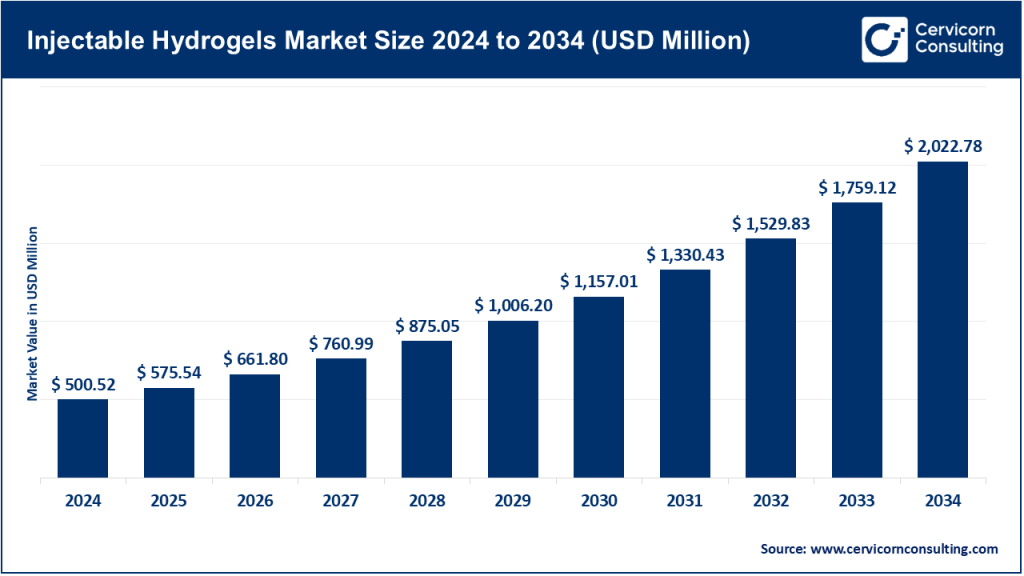

Injectable Hydrogels Market Size

What is the injectable hydrogels market?

Injectable hydrogels are water-swollen polymer networks delivered in liquid form that rapidly gel in situ to provide a three-dimensional, tissue-like environment. These materials can be engineered to be biodegradable, bioactive and cell-friendly and are used across wound care, regenerative medicine (cardiac, cartilage, neural), drug delivery, ophthalmology and surgical sealants. Because injectable hydrogels are adaptable — supporting drug release, cell encapsulation, or local mechanical support — the market includes material manufacturers, contract developers, device partners and pharmaceutical companies that convert laboratory formulations into regulatory-ready, clinically deployable products.

Why is this market important?

Injectable hydrogels address key clinical needs: minimally invasive delivery, localized therapy with reduced systemic exposure, scaffolding for tissue repair that enhances cell survival, and improved management of chronic wounds and surgical sites. With aging populations in many regions, growing rates of diabetes and chronic wounds, and a broader shift toward outpatient and minimally invasive procedures, the strategic importance of injectable hydrogels has increased. Hydrogels also act as platform technologies: a single backbone chemistry can be tuned and repurposed for multiple indications, creating long-term R&D and partnership opportunities for companies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2703

Injectable Hydrogels Market — Growth Factors

The injectable hydrogels market is propelled by several converging growth factors: rising prevalence of chronic wounds and lifestyle diseases such as diabetes; accelerating demand for regenerative therapies and localized drug delivery (especially biologics and cell therapies); improvements in polymer chemistry enabling tunable biodegradation and bioactivity; increased adoption of minimally invasive procedures; growing public and private investment in hydrogel research; expanding clinical trials and early regulatory approvals; and commercial collaborations between material scientists, pharmaceutical companies and medtech firms that shorten time-to-market. Complementary reimbursement trends that reward outpatient care and therapy effectiveness add momentum. Growth is tempered by regulatory complexity for combination products, the need for robust clinical efficacy and health-economic evidence, manufacturing scale-up challenges, and affordability pressures in some markets.

Leading Companies — Snapshot

3M Company

- Specialization: Advanced wound care dressings and hydrogels.

- Focus: Moist wound environments, clinician education and health-system distribution.

- 2024 revenue: $24.6B

Johnson & Johnson

- Specialization: Broad medtech & pharmaceutical portfolio including wound care and biomaterials.

- Focus: Surgical closure, wound management and integrating biomaterials into device platforms.

- 2024 revenue: $88.8B

Smith & Nephew

- Specialization: Advanced wound management, orthopaedics and sports medicine.

- Focus: Hydrogel wound dressings and negative-pressure wound therapy.

- 2024 revenue: $5.8B

Becton, Dickinson and Company (BD)

- Specialization: Drug-delivery systems, syringes and autoinjectors.

- Focus: Delivery devices enabling commercialization of injectable hydrogel therapeutics.

- 2024 revenue: $20.2B

B. Braun Melsungen AG

- Specialization: Surgical products, infusion therapy and biomaterials.

- Focus: Hospital-grade consumables and biomaterial innovation.

- 2024 revenue: ~€8–9B

Leading Trends and Their Impact

- Platformization: Modular hydrogel platforms speed development, enabling reuse across indications and easier partnerships between material innovators and clinical developers.

- Combination products: Hydrogels used as carriers for cells and biologics increase therapeutic potential but add regulatory complexity.

- Smart/responsive hydrogels: Materials that respond to pH, enzymes or infection cues enhance targeted therapy and monitoring.

- Regulatory & reimbursement scrutiny: Payers demand stronger clinical and economic evidence, affecting time-to-adoption.

- Device partnerships: Collaboration with delivery-device companies accelerates commercialization and broadens distribution.

- Public funding: Government and multinational research programs sustain the R&D pipeline.

Successful Examples Around the World

Examples already in clinical use or advanced trials include hydrogel dressings that promote moist wound healing and autolytic debridement, injectable scaffolds for cartilage and bone repair tested in translational studies, hydrogel carriers improving cell survival in cardiac repair programs, and prototype infection-responsive hydrogels that enable early wound infection detection and localized drug release.

Global Regional Analysis

North America

Large clinical markets with strong demand for regenerative therapies and advanced wound care. Regulatory rigor and payer scrutiny shape commercialization strategies; public funding fuels a deep R&D pipeline.

Europe

An active innovation ecosystem with strong translational funding. Country-specific reimbursement frameworks require bespoke market access approaches despite EU-level research support.

Asia-Pacific

Rapid growth driven by expanding healthcare access, high diabetes prevalence in parts of the region, and localized manufacturing that supports affordable product variants and scale-up.

Latin America, Middle East & Africa

Slower adoption of premium therapeutics due to reimbursement constraints, but steady demand for cost-effective hydrogel dressings; partnerships with local distributors aid market entry.

Policy & Reimbursement Factors

Enablers: Public research funding, hospital incentives to reduce length-of-stay and complications, and clear clinical evidence that demonstrates cost savings.

Headwinds: Complex combination-product regulations, stringent payer coverage requirements and the need for health-economic data to secure reimbursement for higher-cost regenerative solutions.

Operational Advice for Market Players

- For startups: Seek early partnerships with device and distribution partners, and prioritize clinical and economic evidence generation.

- For incumbents: Consider licensing or acquisition to access novel hydrogel platforms and invest in combination-product regulatory expertise.

- For investors: Monitor grant pipelines, early clinical readouts, and payer policy updates that influence commercial success.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Electronic Health Records Market Growth Drivers, Leaders & Regional Insights by 2034