Insulation Market Size

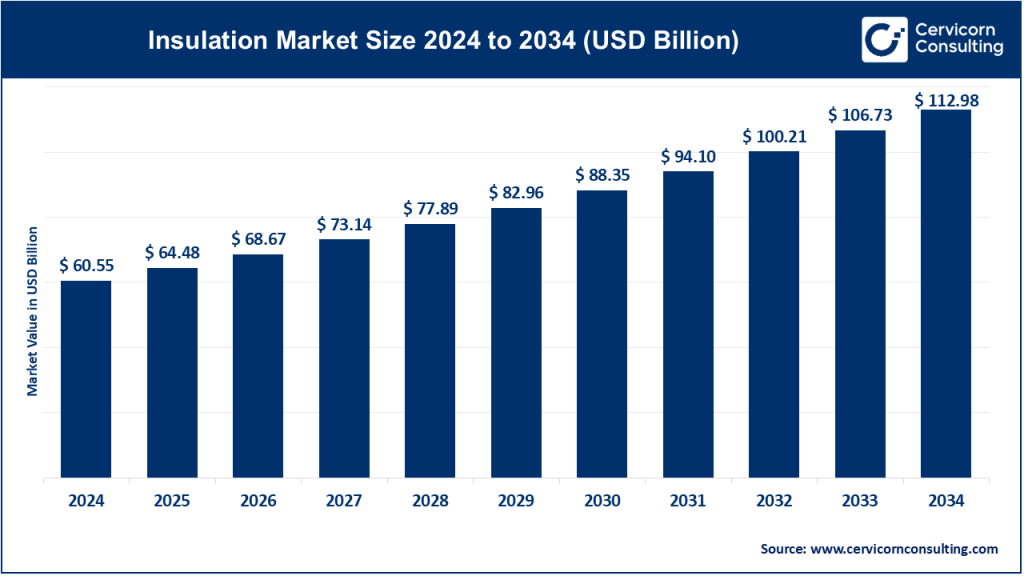

The global insulation market size was worth USD 60.55 billion in 2024 and is anticipated to expand to around USD 112.98 billion by 2034, registering a compound annual growth rate (CAGR) of 6.44% from 2025 to 2034.

What Is the Insulation Market?

The insulation market consists of materials and systems designed to reduce heat transfer, manage sound, enhance fire resistance, and improve the operational efficiency of buildings and industrial processes. It includes:

- Thermal insulation: fiberglass, mineral wool (glass wool and rock wool), expanded polystyrene (EPS), extruded polystyrene (XPS), polyurethane (PUR), polyisocyanurate (PIR), cellulose, aerogel panels, and reflective insulation.

- Acoustic insulation: specialized mineral wool, acoustic foams, panels, and composite materials.

- Industrial and mechanical insulation: products designed for pipes, tanks, ducts, boilers, and high-temperature equipment to prevent heat loss and improve process efficiency.

The insulation market spans new construction, retrofit and renovation, and specialized technical applications across residential, commercial, industrial, marine, automotive, aerospace, and cold-chain sectors.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2398

Why Is Insulation Important?

Insulation is critical for multiple reasons:

- Energy Efficiency: Buildings account for a significant share of global energy consumption, primarily due to heating and cooling. Insulation dramatically reduces energy demand, lowering electricity and fuel consumption.

- Cost Savings: Improved insulation reduces heating and cooling costs, delivering long-term financial savings with relatively fast payback periods.

- Environmental Sustainability: Insulation reduces operational carbon emissions and can have low embodied carbon depending on material type and manufacturing.

- Comfort: Enhances thermal comfort and indoor air quality and reduces noise pollution.

- Fire Protection: Non-combustible insulation materials—such as stone wool—provide critical fire resistance.

- Industrial Efficiency: In industries, insulation prevents thermal losses, safeguards equipment, improves worker safety, and enhances overall process performance.

Insulation Market Growth Factors

Growth in the global insulation market is driven by the tightening of building energy codes, rising energy costs, and expanding retrofit programs designed to reduce energy consumption in aging building stocks. Government regulations targeting net-zero emissions are compelling commercial and residential sectors to adopt higher-performance insulation solutions, while incentives, rebates, and public funding make retrofits financially accessible. Rapid urbanization in Asia-Pacific and the Middle East further boosts demand for both new-build and retrofit insulation. Innovations in materials, including low-carbon and bio-based alternatives, and improvements in manufacturing efficiency are also propelling the market. Additional momentum comes from concerns about fire safety and acoustic performance, increasing awareness of energy-efficient living, and the integration of insulation solutions into prefabricated and modular construction systems.

Top Companies in the Insulation Market

Below are detailed profiles of the leading insulation manufacturers, including company focus areas, notable features, 2024 revenue snapshots, market share remarks, and global presence.

Saint-Gobain

- Specialization: Wide-ranging building materials including insulation, gypsum systems, glass solutions, façade products, and construction chemicals.

- Key Focus Areas: Sustainable construction, low-carbon materials, renovation-driven growth, energy-efficient building envelopes.

- Notable Features: Strong global footprint with innovation-led sustainability initiatives; diversified product portfolio serving residential, commercial, and industrial sectors.

- 2024 Revenue: Tens of billions of euros at the group level (insulation being a multi-billion segment within the broader portfolio).

- Market Share: One of the largest global players with major influence in Europe and a strong presence across the Americas and Asia-Pacific.

- Global Presence: Operations in over 70 countries with extensive manufacturing and R&D capabilities.

Owens Corning

- Specialization: Fiberglass insulation, roofing materials, composites, and specialty building solutions.

- Key Focus Areas: High-performance fiberglass insulation, sustainability improvements, recycled content usage, integrated roofing-insulation systems.

- Notable Features: Market-leading brand recognition in the U.S. and Canada; extensive contractor networks and distribution strength.

- 2024 Revenue: Roughly USD 11 billion in total company sales.

- Market Share: A leading North American insulation supplier with growing global reach.

- Global Presence: Manufacturing and sales operations across North America, Europe, and parts of Asia-Pacific.

Johns Manville (A Berkshire Hathaway Company)

- Specialization: Fiberglass and mineral wool insulation, commercial roofing, industrial insulation, nonwovens, and filtration materials.

- Key Focus Areas: Building insulation, mechanical insulation, energy-efficient industrial solutions, product innovation in specialty nonwoven composites.

- Notable Features: Deep legacy in insulation and industrial materials; part of Berkshire Hathaway’s diversified industrial group.

- 2024 Revenue: Estimated around USD 4 billion.

- Market Share: A top-tier North American producer with strong commercial and industrial market penetration.

- Global Presence: Manufacturing plants and distribution networks across North America and Europe, with exports to global markets.

ROCKWOOL Group (Rockwool International)

- Specialization: Stone wool insulation for thermal, acoustic, and fire-resistant applications in buildings and industrial systems.

- Key Focus Areas: Non-combustible insulation, façade safety, acoustic systems, industrial high-temperature insulation, building retrofits.

- Notable Features: Known for best-in-class fire resistance and durability; strong sustainability and circularity leadership.

- 2024 Revenue: Approximately EUR 3.8–3.9 billion.

- Market Share: Global leader in stone wool insulation.

- Global Presence: Manufacturing across Europe, North America, and global distribution into 120+ countries.

Knauf Insulation

- Specialization: Glass wool, rock mineral wool, and foam-based insulation (EPS/XPS), plus system solutions for envelopes and industrial applications.

- Key Focus Areas: Low-carbon production, recycling and circularity, retrofit markets, expansion of capacity in high-demand regions like North America.

- Notable Features: Family-owned global business with strong innovation and sustainability investments.

- 2024 Revenue: More than EUR 2.5 billion.

- Market Share: One of the leading insulation manufacturers globally, with strong positions in Europe and expanding influence in America and Asia.

- Global Presence: Extensive operations in Europe, major investments in North America, and presence in various regions worldwide.

Leading Trends and Their Impact

1. Rising Demand for Energy-Efficient Buildings

Governments are mandating tighter building codes, higher insulation R-values, and net-zero building targets. This significantly increases penetration of premium insulation materials like PIR/PUR foams and high-density mineral wool.

2. Growth of Retrofit Markets

Aging buildings in North America and Europe present massive retrofit opportunities, often supported by government incentives. This creates steady demand for cavity-wall retrofits, loft insulation, and external wall insulation systems.

3. Focus on Low-Carbon and Sustainable Products

Manufacturers are developing recyclable, bio-based, and low-embodied-carbon products. This trend is reshaping procurement criteria for developers and public-sector projects.

4. Fire Safety and Acoustic Standards

Greater scrutiny of façade safety is increasing adoption of non-combustible materials such as stone wool. Acoustic comfort trends are also boosting demand for specialized sound-absorbing insulation.

5. Industrial Efficiency and Process Optimization

Energy-intensive industries are using insulation to reduce heat loss, improve safety, and meet sustainability goals, driving the mechanical insulation segment.

6. Digitalization and Prefabrication

Insulation providers are integrating BIM tools, offering digital modeling services, and partnering with modular construction firms for factory-installed systems.

7. Electrification and Heat Pump Compatibility

As heat pump adoption surges globally, proper insulation becomes essential to reduce heating loads — making envelope upgrades a prerequisite for electrification plans.

Successful Global Examples of Insulation Deployment

High-Performance Retrofit Projects (USA)

Major commercial buildings in cities such as New York, Boston, and Chicago have implemented deep energy retrofits using advanced stone wool façades, high-performance cavity-fill insulation, and air-sealing strategies to meet stringent local carbon caps.

Passive House and Zero-Energy Buildings (Europe)

Countries like Germany, Austria, and Sweden are leaders in passive building standards. Homes and offices use thick layers of mineral wool and airtight envelope systems to drastically reduce heating demand.

Cavity-Wall & Loft Insulation Programs (UK)

Large-scale social housing retrofits funded by government programs have demonstrated significant reductions in energy bills by installing cavity-wall insulation, attic insulation, and exterior insulation systems.

Middle East Cooling-Efficiency Projects

Gulf countries have adopted high-performance exterior insulation to combat extreme heat, reduce cooling demand, and meet emerging green-building guidelines.

Industrial Thermal Efficiency Upgrades (Global)

Industrial facilities across Europe, North America, and Asia have deployed mechanical insulation upgrades — especially in oil & gas, chemicals, power generation, and food processing — resulting in major reductions in heat loss and improved process efficiency.

Global Regional Analysis & Government Policies Shaping the Market

Europe

Europe leads the world in insulation adoption due to strict energy-efficiency regulations. Key policy drivers include:

- Higher minimum U-values/R-values in national building codes

- Mandatory energy performance certifications

- Energy Performance of Buildings Directive (EPBD)

- Fit-for-55 and climate neutrality targets

- Large-scale renovation programs in France, Germany, the UK, and the Nordics

- Funding for deep renovation of public buildings

These initiatives make Europe the most advanced retrofit market globally. Demand for non-combustible and sustainable products is especially strong due to fire-safety regulations and green-building certification growth.

North America

The U.S. and Canada represent major markets driven by:

- Federal tax credits for insulation upgrades

- State-level energy-efficiency programs

- Utility rebates for attic, wall, and floor insulation

- Adoption of more rigorous versions of the International Energy Conservation Code (IECC)

- Heat pump incentives that pair with envelope improvements

North America also has strong industrial insulation demand driven by manufacturing, power generation, food processing, and petrochemicals.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to rapid urbanization, large-scale infrastructure development, and increasing energy-efficiency awareness. Key drivers include:

- Strengthening national building codes (China, India, ASEAN)

- Government initiatives for sustainable urban development

- Large new construction volumes

- Investments in data centers, cold chain, and industrial plants

While retrofit markets are still emerging, growing middle-class demand for comfort and climate resilience is accelerating insulation adoption.

Latin America

Growth in Latin America is less uniform but notable in:

- Commercial and industrial sectors adopting insulation to reduce energy costs

- Government-backed energy-efficiency programs in countries like Chile and Brazil

- Cooling-dominated markets adopting insulation to reduce power demand

Challenges include lower awareness and fewer mandatory insulation standards, but opportunities are increasing as green-building certifications expand.

Middle East & Africa

The Middle East is adopting insulation rapidly to curb cooling loads, driven by:

- National energy-efficiency strategies

- Higher building-code requirements

- Investments in sustainable city projects

Africa’s insulation market is still nascent, but donor-funded public building retrofits, industrial modernization, and growing urbanization are opening new opportunities.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Dental Market Revenue, Global Presence, and Strategic Insights by 2034