India Semiconductor Market Growth

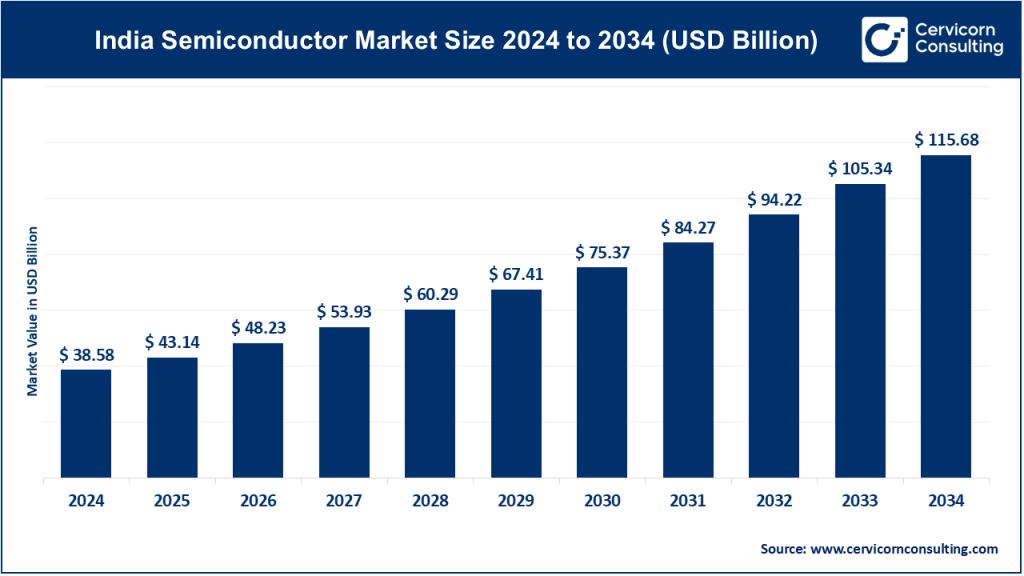

The India semiconductor market was worth USD 38.58 billion in 2024 and is anticipated to expand to around USD 115.68 billion by 2034, registering a compound annual growth rate (CAGR) of 20.70% between 2025 and 2034.

The India semiconductor market is experiencing unprecedented growth, driven by factors such as increasing domestic demand for consumer electronics, the rise of electric vehicles (EVs), the proliferation of Internet of Things (IoT) devices, and government initiatives promoting local manufacturing and innovation. These elements, coupled with the global semiconductor shortage, have positioned India as a significant player in the global semiconductor ecosystem.

What is the India Semiconductor Market?

The India semiconductor market encompasses the design, development, and manufacturing of semiconductor chips and devices used across various industries, including electronics, telecommunications, automotive, healthcare, and defense. It represents a crucial segment of the technology sector, enabling advancements in AI, IoT, 5G, and other emerging technologies.

Why is the India Semiconductor Market Important?

The importance of the India semiconductor market lies in its role as the backbone of modern technology. Semiconductors are the critical components that power devices ranging from smartphones and laptops to EVs and medical equipment. India’s growing semiconductor market not only addresses the increasing domestic demand but also reduces reliance on imports, boosts exports, and strengthens the nation’s position in the global technology landscape.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2354

India Semiconductor Market Top Companies

Below is a detailed look at the top companies operating in the India semiconductor market, including their specialization, key focus areas, notable features, approximate 2023 revenue, and market share:

- Intel India

- Specialization: Microprocessors, chipsets, and IoT solutions

- Key Focus Areas: High-performance computing, AI, and IoT

- Notable Features: Advanced R&D facilities and strong collaboration with academia and startups

- 2024 Revenue (Approx.): $2.5 billion

- Market Share (Approx.): 15%

- Texas Instruments India

- Specialization: Analog and embedded processing solutions

- Key Focus Areas: Industrial automation, automotive electronics, and wireless communications

- Notable Features: Energy-efficient designs and robust educational programs

- 2024 Revenue (Approx.): $1.8 billion

- Market Share (Approx.): 12%

- Qualcomm India

- Specialization: Mobile chipsets, 5G technologies, and AI solutions

- Key Focus Areas: Mobile communications, IoT, and automotive

- Notable Features: Leadership in 5G innovation and strong local partnerships

- 2024 Revenue (Approx.): $2.2 billion

- Market Share (Approx.): 14%

- Samsung Semiconductor India

- Specialization: Memory chips, system LSI, and foundry services

- Key Focus Areas: Consumer electronics, mobile devices, and cloud computing

- Notable Features: Cutting-edge manufacturing facilities and advanced memory solutions

- 2024 Revenue (Approx.): $2.8 billion

- Market Share (Approx.): 17%

- STMicroelectronics India

- Specialization: Analog, MEMS, and power semiconductors

- Key Focus Areas: Automotive, industrial, and IoT applications

- Notable Features: Strong focus on energy-efficient and smart solutions

- 2024 Revenue (Approx.): $1.5 billion

- Market Share (Approx.): 10%

Leading Trends and Their Impact

- Rise of AI and IoT: The integration of AI and IoT technologies is driving demand for advanced semiconductors. Companies are focusing on designing chips that support real-time data processing and energy efficiency, enabling smarter devices and applications.

- Transition to Electric Vehicles: The EV revolution in India is accelerating the need for power electronics and semiconductor devices that enhance energy efficiency and reduce costs. This trend is fostering innovation in automotive-grade chips.

- 5G Deployment: The rollout of 5G networks in India has spurred the development of semiconductors optimized for high-speed, low-latency communications. This has broad implications for industries like telecommunications, gaming, and healthcare.

- Localization of Manufacturing: India’s push for semiconductor self-reliance, supported by government incentives, has led to the establishment of fabrication units and design centers, reducing dependency on imports and boosting domestic production.

- Sustainability Focus: Companies are adopting green manufacturing practices and developing energy-efficient chips to align with global sustainability goals, reflecting a commitment to environmentally responsible growth.

Successful Examples of India Semiconductor Market Around the World

- Qualcomm’s Snapdragon Processors: Qualcomm India’s Snapdragon processors power a significant share of smartphones globally, exemplifying India’s contribution to cutting-edge mobile technologies.

- Intel’s AI Innovations: Intel India’s advancements in AI-enabled chip designs are deployed worldwide in data centers, enhancing computational efficiency and scalability.

- Samsung’s Memory Solutions: Samsung Semiconductor India’s memory products are integral to consumer electronics and cloud services, showcasing global leadership in advanced storage technologies.

- STMicroelectronics’ Automotive Chips: STMicroelectronics India’s automotive semiconductors are widely used in EVs, promoting energy efficiency and sustainability on a global scale.

- Texas Instruments’ Embedded Solutions: Texas Instruments India’s embedded processing solutions enable innovations in industrial automation and healthcare devices worldwide.

Government Initiatives and Policies Shaping the Market

- PLI Scheme for Semiconductors: The Production Linked Incentive (PLI) scheme incentivizes companies to establish semiconductor manufacturing units in India by offering financial support and tax benefits.

- National Policy on Electronics 2019: This policy aims to position India as a global hub for electronics system design and manufacturing (ESDM), with semiconductors being a core component.

- Semiconductor Manufacturing Clusters: The government has proposed establishing semiconductor manufacturing clusters, such as the one in Dholera, Gujarat, to boost local production capabilities.

- Partnerships with Global Firms: India has fostered partnerships with global semiconductor giants to promote technology transfer and R&D collaboration, accelerating the development of local expertise.

- Skill Development Programs: Initiatives like the “FutureSkills Prime” program focus on upskilling the workforce in semiconductor design and manufacturing, ensuring a steady talent pipeline.

- Ease of Doing Business Reforms: Simplified regulatory frameworks and improved infrastructure have made India an attractive destination for semiconductor investments.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Semiconductor Market Size, Share, Trends, Growth & CAGR 2024-2033