Lithium-ion Battery Market Size & Forecast

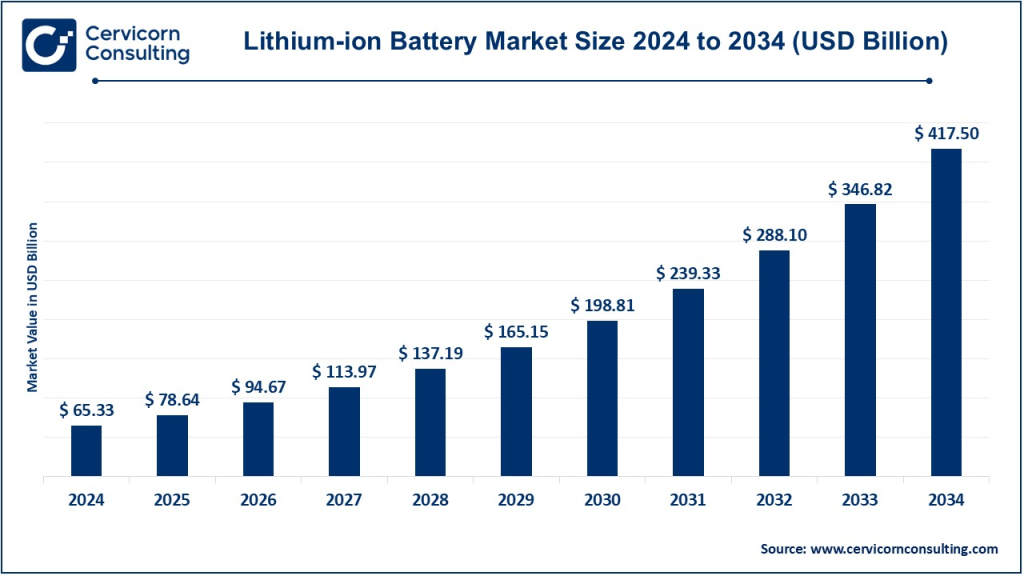

The global lithium-ion battery market size was worth USD 65.33 billion in 2024 and is anticipated to expand to around USD 417.50 billion by 2034, registering a compound annual growth rate (CAGR) of 20.38% from 2025 to 2034.

What Is the Lithium-Ion Battery Market?

The lithium-ion (Li-ion) battery market encompasses the worldwide industry that develops, manufactures, and supplies rechargeable lithium-ion batteries and related materials, systems, and services. These batteries comprise key components—cells (using lithium-cobalt, lithium-iron-phosphate, lithium-nickel-manganese-cobalt chemistries), battery management systems, modules/packs—and support wide-ranging applications: electric vehicles (EVs), consumer electronics (smartphones, laptops), grid/renewable energy storage, industrial equipment, and specialized uses including aerospace and medical devices.

The ecosystem also extends to raw material extraction (lithium, cobalt, nickel), cell factories, recyclers, and supports infrastructure around packaging, integration, and recycling.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2591

Why Is It Important?

Li-ion batteries are critical to the global clean-energy and digital transformation for several reasons:

-

Enabling EVs: These batteries power most electric cars, buses, bikes, and trucks, and are essential for decarbonizing transportation.

-

Supporting renewable integration: Grid and home storage systems rely on Li-ion batteries to buffer solar and wind power.

-

Powering consumer devices: Their high energy density and rechargeability make smartphones, laptops, drones, and medical gadgets viable.

-

Advancing industrial usage: From forklifts to aerospace, Li-ion batteries deliver high-performance portable power.

-

Enabling circular economy: Recycling critical battery materials helps mitigate environmental impact and resource dependence.

-

Strategic energy independence: Nations invest heavily to domesticize battery supply chains for resilience and green leadership.

Growth Factors

The lithium-ion battery market is thriving, propelled by several converging forces: soaring global EV sales; rapid deployment of grid-scale and residential energy storage systems; government policies incentivizing clean energy, electrification, and battery manufacturing; technological advances in energy density, cycle life, and cost; diversification of raw-material supply chains; growth in consumer electronics demand; rising adoption of fast-charging infrastructure; and growing investment in recycling and circular systems. Together, these dynamics underpin a long-term CAGR of approximately 18–21%, projecting the market from roughly USD 84 billion in 2024 to between USD 470–500 billion by 2033–34.

Top Lithium-Ion Battery Market Companies

1. Toshiba Corporation

- Specialization: Lithium-titanate oxide (LTO) batteries—fast-charging, long-cycle cells ideal for EVs, grid systems, industrial equipment.

- Key Focus Areas: Rapid-charging tech, automotive, stationary energy, industrial batteries.

- Notable Features: LTO chemistry allows high charge/discharge rates, long lifespan, and safety.

- 2024 Revenue: Overall Toshiba group ~USD 33 billion; battery segment revenue ~USD 2 billion (approximation).

- Market Share: Leading in LTO batteries; niche adoption compared to mainstream chemistries.

- Global Presence: Japan HQ, R&D globally; LTO cells used in EV chargers, industrial systems in North America, Europe, Asia.

2. Samsung SDI Co., Ltd.

- Specialization: NMC and LFP cells for EVs, ESS, and portable electronics.

- Key Focus Areas: Electric vehicles, energy storage systems, consumer electronics.

- Notable Features: Joint ventures (e.g. GM), strong materials and BMS expertise.

- 2024 Revenue: Estimated USD 12–14 billion (battery segment).

- Market Share: Approximately 4.6% of global EV battery shipments (Jan–Apr 2024).

- Global Presence: South Korea HQ; plants in Europe, US, China; JV with GM.

3. Saft (TotalEnergies)

- Specialization: High-end batteries for industrial, grid, aerospace, defense, telecom backup.

- Key Focus Areas: Stationary energy, backup, specialized industrial systems.

- Notable Features: Custom-designed cells; integrated storage and controls.

- 2024 Revenue: Part of TotalEnergies’ Specialty Operations (~EUR 1.3 billion).

- Market Share: Strong in niche industrial energy markets.

- Global Presence: France HQ, operations across Europe, North America, Asia; major grid storage contracts.

4. Panasonic Corporation

- Specialization: NCA cells for EVs (Tesla), industrial, aerospace.

- Key Focus Areas: EV battery production, energy storage.

- Notable Features: Exclusive Tesla partnership; leading energy density cells.

- 2024 Revenue: Panasonic Energy approx. USD 18 billion; group sales EUR 65 billion.

- Market Share: Roughly 6% EV battery market share (Jan–Apr 2024).

- Global Presence: Japan HQ; Gigafactory South, plants in US, China, Europe.

5. LG Chem (LG Energy Solution)

- Specialization: NMC, LFP cells for EVs, ESS.

- Key Focus Areas: Automotive batteries, grid storage, portable systems.

- Notable Features: JV with Honda in Ohio plant; heavy investment in North America.

- 2024 Revenue: LGES USD 30 billion.

- Market Share: Around 13% global EV battery share Jan–Apr 2024.

- Global Presence: Korea HQ; plants in US, Europe, China, Poland, etc.

Leading Trends & Their Impact

1. EV Electrification

EV sales exceeded 13.5 million units in 2023, comprising over 1 TWh of lithium demand. Batteries remain central to automotive decarbonization.

2. Energy Storage Expansion

Off-grid and grid storage deployments surged globally, with stationary markets growing over 170% year-on-year. This supports grid stability and renewables.

3. Advanced Battery Chemistry

Innovations such as silicon-anode, solid-state cells and LFP/LTO advancements are improving density, safety, and lifespan.

4. Localized Production & Partnerships

Major manufacturers are creating joint ventures with OEMs—Samsung SDI with GM, LGES with Honda, Toshiba with Tesla, Panasonic with Toyota—supporting regional supply chain resilience.

5. Raw-Material & Recycling Focus

Policies and investments address cobalt/nickel dependence through recycling, while geopolitical tensions drive supply security for lithium and rare earths.

6. Government Strategic Goals

Asia-Pacific leads with ~45–48% market share; Europe (~13%) and North America (~40%) follow. Regional incentives shape both production and demand.

Successful Examples Worldwide

- China: CATL holds ~37% global EV battery share, producing over 260 GWh in 2023. The country’s fast-growing EV ecosystem drives domestic battery growth.

- USA: LG & Honda’s Ohio plant ($4.4 billion) supports domestic supply chain goals. Federal incentives like the Inflation Reduction Act back U.S. battery production.

- EU: The European Battery Alliance promotes homegrown battery capacity through plants by Saft, Northvolt, and others.

- South Korea & Japan: Battery tech leaders like LG, Samsung, and Panasonic drive innovation and exports in Asia and globally.

Global Regional Analysis & Policy Initiatives

Asia-Pacific

- Includes China, Japan, South Korea—home to major players like CATL, BYD, Panasonic, Samsung SDI, and LGES.

- China offers subsidies for NEV adoption and has the most developed supply chain from mining to recycling.

- Korea and Japan focus on next-gen batteries and forming global partnerships with automakers.

North America

- The U.S. is scaling battery manufacturing through federal investments, including tax credits and R&D programs.

- Several joint ventures (e.g., GM-Samsung, Ford-SK On) are expanding local production.

- Canada supports lithium mining and battery precursor supply chains.

Europe

- Focused on strategic autonomy and climate goals via the European Battery Alliance.

- Countries like Germany, France, and Sweden are investing in gigafactories (e.g., Northvolt, ACC).

- EU policy mandates include battery passports, carbon footprint disclosures, and end-of-life recycling standards.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Next Generation Batteries Market Driving to USD 4.27 Bn by 2034