Fertilizer Market Overview

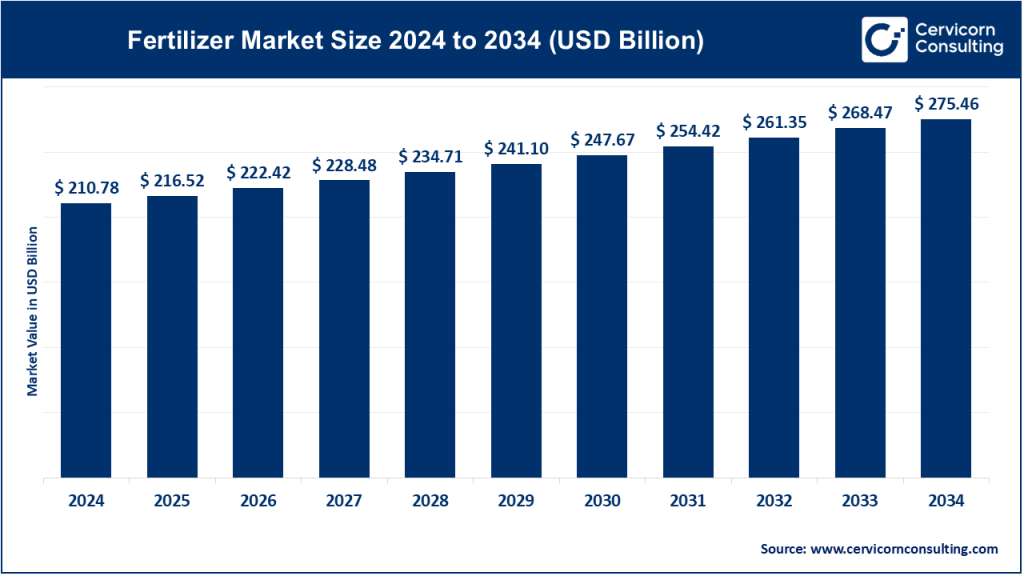

The global fertilizer market was valued at USD 210.78 billion in 2024 and is projected to exceed USD 275.46 billion by 2034, with a CAGR of 2.72% from 2025 to 2034.

Several factors drive the growth of the fertilizer market, including rising food demand due to population growth, increased adoption of advanced agricultural practices, and supportive government policies encouraging sustainable farming. Technological innovations such as controlled-release fertilizers and bio-based alternatives further enhance market potential. Additionally, the rising popularity of organic farming and integrated nutrient management systems contributes to diversification within the market.

Understanding the Fertilizer Market

The fertilizer market is a critical segment of the global agricultural industry, encompassing the production, distribution, and application of chemical or natural substances designed to enhance plant growth and soil fertility. Fertilizers primarily consist of macronutrients such as nitrogen, phosphorus, and potassium, alongside micronutrients that cater to specific crop requirements. With a growing global population and increasing food demand, the market plays a pivotal role in sustaining agricultural productivity and food security.

Importance of the Fertilizer Market

The fertilizer market is indispensable for addressing the challenge of feeding a rapidly growing global population, expected to exceed 9 billion by 2050. By replenishing essential nutrients in the soil, fertilizers enhance crop yield, reduce the need for expanding arable land, and contribute to sustainable farming practices. This sector also supports rural economies and employment, driving technological advancements in precision farming and sustainable agriculture.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2331

Global Fertilizer Market: Top Companies

1. K+S Group

- Specialization: Potash and magnesium products

- Key Focus Areas: Crop yield optimization, sustainable mining practices, and specialty fertilizers

- Notable Features: Advanced logistics network and expertise in soil health solutions

- 2024 Revenue (approx.): $4.5 billion

- Market Share (approx.): 6%

- Global Presence: Predominantly active in Europe, North America, and Asia-Pacific

2. OCI Nitrogen

- Specialization: Nitrogen-based fertilizers and industrial chemicals

- Key Focus Areas: Low-carbon ammonia production, nitrogen efficiency technologies

- Notable Features: Focus on circular economy and energy-efficient production

- 2024 Revenue (approx.): $3.8 billion

- Market Share (approx.): 5.5%

- Global Presence: Strong footprint in Europe, Middle East, and Africa

3. EuroChem Group AG

- Specialization: Nitrogen, phosphate, and potash fertilizers

- Key Focus Areas: Vertical integration, innovation in fertilizer formulations

- Notable Features: Proprietary nutrient delivery systems and mining operations

- 2024 Revenue (approx.): $8 billion

- Market Share (approx.): 8.5%

- Global Presence: Operations in Europe, Asia, and Latin America

4. CF Industries Holdings, Inc.

- Specialization: Nitrogen-based fertilizers

- Key Focus Areas: Green ammonia production, optimizing nitrogen application

- Notable Features: Leader in low-carbon initiatives and extensive distribution networks

- 2024 Revenue (approx.): $12 billion

- Market Share (approx.): 12%

- Global Presence: Predominantly in North America, with growing influence in Asia and Europe

5. Israel Chemicals Ltd (ICL)

- Specialization: Specialty fertilizers, bromine, and phosphates

- Key Focus Areas: Tailored nutrient solutions, water-soluble fertilizers

- Notable Features: Strong R&D capabilities and leadership in specialty markets

- 2024 Revenue (approx.): $7 billion

- Market Share (approx.): 7.5%

- Global Presence: North America, Europe, and Asia-Pacific

Leading Trends and Their Impact

1. Sustainability and Green Fertilizers

The demand for eco-friendly fertilizers is reshaping the industry. Bio-based and slow-release fertilizers are gaining traction as they minimize environmental impact and enhance nutrient use efficiency.

2. Digital Agriculture and Precision Farming

Technologies such as satellite mapping, IoT sensors, and AI-driven analytics enable precise application of fertilizers, reducing waste and optimizing yields.

3. Circular Economy Initiatives

Companies are focusing on recycling agricultural and industrial by-products to produce fertilizers, promoting a circular economy.

4. Emergence of Specialty Fertilizers

Specialty fertilizers tailored for specific crops or soil types are becoming increasingly popular, driven by rising demand for high-value crops and horticulture.

5. Decarbonization of Fertilizer Production

Companies are investing in green ammonia and other low-carbon technologies to meet global sustainability goals, significantly impacting production processes and costs.

Successful Examples of Fertilizer Market Practices

- Netherlands: The country leads in precision agriculture, leveraging advanced technologies and tailored fertilizers to achieve high productivity on limited arable land.

- India: The implementation of nutrient-based subsidy (NBS) schemes has increased the adoption of balanced fertilizers, improving soil health and productivity.

- Brazil: As a major agricultural exporter, Brazil emphasizes customized fertilizers to boost soybean and sugarcane yields, supporting its global market leadership.

Regional Analysis: Government Initiatives and Policies

1. North America

- Government Initiatives: Subsidies for precision farming technologies, support for research in green fertilizers

- Key Markets: United States and Canada

- Regional Highlights: Adoption of advanced farming practices and strong R&D ecosystem

2. Europe

- Government Initiatives: European Green Deal promoting sustainable agriculture

- Key Markets: Germany, France, and the Netherlands

- Regional Highlights: Leading in organic farming and low-carbon fertilizer technologies

3. Asia-Pacific

- Government Initiatives: Subsidy programs and policies to increase fertilizer accessibility

- Key Markets: India, China, and Australia

- Regional Highlights: High growth potential due to large agricultural sectors and increasing mechanization

4. Latin America

- Government Initiatives: Policies supporting infrastructure for fertilizer distribution

- Key Markets: Brazil and Argentina

- Regional Highlights: Strong demand for tailored fertilizers to support export-oriented agriculture

5. Middle East and Africa

- Government Initiatives: Investment in local fertilizer production capacity and infrastructure

- Key Markets: Saudi Arabia, Egypt, and South Africa

- Regional Highlights: Growing focus on self-sufficiency and sustainable practices

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Biofuels Market to Reach USD 246.19B by 2033, Growing 9.2%