Industry 4.0 in the Aerospace and Defense Market Size

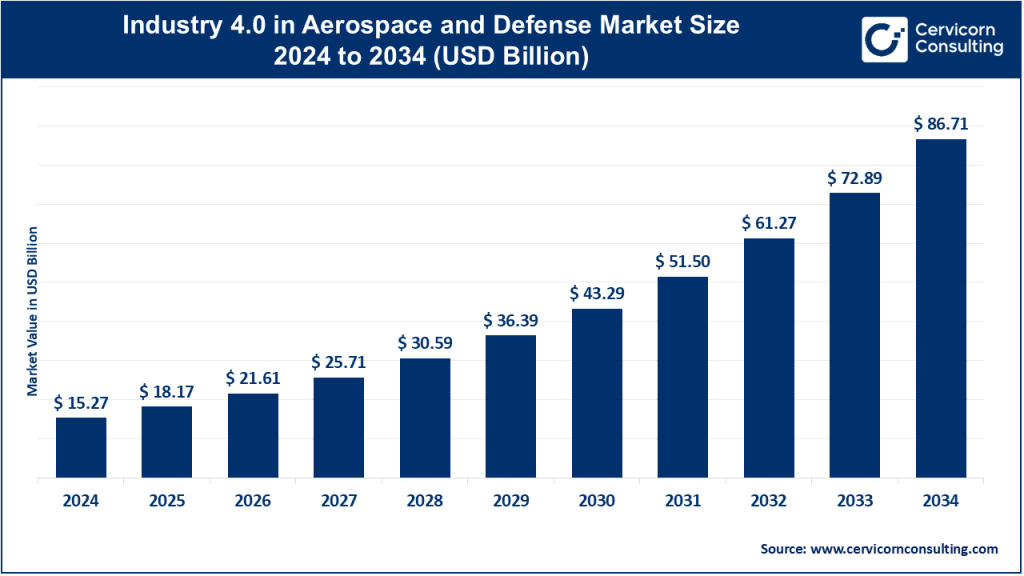

The global industry 4.0 in aerospace and defense market size was worth USD 15.27 billion in 2024 and is anticipated to expand to around USD 86.71 billion by 2034, registering a compound annual growth rate (CAGR) of 18.96% from 2025 to 2034.

What Is Industry 4.0 in the Aerospace & Defense Market?

Industry 4.0 refers to the integration of advanced digital technologies—such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), robotics, digital twins, additive manufacturing, edge and cloud computing, and advanced analytics—into traditional industrial processes. In the aerospace and defense (A&D) market, Industry 4.0 is revolutionizing how aircraft, satellites, drones, and defense systems are designed, produced, maintained, and operated. These technologies enable real-time data exchange, intelligent automation, and seamless digital workflows across the value chain. The result is improved efficiency, reduced downtime, enhanced asset lifecycle management, and more informed decision-making.

Why Is It Important?

Industry 4.0 is critically important in A&D because it addresses some of the sector’s most pressing challenges—stringent safety requirements, supply chain complexity, increasing mission-criticality, and geopolitical unpredictability. It shifts the paradigm from reactive to predictive maintenance, optimizes manufacturing workflows, and ensures real-time situational awareness. This digital transformation also bolsters defense readiness, reduces operational costs, supports sustainability, and accelerates product development. As threats evolve and customer expectations grow, the integration of Industry 4.0 technologies is no longer optional—it is imperative.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2632

Growth Factors

The Industry 4.0 A&D market is growing rapidly, propelled by substantial government and private investment. Rising global tensions have led to increased defense spending, while commercial aerospace is rebounding with the return of global air travel. IoT sensors and data analytics are increasingly used for real-time asset tracking and aircraft health monitoring. Additive manufacturing and digital twins streamline the prototyping and production phases, cutting costs and reducing environmental impact. AI-powered systems are optimizing logistics and improving supply chain resilience. Defense modernization programs, such as those in the U.S., Europe, India, and Asia-Pacific, are accelerating the digital transformation of armed forces. Corporate sustainability initiatives and regulatory compliance requirements are further pushing A&D firms to adopt advanced manufacturing and maintenance practices.

North America leads the charge with roughly 33% of global market share, followed by Asia-Pacific with 28%, and Europe, which is investing heavily in sustainable aerospace systems. All these factors are expected to drive a compound annual growth rate (CAGR) of nearly 19% through 2034.

Market Size and Forecast

As of 2024, the global Industry 4.0 aerospace and defense market is valued at approximately USD 15.27 billion. It is projected to grow to USD 86.71 billion by 2034, reflecting a CAGR of 18.96% over the forecast period. Growth will be driven by both hardware and software components, with significant uptake in IoT, AI, and edge computing systems.

| Segment | 2024 Value | 2034 Forecast | CAGR |

|---|---|---|---|

| Total Market Value | $15.27 B | $86.71 B | 18.96% |

| Predictive Maintenance | High growth | N/A | Leading |

| IoT Technology | Dominant | N/A | Strong |

| Hardware vs. Software Mix | ~45% Hardware | N/A | Balanced |

Top Companies Leading the Market

Motorola Solutions, Inc.

- Focus: Mission-critical communications and secure network infrastructure

- Key Strengths: IoT-enabled public safety systems, real-time dispatch platforms, 5G communications

- Global Footprint: Strong in North America; expanding into EMEA and Asia-Pacific

Cisco Systems, Inc.

- Focus: Networking, cybersecurity, and IoT integration

- Key Strengths: End-to-end edge-to-cloud architecture for aerospace and defense networks

- Global Presence: Worldwide A&D implementation in military and commercial settings

Honeywell International Inc.

- Focus: Avionics, aerospace components, factory automation

- Key Strengths: Predictive analytics, 4D flight paths, smart factory systems

- Relevance: Global supplier to defense agencies and commercial airlines

NEC Corporation

- Focus: AI, biometric surveillance, defense-grade IoT platforms

- Key Strengths: Video analytics, identity verification, critical communications

- Markets: Japan and expanding presence in Europe/North America

Thales Group

- Focus: Aerospace systems, cybersecurity, defense electronics

- Key Strengths: Digital twins, AI in defense, satellite systems

- Market Reach: Strong in Europe; growing in Asia-Pacific and Middle East

Key Trends Driving Adoption

1. IoT and Edge Computing

IoT sensors embedded in aircraft and systems provide real-time health monitoring. Edge computing ensures instant processing for mission-critical operations.

2. Digital Twins and Digital Threads

These technologies simulate performance, predict maintenance needs, and enable end-to-end traceability across lifecycles.

3. Additive Manufacturing

3D printing reduces weight, cost, and lead time of complex aerospace parts. It supports on-demand manufacturing and part consolidation.

4. AI and Predictive Maintenance

AI algorithms process sensor data to predict component failures and optimize maintenance schedules, boosting availability and safety.

5. Robotics and Autonomous Systems

Automation improves production precision. Autonomous drones and vehicles are increasingly used for logistics and battlefield operations.

6. Cybersecurity and Zero-Trust Architectures

Cyber protection is essential as A&D systems become more interconnected. AI-driven threat detection and secure-by-design principles are critical.

7. Quantum and Next-Gen Materials

Quantum communications and materials like composites are shaping the next-gen defense systems and aircraft.

Successful Examples Around the World

- GE Aerospace + Palantir: Predictive engine maintenance for U.S. Air Force aircraft.

- Lockheed Martin: Uses digital twins across air and space systems.

- Boeing: Employs edge-based analytics and real-time flight monitoring.

- Airbus: Implements additive manufacturing and digital twin-based simulations.

- Helsing (EU): Introduced AI-enabled autonomous battlefield drones.

- India’s DRDO & HAL: Rolling out Industry 4.0 for indigenous aerospace development.

Global Regional Analysis

North America

Leads the market with strong defense funding, DARPA-led innovation, and advanced aerospace contractors. Canada is upgrading MRO and aerospace digital infrastructure.

Europe

Promoting sustainability and Industry 4.0 adoption via Clean Aviation and SESAR. Germany, France, and the UK lead in digital twin applications.

Asia-Pacific

Rapidly advancing A&D manufacturing in China, India, Japan, and South Korea. National initiatives promote smart factories and autonomous systems.

Middle East & Africa

Countries like UAE and Saudi Arabia are investing in aerospace hubs and localized MRO with smart surveillance systems. Africa is seeing slow but steady adoption.

Latin America

Brazil’s Embraer and Mexican aerospace suppliers are integrating digital manufacturing for export competitiveness.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Regional Air Mobility Market Size, Share & Forecast (2025–2034)