Humanoid Robots in Packaging Market Size

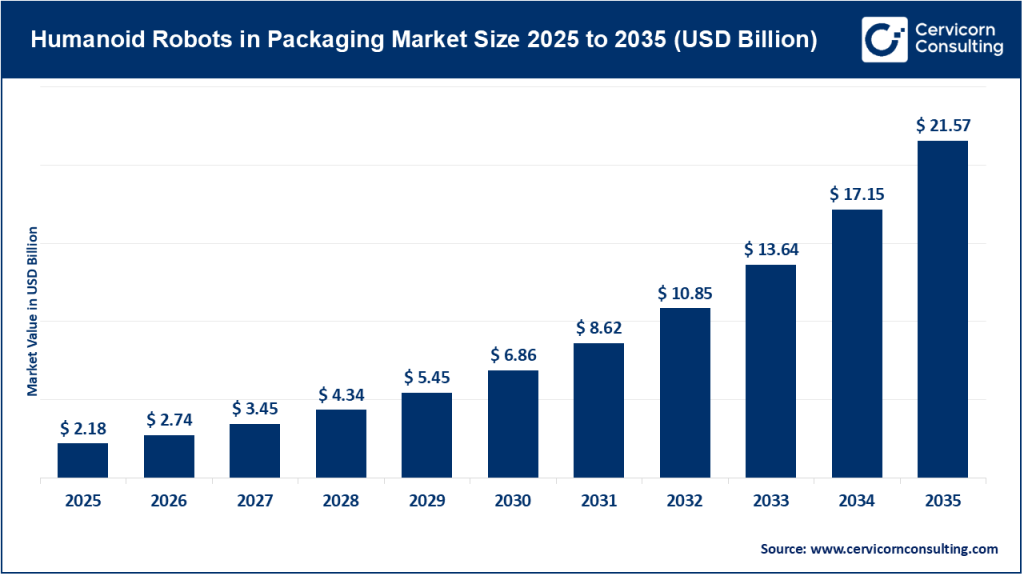

The global humanoid robots in packaging market size was worth USD 2.18 billion in 2025 and is anticipated to expand to around USD 21.57 billion by 2035, registering a compound annual growth rate (CAGR) of 25.76% from 2025 to 2034.

Market Growth Factors

The humanoid robots in packaging market is accelerating rapidly due to four converging forces:

-

Persistent labor shortages and rising labor costs in logistics, e-commerce, and manufacturing that push firms toward flexible automation.

-

Breakthroughs in embodied AI, perception, and whole-body control that allow humanoids to safely handle varied packages and work alongside humans.

-

Improved actuation, battery, and sensor technologies that make continuous deployment increasingly practical.

-

Expanding investments and pilot deployments from deep-tech startups and strategic OEM partnerships that are converting prototypes into commercial pilots and early production runs.

Together, these factors create a virtuous cycle — demand for human-like manipulation drives R&D and investment, accelerating product maturity and cost declines, in turn making broader packaging use cases commercially attractive.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2806

What Is the Humanoid Robots in Packaging Market?

The “humanoid robots in packaging” market refers to the segment of the robotics and packaging automation industries that applies bipedal or human-form robots to perform packaging tasks traditionally handled by human workers.

These tasks include picking irregular or flexible items, grouping and orienting products for boxing, inserting items into packaging, labeling, quality checks requiring dexterous handling, and co-working with human line operators. Unlike fixed-base industrial robots, humanoids are designed to navigate human environments, use existing fixtures and tools, and take on tasks where adaptability and dexterity are essential.

The market spans hardware, onboard and cloud AI systems, grippers and end-effectors, vision stacks, safety systems, integration services, and subscription-based software models.

Why It’s Important

- Flexibility: Packaging lines face SKU proliferation and shorter production runs. Humanoids can switch tasks without full line retooling, since they are built to emulate human reach and dexterity.

- Human–Robot Collaboration: Humanoids can safely share workspace with people, enabling partial automation where full mechanization is uneconomical or impractical.

- Reduced Redesign Costs: Manufacturers often redesign facilities for traditional robots. Humanoids can operate within existing infrastructure, lowering CapEx and deployment time.

- Labor Resilience: In markets facing labor shortages or strict workplace safety regulations, humanoids maintain throughput while reducing ergonomic strain and injuries.

- Higher-Value Work: Automating repetitive packaging tasks allows human staff to focus on quality control, supervision, and value-added roles.

Top Companies in the Humanoid Robots in Packaging Market

Below are key players defining the competitive landscape — their specialization, focus areas, features, 2024 revenue signals, and global presence.

1. Agility Robotics

Specialization: Bipedal humanoid robots focused on logistics, material handling, and embodied AI for real-world tasks.

Key Focus Areas: Digit robot for box handling, bin picking, line augmentation, and navigation in warehouse settings.

Notable Features: Digit emphasizes safe collaboration, whole-body control, and payload optimization. It’s designed to operate around humans in existing warehouses without major redesigns.

2024 Revenue / Market Share: As a private company, Agility Robotics has not disclosed detailed financials. However, growing pilot programs and partnerships with major logistics players signal early commercial traction.

Global Presence: Headquartered in the U.S., active in North America and expanding partnerships globally.

2. Apptronik

Specialization: General-purpose humanoid robots for industrial, logistics, and field applications.

Key Focus Areas: Scalable production, efficient human-safe actuation, and simplified task programming through modular software.

Notable Features: Apptronik’s Apollo humanoid is engineered for manufacturability, with a focus on rapid deployment and adaptability for repetitive packaging and assembly tasks.

2024 Revenue / Market Share: The company’s revenue is primarily from pilot contracts and strategic partnerships. Its $350M Series A in 2025 reflects strong investor confidence in scaling production.

Global Presence: Based in the U.S. with collaborations across automotive and logistics sectors in Europe and Asia.

3. Figure AI

Specialization: Large-scale humanoids for manufacturing, logistics, and general-purpose tasks.

Key Focus Areas: Hardware scalability, intelligent perception systems, and high-profile industrial partnerships.

Notable Features: Figure’s humanoids have demonstrated assembly and packaging assistance in automotive settings. Its focus is on combining dexterous manipulation with robust locomotion.

2024 Revenue / Market Share: Figure’s 2024 revenue derives mainly from pilot projects, supported by significant capital investment and major partnerships with global manufacturers such as BMW.

Global Presence: U.S.-based with global ambitions; active in the Americas, Europe, and parts of Asia through industrial collaborations.

4. Halodi Robotics (now 1X Technologies)

Specialization: Semi-humanoid robots designed for safety-critical and assistive environments.

Key Focus Areas: Safe and compliant actuation, lightweight structure, and human-centric operation for mixed environments like packaging, security, and care.

Notable Features: Focuses on natural human interaction, safety compliance, and physical versatility over brute strength, making it ideal for collaborative tasks.

2024 Revenue / Market Share: Exact revenue is undisclosed. However, continued funding rounds and pilot deployments indicate active growth.

Global Presence: Based in Norway with outreach across Europe and North America.

5. Leju (Shenzhen) Robotics

Specialization: Industrial-grade humanoid robots for factory automation, automotive assembly, and packaging.

Key Focus Areas: Cost-effective mass production, industrial durability, and collaboration with domestic OEMs.

Notable Features: Leju has emerged as a leading Chinese manufacturer in humanoid robotics, scaling rapidly through domestic supply chain advantages.

2024 Revenue / Market Share: While official revenue is undisclosed, bulk orders and domestic deployments indicate rapid scaling and strong market penetration in China.

Global Presence: Headquarters in Shenzhen, with expansion into East Asia and early international interest from manufacturing partners.

Leading Trends and Their Impact

- Integration of AI and Large Language Models: Humanoids increasingly leverage AI for task learning and instruction-based control. This reduces programming complexity and training time for packaging tasks.

- Soft Robotics and Tactile Sensing: Advanced grippers equipped with tactile sensors and soft materials allow humanoids to handle delicate, flexible, or irregularly shaped packages safely.

- Collaborative Workspaces: The industry is shifting toward hybrid work cells where humanoids operate alongside humans. This trend enhances safety, boosts productivity, and requires minimal facility modification.

- Commercial Scale-Up: A surge in venture funding and industrial partnerships is driving humanoids from R&D prototypes to real-world deployments.

- Regional Competition: Asian manufacturers are focusing on affordability and mass production, while Western firms prioritize safety certification, reliability, and enterprise-grade support. This duality will shape pricing, adoption speed, and regional dominance.

Successful Global Examples of Humanoid Robots in Packaging

- Figure AI and BMW Partnership: Figure’s humanoid robots have been deployed in BMW’s assembly facilities to assist with parts handling and packaging preparation, showing the potential for humanoids in real manufacturing environments.

- Apptronik’s Industrial Pilots: The company’s Apollo humanoids have undergone pilot programs with automotive and logistics partners for packaging, loading, and kitting tasks.

- Agility Robotics’ Digit Deployments: Agility’s Digit is actively working in warehouse environments, moving packages between conveyors, pallets, and storage racks.

- Leju’s Chinese Factory Rollouts: Leju has begun large-scale production of humanoid robots used in assembly and packaging within Chinese automotive and electronics factories, signaling the dawn of industrial-scale humanoid deployment.

These examples demonstrate cross-industry interest — from automotive assembly lines to warehouse fulfillment centers — where dexterous manipulation and adaptability are essential.

Global Regional Analysis and Policy Landscape

Asia

China: The Chinese government strongly supports robotics through industrial modernization policies, funding programs, and exhibitions like the World Robot Conference. Domestic firms such as Leju are benefiting from subsidies, local partnerships, and rapid adoption by Chinese factories.

Japan and South Korea: Both countries possess advanced robotics ecosystems and encourage humanoid innovation through R&D incentives and robotics integration grants. Safety-certified humanoids are entering high-precision packaging and electronics sectors.

India: Robotics is gaining momentum through government initiatives that promote AI and automation. With a large manufacturing base, India is expected to adopt humanoids in packaging and logistics as costs decline.

North America

The United States remains the innovation hub for humanoid robotics, home to Figure AI, Agility Robotics, and Apptronik. Federal interest in AI and robotics has led to increased research funding, public-private partnerships, and a focus on strengthening domestic robotics supply chains. Canada’s industrial automation sector is also exploring humanoids for packaging, especially in food and beverage production.

Europe

Europe has a long tradition of advanced robotics development supported by the European Commission’s Horizon Europe programs. EU regulations emphasize ethical, safe, and environmentally sustainable robotics. European firms are prioritizing humanoid applications in food processing, pharmaceutical packaging, and logistics — sectors that demand high precision and compliance.

Policy Highlights Across Regions

- Safety and Standards: Governments are developing guidelines for collaborative robots, emphasizing workplace safety, data privacy, and certification frameworks.

- Workforce Reskilling: Several countries have launched upskilling programs to train workers in robot maintenance and human–robot collaboration.

- Sustainability Goals: As packaging industries seek eco-efficiency, humanoid robots are being integrated into systems designed for minimal waste and optimized material usage.

- Investment Incentives: Tax benefits, innovation grants, and startup accelerators are encouraging private investment in humanoid robotics.

Key Use Cases Emerging in Packaging

- E-commerce Fulfillment: Picking and sorting various product sizes in warehouses with unpredictable workloads.

- Food & Beverage Packaging: Gentle handling of perishable or deformable goods where standard grippers fail.

- Pharmaceutical Packaging: Precise labeling, vial sorting, and assembly of delicate medical packaging.

- Consumer Goods Manufacturing: End-of-line packaging, palletization, and reboxing for multiple SKUs.

- Return Logistics: Automated unpacking, inspection, and repackaging for reuse or recycling.

The Business Case: ROI and Deployment Strategy

Companies considering humanoid robots for packaging should evaluate them across the following dimensions:

- Pilot Program Performance: Measure throughput, error rates, uptime, and safety metrics over several weeks.

- Total Cost of Ownership (TCO): Include hardware, software, maintenance, and integration costs to assess ROI.

- Safety Compliance: Confirm adherence to international collaborative robot standards such as ISO 10218 and ISO/TS 15066.

- Task Adaptability: Assess how easily robots can switch between SKUs or packaging tasks without engineering intervention.

- Integration Compatibility: Ensure seamless communication between humanoids, conveyors, and warehouse management systems.

When deployed strategically, humanoids can improve line flexibility by 25–40%, reduce ergonomic injuries by up to 50%, and shorten packaging cycle times while maintaining accuracy and quality.

Leading Challenges

Despite progress, several challenges remain:

- Hardware Cost: Current humanoids are expensive compared to traditional packaging robots.

- Battery Life and Endurance: Sustained operation over long shifts remains a technical hurdle.

- AI Generalization: Humanoids must adapt to new packaging tasks quickly without extensive retraining.

- Workplace Acceptance: Operators and unions need assurance about safety, reliability, and job transformation rather than displacement.

- Maintenance Complexity: Humanoid systems require specialized technicians for calibration and updates.

Continued innovation and policy support are expected to mitigate these barriers through 2030.

The Road Ahead

Humanoid robots are redefining what automation means in packaging — shifting from rigid, repetitive automation to adaptive, human-scale collaboration. The near future will see humanoids working side by side with humans, handling tasks that require both strength and subtlety, all while learning continuously from experience.

As costs decline and performance stabilizes, these machines will move from pilot projects into mainstream packaging lines, reshaping global manufacturing and logistics. The market is poised for transformative growth, driven by both technological breakthroughs and the pressing need for a more resilient, efficient, and sustainable packaging ecosystem.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: U.S. Biofuels Market Growth Drivers, Trends, Key Players, and Regional Insights by 2034