Iron and Steel Market Size

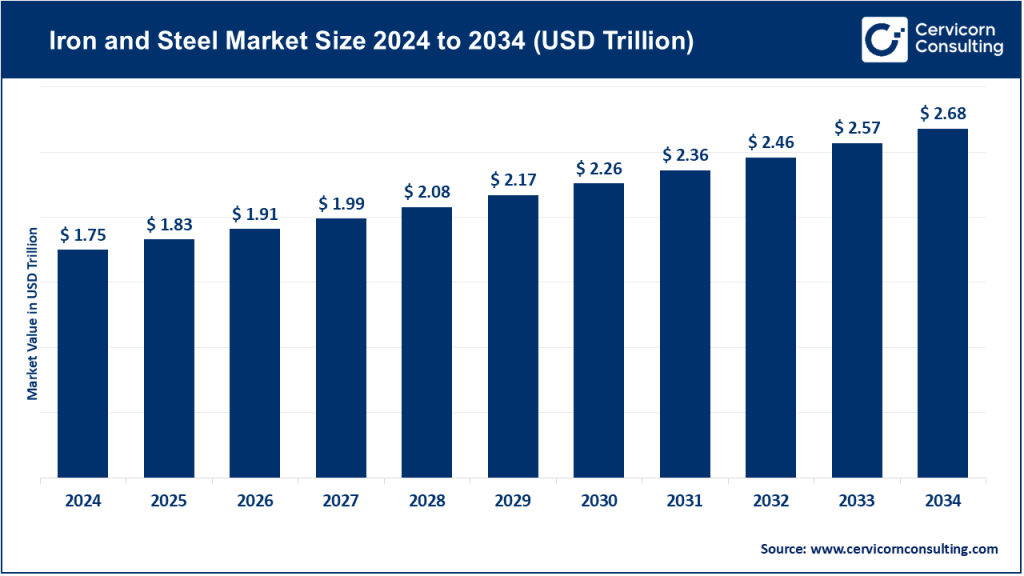

The global iron and steel market size was worth USD 1.75 trillion in 2024 and is anticipated to expand to around USD 2.68 trillion by 2034, registering a compound annual growth rate (CAGR) of 4.8% from 2025 to 2034.

What Is the Iron and Steel Market?

The iron and steel market encompasses the entire value chain involved in converting iron ore, coal, and scrap metal into steel products that form the backbone of industrial development. It includes upstream activities such as mining, smelting, and primary steelmaking, midstream processes like rolling, coating, and finishing, and downstream applications across infrastructure, automotive, construction, energy, machinery, shipbuilding, and consumer goods. Steelmaking processes primarily fall under two categories: the Blast Furnace–Basic Oxygen Furnace (BF–BOF) route and the Electric Arc Furnace (EAF) route, with an emerging shift toward Direct Reduced Iron (DRI) and hydrogen-based steelmaking technologies.

In essence, the iron and steel market is not only a cornerstone of industrialization but also a critical determinant of economic health. It reflects global growth trends, construction activity, trade balances, and technological evolution.

Why Is the Iron and Steel Market Important?

Steel is the world’s most essential engineering material. Its strength, versatility, and recyclability make it indispensable for infrastructure, energy systems, transportation, and manufacturing. Skyscrapers, bridges, cars, railways, wind turbines, pipelines, and industrial machinery all rely on steel’s unmatched structural performance.

Beyond its mechanical advantages, steel is vital for national economic resilience. It supports employment, enables urbanization, and contributes significantly to GDP through exports, infrastructure investment, and manufacturing. Moreover, with the global focus on decarbonization, the steel sector’s transformation toward green and low-carbon production methods plays a central role in achieving global climate goals.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2801

Iron and Steel Market Growth Factors

The global iron and steel market is growing steadily, driven by rapid urbanization, infrastructure expansion, industrialization in emerging economies, and the increasing demand for lightweight, high-strength materials in automotive and construction sectors. Rising investments in renewable energy infrastructure, particularly wind and solar, are boosting the need for specialized steels, while government initiatives to modernize rail, housing, and public works continue to spur demand. In mature markets, refurbishment and green retrofitting projects add resilience to long-term consumption. Technological advancements—such as digital twin-based production, automation, hydrogen-based direct reduced iron (H₂-DRI), and electric arc furnace adoption—enhance efficiency and sustainability.

Additionally, strong policy pushes toward carbon neutrality, trade protection measures, and supply-chain diversification are creating opportunities for regional steel manufacturing hubs. Overall, these growth drivers support the market’s steady value expansion, with global revenues estimated between USD 1.4 trillion and USD 1.7 trillion in 2024.

Top Companies in the Global Iron and Steel Market (2024 Profiles)

1. China Baowu Steel Group (China)

Specialization: Integrated steel production, covering the entire supply chain from iron ore processing to advanced flat and long products.

Key Focus Areas: Capacity optimization, mergers and acquisitions among Chinese state-owned enterprises, high-strength automotive steels, and low-carbon transformation.

Notable Features: As the world’s largest steel producer, Baowu commands an extensive domestic and international presence, combining upstream mining assets with downstream product innovation. The company leads China’s green-steel initiatives and digitized production networks.

2024 Revenue: Approximately RMB 322 billion (via major subsidiary Baosteel), maintaining Baowu’s leadership in global crude steel output.

Market Share & Presence: Estimated at over 10% of global steel output, with exports to Asia, Europe, and the Americas.

2. ArcelorMittal (Luxembourg)

Specialization: A diversified, integrated steel and mining enterprise producing flat, long, and tubular products for automotive, construction, and industrial use.

Key Focus Areas: Decarbonization (electrification and CCUS), digital process control, and expansion in high-value steel segments.

Notable Features: The company’s global presence spans more than 60 countries with strong R&D and a pioneering approach to “green steel” through hydrogen DRI and low-emission processes.

2024 Revenue: Approximately USD 62.4 billion.

Market Share & Presence: Among the top three global producers, ArcelorMittal operates major facilities across Europe, North America, South America, and Africa, and holds a growing stake in Indian steel projects.

3. Ansteel Group Corporation (China)

Specialization: Integrated steel production focusing on hot and cold-rolled sheets, structural steels, and specialty products.

Key Focus Areas: Technological modernization, efficiency improvement, and diversification into value-added products.

Notable Features: One of China’s oldest and most strategically important steelmakers, Ansteel has been consolidating its position through partnerships and product innovation.

2024 Revenue: Approximately RMB 105 billion, reflecting the impact of price cycles but steady operational scale.

Market Share & Presence: Among China’s top producers, serving domestic infrastructure, manufacturing, and export markets across Asia.

4. Nippon Steel Corporation (Japan)

Specialization: Advanced high-strength steels, stainless steels, and specialty alloys for automotive, energy, and construction sectors.

Key Focus Areas: High-value steel solutions, lightweight materials for electric vehicles, and innovation in hydrogen-based DRI and carbon-neutral production.

Notable Features: A global leader in metallurgical research and process innovation, Nippon Steel is also actively acquiring assets in emerging markets to expand its global footprint.

2024 Revenue: Approximately ¥8.86 trillion (USD 60+ billion equivalent).

Market Share & Presence: One of the top five global producers with strong operations across Japan, ASEAN, and Europe.

5. HBIS Group (China)

Specialization: Comprehensive production of flat and long steels for construction, energy, and machinery sectors.

Key Focus Areas: Expansion into advanced materials, international market penetration, and industrial upgrading toward green, low-carbon steel.

Notable Features: A major Chinese state-owned enterprise known for its size, integration, and diversification into new energy and smart manufacturing.

2024 Revenue: Approximately RMB 402 billion.

Market Share & Presence: Among China’s top three producers, exporting to over 80 countries.

Leading Trends and Their Impact on the Iron and Steel Market

1. Decarbonization and Green Steel Transition

The global steel industry is at the forefront of industrial decarbonization. With the sector responsible for nearly 8% of global CO₂ emissions, companies are investing heavily in hydrogen-based steelmaking, electric arc furnaces, and carbon capture utilization and storage (CCUS). Governments in Europe, Japan, and North America are offering incentives to accelerate these transitions. This push is reshaping competitive dynamics—producers capable of supplying certified low-carbon steel will capture premium market segments and secure contracts from automotive and construction industries committed to net-zero supply chains.

2. Technological Advancements and Automation

Digital twins, AI-based process optimization, and predictive maintenance are transforming plant operations. Smart factories reduce energy consumption, enhance quality control, and minimize downtime. The adoption of Industry 4.0 tools in steel production is expected to boost margins while reducing emissions and waste.

3. Product Upgrading and Lightweighting

The rise of electric vehicles and modern infrastructure requires advanced high-strength steels, corrosion-resistant coatings, and tailored microstructures. Automotive manufacturers increasingly prefer steels that offer high tensile strength at lower thicknesses, improving fuel efficiency and safety standards. This trend has encouraged R&D investments across major producers.

4. Raw Material Volatility and Supply Security

Fluctuations in iron ore, coking coal, and energy prices continue to influence profitability. Major steelmakers mitigate risks through vertical integration—owning or investing in mining assets—and long-term supply agreements. Recycling and scrap utilization are becoming critical strategic levers for cost control and emission reduction.

5. Trade Policy and Regionalization

Governments are implementing tariffs, quotas, and carbon border adjustment mechanisms to protect domestic industries. Such measures are encouraging the re-localization of steel production in key markets like the U.S. and EU, fostering supply-chain resilience but also adding price volatility.

Successful Global Examples of the Iron and Steel Market

China Baowu Steel Group

China Baowu exemplifies how scale and state coordination can drive industrial dominance. Through mergers, digital integration, and low-carbon pilot projects, Baowu has transformed into the largest steel producer globally. Its investments in hydrogen-based DRI and electric arc furnaces underscore China’s commitment to greener industrial growth.

ArcelorMittal Europe

ArcelorMittal’s European facilities showcase a successful model for green transition. The company’s DRI–EAF projects and CCUS initiatives, supported by EU industrial decarbonization funds, are setting the benchmark for sustainable steelmaking. The group’s “Smart Carbon” program integrates hydrogen, biogas, and captured carbon to create circular value chains.

Nippon Steel Corporation

Nippon Steel’s emphasis on R&D has made it a pioneer in high-strength automotive steels. Its advanced alloys are used by leading automakers worldwide to produce lightweight electric vehicles. The company’s investment in hydrogen technology and partnerships for global expansion demonstrate Japan’s leadership in sustainable steel innovation.

HBIS Group

HBIS has taken significant steps toward transforming from a traditional steel producer into a materials and technology conglomerate. Its initiatives in renewable energy materials and international collaborations illustrate how Chinese enterprises are diversifying to maintain competitiveness in a decarbonizing world.

Ansteel Group

Ansteel’s modernization program highlights successful adaptation amid cyclical markets. The company has focused on cost efficiency, downstream product development, and partnership with technology providers to maintain resilience and competitiveness in both domestic and international markets.

Global & Regional Market Analysis

1. Asia–Pacific

The Asia–Pacific region dominates global steel production, accounting for over 70% of total output. China, Japan, India, and South Korea are leading producers, with China remaining the primary demand and supply center. India’s government is aggressively expanding domestic capacity through the “Make in India” and “National Steel Policy,” targeting 300 million tonnes of annual capacity by 2030. Japan and South Korea focus on innovation and export-driven production, while Southeast Asia is emerging as a fast-growing market due to infrastructure development.

2. Europe

Europe’s steel industry is undergoing a profound transformation under the European Green Deal. Decarbonization is the defining theme, supported by initiatives such as the Carbon Border Adjustment Mechanism (CBAM), Emissions Trading System (ETS), and public funding for hydrogen-based steelmaking. European producers, including ArcelorMittal, thyssenkrupp, and SSAB, are leading the global shift toward low-emission technologies. Policy alignment ensures that regional steelmakers maintain competitiveness while transitioning to net-zero operations.

3. North America

The U.S. steel industry benefits from strong domestic demand driven by infrastructure investment and reshoring trends. The Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA) have catalyzed growth in clean manufacturing and steel-intensive projects. U.S. producers are increasingly adopting electric arc furnaces and recycled scrap to cut emissions and costs. Canada and Mexico also play integral roles in the North American steel supply chain through trade integration under the USMCA framework.

4. Middle East and North Africa (MENA)

The MENA region is expanding its steel capacity through state-backed diversification efforts. Countries like Saudi Arabia, the UAE, and Egypt are investing heavily in downstream industries and low-emission steel technologies. Access to abundant natural gas makes hydrogen-based DRI economically attractive, positioning the region as a potential global green steel hub.

5. Latin America

Brazil and Mexico are leading producers, supported by rich natural resources and proximity to growing North American markets. Infrastructure modernization and renewable energy investments are major demand drivers. Latin America’s abundant iron ore reserves offer a competitive advantage for long-term expansion.

6. Sub-Saharan Africa

Africa’s steel market remains underdeveloped but holds immense potential. Governments are promoting industrialization and infrastructure projects, with Nigeria, South Africa, and Egypt emerging as regional centers. Policy frameworks emphasizing local value addition and reduced dependence on imports are encouraging investment in new capacity.

Government Initiatives and Policy Influence

- Decarbonization Incentives:

Governments worldwide are deploying subsidies, grants, and tax credits to support clean steel technologies. Europe’s Hydrogen Strategy and Japan’s Green Transformation (GX) initiative are key examples driving industry innovation. - Trade Protection and Fair Competition:

Anti-dumping duties, tariffs, and import restrictions continue to safeguard domestic industries, encouraging investment in local steel production and mitigating the impact of global oversupply. - Infrastructure Stimulus Programs:

Public infrastructure investments—roads, housing, railways, and renewable energy—create sustained demand for steel products, particularly in emerging markets. - Circular Economy and Recycling Mandates:

Regulations promoting scrap collection and reuse are boosting electric arc furnace adoption and supporting closed-loop production models, which reduce waste and emissions. - Carbon Border Adjustment Mechanisms:

Policies linking trade to emission standards, such as the EU CBAM, are reshaping global trade flows and incentivizing low-carbon production methods worldwide.

Strategic Takeaways and Market Outlook

- Green Transformation as Competitive Edge:

Steelmakers adopting hydrogen-DRI, CCUS, and renewable energy integration will gain long-term market advantages and access to premium customers. - Regionalization of Production:

Trade and climate policies are driving localized production networks, encouraging cross-border joint ventures and regional self-sufficiency. - Technological Leadership Matters:

Companies investing in automation, advanced process control, and digital quality systems are outperforming peers in cost efficiency and sustainability. - Circular Economy Integration:

Scrap recycling, secondary steelmaking, and industrial symbiosis are emerging as core business models. - Policy Alignment Will Shape Winners:

Countries aligning industrial strategy, energy policy, and climate goals will anchor the next phase of global steel competitiveness.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: U.S. Ambulatory Surgery Centers Market Growth Drivers, Trends, Key Players and Regional Insights by 2034