Extended-range Electric Vehicles Market Size

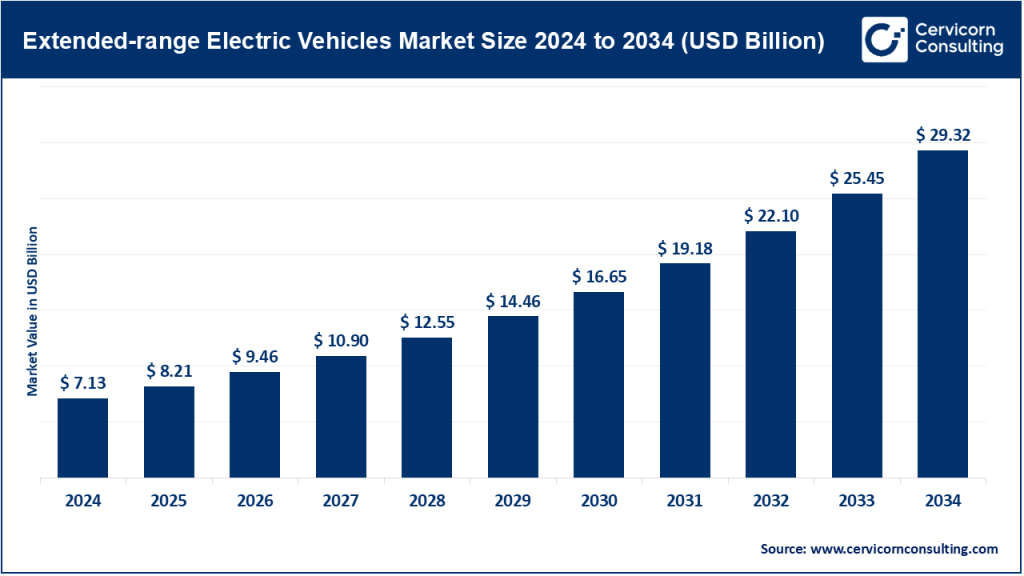

The global extended-range electric vehicles market size was worth USD 7.13 billion in 2024 and is anticipated to expand to around USD 29.32 billion by 2034, registering a compound annual growth rate (CAGR) of 15.2% from 2025 to 2034.

Growth Factors

The EREV market is being propelled by a cluster of structural and tactical forces: persistent range anxiety among mainstream buyers (which makes a small on-board generator attractive), rapid urban EV adoption paired with insufficient fast-charging infrastructure in many regions, declining battery costs that allow designers to calibrate battery size and add efficient range extenders, OEMs’ desire to meet strict emissions or new energy vehicle quotas while offering consumers “no-compromise” range, stronger consumer appetite in large-range markets such as China for family SUVs with flexible fueling options, improvements in small, efficient internal combustion generators and fuel-efficient series hybrids, and regulatory incentives that keep plug-in and range-extender architectures commercially attractive while countries ramp up BEV infrastructure and policy.

These factors combine to make EREVs a commercially sensible intermediate architecture for some manufacturers and buyers — especially in markets where long trips, charging convenience, or regulatory definitions make a blended solution more attractive than a battery-only car.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2702

What is an Extended-Range Electric Vehicle (EREV)?

An EREV is an electric-drive vehicle whose primary traction comes from electric motors powered by a battery, but which also carries a dedicated on-board generator (usually a small internal-combustion engine or other power source) that produces electricity to recharge the battery when it’s depleted. Unlike typical plug-in hybrids where the ICE can mechanically drive the wheels (parallel configuration), EREVs generally use a series configuration: the ICE’s role is to generate electricity, not to mechanically propel the vehicle, so the vehicle behaves like an electric car with an emergency or extended electrical generator on board. This lets designers prioritize electric drivability and battery efficiency while giving drivers the ability to travel long distances without relying on charging infrastructure.

Why EREVs Are Important

EREVs play a strategic role in the transition to full electrification. They reduce range anxiety while enabling high electric-only usage for most daily trips. For markets with patchy fast-charging networks, EREVs let consumers enjoy most of the emissions and efficiency benefits of electrified driving without being limited on long journeys. For OEMs, EREVs can be a pragmatic compliance and margin strategy: smaller battery packs reduce cost and weight, range extenders preserve total range and customer convenience, and in some regulatory frameworks EREVs qualify for incentives that accelerate adoption. In short, EREVs act as a pragmatic bridge technology — offering many of the advantages of EVs today while infrastructure and battery economics evolve toward long-range BEVs.

Extended-Range Electric Vehicles Market — Top Companies

Li Auto Inc.

- Specialization: Large, family-oriented SUVs and MPVs built around EREV platforms.

- Key focus areas: Customer experience, electric-first driving with a gasoline generator for long trips, domestic growth with measured overseas expansion.

- Notable features: Multi-motor electric drivetrains paired with a small 1.5L-class gasoline generator, large infotainment and ADAS features, model lines with long combined ranges.

- 2024 revenue: Approximately RMB 144.5 billion (≈ US$19.8 billion).

BMW AG

- Specialization: Premium vehicles with a history of experimentation in electro-powertrains.

- Key focus areas: Luxury BEVs and electrified models; leveraging range-extender learnings in the electrification roadmap.

- Notable features: The i3 REx demonstrated compact premium EVs with a small generator to extend range.

- 2024 revenue: Group revenues reported at about €142.38 billion.

Toyota Motor Corporation

- Specialization: Broad portfolio spanning hybrids, plug-in hybrids, fuel cell vehicles and BEVs.

- Key focus areas: Reliability, mass-market hybridization and incremental electrified transitions.

- Notable features: Plug-in hybrid models demonstrate Toyota’s pragmatic approach to range and efficiency.

- 2024 performance: Automotive sales revenue for FY2024 was approximately ¥41,266.2 billion.

General Motors (GM)

- Specialization: Broad portfolio across ICE, hybrid, plug-in and BEV models; historically developed the Chevrolet Volt.

- Key focus areas: Electrification investments across brands with lessons from EREV programs informing new designs.

- Notable features: Volt showcased consumer acceptance of electric-first cars with backup generators.

- 2024 revenue: GM reported full-year revenue in the ≈ US$187 billion range.

BYD Auto Co., Ltd.

- Specialization: NEV leader focused on BEVs and plug-in hybrids, with hybridized efficiency architectures.

- Key focus areas: Vertical integration, battery manufacturing, mass affordable NEVs and broad product breadth.

- Notable features: Proprietary battery tech and hybrid systems that deliver high electric range and cost advantages.

- 2024 revenue: BYD reported ≈ RMB 777.1 billion in 2024.

Leading Trends and Their Impact

China as the EREV epicenter: China’s policy framework and consumer demand for long-range family SUVs have created a hotbed for EREVs, with domestic OEMs launching numerous successful range-extended models.

Re-thinking battery sizing: OEMs are experimenting with smaller battery packs plus an efficient range extender to lower cost, weight and charging demand, which can reduce purchase price and grid stress.

Platform modularity & multi-powertrain designs: Flexible platforms accepting BEV, PHEV and EREV powertrains shorten development cycles and enable regional customization.

Regulatory interplay: Incentives and quotas in some regions make EREVs commercially attractive in the short term, while strict BEV mandates push OEMs to accelerate BEV investments for the long term.

Consumer acceptance shift: Buyers who want BEV-like city operation but worry about long trips prefer EREVs, accelerating uptake in specific segments.

Technological improvements in generator efficiency: More efficient small generators reduce fuel penalties and emissions, improving the overall profile of modern EREVs.

Alternative extenders: R&D into fuel-cell, rotary, or biofuel-compatible range extenders may offer lower lifecycle emissions in future designs.

Successful Examples Around the World

- Li Auto L9 / L8 / L6 (China): Large SUVs offering strong electric-only ranges and long combined range figures thanks to onboard generators.

- AITO M9 (China): A tech-forward EREV SUV co-developed with a major tech partner, combining dual-motor layouts with a compact generator for long range.

- Chevrolet Volt (U.S., historical): The first widely sold EREV in North America, which proved the market for electric-first designs with generator backup.

- BMW i3 REx (historical): A premium urban EV with an integrated range-extender that helped shape early consumer expectations for electric-first cars.

- Seres / AITO series (China): Additional Chinese EREVs showing that multiple OEMs can capture demand for long-range hybridized solutions.

Global Regional Analysis — Government Initiatives and Policies

China

China is the global hub for EREVs. The government classifies battery EVs, plug-in hybrids and range-extended vehicles under the NEV umbrella. Production quotas, tax incentives, and strong consumer appetite for long-range SUVs have enabled rapid scaling of EREVs.

Europe

Europe’s regulatory push strongly favors BEVs, with stricter CO₂ targets and plans for ICE limits in coming years. These policies make EREVs more of a short-term transitional solution and favor BEVs long term, especially at scale.

North America

The U.S. presents a mixed federal and state landscape with incentives for EVs and state-level ZEV mandates. Historical EREV examples demonstrate demand, but the region’s increasing focus on BEVs compresses the long-term runway for EREVs as a mainstream architecture.

Asia-Pacific (Japan, Korea, Southeast Asia, India)

Japan and Korea have strong hybrid legacies and are investing in BEVs; EREVs could be relevant in markets with limited fast-charging infrastructure. India and parts of Southeast Asia may find EREVs attractive depending on infrastructure rollout and local policies.

Latin America & Africa

Infrastructure gaps and affordability mean hybrids often dominate. EREVs could be attractive to middle-income buyers and fleets if incentives and fuel economics align.

Policy Levers

- NEV quotas & incentives: Where EREVs qualify, they receive support that directly accelerates adoption.

- BEV mandates: Stricter mandates reduce the medium-term market for EREVs in jurisdictions pushing aggressive BEV targets.

- Charging infrastructure: Slow rollouts extend the practical market for EREVs.

- Testing and certification: Definitions and test cycles affect which vehicles qualify for credits and incentives.

Final Notes on Market Dynamics

The EREV market today is dynamic and regionally differentiated. China leads as the proving ground, with companies leveraging EREV architectures to deliver electric-first driving with long-range assurance. Legacy OEMs and new entrants alike use range-extender know-how as they shift toward BEVs. Infrastructure development, regulatory frameworks, battery costs and consumer preferences will determine the pace and shape of EREV adoption in the coming years.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Commercial Vehicle Market Global Trends, Key Players & Growth Forecast by 2034