India Data Centre Market Size

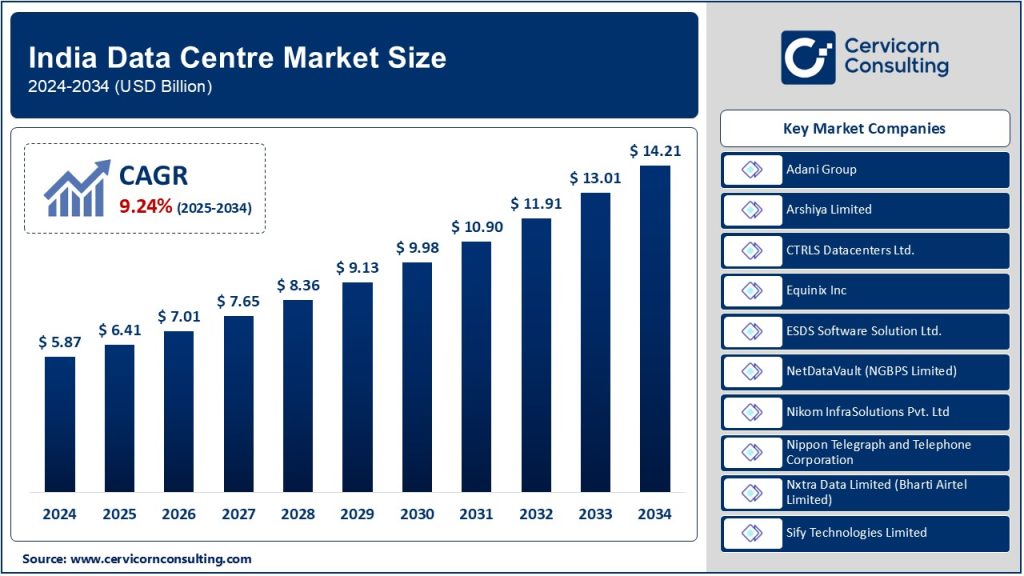

The India data centre market was worth USD 5.87 billion in 2024 and is anticipated to expand to around USD 14.21 billion by 2034, registering a compound annual growth rate (CAGR) of 9.24% from 2025 to 2034.

What is the India Data Centre Market?

The India data centre market refers to the rapidly growing ecosystem of facilities that house critical computing resources, including servers, storage systems, networking equipment, and related infrastructure, to store, process, and distribute data. These data centres form the backbone of India’s digital economy, supporting diverse industries such as IT, BFSI, e-commerce, media, telecommunications, and government services. With increasing digital adoption, the data centre market in India has emerged as one of the key components enabling the country’s transition to a global digital hub.

Why is the India Data Centre Market Important?

India’s data centre market is critical for its role in advancing digital transformation, fostering economic growth, and supporting innovations across industries. The market helps facilitate cloud adoption, seamless data storage, and real-time data analytics, ensuring businesses achieve scalability, agility, and efficiency. Furthermore, the market is pivotal in meeting the demands of an increasingly digital population that relies on smartphones, IoT devices, OTT platforms, and digital payments. Data sovereignty laws, government-led digital initiatives such as “Digital India,” and the surge in artificial intelligence (AI) and machine learning (ML) applications have further heightened the importance of local data centre infrastructure.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2542

India Data Centre Market Growth Factors

The India data centre market is driven by several key factors:

- Rapid Digital Transformation: Increasing penetration of smartphones, IoT devices, and cloud computing is fueling data consumption.

- Government Initiatives: Policies such as “Digital India,” “Make in India,” and data localisation norms are incentivising infrastructure investments.

- 5G Rollout: The launch of 5G networks is accelerating data traffic and creating demand for low-latency data centres.

- Global Interest: Investments by international hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud in Indian data centres reflect India’s strategic importance in the global market.

- Data Localisation: Regulatory mandates requiring businesses to store and process data locally are spurring the construction of data centres within India.

- Sustainability Initiatives: Adoption of renewable energy for data centre operations is gaining traction, further driving investment in green data centres.

India Data Centre Market Top Companies

Here is an overview of some of the leading players in the Indian data centre market:

1. Adani Group

- Specialization: Sustainable data centre solutions integrated with renewable energy sources.

- Key Focus Areas: Hyperscale data centres, cloud hosting, and energy-efficient operations.

- Notable Features: The group’s partnership with EdgeConneX to establish hyperscale data centres powered by renewable energy.

- 2024 Revenue (approx.): INR 10,000 crore.

- Market Share (approx.): 15%.

- Global Presence: Strong presence in India with expanding interests in Southeast Asia.

2. Arshiya Limited

- Specialization: Integrated data centre and logistics parks.

- Key Focus Areas: End-to-end supply chain solutions with data centre integration.

- Notable Features: Focus on Tier II and Tier III cities for scalable infrastructure.

- 2024 Revenue (approx.): INR 3,500 crore.

- Market Share (approx.): 7%.

- Global Presence: Limited to India but with ambitious expansion plans.

3. CTRLS Datacenters Ltd.

- Specialization: Managed hosting, cloud services, and colocation.

- Key Focus Areas: Hyperscale and edge data centres, enterprise solutions.

- Notable Features: India’s largest network of tier-rated data centres.

- 2024 Revenue (approx.): INR 5,500 crore.

- Market Share (approx.): 12%.

- Global Presence: Predominantly India-focused, with partnerships in APAC.

4. Equinix Inc.

- Specialization: Global colocation services and interconnection solutions.

- Key Focus Areas: Enterprise cloud hosting, network peering, and multi-cloud deployments.

- Notable Features: High-density colocation and robust connectivity ecosystems.

- 2024 Revenue (approx.): INR 12,000 crore.

- Market Share (approx.): 18%.

- Global Presence: Operations in over 60 markets globally, with a strong foothold in India.

5. ESDS Software Solution Ltd.

- Specialization: Managed cloud hosting and disaster recovery solutions.

- Key Focus Areas: Cloud automation, SAP hosting, and AI-based solutions.

- Notable Features: eNlight Cloud platform for high scalability.

- 2024 Revenue (approx.): INR 2,800 crore.

- Market Share (approx.): 6%.

- Global Presence: Expanding footprint in the Middle East and Southeast Asia.

Leading Trends and Their Impact

1. Edge Computing

Edge data centres are becoming a major trend, addressing latency issues and catering to the needs of IoT applications and 5G networks. By processing data closer to its source, edge computing enhances real-time analytics capabilities and reduces operational costs.

2. Green Data Centres

Sustainability is a growing concern. Companies like Adani Group and CTRLS are leveraging renewable energy and efficient cooling technologies to reduce carbon footprints. This trend aligns with global ESG (Environmental, Social, and Governance) standards and appeals to environmentally conscious investors.

3. AI and Automation

AI-driven solutions for data centre management are improving operational efficiency and predictive maintenance. Automation is further reducing human intervention, ensuring seamless scalability and security.

4. Hybrid Cloud Adoption

Enterprises are increasingly adopting hybrid cloud models to ensure flexibility, scalability, and cost-effectiveness. Companies like Equinix and ESDS are focusing on seamless cloud integration solutions.

5. Increased Investment by Hyperscalers

Global giants such as AWS, Google, and Microsoft are making significant investments in hyperscale data centres across India. This not only boosts infrastructure development but also fosters technological collaboration.

6. Regional Diversification

Tier II and Tier III cities like Pune, Jaipur, and Bhubaneswar are emerging as data centre hubs, reducing dependence on metros like Mumbai and Bengaluru.

Successful Examples of the India Data Centre Market Around the World

- Adani EdgeConneX Hyperscale Campus: Located in Chennai, this facility sets a benchmark for renewable-powered data centres. The project’s use of 100% renewable energy ensures scalability while being environmentally sustainable.

- CTRLS’ Hyderabad Campus: This state-of-the-art facility serves as a regional hub for hyperscalers and enterprises, offering robust disaster recovery and backup solutions.

- Equinix’s Mumbai Facility: Known for its advanced interconnection capabilities, this data centre attracts global cloud providers and enterprises, strengthening India’s position in the global digital ecosystem.

Regional Analysis: Government Initiatives and Policies Shaping the Market

North India

- Key Cities: Delhi NCR, Jaipur, Chandigarh

- Government Support: Incentives under the “Make in India” initiative for data centre investments.

- Impact: Increasing investments in hyperscale facilities in Delhi NCR to support financial services and e-commerce.

South India

- Key Cities: Bengaluru, Hyderabad, Chennai

- Government Support: Subsidies for renewable energy integration, such as in Tamil Nadu.

- Impact: Emergence of Chennai as a connectivity hub due to undersea cable landing stations.

West India

- Key Cities: Mumbai, Pune, Ahmedabad

- Government Support: Maharashtra’s data centre policy offering fiscal and non-fiscal incentives.

- Impact: Mumbai remains India’s leading data centre hub, driven by financial institutions and hyperscalers.

East India

- Key Cities: Kolkata, Bhubaneswar

- Government Support: Focus on developing IT parks and digital infrastructure in Tier II cities.

- Impact: Bhubaneswar’s rise as a potential data centre hub, attracting investments in disaster recovery solutions.

National Initiatives

- The Indian government’s proposal for a Data Centre Incentivisation Scheme (DCIS) aims to provide land, power, and financial support to data centre developers.

- Data localisation norms under the Personal Data Protection Bill are compelling enterprises to invest in local data storage solutions.

- Development of National Data Centre Parks (NDCPs) to facilitate collaboration between private and public players.

The Indian data centre market continues to thrive, fuelled by a combination of robust policy support, rapid digital adoption, and a dynamic private sector. As the market evolves, it promises to be a critical driver of India’s digital future.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Air Conditioner Market Hits USD 147.89 Bn in 2024, Growth Ahead