Gluten-Free Products Market Size

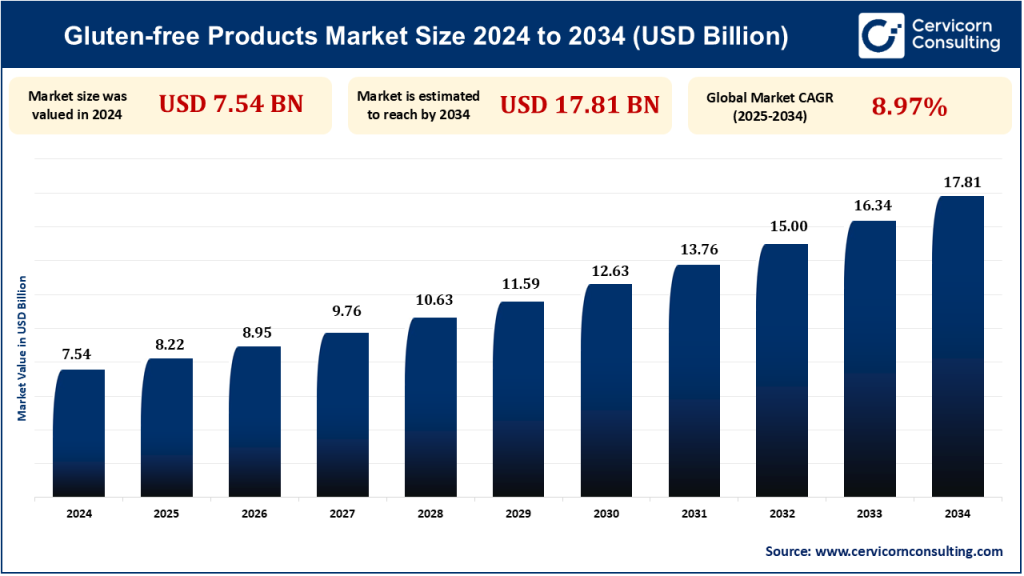

The global gluten-free products market was worth USD 7.54 billion in 2024 and is anticipated to expand to around USD 17.81 billion by 2034, registering a compound annual growth rate (CAGR) of 8.97% from 2025 to 2034.

What is the Gluten-Free Products Market?

The gluten-free products market refers to the industry segment focused on the production, marketing, and distribution of food and beverage products that do not contain gluten—a protein composite found in wheat, barley, rye, and related grains. Gluten-free products cater primarily to individuals with gluten-related disorders such as celiac disease, non-celiac gluten sensitivity, wheat allergy, and dermatitis herpetiformis. Over time, the gluten-free lifestyle has also been adopted by health-conscious consumers who perceive these products as beneficial for digestion, weight loss, and overall well-being. The market encompasses a wide array of products, including gluten-free bakery items (bread, cookies, and cakes), cereals, snacks, pasta, ready meals, and beverages.

Why is the Gluten-Free Products Market Important?

The significance of the gluten-free products market lies in its alignment with growing global health trends, rising awareness of celiac disease, and increasing consumer preference for transparent labeling and clean eating. An estimated 1% of the global population suffers from celiac disease, and millions more are adopting gluten-free diets for health and wellness reasons. The market’s evolution has also empowered food manufacturers to innovate and reformulate traditional products to cater to gluten-intolerant or health-oriented consumers. With increasing diagnosis rates, lifestyle changes, and rising disposable incomes—especially in developing nations—the gluten-free products market plays a vital role in ensuring inclusive, accessible, and safe dietary options.

Gluten-Free Products Market Growth Factors

The gluten-free products market is propelled by several synergistic growth drivers. These include increasing public awareness of gluten-related disorders, improvements in diagnostic techniques for conditions like celiac disease, and an overall rise in health and wellness consciousness. The clean-label movement, growing demand for natural and organic products, and social media influence on dietary trends further amplify market growth. Additionally, advancements in food technology have enabled better taste, texture, and nutritional value in gluten-free alternatives. The surge in e-commerce and direct-to-consumer (DTC) models has made these products more accessible, especially in regions lacking physical retail presence. Furthermore, proactive government regulations for gluten-free labeling and rising investments by major food and beverage companies in gluten-free product lines have significantly fueled market expansion.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2616

Top Companies in the Gluten-Free Products Market

Though Xylem Inc., SPX FLOW, Inc., Southern Heat Exchanger Corporation, Mersen, and Koch Heat Transfer Company are not traditionally associated with food production, their roles in manufacturing and food processing equipment indirectly influence the gluten-free industry. Let’s explore their relevance and key metrics.

| Company | Specialization | Key Focus Areas | Notable Features | 2024 Revenue (Approx.) | Market Share (Approx.) | Global Presence |

|---|---|---|---|---|---|---|

| Xylem Inc | Advanced water and fluid technologies | Fluid transfer in food & beverage processes | Energy-efficient systems used in gluten-free food production | $8.3 billion | ~2% (indirect market via equipment supply) | Over 150 countries |

| SPX FLOW, Inc. | Flow technology and process solutions | Food safety, mixing, separation in gluten-free production | High-sanitization fluid processing for gluten-free production | $2.3 billion | ~3% (indirectly) | 30+ countries |

| Southern Heat Exchanger Corp. | Custom heat exchanger manufacturing | Process optimization for gluten-free product lines | Precision engineering for large-scale production lines | ~$0.5 billion | <1% (equipment-based share) | Primarily North America |

| Mersen | Thermal and electrical equipment | Specialty graphite equipment in food processing | Increases efficiency in gluten-free food drying and packaging | $1.2 billion | ~1% (indirect market influence) | 35+ countries |

| Koch Heat Transfer Company | Thermal process solutions | Heat exchangers in gluten-free food sterilization | Supports high throughput and sanitary operations | $1.8 billion | ~2% (equipment influence) | Global network with strong U.S. base |

While these companies may not produce gluten-free products themselves, they contribute to the backend operations of food and beverage manufacturers by enhancing efficiency, safety, and sustainability in gluten-free product processing and packaging lines.

Leading Trends and Their Impact

Several macro and micro-level trends are influencing the direction of the gluten-free products market:

-

Clean Label and Organic Movement: Consumers are increasingly choosing products that are not only gluten-free but also free from GMOs, artificial preservatives, and additives. Brands that combine gluten-free with organic or non-GMO claims see stronger consumer trust and loyalty.

-

Functional and Fortified Products: To counter concerns about the nutritional deficiencies in gluten-free foods (especially lower fiber and protein content), brands are fortifying products with chia, quinoa, buckwheat, amaranth, and other nutrient-dense grains.

-

E-commerce and Subscription Models: Online platforms and gluten-free subscription boxes are making it easier for consumers, especially in niche markets or remote areas, to access a variety of high-quality gluten-free products.

-

Private Label Expansion: Major retailers like Walmart, Tesco, and Kroger are introducing affordable gluten-free options under private labels, making gluten-free more accessible across income brackets.

-

Increased Investment and M&A Activity: The gluten-free market has witnessed an influx of mergers, acquisitions, and strategic partnerships, particularly from large CPG companies aiming to expand their health-oriented portfolios.

-

Allergen-Free Product Expansion: Many gluten-free brands are now offering multi-allergen-free products (e.g., gluten-free, nut-free, soy-free) to cater to broader health needs and dietary restrictions.

These trends collectively make the gluten-free market dynamic and competitive, fostering innovation and encouraging companies to meet rising consumer expectations.

Successful Gluten-Free Product Examples Around the World

The global marketplace has witnessed the success of numerous gluten-free brands and product lines:

-

Udi’s (United States): A pioneer in gluten-free baking, Udi’s offers a wide range of products including breads, muffins, and frozen meals, widely available in U.S. supermarkets.

-

Schar (Europe): Based in Italy, Schar is Europe’s leading gluten-free food company, offering over 120 products across 30+ countries. Their innovations in shelf-stable gluten-free pasta and baked goods are highly praised.

-

Freedom Foods (Australia): A major player in the Asia-Pacific region, Freedom Foods specializes in allergen-free products, including cereals, snacks, and plant-based beverages.

-

Enjoy Life (United States): Acquired by Mondelēz International, Enjoy Life offers certified gluten-free snacks and bakery products that are also free from 14 common allergens.

-

Genius Foods (UK): A British gluten-free brand well-known for its premium bread, rolls, and breakfast products that appeal to both gluten-sensitive and mainstream consumers.

-

BFree Foods (Ireland): Known for their clean-label ingredients and multi-grain offerings, BFree has seen tremendous growth in the U.S. and Canada.

These brands exemplify how regional expertise, coupled with product innovation and clean-label strategies, can yield global success in the gluten-free sector.

Regional Analysis and Government Initiatives

North America

The U.S. remains the largest market for gluten-free products, accounting for over 40% of global consumption. Government regulations such as the FDA’s Gluten-Free Labeling Rule (2014) have created clarity and safety for consumers. Additionally, the rise in diagnosed celiac cases and a growing population following health-oriented diets fuel market expansion.

-

Canada also has strict regulations on gluten labeling and has seen significant retail expansion of gluten-free goods, supported by government-backed health campaigns.

Europe

Europe is a matured and highly regulated market. The European Union Regulation (EU) No. 828/2014 governs the use of gluten-free labels, setting a threshold of less than 20ppm gluten. Countries like the UK, Germany, Italy, and Scandinavia show high demand, driven by both medical and lifestyle needs.

-

Government healthcare systems in Italy and Sweden provide subsidies or tax relief for diagnosed celiac patients, encouraging consumption of gluten-free alternatives.

Asia-Pacific

This region is witnessing exponential growth, particularly in India, China, and Japan. Rising disposable incomes, western dietary influence, and urbanization are contributing to increased awareness and availability of gluten-free foods.

-

India’s Food Safety and Standards Authority (FSSAI) has issued labeling regulations for gluten-free foods (FSSAI 2018), aiding trust among consumers.

-

In Australia, gluten-free product demand is high and regulated by Food Standards Australia New Zealand (FSANZ), ensuring clarity and safety in labeling.

Latin America

Growth is strong in Brazil, Argentina, and Mexico, driven by improved diagnosis and education. Initiatives from non-profits like the Brazilian Celiac Association (ACELBRA) have raised awareness, while e-commerce has increased access.

-

Government-led food security initiatives now include allergen tracking systems, indirectly benefiting the gluten-free ecosystem.

Middle East & Africa

The market is still nascent but growing due to urbanization, tourism, and the rise of health-conscious consumers. The UAE and Saudi Arabia are leading gluten-free product innovation in the Gulf region.

-

In Africa, South Africa is the most developed market for gluten-free products, supported by NGO-led food safety awareness programs.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Food Safety Testing Market to Reach USD 48.27 Billion by 2033