Healthcare CRM Market Size

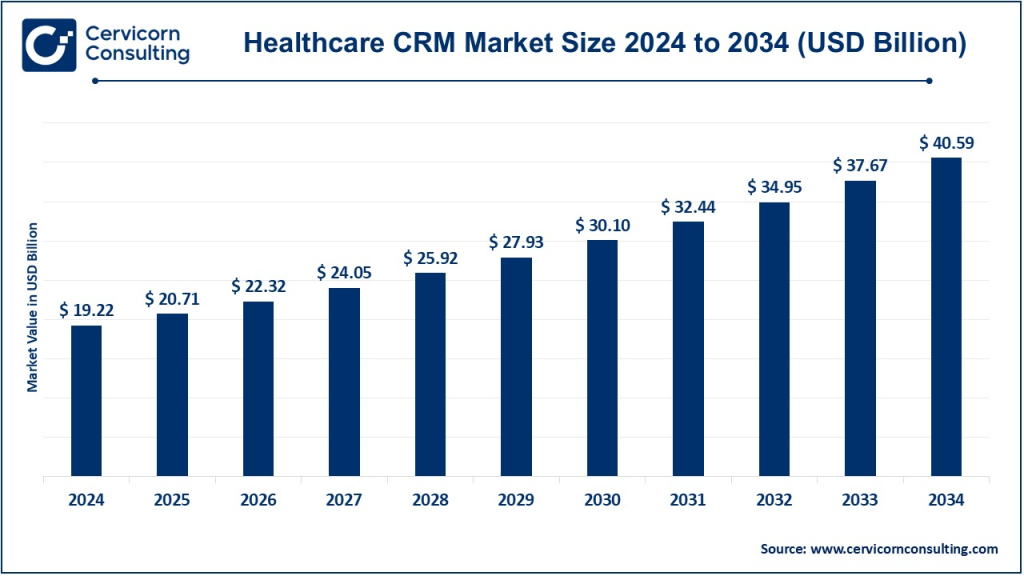

The global healthcare CRM market size was worth USD 19.22 billion in 2024 and is anticipated to expand to around USD 40.59 billion by 2034, registering a compound annual growth rate (CAGR) of 7.76% from 2025 to 2034. The healthcare customer relationship management (CRM) market is a dynamic and rapidly growing sector that integrates CRM strategies with advanced healthcare technologies to streamline operations, enhance patient engagement, and drive value-based care. As global healthcare systems evolve to meet the rising demands of chronic disease management, aging populations, data interoperability, and digital engagement, healthcare CRM platforms have emerged as critical tools to facilitate patient-centered strategies and operational excellence.

Growth Factors in the Healthcare CRM Market

The growth of the healthcare CRM market is driven by several key factors. The primary growth driver is the rising demand for personalized patient care. With healthcare moving toward value-based care, providers are prioritizing relationship-based models rather than transactional services. Technological advancements, such as artificial intelligence (AI), predictive analytics, and cloud-based platforms, further enable robust CRM capabilities. Increasing investments in telemedicine, remote patient monitoring, and electronic health records (EHR) integration also play crucial roles. Additionally, regulatory pressures to improve care coordination and reduce readmission rates are compelling healthcare organizations to adopt CRM tools. The expansion of health insurance coverage, patient mobility, and the increasing need for data-driven decision-making contribute significantly to this market’s growth.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2593

What is the Healthcare CRM Market?

Healthcare CRM (Customer Relationship Management) refers to the software systems and platforms specifically designed to manage relationships between healthcare providers and their patients, vendors, partners, and other stakeholders. These platforms capture and analyze patient data, automate marketing and outreach campaigns, schedule follow-ups, and integrate with clinical and administrative systems to improve operational efficiency. Unlike general CRMs used in commercial industries, healthcare CRMs are HIPAA-compliant, secure, and tailored to manage sensitive medical data, making them unique in both function and architecture.

Why is Healthcare CRM Important?

Healthcare CRM is important because it empowers organizations to provide proactive, personalized care, improve patient retention, and optimize workflow efficiencies. In a landscape where patient expectations are shifting toward more consumer-like experiences, CRMs help bridge the gap between clinical services and patient satisfaction. Healthcare CRM enhances care coordination, reduces administrative burdens, and allows for targeted communication and education, which can significantly improve health outcomes. Moreover, in an era of digital health transformation, CRM systems play a pivotal role in integrating disparate health IT systems, enabling real-time insights and fostering a data-driven approach to patient engagement and population health management.

Healthcare CRM Market: Top Companies Overview

1. Accenture

- Specialization: Digital transformation, patient experience optimization, analytics-driven CRM implementation.

- Key Focus Areas: AI-powered insights, personalized patient engagement, CRM system integration.

- Notable Features: Deep industry expertise, scalable solutions, cross-industry knowledge.

- 2024 Revenue (Est.): $65 billion (across segments; CRM-specific not disclosed).

- Market Share: Approx. 5–7% of CRM consulting and integration services in healthcare.

- Global Presence: Operates in over 120 countries with major healthcare CRM deployments in North America, Europe, and Asia-Pacific.

2. Alvaria

- Specialization: Patient engagement through contact center and outbound communication solutions.

- Key Focus Areas: Omni-channel communication, appointment reminders, patient retention.

- Notable Features: Real-time messaging, predictive dialing, voice + SMS integration.

- 2024 Revenue (Est.): ~$600 million.

- Market Share: Around 3% in healthcare-specific communication CRM tools.

- Global Presence: North America, LATAM, EMEA.

3. Creatio

- Specialization: No-code CRM platform for healthcare operations and marketing automation.

- Key Focus Areas: Workflow automation, patient journey management, compliance-ready CRM.

- Notable Features: Drag-and-drop process builder, seamless EHR integration.

- 2024 Revenue (Est.): ~$250 million.

- Market Share: 1.5–2% in customizable healthcare CRM platforms.

- Global Presence: USA, UK, EMEA, with growing presence in APAC.

4. hc1

- Specialization: Lab CRM and precision health insights platform.

- Key Focus Areas: Clinical lab data analytics, test utilization, precision medicine.

- Notable Features: Lab data normalization, population health insights, COVID-19 dashboard.

- 2024 Revenue (Est.): ~$100 million.

- Market Share: Dominant in lab-specific CRM with ~40% share in that niche.

- Global Presence: Primarily USA, expanding into LATAM and Western Europe.

5. IBM

- Specialization: Cognitive computing, AI-powered CRM, Watson Health integration.

- Key Focus Areas: Predictive analytics, patient risk scoring, care pathway optimization.

- Notable Features: Watson Health AI engine, cloud-based scalability, HIPAA-compliant data architecture.

- 2024 Revenue (Est.): ~$60 billion (total; ~$1.5 billion attributed to healthcare AI & CRM).

- Market Share: ~6% in healthcare IT and CRM analytics solutions.

- Global Presence: Global leader with installations in over 100 countries.

Leading Trends and Their Impact on the Market

1. AI & Predictive Analytics Integration

The incorporation of AI allows providers to forecast patient needs, prevent readmissions, and tailor communication strategies. Predictive analytics help hospitals identify high-risk patients early and reduce treatment costs.

2. Cloud-Based CRM Adoption

Cloud deployment enhances data accessibility, security, and scalability, enabling healthcare organizations to operate across facilities without compromising performance or compliance.

3. Omni-Channel Patient Engagement

Modern CRMs support multiple engagement channels—SMS, email, chat, phone—to communicate with patients. This enhances patient satisfaction and retention rates.

4. Mobile CRM Platforms

With the rise of mobile health, CRM systems are being optimized for smartphones and tablets, enabling healthcare staff to access patient data anytime, anywhere.

5. Interoperability with EHR and EMR

Effective integration with EHRs ensures that CRM platforms are not siloed and can provide a 360-degree view of the patient journey.

6. Focus on Mental Health & Wellness

Healthcare CRMs are expanding into mental health by providing integrated care coordination for behavioral and psychological services.

Successful Examples of Healthcare CRM Implementation Around the World

1. Cleveland Clinic (USA)

By integrating Salesforce Health Cloud, Cleveland Clinic has enhanced patient segmentation and personalized outreach. The CRM system helps manage pre- and post-op care, increasing patient retention and reducing no-shows.

2. NHS UK (United Kingdom)

The UK’s National Health Service uses a custom CRM to track COVID-19 vaccination records, communicate with patients, and streamline test-and-trace programs, significantly reducing administrative overhead.

3. Apollo Hospitals (India)

Apollo uses CRM tools for chronic care management and patient onboarding through its digital platform. The system supports appointment scheduling, remote consultations, and follow-up alerts.

4. Mayo Clinic (USA)

Mayo Clinic uses a combination of CRM platforms to improve clinical trial enrollment, manage patient data, and deliver AI-enhanced risk stratification for various conditions.

Global Regional Analysis and Government Initiatives

North America

- Market Size (2024): ~$6.5 billion.

- Drivers: Strong regulatory push toward value-based care, EHR mandates, and large-scale IT adoption.

- Key Initiatives: HIPAA, HITECH Act, CMS incentives for CRM integration.

Europe

- Market Size (2024): ~$3.1 billion.

- Drivers: GDPR compliance driving secure CRM adoption, patient data rights, universal healthcare systems seeking efficiency.

- Government Initiatives: EU Health Data Space, national funding for digitization (e.g., Germany’s Hospital Future Act).

Asia-Pacific

- Market Size (2024): ~$2.8 billion.

- Drivers: Rapid urbanization, telehealth expansion, smartphone penetration, and emerging health-tech startups.

- Government Policies:

- India: Ayushman Bharat Digital Mission promoting electronic health records and patient management tools.

- China: Healthy China 2030 pushing digital integration in hospitals.

Latin America

- Market Size (2024): ~$1.1 billion.

- Drivers: Growing private healthcare providers, government-run health digitization programs.

- Government Programs: Brazil’s e-SUS and Colombia’s health data digitization efforts.

Middle East & Africa

- Market Size (2024): ~$600 million.

- Growth Factors: Smart hospital initiatives, cloud health partnerships, and public-private collaboration in UAE and Saudi Arabia.

- Key Government Actions: Vision 2030 (Saudi Arabia), UAE’s National Health Strategy.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Full-Service CRO Market Forecast to Hit USD 89.18 Billion by 2034