Liquid Biopsy Market Size

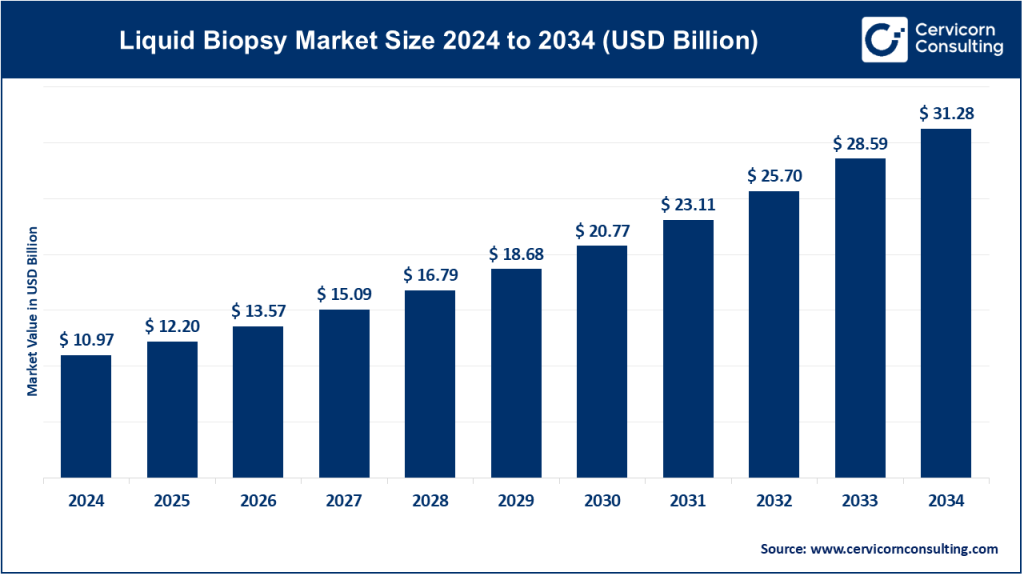

The global liquid biopsy market size was worth USD 10.97 billion in 2024 and is anticipated to expand to around USD 31.28 billion by 2034, registering a compound annual growth rate (CAGR) of 11.05% from 2025 to 2034.

What Is the Liquid Biopsy Market?

The liquid biopsy market includes the tools, assays, laboratory services, and data interpretation platforms used to detect cancer-related biomarkers from non-invasive sources such as blood, urine, saliva, and cerebrospinal fluid. Instead of relying on traditional tissue biopsies—which can be invasive, risky, and limited by tumor heterogeneity—liquid biopsy analyzes fragments of tumor-derived material circulating in bodily fluids.

This market comprises:

- ctDNA-based sequencing tests

- Circulating tumor cell (CTC) detection platforms

- Exosome and extracellular vesicle assays

- NGS platforms and molecular diagnostic systems

- Sample preparation kits and reagents

- Bioinformatics tools and cloud-based interpretation platforms

The market serves oncologists, hospitals, reference laboratories, pharmaceutical companies, precision-medicine clinics, and academic research institutions. As adoption expands across diagnostic, monitoring, and screening applications, liquid biopsy is becoming a central pillar of modern oncology diagnostics.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2401

Why Is Liquid Biopsy Important?

Liquid biopsy is important because it addresses the shortcomings of tissue biopsies—limited sample quantity, patient discomfort, procedural risk, and inability to capture real-time tumor evolution. Liquid biopsy offers:

1. Non-Invasive and Repeatable Testing

Patients can undergo tests frequently, enabling continuous monitoring of disease progression or relapse.

2. Early Detection

Ultra-sensitive ctDNA assays can identify cancers earlier than imaging or symptoms, supporting multi-cancer early detection (MCED) frameworks.

3. Comprehensive Tumor Profiling

Liquid biopsy captures mutations from multiple tumor sites at once, providing a more complete genomic picture.

4. Companion Diagnostics Integration

Many targeted therapies require molecular profiling; liquid biopsy enables tumor mutation detection even when tissue is unavailable.

5. Minimal Residual Disease (MRD) Monitoring

Detects tiny traces of cancer remaining after therapy, enabling earlier intervention.

6. Accelerated Clinical Trials

Biopharma uses liquid biopsy for patient selection, pharmacodynamics, and real-time monitoring, shortening trial timelines.

These capabilities make liquid biopsy essential to precision oncology, preventive screening, and next-generation drug development.

Liquid Biopsy Market Growth Factors

The liquid biopsy market is expanding rapidly due to rising global cancer incidence, increasing focus on early detection, greater use of precision medicine, and major technological advancements in ctDNA analysis, NGS platforms, and bioinformatics. Growing evidence supporting the clinical utility of liquid biopsy in therapy selection, MRD monitoring, and multi-cancer screening has accelerated adoption among hospitals and oncologists.

Biopharma companies are increasingly integrating liquid biopsy into clinical trials for patient stratification and endpoint evaluation, while government initiatives, public screening programs, and improving reimbursement frameworks are further driving growth. Declining sequencing costs, broader clinical approvals, and expanding applications beyond oncology—such as prenatal testing and transplant surveillance—add to the market’s momentum, establishing liquid biopsy as one of the fastest-growing diagnostic sectors worldwide.

Top Companies in the Liquid Biopsy Market (2024)

Below are detailed profiles of the leading players you requested, including their specializations, key focus areas, notable features, 2024 revenue snapshots, market influence, and global presence.

1. Guardant Health

Specialization:

ctDNA-based oncology liquid biopsy tests, including genomic profiling, MRD testing, and emerging screening solutions.

Key Focus Areas:

- Tumor profiling via Guardant360

- Treatment selection for metastatic cancers

- Cancer screening through Guardant Shield

- Biopharma services and real-world evidence programs

Notable Features:

- Leader in clinical ctDNA testing in the U.S.

- Strong data analytics and longitudinal patient datasets

- Rapidly expanding screening and MRD test portfolio

2024 Revenue:

Approximately USD 737 million (significant annual growth).

Market Position & Global Presence:

A top-tier commercial liquid biopsy leader with operations and partnerships across North America, Europe, and Asia.

2. Illumina, Inc.

Specialization:

NGS sequencing platforms that power many global liquid biopsy workflows.

Key Focus Areas:

- NGS sequencers and consumables

- Oncology sequencing partnerships

- Library prep kits and workflow automation

Notable Features:

Illumina is the backbone technology provider for many liquid biopsy companies, making it foundational to the ecosystem.

2024 Revenue:

Around USD 4.3 billion across its core sequencing business (company-wide, not liquid biopsy-specific).

Market Position & Global Presence:

Global leader in sequencing technology with a presence in nearly every major diagnostic and research lab worldwide.

3. Biocept, Inc.

Specialization:

Circulating tumor cell (CTC) assays and targeted molecular testing.

Key Focus Areas:

- CTC collection and analysis

- Molecular oncology lab services

- Niche clinical segments

Notable Features:

A smaller but specialized player focused primarily on CTC technology rather than broad NGS-based testing.

2024 Revenue:

Low single-digit million-dollar range; significantly smaller than major competitors.

Market Position & Global Presence:

Niche U.S.-based participant with focused oncology offerings.

4. QIAGEN N.V.

Specialization:

Sample preparation kits, PCR assays, NGS workflows, and diagnostics used widely in liquid biopsy laboratories.

Key Focus Areas:

- Diagnostic instrumentation

- NGS panels and PCR testing

- Precision oncology

Notable Features:

QIAGEN’s technologies support extraction, enrichment, and analysis across the liquid biopsy workflow.

2024 Revenue:

Approximately USD 1.9–2.0 billion in total company net sales.

Market Position & Global Presence:

Strong global footprint with particularly high adoption in Europe and North America.

5. Roche Diagnostics

Specialization:

Global diagnostics systems, companion diagnostics, and oncology testing solutions; includes capabilities from Foundation Medicine.

Key Focus Areas:

- Molecular diagnostics

- Oncology genomic profiling

- Hospital-integrated diagnostic systems

Notable Features:

Extensive commercial and clinical infrastructure; historically acquired Foundation Medicine to expand liquid biopsy offerings.

2024 Diagnostics Revenue:

Approximately CHF 14.3 billion across the diagnostics division.

Market Position & Global Presence:

One of the world’s largest diagnostics companies, with direct presence in 100+ countries.

Leading Trends in the Liquid Biopsy Market & Their Impact

1. Rise of Multi-Cancer Early Detection (MCED)

Advanced blood-based tests for early cancer detection are gaining global traction. Their success could transform national screening strategies and significantly expand the market.

2. High-Sensitivity MRD Monitoring

Hospitals increasingly adopt MRD liquid biopsy tests to identify relapse months before imaging. This drives repeat testing, boosting long-term market value.

3. Rapid Advancements in NGS & Error Suppression

Ultra-high-depth sequencing and better bioinformatics pipelines improve test accuracy, enabling earlier-stage detection.

4. Growing Pharma–Diagnostics Partnerships

Biopharma companies collaborate with diagnostic firms to co-develop ctDNA companion diagnostics, accelerating clinical adoption.

5. Integration of AI and Genomic Data

AI enhances mutation interpretation, tissue-of-origin prediction, and risk stratification, creating competitive differentiation for companies with strong data capabilities.

6. Expanding Use Cases Beyond Oncology

Potential markets include:

- Organ transplant rejection monitoring

- Prenatal screening

- Infectious disease genomics

These adjacent opportunities broaden the market’s addressable scope.

Successful Global Examples of Liquid Biopsy Adoption

United States

Liquid biopsy is deeply integrated into oncology workflows, especially for genomic profiling in lung, colorectal, and breast cancers. Guardant Health’s Guardant360 test is a widely used example for treatment selection. Screening studies and MRD testing are rapidly expanding.

United Kingdom

The UK has been running large-scale cancer screening pilots using advanced liquid biopsy platforms, evaluating cost-effectiveness and clinical outcomes for use in population-level programs.

Europe

Multiple countries are incorporating ctDNA-based diagnostics into national precision oncology initiatives, supporting clinical validation and reimbursement.

China & Asia Pacific

Hospitals widely use ctDNA tests for EGFR, ALK, KRAS, and other mutations. Domestic genomic companies develop locally tailored assays, supported by government-backed precision medicine initiatives.

Pharmaceutical Trials Worldwide

Liquid biopsy is now common in oncology drug development for:

- Patient mutation screening

- Assessing treatment response

- Monitoring disease evolution

This has driven large-scale adoption across global research networks.

Global Regional Analysis & Government Initiatives Shaping the Market

North America

Market Dynamics

- Largest share of global liquid biopsy revenue

- Advanced sequencing infrastructure

- Strong investor activity and reimbursement progress

Government/Policy Influence

- Regulatory approvals for NGS-based companion diagnostics

- Federal innovation grants supporting precision oncology

- Integration of ctDNA into national screening program discussions

Europe

Market Dynamics

- Strong adoption driven by national cancer plans

- Broad clinical trial networks supporting ctDNA technologies

Government/Policy Influence

- National health services fund large-scale screening pilots

- Health Technology Assessment (HTA) agencies determine reimbursement

- EU-wide cancer mission programs support research collaborations

Asia Pacific

Market Dynamics

- Fastest-growing region

- Rising investment in genomic labs and cancer infrastructure

- High cancer mortality rates driving early detection needs

Government/Policy Influence

- China, Japan, and South Korea have precision medicine roadmaps

- Public–private partnerships for cancer genomics expansion

- Pilot reimbursement schemes for targeted testing

Latin America

Market Dynamics

- Growing adoption in private oncology centers

- Limited but expanding access to high-end molecular testing

Government/Policy Influence

- Select government programs supporting cancer screening

- External funding and academic collaborations driving adoption

Middle East & Africa

Market Dynamics

- Adoption primarily in specialized cancer hospitals

- Limited public reimbursement

Government/Policy Influence

- Investments in national cancer centers

- Gradual inclusion of genomic diagnostics in clinical guidelines

Key Challenges Holding Back the Market

- Uncertain reimbursement pathways in many countries

- Need for stronger evidence of clinical utility in early detection

- High per-test costs in developing regions

- Lack of standardization across platforms

- Regulatory complexity for high-sensitivity assays

What’s Next for the Liquid Biopsy Market

Monitoring upcoming developments will be critical, especially:

- Results from global MCED pilot programs

- Expansion of MRD testing into clinical guidelines

- More companion diagnostic approvals

- Integration with AI-driven interpretation and predictive models

- Increased price competition as sequencing costs continue to fall

These milestones will dictate the market’s direction over the next decade and shape adoption patterns across global health systems.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Electricity 4.0 Market Revenue, Global Presence, and Strategic Insights by 2034