Insulin Delivery Devices Market Size

Insulin Delivery Devices Market — Growth Factors

The insulin delivery devices market’s rapid expansion is driven by several interconnected factors: the rising global prevalence of diabetes (type 1 and type 2), increasing patient demand for convenient and less-invasive administration methods, advances in smart-device and sensor integration (CGM + connected pens/pumps), the emergence of patch and tubeless pumps that improve adherence, broader reimbursement and payer support for technologies that reduce long-term complications, growing awareness and self-management initiatives, and strong private and public R&D investment pushing miniaturization, interoperability, and AI-driven closed-loop systems. Together, these factors are raising per-patient device spend—moving users from basic pens to smart pens and advanced pumps—while expanding the addressable population in both developed and emerging markets.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2777

What Is the Insulin Delivery Devices Market?

The insulin delivery devices market includes all hardware and related consumables used to administer therapeutic insulin to patients. It comprises traditional syringes and vials, disposable and reusable insulin pens (and pen needles), pen injectors with digital tracking, insulin pumps (both tubed and tubeless patch pumps), infusion sets and reservoirs, smart or connected pens with companion mobile applications, and integrated automated insulin delivery systems that combine continuous glucose monitoring, an insulin pump, and a dosing algorithm.

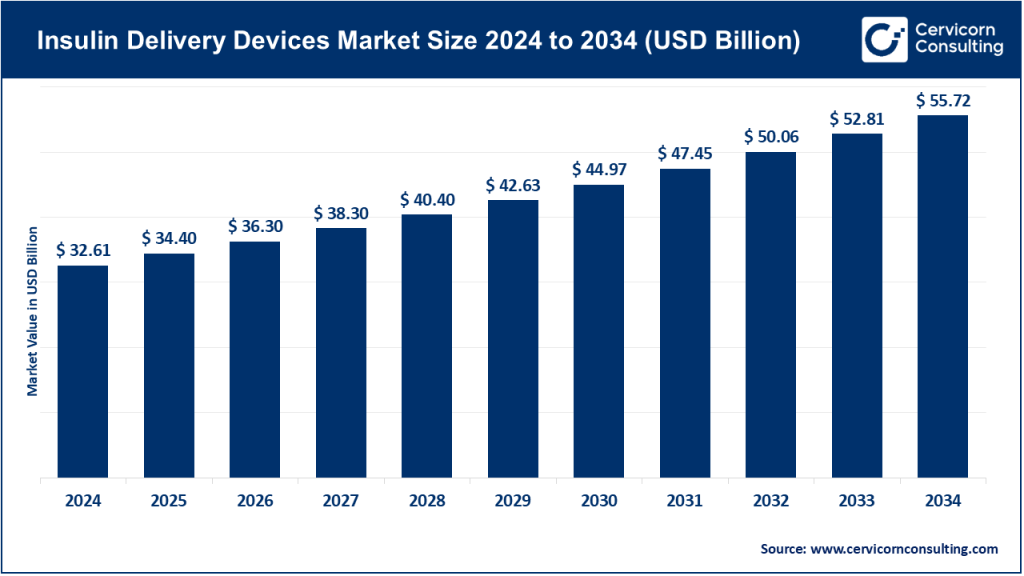

Depending on the inclusion criteria, the global insulin delivery devices market was valued at approximately USD 20–33 billion in 2024. Analysts forecast consistent growth throughout the next decade, fueled by strong innovation pipelines and expanding patient populations.

Why It Is Important

Insulin delivery devices are critical to diabetes management. They determine how effectively and safely insulin reaches the body and how well blood glucose levels are controlled. Better delivery devices minimize dosing errors, improve patient adherence, and enhance clinical outcomes by preventing hypoglycemia and hyperglycemia.

From a public health perspective, advanced insulin delivery systems can significantly reduce the economic burden of diabetes by lowering hospitalization rates and long-term complications such as cardiovascular and kidney diseases. For patients, innovations like smart pens, automated pumps, and patch devices simplify daily life, improve comfort, and enhance independence. The growing availability of these technologies—especially when supported by digital data sharing and remote monitoring—also aligns with broader healthcare trends toward personalized and connected care.

Top Companies in the Insulin Delivery Devices Market

Novo Nordisk A/S

Specialization: Novo Nordisk is the global leader in insulin products and delivery systems. Its portfolio includes both traditional and smart insulin pens, insulin cartridges, and advanced dosing solutions.

Key Focus Areas: The company emphasizes pen-based delivery systems such as the NovoPen line, continuous improvement in ease of use, and integration with digital adherence tools. It also collaborates with health-tech firms to develop connected pen solutions that communicate dosing data to mobile apps.

Notable Features: Novo Nordisk is recognized for its extensive global distribution, high-quality manufacturing, and strong research focus on simplifying insulin therapy.

2024 Revenue: The company reported total 2024 sales of approximately DKK 290 billion, with insulin product sales contributing more than DKK 55 billion.

Market Share: Novo Nordisk dominates the global pen-based insulin delivery segment.

Global Presence: Active in over 170 countries, with especially strong operations in North America, Europe, and Asia-Pacific.

Wockhardt Ltd.

Specialization: Wockhardt is a major biopharmaceutical player known for developing and manufacturing insulin formulations and patented insulin delivery pens.

Key Focus Areas: The company’s focus lies in affordable, patented pen devices and integrated insulin manufacturing, catering primarily to cost-sensitive emerging markets.

Notable Features: Wockhardt holds patents for both disposable and reusable insulin pens and has built a strong domestic manufacturing base for local and export markets.

2024 Revenue: Wockhardt’s 2024 revenue stood in the range of several thousand crore INR, according to its latest filings, largely driven by its biopharma and insulin product lines.

Market Share: Regionally significant within India and other emerging markets; smaller share globally but recognized for affordability and innovation.

Global Presence: Strong presence in India with export activities in Asia, Africa, and parts of Latin America.

Medtronic

Specialization: Medtronic is a world leader in insulin pumps and automated insulin delivery systems under the MiniMed brand.

Key Focus Areas: The company’s focus is on advancing closed-loop insulin delivery, integrating continuous glucose monitoring, and developing miniaturized wearable devices.

Notable Features: Medtronic’s MiniMed 780G and related systems are among the most advanced automated insulin delivery platforms globally.

2024 Revenue: Medtronic’s diabetes division generated approximately USD 2.5 billion in 2024.

Market Share: Among the top global players in insulin pumps and automated systems.

Global Presence: Extensive presence across North America, Europe, and Asia-Pacific, with growing penetration in Latin America.

Roche Holding AG

Specialization: Roche’s Diabetes Care division, known for the Accu-Chek brand, produces glucose monitoring systems and complementary insulin delivery products.

Key Focus Areas: Roche focuses on integrating blood glucose monitoring with dosing workflows, expanding interoperability, and developing connected diabetes management solutions.

Notable Features: A long-standing reputation in diagnostics, with high clinician trust and comprehensive patient support programs.

2024 Revenue: Roche’s diabetes-related sales are incorporated within its Diagnostics division, which remains a key revenue contributor.

Market Share: A recognized name in diabetes ecosystems, particularly in Europe, with historical influence in insulin delivery accessories.

Global Presence: Global operations with strong European and North American bases.

Abbott Laboratories

Specialization: Abbott is a global leader in continuous glucose monitoring (CGM) with its FreeStyle Libre system, which integrates with multiple insulin delivery devices and platforms.

Key Focus Areas: The company focuses on developing CGM technologies, digital ecosystems, and partnerships with pump and pen manufacturers to create connected diabetes solutions.

Notable Features: The FreeStyle Libre CGM system revolutionized glucose monitoring by reducing the need for fingersticks, enabling real-time glucose readings, and facilitating integration with insulin pumps.

2024 Revenue: Abbott reported total 2024 sales of around USD 42 billion, with Diabetes Care revenue reaching USD 6.8 billion.

Market Share: Global leader in CGM, influencing insulin delivery device adoption through data-driven decision-making.

Global Presence: Extensive operations in North America and Europe, rapidly expanding in Asia-Pacific and Latin America.

Leading Trends and Their Impact

- Smart and Connected Pens: The shift toward digital insulin pens capable of tracking doses and transmitting data to smartphone apps enhances adherence and enables data-driven treatment adjustments. This digitalization is driving new revenue streams through software ecosystems.

- Closed-Loop Automated Insulin Delivery Systems: Closed-loop or hybrid systems integrate CGMs, pumps, and algorithms to automatically adjust insulin delivery. They offer superior glucose control and are gaining rapid clinical and payer acceptance.

- Patch and Tubeless Pumps: Wearable patch pumps eliminate the need for tubing, offering discreet and convenient insulin administration. Their growing adoption, particularly among adults with type 2 diabetes, expands the overall pump market.

- CGM and Pump Interoperability: The integration of CGM data with insulin pumps and pens promotes personalized therapy and simplifies disease management, encouraging ecosystem collaborations among leading device companies.

- AI and Data Analytics: Artificial intelligence is increasingly used to predict blood glucose trends and adjust insulin delivery accordingly, pushing the market toward personalized, predictive care.

- Affordability and Emerging Markets: Affordable insulin delivery systems and government-supported manufacturing initiatives in emerging markets, particularly in Asia-Pacific, are expanding global access while maintaining cost efficiency.

Successful Examples of Insulin Delivery Devices

- Medtronic MiniMed 780G: A hybrid closed-loop insulin pump system that automatically adjusts insulin delivery based on real-time glucose readings. It has significantly improved clinical outcomes for patients worldwide.

- Insulet Omnipod System: A tubeless, wearable insulin patch pump that offers wireless control, convenience, and flexibility. Its success demonstrates strong consumer preference for simple, on-body devices.

- Abbott FreeStyle Libre System: One of the most successful CGM technologies globally, it integrates seamlessly with multiple insulin delivery platforms, enabling users to make informed dosing decisions.

- Novo Nordisk Insulin Pens: The NovoPen series and newer smart pen variants are among the most widely used delivery devices globally, known for accuracy, reliability, and comfort.

- Wockhardt Patented Insulin Pens: In emerging markets like India, Wockhardt’s cost-effective patented pen designs have made insulin therapy more accessible and improved treatment adherence.

Global Regional Analysis

North America

North America holds the largest share of the insulin delivery devices market due to high diabetes prevalence, advanced healthcare infrastructure, and widespread insurance coverage for medical devices. The U.S. is the largest single market, with continuous innovations, such as smart pens and closed-loop systems, receiving regulatory approval. Government initiatives like expanded Medicare reimbursement for CGM and insulin pump systems have significantly accelerated adoption. Collaborations between device makers, insurers, and digital health startups further enhance access and affordability.

Europe

Europe is the second-largest market, characterized by favorable reimbursement policies and high patient awareness. Countries such as Germany, the U.K., and the Nordics have integrated CGMs and insulin pumps into national health systems. The European Union’s Medical Device Regulation (MDR) has standardized device approvals, while ongoing national programs promote technology adoption among youth and high-risk populations.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the global market, driven by a large diabetic population, rising healthcare expenditure, and expanding access to modern healthcare technologies. Countries like China, Japan, and India are investing heavily in local manufacturing and innovation to meet growing demand. India, for instance, supports indigenous production of insulin and delivery devices through pharmaceutical and biotechnology policies. Increasing urbanization, improved healthcare infrastructure, and public health campaigns on diabetes awareness are catalyzing device adoption.

Latin America

Latin America’s insulin delivery device market is developing rapidly, led by Brazil and Mexico. Economic reforms and public health initiatives are improving access to advanced diabetes technologies. Partnerships between governments and multinational device makers are helping expand reach in underserved regions.

Middle East & Africa

While overall penetration remains low, the Middle East and Africa are emerging markets with growing opportunities. Governments in Gulf Cooperation Council (GCC) countries are investing in diabetes prevention and management programs, while African nations are partnering with NGOs to enhance insulin and device availability. Affordability remains the key barrier, but gradual policy reforms and foreign investments are expected to support long-term growth.

Government Initiatives and Policies Shaping the Market

- Reimbursement Expansion: In the United States and Europe, expanding reimbursement policies for CGMs, pumps, and hybrid systems are pivotal in driving device uptake. Public and private insurers are increasingly recognizing the long-term cost savings associated with these technologies.

- Local Manufacturing Incentives: Governments in emerging markets such as India and China are encouraging local production of insulin delivery devices through tax incentives and public-private partnerships, reducing dependence on imports and improving affordability.

- Regulatory Harmonization: Regulatory agencies worldwide are streamlining approval processes for connected medical devices and digital health platforms. Harmonization between FDA, EMA, and regional authorities enables faster market access for innovative technologies.

- Public Awareness Campaigns: National diabetes programs promoting early diagnosis and treatment adherence indirectly fuel device adoption by increasing patient engagement and education.

- Digital Health Integration: Policies that promote telemedicine, e-health, and remote monitoring are fostering greater integration between insulin delivery systems and healthcare platforms.

Market Future Direction

As of 2024, the global insulin delivery devices market is valued between USD 20–33 billion, depending on product inclusion. Market forecasts predict robust growth over the next decade, with compound annual growth rates (CAGR) ranging from 8% to 11%. North America currently leads in revenue, while Asia-Pacific is the fastest-growing region. Increasing penetration of smart, connected, and automated systems is expected to dominate market dynamics.

The convergence of hardware, software, and analytics will continue to redefine how patients manage diabetes. As government initiatives promote accessibility and affordability, and as major players expand innovation pipelines, the insulin delivery devices market is set to remain one of the most dynamic and transformative sectors within global healthcare technology.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Remote Monitoring and Control Market Growth Trends, Top Companies, and Global Insights by 2034