India Health Insurance Market Overview and Growth Factors

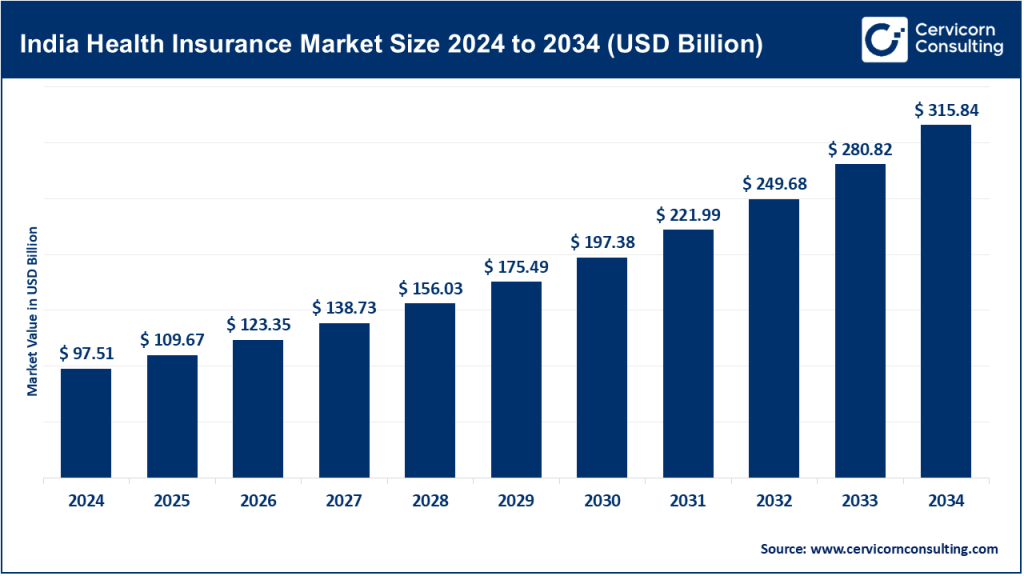

The India health insurance market size is experiencing significant growth, projected to expand from USD 97.51 billion in 2024 to USD 315.84 billion by 2034, at a compound annual growth rate (CAGR) of 12.47%. This growth is fueled by rising healthcare costs, increased awareness of health insurance, digitalization, and supportive government initiatives. Despite these advancements, health insurance penetration remains low, with only 18% of urban and 14% of rural populations covered, highlighting substantial growth potential.

What is the India Health Insurance Market?

The India health insurance market comprises a range of products and services offered by public and private insurers to provide financial protection against medical expenses. These include individual and family health policies, group insurance, critical illness covers, and government-sponsored schemes. The market caters to diverse segments, from urban to rural populations, and from economically weaker sections to affluent individuals, aiming to reduce out-of-pocket healthcare expenditures.

Importance of Health Insurance in India

Health insurance is crucial in India due to the high out-of-pocket healthcare expenditures, which can lead to financial distress. It offers financial security, access to quality healthcare, and promotes preventive care. Government schemes like Ayushman Bharat have expanded coverage to economically weaker sections, while private insurers offer tailored products to meet diverse needs. The integration of digital technologies has further enhanced accessibility and efficiency in the sector.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2638

Top Companies in the India Health Insurance Market

1. Star Health and Allied Insurance Co. Ltd.

- Specialization: Standalone health insurance.

- Key Focus Areas: Retail health, personal accident, and overseas travel insurance.

- Notable Features: Extensive network of hospitals and customer-centric services.

- Market Share: Significant presence in the standalone health insurance segment.

2. New India Assurance Co. Ltd.

- Specialization: General insurance, including health, motor, and property.

- Key Focus Areas: Comprehensive health insurance solutions.

- Notable Features: Government-owned with a strong domestic and international presence.

- 2024 Revenue: Gross written premium of ₹41,996 crore.

- Market Share: Leading position in the general insurance sector.

3. National Insurance Company Ltd.

- Specialization: General insurance services.

- Key Focus Areas: Health, motor, and property insurance.

- Notable Features: Oldest general insurance company in India with a wide network.

- Market Share: Strong presence in the eastern and northern regions.

4. Oriental Insurance Company Ltd.

- Specialization: General insurance, including health and motor.

- Key Focus Areas: Customized health insurance products.

- Notable Features: Extensive branch network across India and abroad.

- 2024 Revenue: Gross premium of ₹20,434 crore globally.

- Market Share: Significant share in the public sector insurance market.

5. United India Insurance Company Ltd.

- Specialization: General insurance services.

- Key Focus Areas: Health, motor, and property insurance.

- Notable Features: Strong presence in southern India with a vast network.

- Market Share: Key player in the public sector insurance domain.

Leading Trends and Their Impact

1. Digital Transformation

The adoption of digital technologies has revolutionized the health insurance sector in India. From online policy purchases to digital claim settlements, insurers are leveraging technology to enhance customer experience and operational efficiency. Telemedicine and online consultations have become integral, especially post-COVID-19.

2. Personalized Health Insurance Plans

Insurers are increasingly offering customized health insurance plans tailored to individual needs, considering factors like age, health conditions, and lifestyle. This personalization enhances customer satisfaction and broadens the market reach.

3. Preventive Healthcare Focus

There is a growing emphasis on preventive healthcare, with insurers offering wellness programs, regular health check-ups, and incentives for healthy lifestyles. This approach aims to reduce long-term healthcare costs and improve overall public health.

4. Regulatory Reforms

The Insurance Regulatory and Development Authority of India (IRDAI) has introduced reforms to enhance transparency and efficiency. Initiatives like the Bima Sugam platform aim to simplify the insurance process and increase penetration.

Successful Examples in the Indian Health Insurance Market

1. Ayushman Bharat Yojana (PM-JAY)

Launched in 2018, this government scheme provides health coverage of up to ₹5 lakh per family annually, targeting over 10 crore poor and vulnerable families. It has significantly increased health insurance coverage in India.

2. Star Health’s CSC Partnership

Star Health partnered with Common Services Centers (CSCs) to offer insurance products across rural India, enhancing accessibility and expanding their customer base.

3. HDFC ERGO’s Digital Initiatives

HDFC ERGO has embraced digital transformation by implementing AI-based chatbots, robotic process automation, and mobile applications, streamlining operations and improving customer service.

Government Initiatives and Policies Shaping the Market

1. Ayushman Bharat Yojana

This flagship scheme aims to provide comprehensive health coverage to economically weaker sections, significantly impacting the health insurance landscape in India.

2. State-Level Schemes

States like Tamil Nadu, Maharashtra, and Karnataka have implemented their own health insurance programs, complementing national initiatives and increasing overall coverage.

3. National Health Mission (NHM)

NHM focuses on strengthening healthcare infrastructure and services, indirectly supporting the health insurance sector by improving healthcare delivery systems.

4. IRDAI’s Regulatory Measures

The IRDAI has introduced various reforms to enhance transparency, protect policyholders’ interests, and promote innovation in the health insurance sector.

These initiatives collectively aim to increase health insurance penetration, improve healthcare accessibility, and ensure financial protection against medical expenses for India’s diverse population.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: AI in Clinical Trials Market Size and Growth, Trends, Key Players, and Forecast to 2034