Hydrogen Internal Combustion Engine Market Size

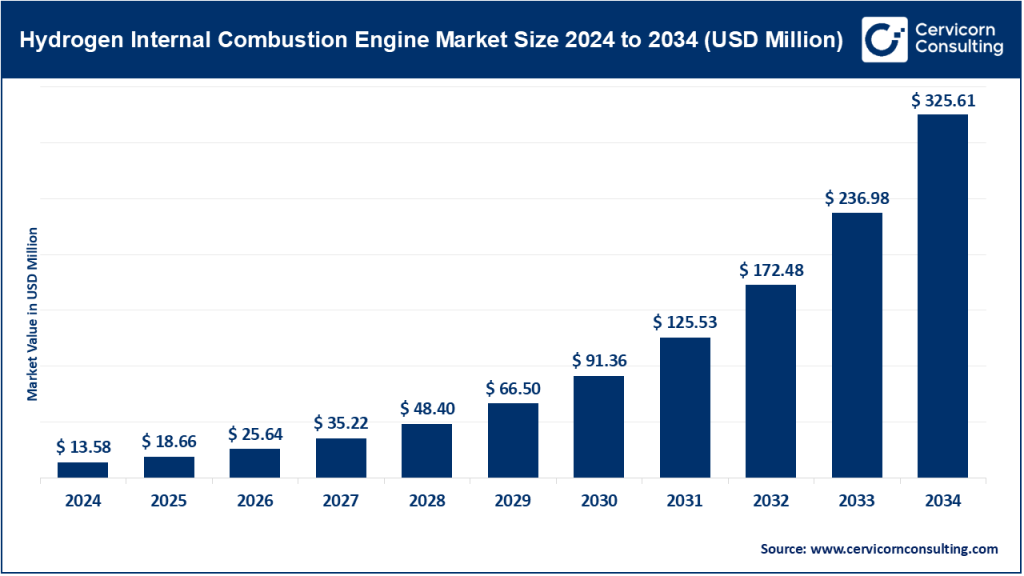

The global hydrogen internal combustion engine market size was worth USD 13.58 million in 2024 and is anticipated to expand to around USD 325.61 million by 2034, registering a compound annual growth rate (CAGR) of 37.40% from 2025 to 2034.

What is the Hydrogen Internal Combustion Engine Market?

The hydrogen internal combustion engine market consists of companies that design, manufacture, and integrate hydrogen-fueled combustion systems for vehicles, machinery, and stationary power units. Unlike traditional fuel-cell electric vehicles that convert hydrogen into electricity through chemical reactions, hydrogen ICEs burn hydrogen directly in an internal combustion chamber. These engines can be either newly manufactured or retrofitted from existing diesel or gasoline engines, making them an attractive transitional technology.

Hydrogen combustion engines emit water vapor instead of carbon dioxide, and with proper after-treatment systems, nitrogen oxide (NOₓ) emissions can be minimized to comply with environmental regulations. The market encompasses OEMs developing new hydrogen engines, suppliers providing fuel-delivery systems, storage solutions, ignition components, and integrators converting fleets for hydrogen operation. Applications include heavy-duty trucks, buses, ships, construction equipment, generators, and off-highway machinery.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2785

Why Hydrogen Internal Combustion Engines Are Important

Hydrogen ICEs play a critical role in global decarbonization because they enable the reduction of greenhouse-gas emissions without requiring a complete overhaul of manufacturing infrastructure. They serve as a near-term and cost-effective solution for sectors where battery electrification or hydrogen fuel cells remain technically challenging or economically prohibitive.

These engines can use existing supply chains, manufacturing tools, and service networks, making adoption faster than emerging technologies that demand new platforms. Hydrogen ICEs also support energy diversification by allowing different hydrogen sources (green, blue, or bio-hydrogen) and can act as a key enabler for countries investing in hydrogen infrastructure.

For industries such as trucking, marine shipping, and stationary power generation—where range, refueling time, and load capacity are vital—hydrogen ICEs offer comparable performance to diesel engines while cutting CO₂ emissions by up to 99% when powered by renewable hydrogen. They therefore form a pivotal part of the broader hydrogen economy, helping bridge today’s internal combustion expertise to tomorrow’s zero-emission ecosystems.

Hydrogen Internal Combustion Engine Market Growth Factors

The growth of the hydrogen ICE market is driven by a convergence of technological, economic, and regulatory forces. Increasing global policies supporting hydrogen production and decarbonization initiatives are creating fertile ground for hydrogen-based propulsion technologies. Advancements in fuel-injection, turbocharging, combustion control, and after-treatment have made hydrogen engines more efficient and cleaner, solving past challenges of pre-ignition and NOₓ emissions.

The widespread availability of diesel-engine platforms and the growing interest in retrofitting existing fleets are making hydrogen ICEs commercially attractive. Green hydrogen costs are declining due to global investment in electrolyzers and renewable energy, improving the total cost of ownership. At the same time, industries face mounting pressure to decarbonize under government mandates and corporate sustainability goals.

Major engine manufacturers are heavily investing in R&D and partnerships, ensuring scalability and supply-chain readiness. Collectively, these drivers—policy support, technical innovation, cost reduction, and industrial momentum—are accelerating the global adoption of hydrogen internal combustion engines.

Top Companies in the Hydrogen Internal Combustion Engine Market

1. Cummins Inc.

Specialization: Heavy-duty engines, power systems, and low-carbon propulsion technologies.

Key Focus Areas: Hydrogen-capable engines for commercial trucks, construction vehicles, and power generation. The company’s Project Brunel introduced a 6.7-liter hydrogen engine that achieved over 99% carbon-tailpipe reduction when powered by renewable hydrogen.

Notable Features: Extensive R&D in hydrogen combustion and after-treatment systems, global service and manufacturing networks.

2024 Revenue: Approximately USD 34.1 billion.

Market Share and Global Presence: A global leader in heavy-duty powertrains, Cummins is actively expanding hydrogen projects across North America, Europe, and Asia.

2. Rolls-Royce plc (MTU Engines)

Specialization: High-power propulsion and energy systems for marine, rail, defense, and industrial applications.

Key Focus Areas: Developing hydrogen-ready versions of MTU engines for marine propulsion and stationary power systems. The company integrates hybrid systems to optimize energy efficiency.

Notable Features: Extensive experience in large-engine architecture, high thermal efficiency, and robust powertrain solutions.

2024 Revenue: Reported strong growth in 2024, driven by the Power Systems and Civil Aerospace divisions.

Market Share and Global Presence: A major presence in European and global markets, particularly in marine and distributed energy applications.

3. Toyota Motor Corporation

Specialization: Automotive innovation including hybrids, battery EVs, and hydrogen technologies.

Key Focus Areas: Toyota is known for its Mirai fuel-cell vehicle but has also developed hydrogen ICE prototypes for motorsport and fleet applications. The company’s “multi-pathway” strategy explores hydrogen combustion alongside other low-carbon solutions.

Notable Features: Advanced R&D capability, vehicle integration expertise, and large-scale manufacturing across global markets.

2024 Revenue: Over ¥35 trillion (approx. USD 240 billion) in consolidated revenue.

Market Share and Global Presence: Toyota remains one of the largest automakers worldwide, leveraging its influence to expand hydrogen infrastructure and cross-sector innovation.

4. MAN Truck & Bus (Volkswagen Group)

Specialization: Heavy commercial vehicles and bus engines for long-haul and regional transport.

Key Focus Areas: Developing hydrogen-combustion and fuel-cell systems for heavy-duty trucks and buses. MAN’s research aligns with Europe’s push for zero-emission transport under the TRATON Group umbrella.

Notable Features: Extensive service networks and logistics partnerships across Europe; leveraging existing diesel expertise to transition fleets.

2024 Revenue: Approximately €13.7 billion.

Market Share and Global Presence: Prominent in Europe with a growing footprint in hydrogen pilot fleets and transport decarbonization initiatives.

5. Deutz AG

Specialization: Small-to-medium industrial engines for off-highway machinery, construction, and agriculture.

Key Focus Areas: Hydrogen-ready engines and retrofit solutions under its “Deutz Green” strategy. The company aims to offer hydrogen engines as a drop-in alternative for industrial applications.

Notable Features: Compact engine design, modular architecture, and ability to scale into niche segments.

2024 Revenue: €1.81 billion.

Market Share and Global Presence: Strong in the European off-highway market with increasing global distribution channels and partnerships.

Leading Trends and Their Impact

1. Rising Government Support for Hydrogen Ecosystems

Public funding and hydrogen-specific policies are accelerating hydrogen ICE adoption. National roadmaps, tax credits, and zero-emission vehicle mandates are pushing engine manufacturers to diversify their hydrogen portfolios. This trend has led to expanded hydrogen hubs, refueling networks, and demonstration programs that enhance commercial viability.

2. OEM Demonstrations Turning Into Commercial Pilots

Major OEMs such as Cummins, MAN, and Rolls-Royce are moving from research prototypes to commercial deployment. Successful field trials improve confidence in hydrogen ICE reliability, durability, and emissions control. These demonstrations prove the engines’ suitability for logistics fleets, mining, and marine applications.

3. Breakthroughs in Combustion and After-Treatment

Modern ignition systems, direct injection, and advanced SCR (Selective Catalytic Reduction) technologies have drastically lowered NOₓ emissions. Combined with precise combustion control, today’s hydrogen engines meet stringent emission standards, removing one of the biggest barriers to commercialization.

4. Hydrogen Retrofits for Existing Fleets

As fleets face emission-reduction mandates, retrofitting existing diesel engines to run on hydrogen has gained traction. Retrofit kits and conversion services allow operators to cut emissions without replacing entire vehicles, lowering upfront costs and reducing waste from decommissioned assets.

5. Hydrogen Production and Cost Decline

Global investments in electrolyzers and renewable power are cutting hydrogen production costs. As green hydrogen becomes cheaper, the economics of hydrogen ICEs improve relative to both fuel-cell and diesel alternatives. This cost parity is expected to accelerate adoption in the late 2020s.

6. Sector-Specific Adoption Patterns

Adoption rates differ across sectors. Heavy-duty trucking, maritime transport, rail, and off-highway machinery are emerging leaders, while passenger cars remain secondary due to the dominance of battery EVs. The diversification of applications ensures steady growth across complementary markets.

Successful Examples Worldwide

Cummins Project Brunel (United Kingdom)

Cummins successfully tested a 6.7-liter hydrogen engine for commercial trucks, achieving over 99% CO₂ reduction compared with diesel when fueled by renewable hydrogen. The engine demonstrated equivalent power and torque to conventional diesel engines, confirming hydrogen’s viability in heavy transport.

MTU Hydrogen Marine Projects (Europe)

Rolls-Royce’s MTU division is testing hydrogen combustion in marine and stationary power applications. These projects aim to meet future maritime emission standards by offering hydrogen-ready engines for auxiliary and propulsion systems.

Toyota’s Hydrogen Racing Initiative (Japan)

Toyota has fielded hydrogen ICE vehicles in endurance racing events. This initiative not only validates the technology under extreme conditions but also raises public awareness about hydrogen’s potential beyond fuel cells.

Hydrogen Buses and Fleet Trials (Europe and Asia)

Across Japan, Germany, and the Netherlands, regional bus operators have piloted hydrogen combustion and hybrid-hydrogen systems for public transportation. These projects showcase how hydrogen ICEs can deliver long range, fast refueling, and reduced carbon emissions within existing infrastructure.

Global Regional Analysis: Government Initiatives and Policy Landscape

Europe

Europe is a leader in hydrogen policy, supported by programs such as REPowerEU and the European Clean Hydrogen Alliance. The European Union has allocated billions in funding to establish hydrogen valleys, electrolyzer manufacturing, and infrastructure. Countries like Germany, the Netherlands, and France are investing heavily in hydrogen mobility pilots for trucks and buses. Stringent emission regulations under the European Green Deal further encourage OEMs to scale hydrogen ICE offerings.

North America

The United States is witnessing significant momentum through the Department of Energy’s Hydrogen Program Plan and the Inflation Reduction Act (IRA), which provides production tax credits for clean hydrogen. Federal and state governments are also funding hydrogen hubs and refueling corridors for heavy-duty transport. These initiatives are positioning hydrogen ICEs as viable solutions for decarbonizing logistics and long-haul trucking.

Asia-Pacific

Japan and South Korea are aggressively promoting hydrogen as a key pillar of their energy strategies. Japan’s national hydrogen roadmap supports vehicle deployment, infrastructure expansion, and R&D grants for hydrogen combustion engines. China’s regional governments are funding hydrogen demonstration zones and hybrid applications for industrial vehicles, while India is initiating hydrogen mobility missions to cut urban pollution and import dependence.

Middle East and Australia

Countries in the Middle East, such as Saudi Arabia and the UAE, are investing in hydrogen production for export and domestic use. Australia is developing large-scale green hydrogen projects under its National Hydrogen Strategy, offering opportunities for hydrogen ICE testing in mining and off-highway operations. These regions’ abundance of renewable energy sources makes them prime candidates for producing and exporting low-cost hydrogen.

Latin America and Africa

Emerging markets are beginning to explore hydrogen as part of industrial decarbonization. Brazil and Chile are leading regional initiatives to build green hydrogen capacity, with Chile aiming to become a top exporter by 2030. South Africa is promoting hydrogen valleys and fuel initiatives supported by international partnerships, laying the groundwork for future hydrogen engine applications.

Strategic Insights for Stakeholders

- Hydrogen Source and Sustainability: Lifecycle emissions depend on hydrogen production methods. Green hydrogen derived from renewables offers the most sustainable advantage.

- Regulatory Compliance: OEMs must ensure engines meet ultra-low-NOₓ and carbon standards through advanced after-treatment systems.

- Infrastructure Planning: Availability of hydrogen fueling stations remains critical. Public-private partnerships and centralized hydrogen hubs will be key to adoption.

- Total Cost of Ownership (TCO): Retrofits and engine conversions offer near-term decarbonization at lower capital costs than full electrification.

- Collaboration and Supply Chain: Cross-industry collaboration between fuel suppliers, engine manufacturers, and fleet operators is essential for scaling hydrogen ICE applications.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Europe Hydrogen Generation Market Growth Drivers, Key Players, Trends and Regional Insights by 2034