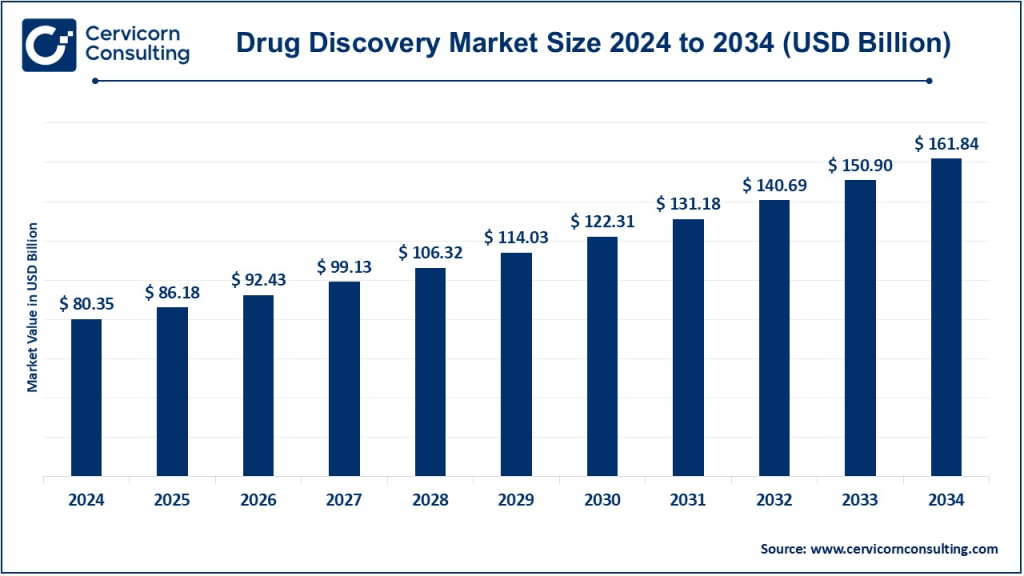

Drug Discovery Market Size

The global drug discovery market size was worth USD 80.35 billion in 2024 and is anticipated to expand to around USD 161.84 billion by 2034, registering a compound annual growth rate (CAGR) of 7.25% from 2025 to 2034.

What is the Drug Discovery Market?

The drug discovery market includes the companies, tools, services, and technologies that support the early stages of drug development. It brings together biopharmaceutical firms, CROs, instrument makers, AI-driven platforms, and academic research centers, all focused on identifying new therapeutic compounds or biological molecules with potential clinical efficacy. The market covers small molecules, biologics, vaccines, peptides, RNA therapies, and newer modalities such as gene and cell therapies.

Drug discovery involves a multi-step process beginning with target identification and validation, followed by hit and lead discovery through screening and computational modeling. The most promising candidates undergo optimization, ADME/Toxicology testing, and preclinical trials to ensure safety and efficacy before moving into clinical development.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2578

Why is the Drug Discovery Market Important?

- Global Health Impact: Drug discovery is the foundation for curing, preventing, and managing diseases. Faster and more efficient discovery translates directly into improved patient outcomes and reduced global disease burdens.

- Economic Significance: The pharmaceutical and biotech sectors contribute massively to global GDP. Successful drug discoveries generate billions in revenues, create high-skill jobs, and stimulate innovation across related industries.

- Technological Innovation: Tools and technologies developed for drug discovery — such as AI, genomics, and high-throughput screening — have applications across multiple sectors including diagnostics, food safety, and agriculture.

- Public Health Preparedness: A robust drug discovery ecosystem ensures rapid response to pandemics and emerging diseases. The COVID-19 vaccine development demonstrated how advanced discovery platforms can save millions of lives in record time.

Drug Discovery Market Growth Factors

The global drug discovery market is driven by a convergence of technological, economic, and scientific factors. Key growth drivers include increased pharmaceutical R&D spending, growing demand for biologics and precision medicines, and advances in artificial intelligence (AI) and machine learning (ML) that accelerate early-stage research.

The expansion of automation, robotics, and high-throughput screening technologies enables faster and more accurate identification of potential drug candidates. Outsourcing to contract research organizations (CROs) and contract development organizations (CDOs) helps pharmaceutical companies reduce costs and enhance flexibility. Aging populations worldwide, rising prevalence of chronic and rare diseases, government funding for biomedical innovation, and regulatory incentives such as accelerated approval pathways further fuel the market. Collectively, these forces are reshaping the discovery landscape and positioning it for sustained growth throughout the coming decade.

Top Companies in the Global Drug Discovery Market

Below is an overview of major players driving innovation and growth in the global drug discovery market in 2024.

1. Pfizer Inc.

- Specialization: Full-spectrum pharmaceutical company engaged in the discovery, development, and commercialization of small molecules, biologics, and vaccines.

- Key Focus Areas: Oncology, vaccines, immunology, cardiovascular, and rare diseases. Pfizer’s mRNA vaccine collaboration with BioNTech remains a hallmark example of rapid drug discovery and development.

- Notable Features: Extensive R&D infrastructure, strong partnerships with biotech firms, and leadership in vaccine innovation.

- 2024 Revenue: Approximately USD 63.6 billion.

- Market Share: Pfizer commands a significant share of global pharmaceutical R&D spending but does not report a separate figure for discovery-specific activities.

- Global Presence: Operations in over 100 countries, with major R&D and manufacturing facilities across North America, Europe, and Asia.

2. GlaxoSmithKline PLC (GSK)

- Specialization: Multinational pharmaceutical company with a leading presence in vaccines and specialty medicines.

- Key Focus Areas: Respiratory diseases, oncology, immunology, and vaccines.

- Notable Features: Strong heritage in vaccine discovery and production, robust R&D pipeline, and partnerships that bridge academia and industry.

- 2024 Revenue: Around £31.4 billion in total turnover.

- Market Share: GSK holds a strong position in global vaccine discovery and production.

- Global Presence: Active across North America, Europe, Asia-Pacific, and emerging markets with major research hubs in the UK and the U.S.

3. Merck & Co., Inc. (MSD)

- Specialization: Research-driven biopharmaceutical company focused on oncology, vaccines, and infectious diseases.

- Key Focus Areas: Immuno-oncology, cardiometabolic disorders, and vaccine development.

- Notable Features: Developer of Keytruda (pembrolizumab), one of the world’s top-selling oncology drugs. Merck’s discovery strategy emphasizes translational medicine and biomarker-driven innovation.

- 2024 Revenue: Approximately USD 64.2 billion.

- Market Share: Merck is among the top global investors in early-stage discovery and translational R&D.

- Global Presence: Global R&D network with major research facilities in the U.S., Europe, and Asia.

4. Agilent Technologies Inc.

- Specialization: Provider of analytical instruments, automation systems, software, and consumables essential to drug discovery laboratories.

- Key Focus Areas: High-performance liquid chromatography (HPLC), mass spectrometry, bioanalysis, and laboratory informatics.

- Notable Features: Its instruments are foundational to ADME/Tox studies, analytical chemistry, and biomarker discovery.

- 2024 Revenue: Approximately USD 6.5 billion.

- Market Share: Agilent is one of the top suppliers in analytical technologies for pharmaceutical R&D and discovery workflows.

- Global Presence: Serves customers worldwide through a vast sales and service network, with manufacturing and R&D centers across the U.S., Europe, and Asia.

5. Eli Lilly and Company

-

Specialization: Global biopharmaceutical company known for innovative medicines in metabolic disorders, oncology, and neuroscience.

-

Key Focus Areas: Diabetes, obesity, oncology, and immunology.

-

Notable Features: Discovery and development of tirzepatide (marketed as Mounjaro/Zepbound), a next-generation metabolic therapy, exemplifies breakthrough discovery success.

-

2024 Revenue: Approximately USD 45 billion.

-

Market Share: Eli Lilly is a major player in metabolic and oncology discovery programs.

-

Global Presence: Strong presence in North America, expanding R&D and manufacturing operations in Europe and Asia.

Leading Trends and Their Impact

1. Artificial Intelligence and Computational Discovery

AI and machine learning are revolutionizing drug discovery by enhancing hit identification, molecular design, and toxicity prediction. Computational models allow scientists to simulate millions of compound interactions in silico, significantly reducing time and cost. This has led to the rise of AI-driven biotech startups and major partnerships between tech firms and pharmaceutical giants.

2. Rise of New Modalities

Beyond small molecules, new therapeutic modalities such as monoclonal antibodies, cell and gene therapies, RNA-based treatments, and antibody-drug conjugates (ADCs) are reshaping discovery. These require novel discovery platforms, manufacturing techniques, and analytical tools, expanding the market’s scope.

3. High-Throughput Screening and Automation

Automated screening technologies have transformed how compounds are tested against biological targets. Robotic systems, coupled with advanced data analytics, enable screening of millions of compounds in weeks, improving the speed and precision of discovery.

4. Outsourcing and Collaboration

Pharma companies increasingly rely on external partnerships to improve efficiency and share risk. Outsourcing to CROs and collaborations with AI-based startups enable faster innovation and cost optimization, fostering a global ecosystem of specialized discovery service providers.

5. Regulatory Evolution and Accelerated Pathways

Agencies like the FDA and EMA have introduced expedited programs—such as Breakthrough Therapy Designation and Accelerated Approval—that incentivize innovation. These frameworks shorten the time between discovery and commercialization, encouraging investment in high-unmet-need areas like oncology and rare diseases.

6. Public Funding and Global Collaboration

Governments and global health organizations are funding drug discovery initiatives for neglected diseases, pandemic preparedness, and antibiotic resistance. Public-private partnerships and open innovation models are driving collaborative discovery efforts at an unprecedented scale.

Successful Examples of Drug Discovery Around the World

Pfizer-BioNTech COVID-19 Vaccine

Pfizer’s collaboration with BioNTech in developing the mRNA-based COVID-19 vaccine remains one of the most remarkable achievements in modern drug discovery. It demonstrated the power of rapid genomic sequencing, AI-assisted design, and global regulatory coordination to produce a lifesaving product in record time.

Merck’s Keytruda

Merck’s Keytruda (pembrolizumab) transformed oncology by targeting the PD-1 receptor, enabling the immune system to fight cancer. Its discovery and clinical success redefined immuno-oncology and set a new standard for precision medicine.

Eli Lilly’s Tirzepatide

Eli Lilly’s tirzepatide, marketed as Mounjaro and Zepbound, represents groundbreaking innovation in metabolic therapy. Its dual-action mechanism for treating diabetes and obesity has positioned Lilly as a leader in endocrine and metabolic research.

Agilent Technologies’ Analytical Solutions

Agilent’s mass spectrometry and chromatography technologies have become cornerstones in analytical testing, accelerating drug discovery processes from biomarker analysis to metabolite identification. The company’s instruments underpin the reliability of modern discovery workflows.

Global Regional Analysis and Government Initiatives

North America (United States and Canada)

North America dominates the drug discovery market, supported by robust public funding, advanced healthcare infrastructure, and a strong regulatory framework. The U.S. National Institutes of Health (NIH), BARDA, and other agencies fund early-stage discovery, while the FDA’s accelerated approval programs shorten time-to-market for promising therapies. Canada’s federal and provincial funding programs also support translational research and biotech incubation. The presence of leading CROs, biotech startups, and top-tier research universities makes the region the most innovation-intensive globally.

Europe

Europe remains a vital hub for drug discovery, with countries like the UK, Germany, France, and Switzerland leading in R&D. The European Union’s Horizon Europe program provides significant funding for cross-border research projects focused on oncology, infectious diseases, and advanced therapeutics. Public-private partnerships, such as the Innovative Medicines Initiative (IMI), strengthen collaboration between academia, regulators, and industry players. European regulators continue to streamline pathways for clinical translation, making the continent a powerhouse of discovery innovation.

Asia-Pacific

Asia-Pacific is experiencing rapid growth in drug discovery investments, especially in China, Japan, India, and South Korea. China’s regulatory reforms and financial incentives for innovation have spurred a surge in domestic biotech startups and partnerships with global pharmaceutical companies. Japan remains a leader in precision medicine and biologics discovery, while India’s Production-Linked Incentive (PLI) schemes are nurturing its R&D and manufacturing base. South Korea’s biotech sector is gaining momentum, with increased venture funding and government-backed initiatives promoting discovery capabilities.

Latin America

Countries such as Brazil, Mexico, and Argentina are gradually expanding their pharmaceutical R&D infrastructure. Government policies supporting clinical research and technology transfer are encouraging foreign investment. While still in early stages, Latin America holds potential as a cost-efficient region for preclinical studies and biosimilar development.

Middle East and Africa

The Middle East, particularly the UAE and Saudi Arabia, is investing in life sciences infrastructure as part of broader economic diversification strategies. Africa, though at an emerging stage, benefits from global health partnerships targeting infectious and neglected diseases. International collaborations and donor-backed initiatives are slowly building regional capabilities in early-stage discovery.

Government Policies and Their Role in Market Shaping

- Regulatory Incentives: Governments are creating faster approval channels for innovative drugs to encourage investment in discovery and development.

- Public-Private Partnerships: Collaborative projects between academia, government, and industry are fostering open innovation and shared risk.

- Funding and Grants: Programs such as NIH (U.S.), Horizon Europe (EU), and national innovation funds in Asia are directly financing early-stage discovery.

- Tax Credits and R&D Incentives: Many countries offer tax benefits to encourage domestic research and attract foreign direct investment.

- Infrastructure and Talent Development: Initiatives promoting biotech clusters, incubators, and R&D talent pipelines strengthen long-term competitiveness in drug discovery.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: AI Smart Glasses Market Revenue, Global Presence, and Strategic Insights by 2034