Market Overview

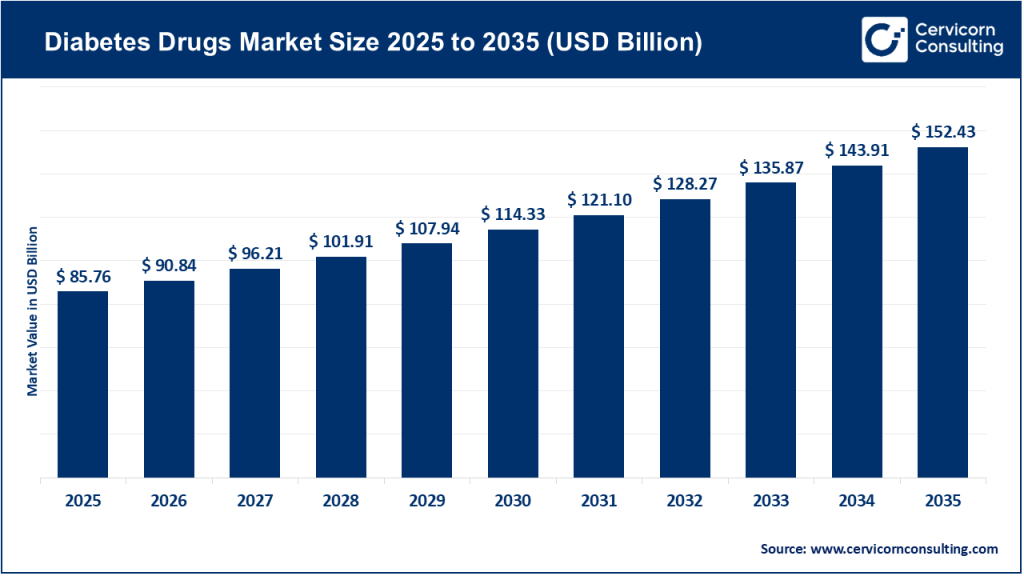

The global diabetes drugs market size was worth USD 85.76 billion in 2025 and is anticipated to expand to around USD 152.43 billion by 2035, registering a compound annual growth rate (CAGR) of 5.92% from 2025 to 2034.

The market is driven by the increasing prevalence of diabetes worldwide, rising healthcare expenditures, advancements in drug innovation, and expanded adoption of newer classes of antidiabetic therapies. Novel drug categories—particularly GLP-1 receptor agonists and SGLT2 inhibitors—are transforming diabetes management with benefits that extend beyond glycaemic control, such as weight loss and cardio-renal protection. As a result, pharmaceutical companies are investing heavily in research, manufacturing scale-up, and multi-indication strategies.

What is the Diabetes Drugs Market?

The diabetes drugs market includes all pharmaceutical therapies designed to prevent, manage, or treat diabetes mellitus—a chronic metabolic disorder characterized by high blood sugar levels resulting from insulin resistance, impaired insulin production, or both. The market encompasses:

- Insulin products (human insulin, analog insulin, ultra-long acting and rapid-acting formulations)

- Oral antidiabetic drugs (metformin, sulfonylureas, DPP-4 inhibitors, TZDs)

- SGLT2 inhibitors

- GLP-1 receptor agonists (injectable and oral)

- Combination therapies

- Adjunct drugs with obesity or cardiovascular indications

The market also includes generic, branded, and biosimilar drugs distributed across hospitals, retail pharmacies, and specialty clinics.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2821

Why is the Diabetes Drugs Market Important?

Diabetes is one of the world’s most urgent public-health challenges. The disease affects hundreds of millions globally and is associated with multiple severe health complications, including:

- Cardiovascular diseases

- Kidney failure

- Nerve damage

- Vision loss

- Lower-limb amputations

The economic burden of diabetes—spanning treatment, long-term care, and productivity losses—is significant for families, healthcare systems, and governments. Advanced diabetes therapies are essential because they:

- Improve quality of life

- Reduce life-threatening complications

- Lower long-term healthcare costs

- Support healthy ageing

- Decrease obesity-related risks

- Improve cardiovascular and renal outcomes

The shift toward innovative drug classes is reshaping the industry and redefining standard care protocols worldwide.

Growth Factors of the Diabetes Drugs Market

The diabetes drugs market is expanding rapidly due to rising global diabetes prevalence, driven by ageing populations, sedentary lifestyles, and obesity; growing diagnosis and treatment rates in emerging economies; increased uptake of new drug classes such as GLP-1 receptor agonists and SGLT2 inhibitors that offer cardio-renal benefits and weight loss; strong investment in R&D to develop longer-acting insulin, oral GLP-1 formulations, and combination therapies; favorable reimbursement policies for high-efficacy drugs; and broader access to generic and biosimilar insulins that increase affordability and treatment penetration across developing regions.

Top Companies in the Diabetes Drugs Market

Below are the leading global players shaping the diabetes drugs market, along with their expertise, focus areas, notable features, 2024 performance, and global footprint.

1. Novo Nordisk

Specialization:

World leader in diabetes and obesity care with a portfolio focused on insulin, GLP-1 therapies, and cutting-edge metabolic drugs.

Key Focus Areas:

- GLP-1 receptor agonists (Ozempic®, Rybelsus®)

- Obesity treatment (Wegovy®)

- Long-acting insulin analogues

- Advanced delivery devices

Notable Features:

- Dominant position in GLP-1 class globally

- Strong manufacturing capabilities

- Expanding obesity and cardiometabolic pipeline

2024 Revenue & Market Share:

Novo Nordisk saw strong 2024 revenue growth led by unprecedented demand for GLP-1 therapies. Diabetes and obesity care contributed the majority of its pharmaceutical sales. The company holds the largest global market share in GLP-1 products.

Global Presence:

Operations in 70+ countries with strong presence in North America, Europe, Middle East, and Asia-Pacific.

2. Bayer AG

Specialization:

A diversified life sciences conglomerate with interests in pharmaceuticals, consumer health, and diagnostics. While not exclusively focused on diabetes, the company contributes metabolic and cardiovascular solutions.

Key Focus Areas:

- Cardiometabolic diseases

- Preventive medicine

- Global healthcare initiatives

Notable Features:

- One of the world’s largest pharmaceutical & life sciences companies

- Strong R&D ecosystem

- Integrated healthcare offerings

2024 Revenue & Market Share:

Bayer reported revenue exceeding €46 billion in 2024 across its business units. Its diabetes-related contributions come from its pharmaceuticals segment, though not as a dedicated diabetes specialist.

Global Presence:

Worldwide presence in over 90 countries, with strong distribution networks in Europe, the Americas, and Asia.

3. Johnson & Johnson (J&J)

Specialization:

Global healthcare giant with pharmaceuticals, medical devices, and consumer health. Its diabetes exposure is indirect but significant through metabolic drug development and devices.

Key Focus Areas:

- Innovative medicines

- Medical technologies

- Cardiometabolic drug research

Notable Features:

- Extensive global R&D footprint

- Integrated device-pharma approach

- Strategic investment in chronic disease management

2024 Revenue & Market Share:

J&J’s 2024 pharmaceutical revenues reflect continued strength across chronic disease therapies. Diabetes is one area within its broader therapeutic portfolio.

Global Presence:

Active in more than 60 countries with a global sales footprint across all healthcare sectors.

4. Boehringer Ingelheim

Specialization:

A leading player in human pharmaceuticals, particularly known for its success in cardio-renal and metabolic diseases through its breakthrough drug Jardiance®.

Key Focus Areas:

- SGLT2 inhibitor development

- Cardiovascular and renal outcomes

- Metabolic disease pipeline

Notable Features:

- Privately held, heavily R&D-focused

- Strong portfolio diversification

- Global partnership with Eli Lilly

2024 Revenue & Market Share:

Boehringer Ingelheim’s diabetes portfolio, especially Jardiance®, achieved multi-billion euro sales in 2024, contributing significantly to global SGLT2 inhibitor market share.

Global Presence:

Present in 100+ markets with major commercial operations across Europe, the U.S., and Asia.

5. Dr. Reddy’s Laboratories

Specialization:

India-based pharmaceutical manufacturer specializing in generics, biosimilars, and affordable diabetes drugs.

Key Focus Areas:

- Generic antidiabetic medications

- Biosimilar insulins

- Cost-efficient manufacturing

- Emerging-market access

Notable Features:

- Strong focus on affordability

- Major supplier to developing nations

- Growing biologics pipeline

2024 Revenue & Market Share:

Dr. Reddy’s reported steady growth in 2024, driven by generics and biosimilars. The company retains a solid share in global generic antidiabetic medications.

Global Presence:

Extensive presence across India, Russia, the U.S., Europe, and over 70 emerging markets.

Leading Trends in the Diabetes Drugs Market and Their Impact

1. Rise of GLP-1 Receptor Agonists

GLP-1 drugs have transformed diabetes treatment due to their dual effect: reducing blood glucose and promoting meaningful weight loss. Their enormous commercial success has reshaped industry strategies, manufacturing priorities, and competition.

Impact:

- Rapid revenue growth for GLP-1 manufacturers

- Shift in standard of care

- Expansion into obesity and cardiovascular indications

2. Expansion of SGLT2 Inhibitors (Cardio-Renal Benefits)

SGLT2 inhibitors such as empagliflozin are gaining traction for their benefits beyond glycaemic control, including protection against heart failure and kidney disease.

Impact:

- Larger eligible patient groups

- Strong payer support for long-term savings

- Cross-specialty adoption (endocrinology, cardiology, nephrology)

3. Growing Availability of Biosimilar Insulins

Increased competition from biosimilars is reducing prices and expanding access globally.

Impact:

- Improved affordability

- Wider treatment access in low-income regions

- Pricing pressure on branded insulin manufacturers

4. Innovation in Drug Delivery & Convenience

Oral GLP-1 formulations, patch pumps, long-acting injectables, and connected devices are improving patient adherence.

Impact:

- Higher patient satisfaction

- Greater therapy retention

- Increased adoption among newly diagnosed patients

5. Demand in Emerging Markets

Asia-Pacific, Latin America, and Africa are seeing rapid growth in diabetes prevalence and drug uptake.

Impact:

- Opportunity for generics and biosimilars

- Local manufacturing and partnerships

- Government-led screening programs

Successful Examples in the Diabetes Drugs Market Worldwide

1. Ozempic® and Wegovy® (Novo Nordisk)

These GLP-1 therapies have become global success stories due to their combined impact on diabetes, weight loss, and cardiometabolic health. They have set new benchmarks for metabolic drugs.

2. Jardiance® (Boehringer Ingelheim / Eli Lilly)

One of the most successful SGLT2 inhibitors globally, widely adopted for its heart and kidney protective benefits across diabetic and non-diabetic populations.

3. Biosimilar & Low-Cost Insulin Programs

Manufacturers and global health organizations have collaborated to improve insulin accessibility in low- and middle-income countries, increasing diagnosis and treatment rates.

Global Regional Analysis & Government Initiatives

North America

-

Trends: High adoption of GLP-1 and SGLT2 drugs; strong payer-driven competition; robust R&D ecosystem.

-

Government Policies: Drug price negotiations, Medicare reforms, obesity-care expansion, and national chronic disease prevention programs.

Europe

- Trends: Moderate but steady uptake of innovative drugs; emphasis on cost-effectiveness.

- Government Policies: Pricing regulations, centralized EMA approvals, national reimbursement frameworks.

Asia-Pacific

- Trends: Fastest-growing regional market due to huge population base and rising diabetes prevalence.

- Government Policies: Local manufacturing incentives (e.g., India), large-scale diabetes screening, public health insurance expansion.

Latin America

- Trends: Increasing adoption of generics and biosimilars; access still limited by affordability.

- Government Policies: Subsidized medicine programs, price caps, chronic disease management initiatives.

Middle East & Africa

- Trends: Growing demand but high disparity between urban and rural access.

- Government Policies: Public-private partnerships, national diabetes control programs, focus on improving insulin availability.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Payment Integrity Market Growth Drivers, Trends, Key Players and Regional Insights by 2035