Life Sciences IT Market Size

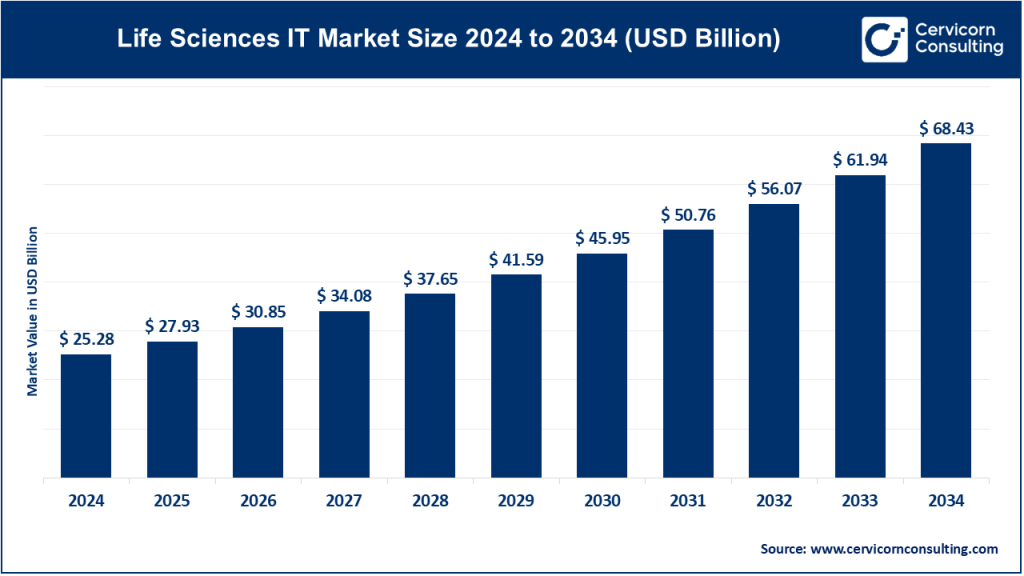

The global life sciences IT market was worth USD 25.28 billion in 2024 and is anticipated to expand to around USD 68.43 billion by 2034, registering a compound annual growth rate (CAGR) of 10.47% from 2025 to 2034.

What is the Life Sciences IT Market?

The Life Sciences Information Technology (IT) market encompasses a broad spectrum of digital solutions and services tailored to the unique needs of the life sciences sector. This includes software and platforms designed for clinical trial management, bioinformatics, laboratory information management systems (LIMS), electronic data capture (EDC), and other tools that facilitate research, development, and regulatory compliance in pharmaceuticals, biotechnology, and healthcare.

Why is the Life Sciences IT Market Important?

The integration of IT into life sciences is pivotal for several reasons:

- Enhanced Research and Development: IT solutions accelerate drug discovery and development by enabling efficient data analysis and simulation models.

- Improved Clinical Trials: Digital tools streamline clinical trial processes, from patient recruitment to data management, reducing time-to-market for new therapies.

- Regulatory Compliance: Automated systems ensure adherence to stringent regulatory standards, minimizing errors and enhancing data integrity.

- Personalized Medicine: Advanced analytics and bioinformatics facilitate the development of personalized treatment plans based on genetic and molecular profiling.

- Operational Efficiency: Automation and data integration reduce redundancies, lower costs, and improve overall productivity in life sciences organizations.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2619

Growth Factors Driving the Life Sciences IT Market

The life sciences IT market is experiencing robust growth, driven by several key factors:

- Rising Demand for Advanced Analytical Tools: The need to analyze and manage large volumes of healthcare data is propelling the adoption of sophisticated IT solutions.

- Adoption in Drug Discovery and Development: Life sciences IT technologies are increasingly utilized in drug discovery processes, enhancing efficiency and accuracy.

- Digitalization of Healthcare Systems: The shift towards digital healthcare infrastructures is fostering the integration of IT solutions in life sciences.

- Prevalence of Chronic Diseases: The increasing incidence of chronic conditions necessitates advanced imaging and diagnostic software, contributing to market growth.

- Laboratory Automation Trends: The move towards automating laboratory processes is boosting the demand for IT solutions that can manage and integrate data from automated equipment.

Leading Companies in the Life Sciences IT Market

Below is an overview of prominent companies shaping the life sciences IT landscape:

Genedata AG

- Specialization: Bioinformatics and data analysis platforms for life sciences research.

- Key Focus Areas: Drug discovery, omics data management, and biopharmaceutical process optimization.

- Notable Features: Offers integrated software solutions that streamline complex data workflows in research and development.

- 2024 Revenue (Approx.): Data not publicly disclosed.

- Market Share (Approx.): Specific figures not available.

- Global Presence: Headquartered in Switzerland with a global client base.

Qiagen N.V.

- Specialization: Sample and assay technologies for molecular diagnostics, applied testing, and academic research.

- Key Focus Areas: Genomics, molecular diagnostics, and bioinformatics.

- Notable Features: Provides a comprehensive portfolio of products and services, including QIAGEN Digital Insights for data analysis.

- 2024 Revenue (Approx.): Data not publicly disclosed.

- Market Share (Approx.): Specific figures not available.

- Global Presence: Operates in over 25 countries worldwide.

Clario

- Specialization: Clinical trial technology solutions.

- Key Focus Areas: Data capture, management, and analysis for clinical trials.

- Notable Features: Offers a suite of eClinical solutions, including electronic patient-reported outcomes (ePRO) and electronic clinical outcome assessments (eCOA).

- 2024 Revenue (Approx.): Data not publicly disclosed.

- Market Share (Approx.): Specific figures not available.

- Global Presence: Serves clients globally with offices in multiple countries.

Thermo Fisher Scientific Inc.

- Specialization: Scientific instrumentation, reagents, and software services.

- Key Focus Areas: Laboratory equipment, analytical instruments, and life sciences software.

- Notable Features: Provides comprehensive solutions that integrate hardware and software for laboratory workflows.

- 2024 Revenue (Approx.): $42.88 billion.

- Market Share (Approx.): Holds a significant share in the life sciences tools and services market.

- Global Presence: Operates in over 50 countries worldwide.

Revvity, Inc.

- Specialization: Health science solutions encompassing technologies and services.

- Key Focus Areas: Translational multi-omics technologies, biomarker identification, imaging, and informatics.

- Notable Features: Delivers complete workflows from discovery to development and diagnosis to cure.

- 2024 Revenue (Approx.): $2.756 billion.

- Market Share (Approx.): Specific figures not available.

- Global Presence: Serves customers in over 190 countries.

Leading Trends and Their Impact

The life sciences IT market is influenced by several emerging trends:

- Artificial Intelligence (AI) Integration: AI is being increasingly adopted for data analysis, predictive modeling, and decision-making processes. However, many companies are still developing policies and procedures to manage AI technologies effectively.

- Cloud Computing: The shift towards cloud-based solutions facilitates scalability, collaboration, and remote access to data and applications.

- Personalized Medicine: IT solutions enable the analysis of genetic and molecular data, supporting the development of individualized treatment plans.

- Regulatory Technology (RegTech): Automation of compliance processes ensures adherence to regulatory standards, reducing the risk of errors and penalties.

- Data Security and Privacy: With the increasing digitization of sensitive health data, robust cybersecurity measures are essential to protect patient information.

Successful Examples of Life Sciences IT Implementation

Several organizations have successfully integrated IT solutions into their life sciences operations:

- Genedata AG: Their bioinformatics platforms have streamlined data analysis in drug discovery and development processes.

- Qiagen N.V.: Their digital insights tools have enhanced genomic data interpretation, aiding in diagnostics and research.

- Clario: Their eClinical solutions have improved the efficiency and accuracy of clinical trials.

- Thermo Fisher Scientific Inc.: Their integrated laboratory solutions have optimized research workflows and data management.

- Revvity, Inc.: Their comprehensive health science solutions have facilitated advancements in translational research and diagnostics.

Regional Analysis: Government Initiatives and Policies Shaping the Market

Government initiatives and policies play a crucial role in shaping the life sciences IT market across different regions:

United Kingdom: The UK government has announced reforms to accelerate clinical trials and expand research access to NHS data, aiming to bolster the country’s standing in global medical innovation. Up to £600 million will be invested in a new health data research service to centralize access to NHS data for researchers.

United States: The U.S. continues to invest in healthcare IT infrastructure, promoting the adoption of electronic health records (EHRs) and supporting research through agencies like the National Institutes of Health (NIH). Initiatives such as the 21st Century Cures Act aim to accelerate medical product development and bring new innovations faster to patients by enhancing health data interoperability and streamlining regulatory approval.

European Union (EU): The EU supports life sciences IT through its Horizon Europe program, which funds research and innovation in health and biotechnology. The General Data Protection Regulation (GDPR) also plays a key role in shaping how health data is managed and processed, encouraging the development of secure and compliant IT systems.

China: The Chinese government is investing heavily in health technology as part of its “Healthy China 2030” initiative. This includes digitizing hospital infrastructure and supporting genomics and biotech industries, particularly through artificial intelligence (AI)-driven analytics platforms.

India: The National Digital Health Mission (NDHM) is creating a digital health ecosystem by establishing digital health IDs and encouraging the use of EHRs. The government also supports biotech startups through grants and incubators, which increasingly rely on IT tools for genomics, diagnostics, and personalized medicine.

Japan: Japan’s health IT strategy emphasizes data standardization and the promotion of AI in medical research. Regulatory authorities are working to support the digital transformation of pharmaceutical development and medical diagnostics.

Middle East: Countries like the UAE and Saudi Arabia are integrating life sciences IT into their national health strategies, focusing on smart hospitals, digital health records, and medical AI research as part of broader economic diversification plans (e.g., Saudi Vision 2030).

Industry Challenges and Opportunities

Challenges

- Data Interoperability: Integrating diverse data systems across labs, clinics, and geographies remains a major hurdle.

- Cybersecurity Concerns: Sensitive patient and trial data are vulnerable to cyberattacks, prompting stringent security requirements.

- Regulatory Complexity: Navigating a patchwork of international regulations can be resource-intensive.

- High Implementation Costs: Advanced IT solutions require substantial upfront investment, posing a barrier for small- to mid-sized firms.

Opportunities

- Precision Medicine: As more genetic data becomes available, IT tools will be essential in interpreting complex datasets for customized treatment plans.

- Real-World Evidence (RWE): The growing use of real-world data in regulatory and clinical settings opens new avenues for IT-driven insights.

- Telehealth Integration: Combining life sciences IT with telehealth platforms can improve remote clinical trials and patient engagement.

- AI and Machine Learning: These technologies offer transformative capabilities in predictive modeling, diagnostic imaging, and drug response simulation.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Fertility Market Size, Share & Growth Report 2025-2034