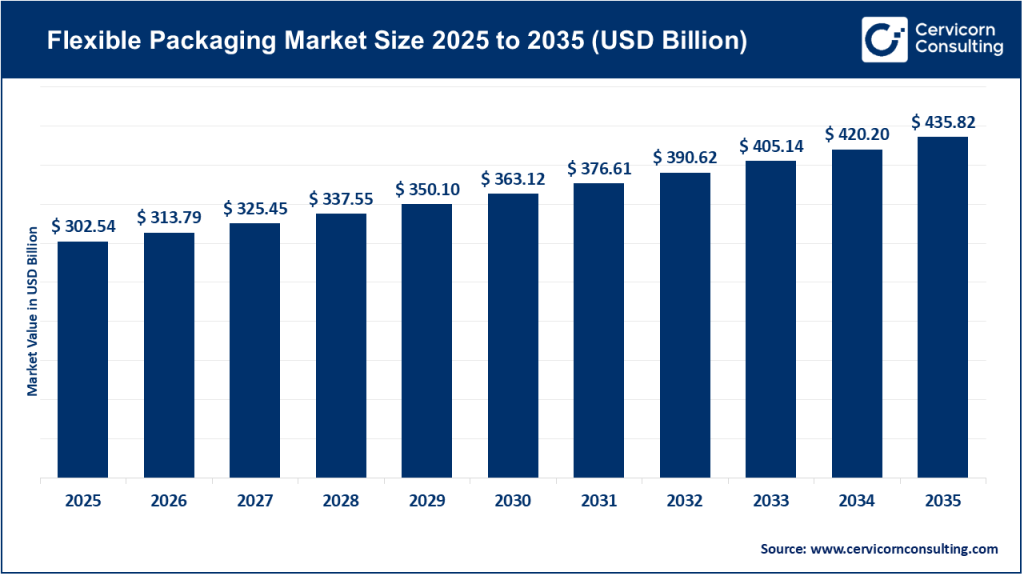

Flexible Packaging Market Size

The global flexible packaging market size was worth USD 302.54 billion in 2025 and is anticipated to expand to around USD 435.82 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% from 2026 to 2035.

Flexible Packaging Market Growth Factors

The flexible packaging market is being propelled by rising demand for lightweight and convenient packaging formats, the rapid expansion of e-commerce, and increasing consumer preference for single-serve, resealable and portable products; continuous innovation in barrier films, laminates and active packaging that extend shelf life for food and pharmaceuticals; cost efficiency and logistics advantages offered by reduced material usage and lower transport weight; sustainability-driven adoption of recyclable mono-material structures and post-consumer recycled (PCR) content; regulatory pressure for environmentally responsible packaging.

Growing use of flexible formats in emerging markets with increasing urbanization; and brand-driven emphasis on standout shelf aesthetics and enhanced customer experience. Together these factors are pushing the market toward higher-value, sustainable solutions while simultaneously driving global capacity expansion, material innovation, and cross-industry collaboration.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2830

What Is the Flexible Packaging Market?

The flexible packaging market comprises manufacturers of packaging made from flexible materials such as plastic films, laminated composites, papers, and aluminum foil. These materials allow packaging to be easily shaped, sealed, printed, and transported. Common formats include stand-up pouches, sachets, rollstock for form-fill-seal systems, shrink films, lidding films, spouted pouches, and vacuum skin packaging. The market serves a wide range of industries — including food & beverage, pharmaceuticals, nutraceuticals, cosmetics, personal care, home care, pet food, and industrial goods. Its defining attributes are low weight, minimal material usage, versatility in shape and size, compatibility with high-speed filling systems, and the ability to integrate multiple functional layers for moisture, oxygen, aroma, and UV protection.

Why Is Flexible Packaging Important?

Flexible packaging is essential because it strikes a unique balance between performance, cost efficiency, environmental footprint, and consumer convenience. It uses significantly less material compared to rigid packaging formats like glass, metal, or hard plastics, resulting in reduced transportation emissions and lower supply chain costs. Advanced barrier films help extend the shelf life of perishable foods, reduce global food waste, and maintain product freshness during long-distance distribution. For consumers, flexible packaging offers convenience through resealable closures, single-serve formats, portion-controlled solutions, and lightweight portability.

For brands, it provides excellent printability for eye-catching designs, the ability to manufacture custom shapes for differentiation, and compatibility with automation technologies. As sustainability regulations tighten globally, recyclable mono-material flexible packaging is becoming increasingly important in achieving circularity and reducing environmental impact.

Top Flexible Packaging Companies — Profiles and Market Positioning

Below are detailed profiles of the top companies in the flexible packaging market, covering specialization, focus areas, notable features, 2024 revenue, market footprint, and competitive strengths.

1. Sealed Air

Specialization:

Protective packaging solutions, flexible films, food packaging technologies, and high-performance barrier materials.

Key Focus Areas:

- Fresh food protection

- Sustainable lightweight packaging

- Automation and smart packaging systems

- E-commerce-ready protective packaging

Notable Features:

Known for its Cryovac® food packaging technologies, Sealed Air is a pioneer in vacuum and barrier solutions. It is also a key player in packaging automation.

2024 Revenue:

Approx. USD 5.4 billion (company level).

Market Share & Global Presence:

Strong presence in North America, Europe, and Asia-Pacific, operating in over 100 countries with a significant share in food safety and protective flexible packaging.

2. Berry Global

Specialization:

A diversified packaging manufacturer producing flexible films, pouches, blow-molded products, closures, and non-wovens.

Key Focus Areas:

- Healthcare and consumer packaging

- Recyclable and reusable designs

- Advanced film solutions

- PCR integration in packaging

Notable Features:

One of the largest packaging producers in the world, with integrated manufacturing technologies across both rigid and flexible formats.

2024 Revenue:

Approx. USD 3.2 billion net sales for fiscal 2024.

Market Share & Global Presence:

A major player in North America and Europe with a broad manufacturing footprint and a strong presence across consumer and healthcare segments.

3. Amcor

Specialization:

One of the world’s largest producers of flexible and rigid packaging for food, beverage, health care, and personal care industries.

Key Focus Areas:

- Recyclable flexible laminates

- Mono-material packaging

- Advanced barrier technologies

- Strong global manufacturing footprint

Notable Features:

Amcor is a leader in sustainability, constantly innovating recyclable and high-performance flexible structures. A major strategic development in 2024 was Amcor’s announcement of its intent to acquire Berry Global — a transformative move expected to reshape the global packaging market.

2024 Revenue:

Combined operations (Amcor + Berry, pending regulatory approval) projected to exceed USD 24 billion annually.

Market Share & Global Presence:

A top-tier global flexible packaging manufacturer operating across more than 40 countries with leadership in healthcare and food packaging.

4. Mondi

Specialization:

Sustainable paper and flexible packaging solutions, kraft papers, and hybrid fiber-film structures.

Key Focus Areas:

- Recyclable paper-based flexible packaging

- High-barrier sustainable alternatives

- European food & industrial markets

Notable Features:

Mondi has invested heavily in fiber-based and recyclable solutions, becoming a leader in innovation for paper-flexible hybrids.

2024 Performance:

Strong European presence with expanding global facilities and increasing revenue contributions from sustainable flexible packaging.

Global Presence:

Headquartered in Europe with operations worldwide, especially strong in EMEA and strategic sites in North America and Asia.

5. Uflex

Specialization:

India’s largest multinational flexible packaging company involved in laminates, packaging films, aseptic cartons, and packaging machinery.

Key Focus Areas:

- Vertical integration from films to finished packaging

- Aseptic liquid packaging

- Advanced barrier films

- Printing & converting excellence

Notable Features:

Uflex has a strong international footprint and is known for customized packaging solutions, advanced printing, and proprietary packaging machinery.

2024 Revenue:

Reported strong revenue figures in its quarterly FY24–FY25 updates, with robust domestic and export sales across flexible films and packaging.

Global Presence:

Manufacturing facilities in India, the UAE, Egypt, Poland, the US, and Mexico, exporting to 150+ countries.

6. Toppan Packaging

Specialization:

High-quality printed flexible packaging, functional films, and specialty solutions for food and healthcare.

Key Focus Areas:

- Advanced printing and packaging design

- High-barrier flexible packaging

- Global expansion through acquisitions

Notable Features:

Toppan’s acquisition of Sonoco’s thermoformed packaging business strengthened its footprint in the US and Latin America.

2024 Revenue:

The parent group (Toppan Holdings) reported consolidated revenues around JPY 1.68 trillion (all business segments).

Global Presence:

Strong presence in Japan with fast-growing operations in North America, Europe, and Southeast Asia.

Leading Trends in the Flexible Packaging Market and Their Impact

1. Recyclable Mono-Material Structures

Mono-PE and mono-PP solutions are rapidly replacing multi-layer laminates.

Impact:

- Greater alignment with recycling systems

- Increasing investments in new film lines

- Short-term cost challenges due to redesign and qualification

2. Lightweighting and Material Reduction

Manufacturers continue to reduce material thickness while maintaining barrier performance.

Impact:

- Lower shipping costs

- Reduced carbon footprint

- More competitive pricing for brands

3. Expansion of High-Barrier Films

Essential for frozen foods, ready-to-eat meals, and pharmaceuticals.

Impact:

- Extended shelf life

- Reduced global food waste

- Ability to reach distant markets

4. E-commerce-Friendly Flexible Packaging

Rise of ship-ready flexible mailers, bubble film alternatives, and tear-resistant pouches.

Impact:

- Better consumer experience

- Reduced breakage

- Higher demand for protective flexibles

5. Digital Printing for Short Runs

Digitalization allows brands to produce personalized and promotional packaging without large minimums.

Impact:

- Faster turnaround

- Higher brand differentiation

- Cost-efficient SKUs for seasonal or regional campaigns

6. Regulatory Pressure on Sustainability

Governments worldwide are implementing Extended Producer Responsibility (EPR) programs, recycled content mandates, and recyclability requirements.

Impact:

- Companies redesign entire product portfolios

- Increased investment in recycling infrastructure

- Clear competitive advantage for early adopters of recyclable designs

Successful Examples of Flexible Packaging Globally

1. Mono-PE Stand-Up Pouches in Europe

Brands across Europe have shifted frozen vegetables, snacks, and dry goods from multi-layer laminates to mono-PE structures that can be recycled easily.

Outcome: Higher recyclability rates and lower environmental impact.

2. Aseptic Spouted Pouches in India

Popular for dairy beverages, juices, and flavored milk, these pouches provide long shelf life without refrigeration.

Outcome: Improved rural availability and reduced logistic costs.

3. PCR-Integrated Pouches in North America

Brands are launching food-grade pouches made with post-consumer recycled content.

Outcome: Lower environmental impact and compliance with retailer sustainability goals.

4. Paper-Flexible Hybrids by Mondi in Europe

These paper-based pouches with functional coatings are replacing conventional plastic in dry food and pet nutrition.

Outcome: High consumer acceptance and improved recyclability.

Global Regional Analysis — Market Dynamics and Government Policy Initiatives

Asia-Pacific (China, India, ASEAN)

Market Dynamics:

- Fastest-growing market

- Rising packaged food consumption

- Expansion of organized retail and e-commerce

Government Initiatives:

- India: Plastic Waste Management Rules and EPR targets for producers and brand owners

- China: Regulations on reducing excessive packaging and expansion of green packaging standards

- ASEAN: Waste management modernization and restrictions on non-recyclable packaging

Impact:

Accelerated shift to recyclable flexible packaging and development of regional recycling ecosystems.

Europe

Market Dynamics:

- High adoption of sustainable packaging

- Strong presence of multinational CPG and food brands

- Mature recycling infrastructure

Government Initiatives:

- EU Packaging and Packaging Waste Regulation (PPWR)

- Recyclability and labeling mandates

- Recycled content minimum thresholds

Impact:

Major redesign of packaging portfolios, driving demand for mono-material and fiber-based flexible solutions.

North America (U.S. & Canada)

Market Dynamics:

- Large food and beverage market

- Rapid growth in e-commerce packaging

- Multi-format packaging preferences

Government Initiatives:

- State-level EPR laws

- Recycled content mandates for plastic packaging

- Retailer-driven sustainability scorecards

Impact:

Strong push for PCR-based flexible packaging and innovation in recyclable formats.

Latin America

Market Dynamics:

- Growing consumption of packaged food

- Expansion of manufacturing capacity

- Attractive cost structure for global brands

Government Initiatives:

- Country-specific plastic regulations

- Increasing regional focus on collection and recycling infrastructure

Impact:

Shift toward cost-effective but recyclable flexible packaging formats.

Middle East & Africa

Market Dynamics:

- Expanding FMCG penetration

- High demand for sachets and low-cost packaging formats

Government Initiatives:

- Early-stage recycling policies

- Government and NGO partnerships for waste management

Impact:

Steady growth in flexible packaging demand, with long-term sustainability developments expected.

Government & Policy Influence on Future Roadmaps

- EPR Enforcement: Manufacturers must comply with recycling and recovery obligations, prompting redesign of packaging.

- Recycled Content Rules: Boost demand for high-quality PCR materials.

- Waste Collection Upgrades: Encourage collaborative investments between brands, packaging producers, and recyclers.

- Trade Regulations: Influence sourcing strategies and push for localized production of recyclable materials.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Healthcare Services Market Revenue, Global Presence, and Strategic Insights by 2035