Electric Motor Market Size

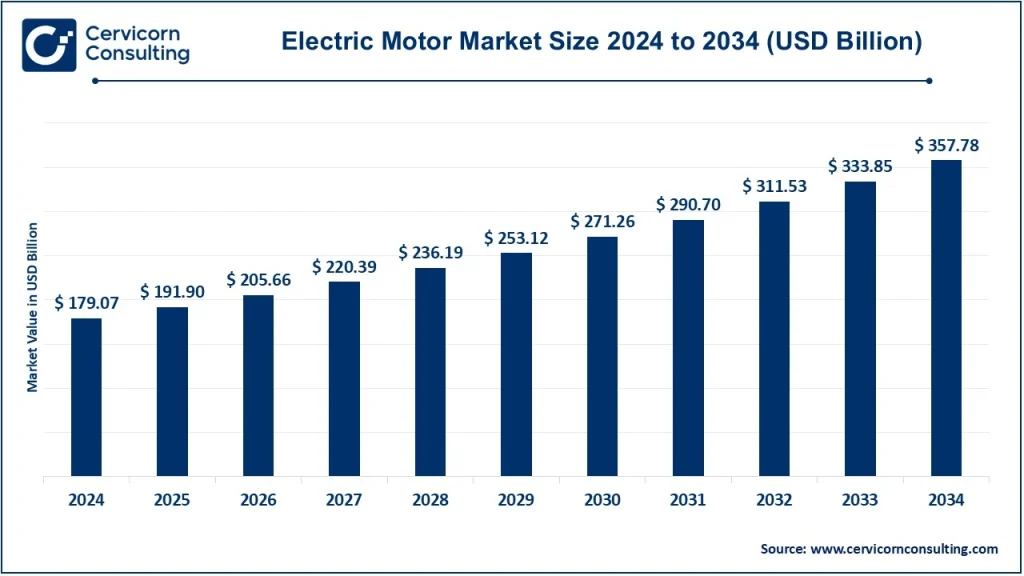

The global electric motor market size was worth USD 179.07 billion in 2024 and is anticipated to expand to around USD 357.78 billion by 2034, registering a compound annual growth rate (CAGR) of 7.16% from 2025 to 2034.

What Is the Electric Motor Market?

The electric motor market encompasses the global industry focused on the design, production, and application of electric motors—devices that convert electrical energy into mechanical energy. These motors are integral to a wide array of sectors including automotive, industrial machinery, household appliances, HVAC systems, medical equipment, aerospace, and electric utilities. The market spans a range of motor types such as AC motors, DC motors, brushless motors, servo motors, and stepper motors. Rapid advancements in motor control technologies, materials science, and power electronics have transformed electric motors from simple mechanical devices into highly efficient, intelligent systems integral to the modern digital-industrial era.

Why Is It Important?

Electric motors are the heartbeat of modern industry and infrastructure. They drive innovation in automation, sustainable transportation, robotics, and energy efficiency. As key components in electric vehicles (EVs), smart home devices, renewable energy systems, and next-generation industrial machinery, they are indispensable to the clean energy transition and global economic productivity. The importance of electric motors is further magnified in efforts to decarbonize economies, improve energy efficiency, and reduce reliance on fossil fuels. With governments and businesses pivoting toward electrification, the electric motor market is central to achieving global sustainability targets and economic modernization.

Growth Factors Driving the Electric Motor Market

The global electric motor market is expanding rapidly due to several converging growth factors. The surging demand for electric vehicles is perhaps the most influential catalyst, as automakers increasingly adopt brushless DC and traction motors to power EVs. Rising industrial automation and adoption of smart manufacturing technologies are driving demand for efficient motors with integrated IoT and sensor capabilities. Government policies supporting energy efficiency and carbon emission reductions are mandating the replacement of traditional combustion systems with electric alternatives.

Additionally, the integration of electric motors in HVAC systems, home appliances, and medical devices contributes to market expansion. Investments in renewable energy, particularly wind and hydropower, further stimulate demand for high-torque, high-efficiency motors. Finally, the development of advanced materials like rare earth magnets and innovations in motor design (such as axial flux and solid-state motors) are enhancing performance while reducing size and cost.

Top Companies in the Electric Motor Market

1. ABB Ltd.

- Specialization: Industrial motors, robotics, automation solutions, and transportation systems.

- Key Focus Areas: Energy efficiency, smart motor systems, sustainable electrification, and Industry 4.0.

- Notable Features: Offers one of the broadest portfolios of electric motors, including synchronous reluctance motors, IE5 ultra-premium efficiency motors, and integrated digital motor monitoring via ABB Ability™.

- 2024 Revenue: Approx. $7.3 billion (from the Motion division, which includes electric motors and drives).

- Market Share: ~14% of the global electric motor market.

- Global Presence: Operations in over 100 countries with manufacturing hubs in Europe, Asia, and North America.

2. Arc Systems Inc.

- Specialization: Custom electric motors for aerospace, military, and industrial markets.

- Key Focus Areas: Brushless DC motors, AC induction motors, and permanent magnet motors.

- Notable Features: Known for custom-built, high-reliability motors used in mission-critical applications including UAVs, missiles, and military ground vehicles.

- 2024 Revenue: Estimated ~$120 million.

- Market Share: ~0.2% (niche, high-value segment).

- Global Presence: Primarily North America with partnerships in Europe and defense contracts globally.

3. Brose Fahrzeugteile SE & Co. KG

- Specialization: Electric motors and mechatronic systems for automotive applications.

- Key Focus Areas: Powertrain electrification, seat systems, and door/liftgate systems.

- Notable Features: Supplies electric motors for EV cooling fans, electric drives, and e-bike systems; strong collaboration with automakers like BMW and Volkswagen.

- 2024 Revenue: Approx. $7.1 billion.

- Market Share: ~3% of the automotive electric motor market.

- Global Presence: 69 locations in 24 countries, with key production in Germany, the US, China, and Eastern Europe.

4. Coburg (Siemens Electric Motors from Coburg)

- Specialization: High-performance motors for industrial and power generation applications.

- Key Focus Areas: High-voltage motors, custom drive solutions, and energy-efficient retrofitting.

- Notable Features: Known for durable motors used in steel mills, cement plants, and oil & gas; part of Siemens’ extensive energy and automation ecosystem.

- 2024 Revenue: ~$2.5 billion (estimated from motor business in Siemens Energy and Digital Industries).

- Market Share: ~5% of the industrial motor segment.

- Global Presence: Predominantly Europe and the Middle East, with exports to Asia and the Americas.

5. DENSO CORPORATION

- Specialization: Automotive motors and components for electrified powertrains.

- Key Focus Areas: EV traction motors, hybrid drive motors, starter-generators.

- Notable Features: Supplies major Japanese automakers and Tesla; strong emphasis on integrated thermal and electrical motor systems.

- 2024 Revenue: Approx. $6.2 billion from the electrification segment.

- Market Share: ~12% of the automotive electric motor market.

- Global Presence: Headquarters in Japan, with over 200 subsidiaries worldwide in North America, China, Europe, and ASEAN.

Leading Trends and Their Impact

1. Electrification of Mobility

The rapid adoption of electric vehicles is reshaping the electric motor market. Motors used in EVs must balance power density, thermal management, and efficiency. Innovations such as axial flux motors and silicon carbide (SiC) inverters are improving performance.

2. Integration of IoT and Predictive Maintenance

Electric motors now feature embedded sensors for real-time health monitoring. These “smart motors” reduce downtime and improve operational efficiency, especially in manufacturing and process industries.

3. Energy Efficiency and IE4/IE5 Standards

Global regulatory push for energy-efficient systems is driving the adoption of IE4 and IE5-rated motors, which consume less electricity and emit fewer greenhouse gases.

4. Rise of Compact and Lightweight Designs

Markets such as robotics, drones, and medical devices demand high-torque, lightweight motors. This trend is pushing innovation in materials like rare earth magnets and aluminum housing, and in design approaches such as direct-drive configurations.

5. Solid-State Motor Technology

Still emerging, solid-state motors eliminate moving parts in specific applications, promising extremely low maintenance and high reliability. This could be transformative in HVAC and utility-scale applications.

Successful Examples Around the World

1. Tesla’s Electric Powertrains

Tesla’s use of permanent magnet synchronous reluctance motors has set new benchmarks for range and acceleration in EVs. The company’s proprietary inverter and motor control software contribute to its market leadership.

2. ABB Motors in Water Infrastructure – Middle East

ABB has supplied IE5-rated motors and drives for desalination plants in Saudi Arabia and the UAE, significantly reducing operational energy consumption and ensuring uninterrupted water supply.

3. DENSO in Toyota Hybrid Models

DENSO electric motors are embedded in Toyota’s hybrid systems (e.g., Prius), which have become benchmarks for reliability and energy savings in the hybrid segment.

4. Brose in e-Bike Systems – Europe

Brose motors are used in over 50 e-bike brands across Europe, contributing to the continent’s green transportation goals. The company’s compact, quiet, and powerful motors are praised for their durability.

5. Siemens Motors in Offshore Wind Turbines – Europe

Siemens Coburg motors power turbine mechanisms in offshore wind farms across Germany and the UK, ensuring high-reliability performance under harsh environmental conditions.

Regional Analysis and Government Policies

North America

- Market Share: ~28%

- Key Drivers: Surge in EV adoption, industrial automation, and energy-efficiency mandates.

- Key Policies:

- U.S. DOE’s Motor Efficiency Regulations and tax incentives for industrial retrofitting.

- Infrastructure Investment and Jobs Act supporting electrified transport and smart grids.

Europe

- Market Share: ~32%

- Key Drivers: EU’s decarbonization targets, stringent motor efficiency regulations, and EV subsidies.

- Key Policies:

- Ecodesign Directive mandates IE3/IE4 motor adoption.

- EU Green Deal and Fit for 55 policies accelerating electric mobility and clean energy integration.

Asia-Pacific

- Market Share: ~30%

- Key Drivers: Manufacturing expansion, rising EV demand, and government support for smart industries.

- Key Policies:

- China’s “Made in China 2025” focuses on energy-efficient manufacturing and EV production.

- India’s FAME II scheme incentivizes EV production and localization of electric motors.

Latin America

- Market Share: ~6%

- Key Drivers: Urbanization, public transit electrification, and energy-saving retrofits.

- Key Policies:

- Brazil’s Procel program promotes efficient motor systems.

- Mexico’s green building codes include motor efficiency mandates.

Middle East & Africa

- Market Share: ~4%

- Key Drivers: Infrastructure development, water and HVAC projects, and oil & gas diversification.

- Key Policies:

- Saudi Arabia’s Vision 2030 includes energy-efficiency standards for motors.

- Africa’s electrification efforts and microgrid programs are increasing motor demand for water pumps and small industries.