Digital Transformation in the Insurance Market Size

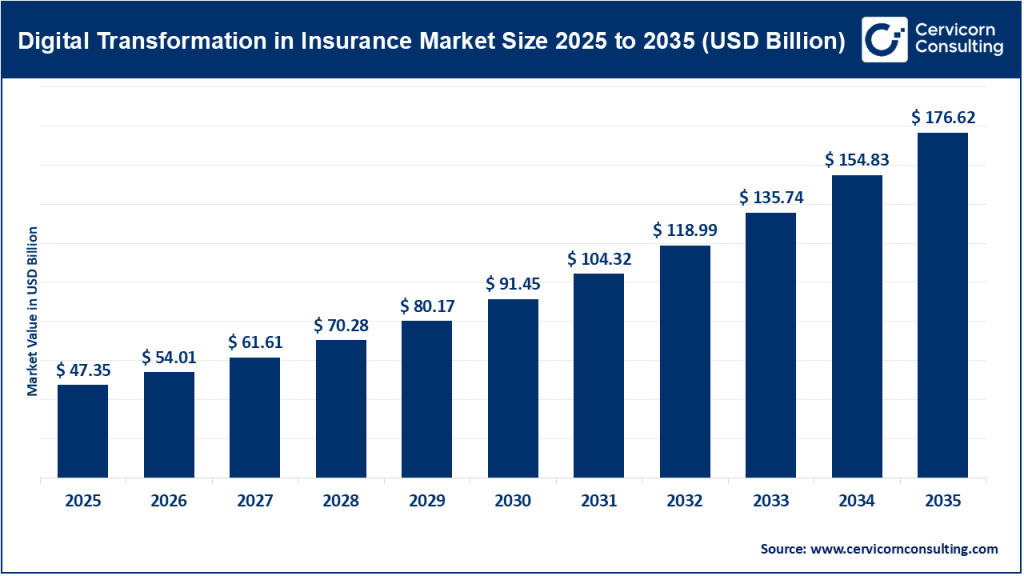

The global digital transformation in insurance market size was worth USD 47.35 billion in 2025 and is anticipated to expand to around USD 176.62 billion by 2035, registering a compound annual growth rate (CAGR) of 14.1% from 2026 to 2035.

What Is Digital Transformation in the Insurance Market?

Digital transformation in the insurance market refers to the comprehensive integration of digital technologies across insurance operations to modernize processes, enhance efficiency, and improve customer engagement. It involves replacing legacy systems and manual workflows with advanced digital solutions that enable real-time data access, automation, and intelligent decision-making. Core insurance functions such as underwriting, policy administration, claims processing, fraud detection, customer service, and compliance are increasingly powered by technologies including artificial intelligence (AI), machine learning (ML), big data analytics, cloud computing, robotic process automation (RPA), blockchain, Internet of Things (IoT) devices, and digital self-service platforms.

Rather than being limited to operational automation, digital transformation reshapes the entire insurance value chain by enabling personalized products, predictive risk modeling, instant policy issuance, and seamless omnichannel customer experiences. It also supports insurers in responding faster to market changes, regulatory requirements, and evolving customer expectations. In today’s digital economy, digital transformation is no longer optional; it is a strategic imperative that determines an insurer’s long-term competitiveness, resilience, and growth.

Digital Transformation in Insurance Market Growth Factors

The growth of digital transformation in the insurance market is driven by a convergence of technological, economic, and consumer-centric factors. Rising customer expectations for faster service, transparency, and personalized insurance offerings have compelled insurers to adopt digital platforms that deliver seamless experiences across mobile and online channels. Increasing competition from agile insurtech startups has further pressured traditional insurers to modernize legacy systems to remain relevant. Rapid advancements in AI, machine learning, data analytics, cloud infrastructure, and IoT technologies have made large-scale automation and predictive risk assessment both feasible and cost-effective.

Additionally, insurers face mounting pressure to reduce operational costs, minimize fraud losses, and improve underwriting accuracy, all of which are enabled by digital tools. Regulatory requirements related to data reporting, compliance, and risk management also accelerate digital adoption. Broader macroeconomic trends such as increased smartphone penetration, internet accessibility, and remote service delivery have further fueled market expansion, positioning digital transformation as a critical growth enabler for the global insurance industry.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2857

Why Digital Transformation in Insurance Is Important

Digital transformation plays a pivotal role in reshaping the insurance industry by addressing long-standing inefficiencies and unlocking new growth opportunities. Traditionally, insurance operations were characterized by manual paperwork, fragmented data systems, long processing cycles, and limited customer interaction. Digital technologies eliminate these inefficiencies by automating workflows, centralizing data, and enabling real-time decision-making. As a result, insurers can significantly reduce claims settlement times, enhance underwriting precision, and proactively detect fraudulent activities.

From a customer perspective, digital transformation improves accessibility and convenience by enabling online policy purchases, instant quotes, mobile claims filing, and 24/7 self-service support. Personalized pricing models and usage-based insurance products further increase customer satisfaction and retention. Operationally, automation reduces administrative costs and human error while freeing employees to focus on strategic and analytical tasks. Moreover, digitally transformed insurers are better equipped to manage regulatory compliance, cybersecurity risks, and data governance requirements. In an era of continuous disruption, digital transformation ensures insurers remain agile, customer-centric, and future-ready.

Key Companies Driving Digital Transformation in Insurance

Shift Technology

Company: Shift Technology

Specialization: AI-driven insurance decisioning platforms

Key Focus Areas: Fraud detection, claims automation, underwriting intelligence, payment integrity, compliance risk management

Notable Features:

Shift Technology leverages advanced AI and machine learning models to automate complex insurance decisions across claims and underwriting workflows. Its platforms analyze vast datasets to detect fraud, reduce false positives, and improve operational accuracy. The company’s collaborative data intelligence approach enables insurers to share insights while maintaining data security.

2024 Revenue: Approximately USD 1 billion (estimated)

Market Share: Strong position within the global insurtech and AI-insurance solutions segment

Global Presence: Operations and clients across more than 25 countries, serving major insurers in North America, Europe, Asia-Pacific, and Latin America

Shift Technology is widely recognized for accelerating insurance digitalization by reducing manual workloads and enabling intelligent automation at scale.

Bestow

Company: Bestow

Specialization: Digital life insurance distribution and underwriting

Key Focus Areas: API-based underwriting, simplified risk assessment, instant policy issuance

Notable Features:

Bestow focuses on transforming the traditionally complex life insurance process into a streamlined digital experience. Its technology eliminates lengthy medical exams and paperwork, allowing customers to obtain life insurance quickly through online channels.

2024 Revenue: Privately held (revenue undisclosed)

Market Share: Growing presence in digital life insurance solutions

Global Presence: Primarily focused on the United States, with scalable digital infrastructure supporting partnerships and expansion

Bestow exemplifies how digital transformation can dramatically improve accessibility and efficiency within life insurance markets.

Snapsheet

Company: Snapsheet

Specialization: Digital claims management and virtual appraisal solutions

Key Focus Areas: Claims automation, virtual inspections, cloud-based claims workflows

Notable Features:

Snapsheet provides insurers with end-to-end digital claims platforms that support remote inspections, automated estimations, and faster settlements. Its solutions significantly reduce cycle times and operational costs while improving customer experience.

2024 Revenue: Privately held; strong year-over-year growth

Market Share: Widely adopted by leading property and casualty insurers

Global Presence: Strong presence in North America with expanding international adoption

Snapsheet plays a critical role in digitizing claims operations, one of the most customer-impacting areas of insurance.

BriteCore

Company: BriteCore

Specialization: Cloud-native core insurance platforms

Key Focus Areas: Policy administration, billing, claims management, system modernization

Notable Features:

BriteCore delivers configurable, API-enabled core systems designed to replace outdated legacy platforms. Its cloud-native architecture allows insurers to scale operations, integrate new technologies, and accelerate digital innovation.

2024 Revenue: Privately held

Market Share: Strong adoption among mid-sized property and casualty insurers

Global Presence: Primarily U.S.-based with growing international footprint

BriteCore supports digital transformation by modernizing foundational insurance infrastructure.

Next Insurance

Company: Next Insurance

Specialization: Digital small business insurance

Key Focus Areas: Automated underwriting, SME-focused products, digital distribution

Notable Features:

Next Insurance offers tailored insurance solutions for small businesses through fully digital platforms. Its technology enables instant quotes, policy purchases, and claims management without intermediaries.

2024 Revenue: Approximately USD 548 million

Market Share: Significant presence in the U.S. small business insurance segment

Global Presence: Strong U.S. footprint with expansion potential through strategic partnerships

Next Insurance demonstrates how digital-first models can disrupt traditional insurance distribution.

Leading Trends in Digital Transformation and Their Impact

Artificial Intelligence and Machine Learning

AI and machine learning are transforming insurance by automating underwriting, claims processing, fraud detection, and customer service. Predictive analytics enables insurers to assess risk more accurately, reduce losses, and personalize pricing. AI-powered chatbots and virtual assistants enhance customer engagement while lowering service costs.

Low-Code and No-Code Platforms

Low-code and no-code platforms allow insurers to rapidly develop and deploy digital applications without extensive software development resources. These platforms reduce time-to-market, foster innovation, and empower business teams to customize workflows and services.

IoT and Telematics Integration

Connected devices such as vehicle telematics, wearables, and smart home sensors provide real-time data on customer behavior and risk exposure. This data enables usage-based insurance, dynamic pricing, proactive loss prevention, and personalized policy offerings.

Robotic Process Automation (RPA)

RPA automates repetitive tasks such as data entry, policy renewals, and compliance reporting. Automation improves accuracy, reduces processing time, and significantly lowers operational costs, allowing insurers to focus on strategic initiatives.

Cloud Computing and Digital Platforms

Cloud adoption underpins modern insurance transformation by enabling scalability, flexibility, and cost efficiency. Cloud platforms support integration with AI, analytics, and mobile technologies while improving disaster recovery and system resilience.

Successful Examples of Digital Transformation in Insurance Worldwide

AI-Driven Insurance Platforms in China

Chinese insurers have adopted AI-based underwriting and claims models that analyze consumer data to offer highly personalized products. These platforms enable rapid product innovation, improved risk assessment, and large-scale digital distribution.

India’s Unified Digital Insurance Ecosystem

India has introduced nationwide digital insurance platforms that consolidate policy issuance, claims processing, and regulatory reporting into a single digital ecosystem. These initiatives promote transparency, efficiency, and financial inclusion across urban and rural populations.

Digital Claims Transformation in the United States

U.S. insurers have widely implemented digital claims platforms that use AI, automation, and virtual inspections to speed up settlements. These systems significantly enhance customer satisfaction while reducing claims handling costs.

Global Regional Analysis Including Government Initiatives and Policies

North America

North America leads the digital transformation of insurance due to strong digital infrastructure, high technology adoption, and substantial investment in insurtech innovation. Regulatory frameworks encourage experimentation through innovation sandboxes while maintaining consumer protection standards. Insurers in the region actively deploy AI, cloud computing, and automation across core operations.

Asia-Pacific

Asia-Pacific represents the fastest-growing region for insurance digital transformation. Government-led digital identity programs, supportive regulatory policies, and widespread mobile adoption drive rapid modernization. Countries such as India, China, and Southeast Asian nations emphasize digital insurance to improve financial inclusion and market penetration.

Europe

Europe’s digital insurance transformation is shaped by strict data protection regulations and consumer privacy laws. These policies foster trust in digital insurance services while encouraging insurers to adopt secure, interoperable platforms. European insurers focus on omnichannel engagement, compliance automation, and customer-centric digital strategies.

Latin America, Middle East, and Africa

Emerging markets in Latin America, the Middle East, and Africa are increasingly adopting mobile-first insurance models. Government-supported innovation hubs, regulatory sandboxes, and digital financial inclusion programs enable insurers to reach underserved populations through affordable digital products.

Government Policies Influencing Market Growth

Across regions, governments are shaping digital insurance adoption through regulatory sandboxes, digital identity frameworks, electronic KYC systems, data privacy regulations, financial inclusion initiatives, and public-private partnerships. These policies create balanced environments where innovation thrives alongside consumer protection and risk management.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Micromobility Market Revenue, Global Presence, and Strategic Insights by 2035