Hyperscale Data Center Market Size

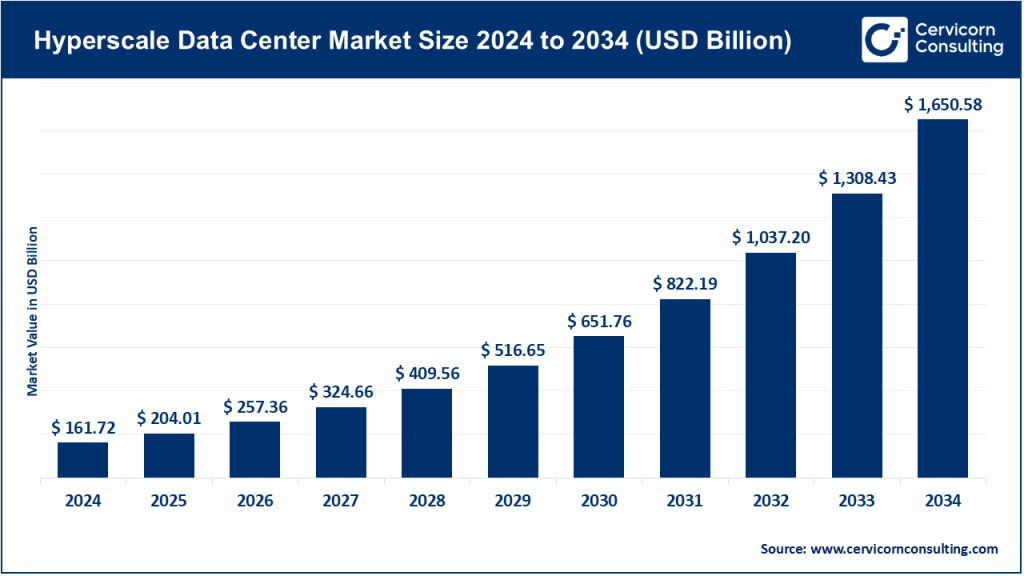

The global hyperscale data center market size was worth USD 161.72 billion in 2024 and is anticipated to expand to around USD 1,650.58 billion by 2034, registering a compound annual growth rate (CAGR) of 26.15% from 2025 to 2034.

What Is the Hyperscale Data Center Market?

A hyperscale data center is an extremely large facility designed to efficiently support vast numbers of servers and storage systems that deliver massive computing power. These centers are optimized for scalability, meaning they can expand capacity easily through modular infrastructure. They serve as the backbone for cloud service providers, social networks, streaming services, AI workloads, and large enterprises that require enormous computational and storage resources.

The hyperscale data center market encompasses all components of this ecosystem—construction, power and cooling systems, networking equipment, servers, racks, facility management software, and specialized services such as colocation and interconnectivity. As of 2024, the global hyperscale data center market is estimated to be worth around USD 162.8 billion, and it continues to grow at a strong compound annual growth rate (CAGR) fueled by AI and cloud expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2800

Why the Hyperscale Data Center Market Is Important

Hyperscale data centers are vital to the digital transformation of the global economy. They host the cloud services that power enterprise IT systems, consumer applications, and data-intensive technologies such as artificial intelligence and machine learning. The ability to process, store, and analyze enormous datasets quickly and cost-effectively makes these data centers indispensable for innovation in areas like autonomous vehicles, healthcare analytics, smart cities, and digital banking.

In essence, hyperscale data centers are what allow billions of users to access digital services instantly and reliably. Without them, most cloud applications, video streaming platforms, and AI models would either become prohibitively expensive or too slow to be practical.

Hyperscale Data Center Market Growth Factors

The hyperscale data center market is growing rapidly due to several converging factors. The exponential increase in cloud adoption and enterprise migration to public cloud environments is a primary driver. Rising demand for artificial intelligence and machine learning workloads is creating a need for more powerful, GPU-based infrastructure. The explosion of data generated by IoT devices, mobile applications, and edge computing ecosystems also requires centralized storage and analysis capabilities.

Cost efficiencies achieved through scale, standardization, and automation make hyperscale data centers more attractive than smaller facilities. Governments worldwide are supporting the development of such infrastructure through tax incentives, data localization regulations, and green energy initiatives. Additionally, the ongoing rollout of high-speed 5G networks and global content delivery services further boosts demand for low-latency, high-capacity hyperscale facilities. Together, these forces are propelling the market’s expansion in all major regions.

Top Companies in the Hyperscale Data Center Market (2024 Overview)

1. Amazon Web Services (AWS)

- Specialization: AWS leads the public cloud industry, providing computing, storage, database, and networking services at massive scale.

- Key Focus Areas: Expansion of cloud regions, AI infrastructure, hybrid and edge computing, and sustainability through renewable energy usage.

- Notable Features: Offers the most comprehensive set of cloud services; strong ecosystem of partners and tools; continuous investment in AI-specific infrastructure.

- 2024 Revenue: Approximately USD 107–108 billion from its cloud division.

- Market Share & Global Presence: AWS maintains the largest global cloud market share, operating in multiple continents with numerous regions and availability zones.

2. Microsoft Corporation (Azure)

- Specialization: Cloud computing, hybrid cloud platforms, and AI-powered services under the Azure brand.

- Key Focus Areas: Hybrid infrastructure through Azure Stack, enterprise AI partnerships, and development of green data centers.

- Notable Features: Deep integration with Microsoft enterprise tools (Office, Windows Server), extensive security framework, and robust hybrid capabilities.

- 2024 Revenue: Azure and related cloud services contributed roughly USD 75 billion, within Microsoft’s Intelligent Cloud segment.

- Market Share & Global Presence: The second-largest hyperscale operator globally, with hundreds of data centers spread across over 60 regions.

3. Google LLC (Google Cloud Platform)

- Specialization: Cloud platform optimized for analytics, AI, and scalable compute workloads.

- Key Focus Areas: Development of custom AI chips (TPUs), sustainable energy operations, and secure multi-cloud solutions.

- Notable Features: Strong in AI and data analytics, with industry-leading tools such as TensorFlow and Vertex AI.

- 2024 Revenue: Google Cloud generated about USD 48 billion annually, with steady double-digit growth.

- Market Share & Global Presence: Ranks third in global market share with major campuses in North America, Europe, and Asia-Pacific.

4. Meta Platforms, Inc.

- Specialization: Social media and communication infrastructure supported by proprietary hyperscale data centers.

- Key Focus Areas: Building AI supercomputing clusters, custom hardware development, and next-generation cooling and energy systems.

- Notable Features: Founding member of the Open Compute Project; operates some of the most energy-efficient data centers worldwide.

- 2024 Revenue: Around USD 164.5 billion, driven by its advertising and digital services ecosystem.

- Market Share & Global Presence: While not a public cloud provider, Meta ranks among the world’s largest private hyperscale operators with facilities across the U.S. and Europe.

5. Apple Inc.

- Specialization: Consumer services and cloud infrastructure for iCloud, Apple Music, and other platforms.

- Key Focus Areas: Privacy protection, renewable energy utilization, and service reliability.

- Notable Features: Operates hyperscale campuses to support its growing services segment; heavily invests in sustainability.

- 2024 Revenue: Approximately USD 391 billion companywide.

- Market Share & Global Presence: Apple’s data center footprint is primarily private, serving its ecosystem of products and users across the Americas and Europe.

Leading Trends and Their Impact

1. AI-Driven Infrastructure

The rise of generative AI and large language models has transformed data center design. Facilities now require higher power density to accommodate GPUs and AI accelerators. This has led to innovations in liquid cooling, advanced chip packaging, and smarter power distribution systems. The result is a new generation of AI-optimized hyperscale campuses designed for intense computational loads.

2. Sustainability and Green Energy

Sustainability is now central to hyperscale strategy. Leading operators are targeting net-zero emissions by securing long-term renewable energy purchase agreements, using recycled water cooling, and deploying AI to optimize energy use. Some facilities reuse waste heat to warm nearby buildings, integrating data centers into local energy ecosystems.

3. Modular and Prefabricated Construction

To reduce time-to-market, companies are increasingly adopting modular construction. Prefabricated units built off-site can be rapidly assembled, cutting construction timelines from years to months. This standardization also reduces costs and improves scalability.

4. Edge Computing Integration

While hyperscale facilities provide centralized power, the growth of latency-sensitive applications—like autonomous vehicles and real-time analytics—has fueled the rise of edge nodes. Many hyperscalers are adopting hybrid architectures, combining large data campuses with distributed edge micro-centers for faster service delivery.

5. Data Localization and Compliance

Countries are enacting strict data residency laws that require local storage and processing of sensitive data. This has encouraged hyperscalers to expand regionally, often partnering with local companies to meet compliance requirements.

6. Automation and AI Operations

AI-based monitoring systems are increasingly used to manage workloads, predict equipment failure, and optimize energy consumption. Automated infrastructure reduces downtime and operating costs while increasing system reliability.

7. Supply Chain Diversification

Hyperscalers are investing in vertical integration—designing their own chips, servers, and network equipment—to reduce dependency on external suppliers. This improves performance control and lowers costs amid global supply chain challenges.

Successful Examples of Hyperscale Data Centers Around the World

- Google Hamina, Finland: Built in a repurposed paper mill, Google’s Finnish campus uses seawater cooling and renewable energy. It is considered a benchmark for sustainable data center design.

- AWS Northern Virginia (Ashburn): Known as “Data Center Alley,” this region hosts one of the world’s largest concentrations of data facilities. AWS’s multiple availability zones here serve as the foundation of many U.S. internet services.

- Microsoft Quincy, Washington: A pioneering hyperscale hub chosen for its affordable electricity and access to fiber networks. The site showcases Microsoft’s hybrid cloud and renewable integration strategies.

- Meta Prineville, Oregon: Meta’s first hyperscale campus and birthplace of the Open Compute Project. It demonstrates cutting-edge energy efficiency, modularity, and AI-readiness.

- Apple Maiden, North Carolina: One of Apple’s major iCloud campuses, entirely powered by renewable energy. It embodies the company’s commitment to privacy, sustainability, and seamless user experience.

Each of these projects demonstrates different priorities—sustainability, scale, cost optimization, and proximity to users—but all share a focus on efficiency and innovation.

Global Regional Analysis — Government Initiatives and Policies

North America (United States & Canada)

The United States remains the epicenter of hyperscale development, driven by its large consumer market, strong digital ecosystem, and favorable business environment. Many U.S. states offer substantial tax breaks, renewable energy incentives, and expedited permitting for hyperscale projects. States such as Virginia, Texas, and Iowa have become major hubs. Federal agencies are also streamlining data infrastructure approvals to support AI and semiconductor growth.

In Canada, government-backed green energy initiatives are attracting hyperscale investment to provinces such as Quebec and Ontario, which offer abundant hydroelectric power.

Europe (European Union & United Kingdom)

Europe’s hyperscale growth is shaped by strict data privacy laws and sustainability mandates. The EU’s emphasis on data sovereignty, energy efficiency, and carbon reduction pushes operators to innovate in cooling and renewable integration. Nordic countries—Finland, Sweden, and Denmark—have become preferred locations for hyperscale centers due to low temperatures, stable governments, and renewable energy availability.

The United Kingdom continues to expand its hyperscale infrastructure post-Brexit, leveraging its strong financial and enterprise cloud markets while aligning with national net-zero targets.

Asia-Pacific (India, China, Southeast Asia, Australia)

Asia-Pacific is the fastest-growing hyperscale market. India’s Digital Personal Data Protection Act (DPDP) and “Digital India” program encourage local data storage and cloud infrastructure development. Hyperscalers such as AWS, Microsoft, and Google are building new campuses in Hyderabad, Chennai, and Mumbai.

China remains a tightly regulated but massive market, with domestic giants like Alibaba and Tencent leading hyperscale expansion. In Southeast Asia, Singapore, Indonesia, and Malaysia are experiencing rapid hyperscale growth as regional cloud hubs. Australia’s stable energy and regulatory environment also make it a prime destination for large-scale data facilities.

Middle East & Africa

Countries such as Saudi Arabia and the United Arab Emirates are actively investing in data infrastructure as part of national digital transformation agendas. Sovereign funds and government-backed technology programs provide financial and policy support for hyperscale campuses. The region’s large renewable energy projects, especially solar farms, align well with hyperscaler sustainability goals.

In Africa, countries like South Africa and Kenya are witnessing growing interest in hyperscale deployments as connectivity and cloud adoption increase.

Latin America

Brazil, Chile, and Mexico lead Latin America’s hyperscale expansion. Rising digitalization, e-commerce, and government cloud initiatives have accelerated local capacity building. However, challenges such as inconsistent power supply and complex permitting continue to slow deployment in some areas.

Key Policy and Market Shaping Factors

- Data Protection and Residency Laws: Regulations such as the EU’s GDPR and India’s DPDP Act compel companies to store and process data within local borders, fueling regional hyperscale investment.

- Energy and Sustainability Policies: Many governments require renewable sourcing and efficient cooling systems, pushing hyperscalers toward carbon-neutral operations.

- Incentive Programs: Tax exemptions, grants, and land concessions encourage investment in data infrastructure, especially in emerging markets.

- Digital Transformation Agendas: National programs promoting AI, 5G, and smart city initiatives indirectly drive hyperscale demand.

- Infrastructure Modernization: Public-private partnerships in power, fiber connectivity, and logistics facilitate large-scale data center construction.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Herbal Extract Market Revenue, Global Presence, and Strategic Insights by 2034