Industrial Distribution Market Size

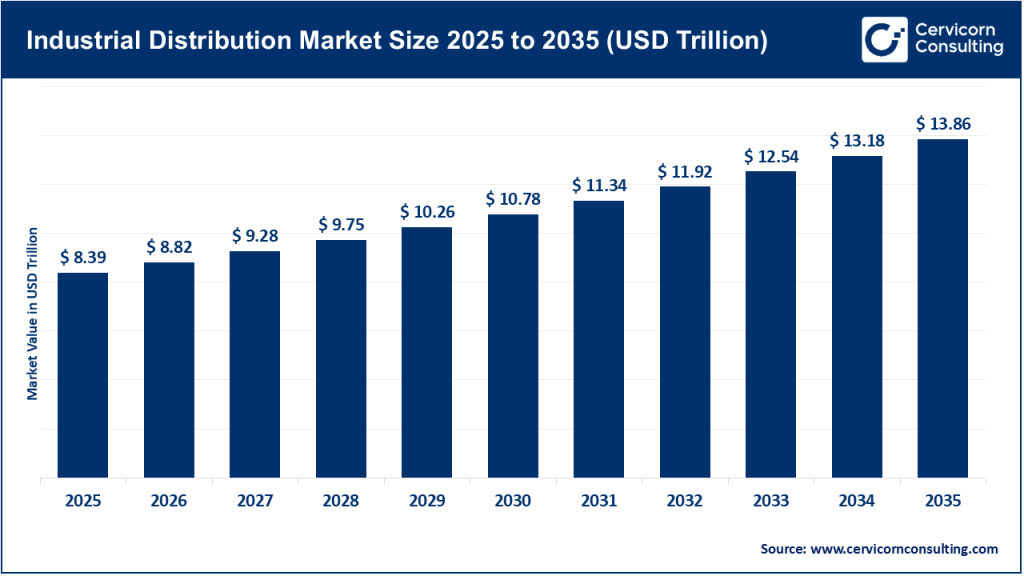

The global industrial distribution market size was worth USD 8.39 trillion in 2025 and is anticipated to expand to around USD 13.86 trillion by 2035, registering a compound annual growth rate (CAGR) of 5.15% from 2026 to 2035.

Industrial Distribution Market Growth Factors

The industrial distribution market is expanding due to a combination of macroeconomic, technological, and regulatory drivers. Growing manufacturing output, increased construction and infrastructure investments, and the rapid adoption of automation technologies all contribute to rising demand for industrial components and maintenance supplies. Supply chain restructuring, particularly reshoring and diversification initiatives, further fuels the need for regional distributors with strong local inventories. Digital transformation — specifically e-commerce capabilities, procurement automation, and AI-driven forecasting — improves the way distributors interact with customers and enhances operational efficiency. Additionally, sustainability regulations and workplace safety requirements increase demand for traceable, compliant, eco-friendly industrial products. As industries pursue supply-chain resilience, efficiency, and compliance, industrial distribution becomes increasingly indispensable, ultimately driving steady market growth across global regions.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2816

What Is the Industrial Distribution Market?

The industrial distribution market is the network of businesses that purchase products from manufacturers and supply them to industrial customers. These products range widely: fasteners, bearings, power transmission equipment, hand and power tools, safety gear, electrical components, personal protective equipment (PPE), pipe-valve-fitting (PVF) systems, automation systems, abrasives, and thousands of other maintenance, repair, and operations (MRO) items.

However, industrial distributors do far more than merely sell products. They add value through services such as:

- Inventory management

- Vendor-managed inventory (VMI) programs

- Onsite stocking and industrial vending

- Technical support and engineering advice

- Repair and maintenance services

- Supply chain optimization

- Procurement and sourcing solutions

This role positions distributors as vital partners for industrial customers by reducing operational downtime, simplifying procurement, and providing critical products exactly when and where they are needed.

Why Is the Industrial Distribution Market Important?

The market’s importance lies in its direct impact on industrial productivity, cost efficiency, and operational continuity.

1. Minimizing Downtime

Industrial facilities depend heavily on immediate access to replacement parts. Without distributors, companies would face production delays, equipment failures, and costly shutdowns.

2. Reducing Inventory Burden

Distributors maintain warehouses and onsite inventory solutions, allowing end users to operate with less capital tied up in stock.

3. Strengthening Supply Chain Resilience

By carrying diverse inventory and offering alternative sourcing solutions, distributors help industries mitigate disruptions caused by geopolitical tensions, global trade barriers, or transportation delays.

4. Supporting Compliance and Safety

Distributors offer certified, compliant products — particularly in key areas such as PPE, electrical components, and industrial safety — ensuring companies adhere to regulatory requirements.

5. Enabling Technological Advancement

They deliver automation components, smart tools, and IoT-enabled devices that drive modernization and productivity improvements in factories and industrial environments.

Ultimately, industrial distribution is essential for maintaining a stable and efficient industrial ecosystem across global markets.

Top Industrial Distribution Market Companies

Below is a detailed look at five major companies shaping the global industrial distribution landscape.

1. Fastenal Company

Specialization: Fasteners, industrial supplies, MRO products, safety equipment

Key Focus Areas: Onsite inventory programs, industrial vending machines, branch-based distribution, digital procurement

Notable Features: Fastenal is known for its extensive network of local stores, rapidly expanding onsite locations, and highly successful industrial vending solutions. These automated inventory systems allow customers to track usage, reduce waste, and maintain critical stock in real time.

2024 Revenue: Approximately USD 7.5 billion

Market Share: Significant share in the North American MRO and industrial fastener space

Global Presence: Primarily North America, with expanding international operations and onsite programs in manufacturing hubs worldwide

2. Motion Industries Inc. (Industrial Segment of Genuine Parts Company)

Specialization: Bearings, mechanical power transmission, industrial automation components, hydraulic and pneumatic products

Key Focus Areas: Technical field support, engineering services, equipment repair, integrated supply programs

Notable Features: Motion Industries stands out for its deep technical expertise. Beyond distribution, the company offers repair centers, fluid power shops, and advanced engineering capabilities to support OEMs and maintenance teams.

2024 Revenue: Industrial segment estimated around USD 8.2 billion

Market Share: Strong share in North American industrial components and technical distribution

Global Presence: North America dominant, with strategic operations in Australia, New Zealand, and other industrial markets

3. WESCO International Inc.

Specialization: Electrical, communications, lighting, industrial automation, utility distribution solutions

Key Focus Areas: Supply chain optimization, large project execution, electrical safety, and infrastructure support

Notable Features: WESCO serves high-value verticals such as utilities, construction, data centers, and renewable energy. Its integrated supply and project management capabilities help customers reduce procurement and installation complexity.

2024 Revenue: Approximately USD 21.8 billion

Market Share: One of the largest electrical and industrial distributors globally

Global Presence: Extensive operations across North America and strong presence in international markets

4. MRC Global Inc.

Specialization: Pipe, valves, fittings (PVF), and flow control equipment for the energy and industrial markets

Key Focus Areas: Oil and gas transmission, refining, petrochemicals, and industrial manufacturing

Notable Features: MRC Global is known for its sector specialization and deep inventory in PVF products, making it a top supplier for energy companies and large industrial projects.

2024 Revenue: Approximately USD 3 billion

Market Share: Leading global PVF distributor for energy and industrial applications

Global Presence: Operations across energy-driven regions including North America, Europe, and select international markets

5. MSC Industrial Direct Co. Inc.

Specialization: Cutting tools, safety products, metalworking supplies, MRO solutions

Key Focus Areas: E-commerce distribution, vending & onsite services, inventory management, manufacturing optimization

Notable Features: MSC is a digital-forward distributor with a strong catalog and robust e-commerce capabilities. It is particularly strong in serving machine shops, metalworking facilities, and manufacturing plants.

2024 Revenue: Approximately USD 3.8 billion

Market Share: Major share in North American MRO and metalworking tooling

Global Presence: Primarily United States with extended services for multinational customers

Leading Trends and Their Impact on the Industrial Distribution Market

1. Digitalization & E-Commerce Adoption

Distributors are rapidly shifting to digital platforms with real-time inventory visibility, automated ordering, online catalogs, and integrated procurement systems.

Impact: Reduced ordering friction, higher customer retention, and increased efficiency.

2. Vendor-Managed Inventory and Onsite Programs

Companies increasingly rely on onsite inventory locations, vending machines, and automated replenishment systems.

Impact: Lower customer stockouts, deeper distributor relationships, and recurring revenue models.

3. Supply Chain Resilience and Localization

Post-pandemic and geopolitical uncertainties have driven industries toward localized supply chains.

Impact: Higher demand for regional distributors and increased warehouse investments.

4. AI, Automation & Data-Driven Procurement

AI is improving demand forecasting, route planning, and inventory optimization.

Impact: Lower operational costs and reduced waste.

5. Sustainability and Regulatory Compliance

Industries are embracing carbon reporting, energy-efficient tools, and recyclable materials.

Impact: Distributors expand product lines to include eco-friendly and compliant options.

6. Specialization & Value-Added Services

Customers expect not just products but technical expertise, repair services, and turnkey solutions.

Impact: Distributors evolve into service-driven industrial partners.

Successful Examples of Industrial Distribution Across the World

Fastenal’s Onsite & Vending Model

Fastenal revolutionized inventory management through its onsite locations and vending machines. Many manufacturers now operate with minimal internal inventory because Fastenal manages thousands of SKUs directly at the customer’s facility.

WESCO’s Utility Sector Dominance

WESCO’s integrated services for utilities — from electrical components to grid modernization solutions — demonstrate how large distributors can support national infrastructure projects.

Motion Industries’ Technical Ecosystem

Motion’s focus on repair services, engineering consulting, and technical field support shows how distributors can become trusted partners instead of transactional suppliers.

MRC Global’s Energy-Centric Distribution

With deep specialization in PVF, MRC Global supports complex oil and gas projects worldwide. This demonstrates the value of niche expertise in a global distribution market.

European Regional Specialists

In Europe, many mid-sized distributors specialize in chemicals, railway systems, electrical safety, and industrial automation. Their success highlights how regional expertise and regulatory knowledge create competitive advantage.

Global Regional Analysis

The industrial distribution landscape varies significantly across global regions, shaped by economic priorities, industrial activity, and policy frameworks.

North America

Government policies in the United States and Canada focus heavily on manufacturing growth, clean energy transition, and infrastructure expansion.

Key drivers:

- Infrastructure modernization programs (transportation, power grid, public facilities)

- Clean energy incentives supporting solar, wind, EV charging, and electrification

- Increased domestic manufacturing through reshoring initiatives

- Stricter safety standards and PPE requirements

These policies directly increase demand for electrical components, safety supplies, automation tools, and MRO equipment — strengthening the industrial distribution market.

Europe

Europe is driven by industrial modernization, decarbonization goals, and highly regulated manufacturing standards.

Key drivers:

- EU Green Deal and carbon-reduction mandates

- Investments in renewable energy, robotics, and smart factories

- Strict workplace safety laws requiring certified PPE and industrial equipment

- Circular economy regulations pushing for recycling and low-impact products

European distributors benefit from high technical sophistication and demand for sustainable and compliant industrial supplies.

Asia-Pacific

APAC is home to some of the fastest-growing industrial economies, including China, India, Vietnam, and Indonesia.

Key drivers:

- Rapid expansion in manufacturing, automotive, and electronics sectors

- Government incentives for domestic production (India’s PLI programs, China’s industrial upgrade plans)

- Smart factory adoption and industrial automation

- Large-scale infrastructure and urbanization projects

This region is witnessing rising demand for MRO, PVF, electrical equipment, and automation products.

Middle East & Africa

The region is driven by mega-projects, energy sector expansion, and economic diversification.

Key drivers:

- Investments in oil & gas, petrochemicals, and power generation

- National industrialization strategies (such as Saudi Vision 2030)

- Major infrastructure, urban development, and transportation projects

- Rising focus on industrial safety and workforce protection

PVF, electrical products, safety gear, and construction-related supplies have particularly strong demand.

Latin America

Despite economic fluctuations, the region sees strong industrial and infrastructural growth in select markets.

Key drivers:

- Mining and natural resource extraction

- Public infrastructure improvements

- Growing manufacturing hubs in Mexico and Brazil

- Local content laws requiring regional supply partnerships

Industrial distributors often expand through joint ventures or local partners due to regulatory and logistical complexities.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Copper Products Market Growth Drivers, Trends, Key Players and Regional Insights by 2034