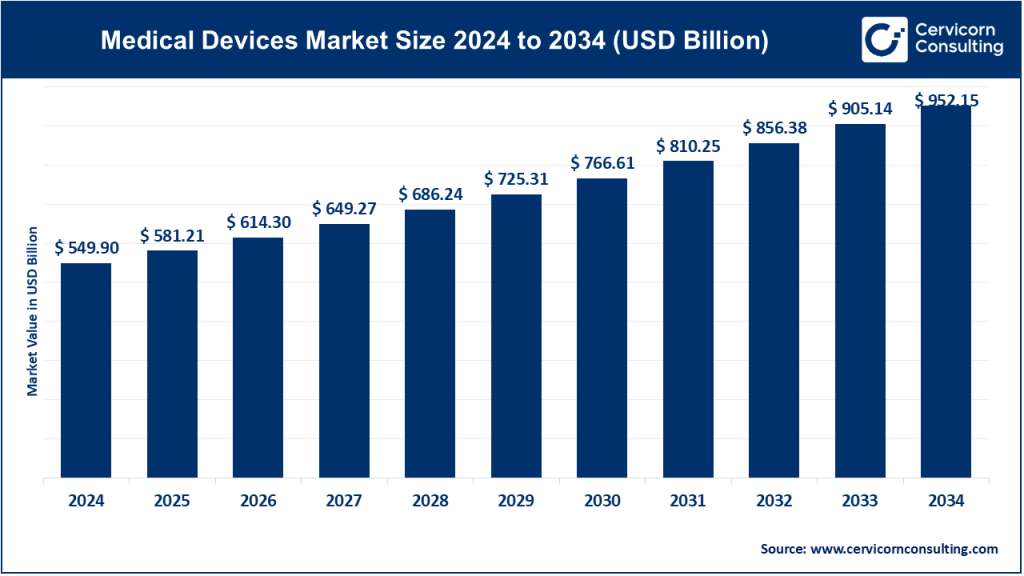

In 2024, the global medical devices market was valued at approximately USD 540–550 billion and is projected to continue its upward trajectory through the next decade, driven by technological advancements and healthcare modernization.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2445

Why is the Medical Devices Market Important?

The medical devices market plays a pivotal role in the global healthcare ecosystem for multiple reasons:

- Clinical Impact: Medical devices enable early detection, precise diagnosis, and effective treatment of diseases. They reduce mortality, improve recovery rates, and enhance the quality of life for patients.

- Operational Efficiency: Modern devices automate diagnostic and therapeutic processes, reducing hospital stays, minimizing human error, and improving workflow efficiency.

- Economic Contribution: The industry supports millions of jobs globally, stimulates high-value manufacturing, and represents a significant share of healthcare expenditure.

- Innovation Catalyst: Device advancements often lead to breakthroughs in related fields such as biotechnology, pharmaceuticals, and digital health.

By integrating technology and medicine, the medical devices sector enhances both the quality and efficiency of healthcare delivery worldwide.

Top Companies in the Medical Devices Market

Medtronic

Specialization: Cardiac rhythm management, insulin pumps, diabetes care, spinal and neurosurgery devices, and minimally invasive therapies.

Key Focus Areas: Chronic disease management, minimally invasive surgery, and advanced therapy portfolios.

Notable Features: Strong global presence, rechargeable and connected implantable devices, and advanced remote monitoring systems.

2024 Revenue: Approximately USD 32.4 billion.

Market Share and Presence: Medtronic ranks among the largest medical device manufacturers globally, with operations spanning North America, Europe, Asia Pacific, and emerging economies.

Johnson & Johnson (MedTech Division)

Specialization: Orthopedics (DePuy Synthes), surgical systems (Ethicon), cardiovascular and electrophysiology devices.

Key Focus Areas: Surgical robotics, orthopedic innovation, and advanced surgical technologies.

Notable Features: Integrated healthcare portfolio combining pharmaceuticals and medical devices, strong R&D capabilities, and global distribution networks.

2024 Revenue: Approximately USD 88.8 billion (consolidated company).

Market Share and Presence: A top-tier diversified healthcare company with strong market leadership in orthopedics, surgery, and electrophysiology, with operations in over 100 countries.

Abbott Laboratories

Specialization: Diagnostics, cardiovascular devices, diabetes management systems, and nutrition products.

Key Focus Areas: Point-of-care and rapid diagnostics, continuous glucose monitoring, and structural heart therapies.

Notable Features: A robust diagnostic franchise offering recurring consumable revenues and scalable remote glucose monitoring technology.

2024 Revenue: Approximately USD 42 billion.

Market Share and Presence: Abbott holds a leading position in diagnostics and diabetes care, with a significant presence across developed and emerging markets.

Siemens Healthineers

Specialization: Diagnostic imaging (CT, MRI, ultrasound), in-vitro diagnostics, image-guided therapy, and oncology systems.

Key Focus Areas: Imaging and diagnostic software, oncology treatment solutions, and AI-driven healthcare automation.

Notable Features: Integration of imaging hardware and software with digital services, focus on cancer therapy through Varian acquisition, and vast hospital network installations.

2024 Revenue: Approximately EUR 22.4 billion (USD 24 billion).

Market Share and Presence: A leader in imaging and diagnostics with strong footprints in Europe, North America, and rapidly growing markets in Asia.

GE HealthCare

Specialization: Diagnostic imaging, ultrasound, anesthesia systems, monitoring, molecular imaging, and enterprise health IT solutions.

Key Focus Areas: AI-enabled imaging, hybrid imaging solutions, and service-based healthcare models.

Notable Features: Deep industrial expertise, broad R&D investment, and large global service infrastructure.

2024 Revenue: Approximately USD 19.7 billion.

Market Share and Presence: One of the most recognized imaging technology providers with substantial global reach and a focus on digital transformation in healthcare.

Leading Trends and Their Impact

- Digital Health and Remote Monitoring

The integration of IoT and digital health platforms allows real-time patient monitoring, predictive analytics, and early intervention. This trend has expanded the home healthcare market and promoted continuous care beyond hospitals. - Artificial Intelligence (AI) and Software-as-a-Medical-Device (SaMD)

AI is revolutionizing diagnostics and clinical decision-making. AI-enabled devices streamline image analysis, improve accuracy, and reduce clinician workload, leading to faster diagnoses and treatment planning. - Minimally Invasive Surgery and Robotics

Surgeons are increasingly adopting robotic-assisted procedures, improving precision and recovery times. The trend boosts demand for high-tech instruments, imaging systems, and specialized consumables. - Point-of-Care and Rapid Diagnostics

The demand for decentralized diagnostics is rising, particularly for infectious disease testing and chronic condition management. Rapid and portable devices are critical in emergency and rural settings. - Wearable and Consumer Medical Devices

Devices like smartwatches and fitness trackers are evolving into regulated medical devices capable of ECG monitoring and sleep analysis. They empower patients to manage their health proactively. - Value-Based Healthcare Models

Payers and hospitals are shifting toward reimbursement based on patient outcomes rather than device sales. This compels manufacturers to demonstrate clinical efficacy and long-term value. - Supply Chain Resilience

In the post-pandemic era, governments and companies are investing in local manufacturing to mitigate supply chain disruptions and ensure device availability. - Regulatory Harmonization and Cybersecurity

Regulatory bodies are emphasizing cybersecurity, real-world evidence, and harmonized approval frameworks for connected devices. This ensures patient safety and accelerates market access for compliant products.

Successful Examples of Medical Device Adoption Worldwide

- Continuous Glucose Monitoring (CGM)

Abbott’s continuous glucose monitoring systems have transformed diabetes management by enabling real-time blood glucose tracking and improving glycemic control globally. - AI-Enabled Imaging in Hospitals

Hospitals in the U.S. and Europe have adopted AI-assisted imaging tools that detect strokes and cardiac events faster, reducing treatment times and improving survival rates. - Remote Cardiac Monitoring

Medtronic’s remote cardiac monitoring systems allow physicians to track arrhythmias and heart performance remotely, reducing hospital visits and improving patient outcomes. - Point-of-Care Diagnostic Devices

Rapid testing platforms have revolutionized infectious disease control by delivering immediate results, especially during public health crises. - Integrated Oncology Platforms

Siemens Healthineers’ integration with Varian has improved radiation therapy planning and delivery, creating more effective, patient-specific cancer treatments.

Global Regional Analysis and Government Initiatives

North America

The United States remains the largest medical devices market globally, driven by advanced healthcare infrastructure, high R&D investment, and supportive regulatory frameworks. The FDA continues to refine guidelines for AI/ML-based medical devices and digital health tools. Government initiatives focus on strengthening domestic manufacturing, enhancing cybersecurity, and expanding telehealth reimbursement. Canada’s policies emphasize interoperability and healthcare digitalization. North America’s innovation ecosystem ensures fast product development but demands rigorous compliance and cost-effectiveness.

Europe

Europe represents a mature and highly regulated market led by Germany, France, and the United Kingdom. The EU Medical Device Regulation (MDR) has increased safety, transparency, and post-market surveillance. Governments are investing in digital healthcare and cross-border data-sharing projects to promote value-based procurement. The emphasis on sustainable manufacturing and ethical sourcing is shaping purchasing decisions. Despite longer certification timelines, Europe remains a lucrative market for compliant and high-quality device manufacturers.

Asia-Pacific

Asia-Pacific is the fastest-growing region for medical devices. China and Japan lead the region in production and consumption, while India, South Korea, and Southeast Asia are rapidly emerging as manufacturing hubs. Governments are introducing local production incentives and funding R&D in diagnostics and imaging. India’s “Make in India” initiative, for instance, encourages domestic medical device manufacturing. China is promoting self-sufficiency through innovation clusters and technology parks, while Japan focuses on integrating robotics and AI into healthcare systems. The result is a diverse, high-growth market with varying regulatory complexities.

Latin America

Latin American markets, including Brazil, Mexico, and Argentina, are expanding due to improved healthcare infrastructure and public health initiatives. Governments are reforming medical device regulations and encouraging local production. The region’s aging population and growing incidence of chronic diseases are increasing demand for affordable and portable medical devices. However, challenges such as economic volatility and import dependency still exist. Multinational companies are partnering with local distributors to enhance market access.

Middle East and Africa

The Middle East and Africa region is characterized by increasing healthcare investments, especially in the Gulf countries and South Africa. Governments are building advanced hospitals and diagnostic centers, adopting national e-health strategies, and facilitating foreign investment. Africa, supported by international aid and NGOs, is prioritizing affordable diagnostic and maternal health devices. The gradual harmonization of device regulations is expected to make these markets more accessible to global manufacturers in the coming years.

Government Initiatives Shaping the Market Globally

- Domestic Manufacturing Incentives: Many countries have introduced subsidies and tax incentives to boost local device production and reduce import reliance.

- Digital Health Policies: Governments are implementing national electronic health record systems, telemedicine laws, and reimbursement for digital therapeutics, driving connected device adoption.

- Public Procurement Reforms: Transparent tendering systems and innovation-based procurement encourage the adoption of advanced, high-performance devices.

- Regulatory Harmonization: International collaborations are simplifying certification procedures, reducing time-to-market, and improving safety oversight.

- Cybersecurity and Data Governance: Countries are setting standards to ensure patient data protection in connected devices, fostering trust in digital healthcare.

Market Dynamics and Strategic Directions

Leading companies are evolving from hardware manufacturers to integrated solution providers offering data-driven services. This shift is driven by the need for continuous connectivity, predictive maintenance, and personalized medicine.

- Medtronic and Abbott focus on digital integration in diabetes and cardiac care.

- GE HealthCare and Siemens Healthineers are expanding AI-based imaging analytics and service models.

- Johnson & Johnson continues investing in surgical robotics and orthopedic advancements.

The future of the medical devices market will revolve around interoperability, precision medicine, and sustainable manufacturing practices. Device manufacturers are expected to align closely with healthcare providers, governments, and insurers to create patient-centered ecosystems.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Water-based Battery Market Growth Drivers, Trends, Key Players and Regional Insights by 2034