Floating Power Plant Market Size

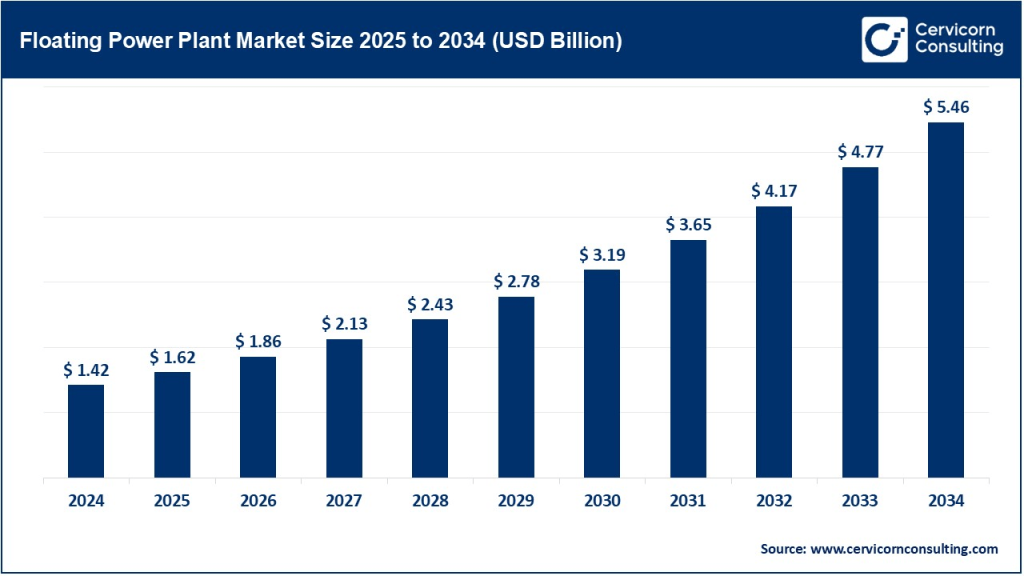

The global floating power plant market size was worth USD 1.42 billion in 2024 and is anticipated to expand to around USD 5.46 billion by 2034, registering a compound annual growth rate (CAGR) of 14.41% from 2025 to 2034.

Floating Power Plant Market Growth Factors

The floating power plant market is being propelled by a convergence of drivers: escalating power demands in densely populated and coastal regions, land scarcity for new installations, and environmental pressures pushing toward low-impact infrastructure. Advances in marine engineering now enable scalable floating platforms offering efficient cooling, mobility, and rapid deployment—ideal for disaster zones, island grids, and offshore oil & gas installations. Supportive government mandates targeting carbon neutrality and renewable integration further buoy the sector, as do incentives, R&D spending, and the promise of hybrid systems (solar–wind–storage). Moreover, partnerships between engineering firms, utilities, and investors are accelerating project implementation, while local manufacturing policies are reducing cost and galvanizing deployment.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2594

What Is the Floating Power Plant Market?

Floating power plants (FPPs) are electricity-generating units—solar arrays, wind turbines, gas-turbine barges, or hybrid systems—deployed on floating platforms: barges, ships, semi-submersibles, pontoons. They offer decentralized, mobile energy solutions, reducing the need for land occupancy and enabling access to remote, water-constrained, or disaster‑affected regions. FPPs also serve offshore oil & gas platforms and island grids with cleaner, nearby power.

Why It Matters

Floating power plants are a game-changer because they deliver:

- Land Conservation – Utilize water surfaces instead of precious land; ideal for dense or ecologically sensitive locations.

- Rapid Deployment & Mobility – Can be built in facilities and towed to sites—critical during disasters or grid emergencies.

- Enhanced Efficiency – Water-cooling improves performance and longer plant life.

- Energy Security – Localized, resilient grids, particularly useful in island nations, remote communities, and oilfield operations.

- Environmental Benefits – Lower land impact, reduced evaporation, decreased algae growth; can host renewable sources and storage.

Top Market Companies (2024 Snapshot)

1. CHN ENERGY Investment Group Co. LTD

- Specialization: Large-scale floating solar (LNG renewable hybrid initiatives under development).

- Key Focus: Land‑conserving solar solutions and integration with thermal plants.

- Notable Features: China’s 1 GW+ Shandong floating solar panel deployed in Dec 2024.

- 2024 Revenue / Market Share: Not disclosed publicly; Asia Pacific segment leads ~40 % share—China is fastest-growing.

- Global Presence: China, engaged in APAC development.

2. Ciel et Terre International, SAS

- Specialization: Floating solar (Hydrelio® platform).

- Key Focus: Brackish inland reservoirs and fast large‑scale modules.

- Notable Features: Kayamkulam 73.4 MWp project in India—the world record install in 70 days.

- 2024 Revenue / Share: Among top in floating solar; company often leads behind Asia-Pacific dominance.

- Global Presence: France HQ; India (subsidiary led Kayamkulam), global projects via B2B.

3. Floating Power Plant A/S (Denmark)

- Specialization: Modular floating platforms for solar, wind, and hybrid setups.

- Key Focus: Coastal and marine infrastructure solutions.

- Notable Features: Strong European tech focus; integrated marine–energy expertise.

- 2024 Revenue / Share: Among top ten globally.

- Global Presence: Europe, expanding into APAC, North America.

4. GE Vernova (formerly General Electric Power)

- Specialization: Gas turbine barges and hybrid floating systems.

- Key Focus: High‑power ratings (>100 MW), grid stabilization.

- Notable Features: Part of GE’s energy transition offering; modular, mobile thermal units.

- 2024 Revenue / Share: GE revenue is public; floating division unspecified—non-renewables ~70 % market.

- Global Presence: U.S., Europe, and Asia Pacific.

5. Karadeniz Holding (Turkey)

- Specialization: Power ships (e.g., Karpowership fleet).

- Key Focus: LNG/diesel barge solutions for grid-short or emergency needs.

- Notable Features: World’s largest fleet of powerships, deployed across Africa and Asia.

- 2024 Revenue / Share: Significant within non-renewable high-power barges.

- Global Presence: Deployed in Lebanon, Pakistan, Mozambique, Ghana, more.

Leading Trends & Impacts

Shift Toward Renewables & Hybridization

Floating solar and wind are gaining share over gas/diesel systems. Asia Pacific leads renewables >100 MW growth.

Storage Integration & Smart Ops

Battery systems, sensors, predictive maintenance, and remote control are becoming standard.

Non-Renewable Still Dominates

Fossil-fuel barges are essential for stable, quick-deploy systems, making up ~70–80 % of current installed capacity.

Platform Power Rating Shift

High (>100 MW) projects dominate revenue, but medium-scale (20–100 MW) are fastest growing—ideal for scaling deployments.

Regional Divergence

- Asia Pacific leads (>40 % share), powered by China, India, Southeast Asia

- Europe focuses on innovation zones for floating offshore wind with strong EU funding

- North America grows via U.S. DOE offshore wind and California floating solar projects

Successful Global Examples

India:

- NTPC Ramagundam (Telangana) – 100 MW floating solar on reservoir, operational since July 2022.

- Kayamkulam (Kerala) – 73.4 MW by Ciel et Terre India (NTPC & TATA) in just 70 days—a world record cadence.

- Omkareshwar (Madhya Pradesh) – Up to 600 MW planned; Phase‑1 began in 2023 (278 MW), storm-exposed but innovative.

Europe:

- Hywind Tampen (Norway) – 88 MW floating wind supplying offshore platforms since Nov 2022; world’s first renewables-powered offshore oil & gas field.

- Green Volt (Scotland) – 560 MW planned by 2029; Europe’s first commercial-scale floating wind farm after seafield lease awarded in April 2024.

North America:

- Orbital Marine (UK/Canada) – Flow turbine arrays planned in UK and Canada (Bay of Fundy), pushing tidal energy as floating generation.

- D3Energy (USA) – Partnered with Ciel & Terre for US floating solar, including Florida (31.5 kWp) and Ohio waters; expands Hydrelio system.

Global Regional Analysis & Government Initiatives

Asia-Pacific

- Policy & Demand: Exploding industrialization and urbanization stress energy grids; land scarcity pushes floating solutions.

- India: National Floating Solar Mission & reservoir-based deployments; key projects like Omkareshwar.

- China: 1 GW+ Shandong plant launched, massive state-backed renewable push.

- Japan/South Korea: Offshore floating wind trials and testbeds underway.

- Southeast Asia: Cirata 145 MW plant in Indonesia via Masdar–PLN joint venture.

Europe

- EU Targets: Green Deal goals and carbon-neutral mandates by 2050, with offshore wind development zones prioritized.

- Norway: $3.3 billion subsidy for Utsira Nord floating wind project (2.25 GW) awarded in 2024.

- UK: Public-private GB Energy company formed to lead floating wind build-out; $10+ billion funding secured.

- Scotland / France: Projects like Green Volt and Provence driving innovation.

North America

- USA: Department of Energy funds east and west-coast offshore floating wind and floating solar; major approvals in Atlantic Shores South and Gulf Coast.

- Canada: Strong development in tidal and floating solar solutions; Bay of Fundy site is promising for marine generation.

- Mexico: Exploration of floating LNG barge solutions for coastal refinery electrification.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Hydrogen Fueling Station Market Growth Drivers and Future Outlook (2025–2034)