Dental Implants and Prosthetics Market Size

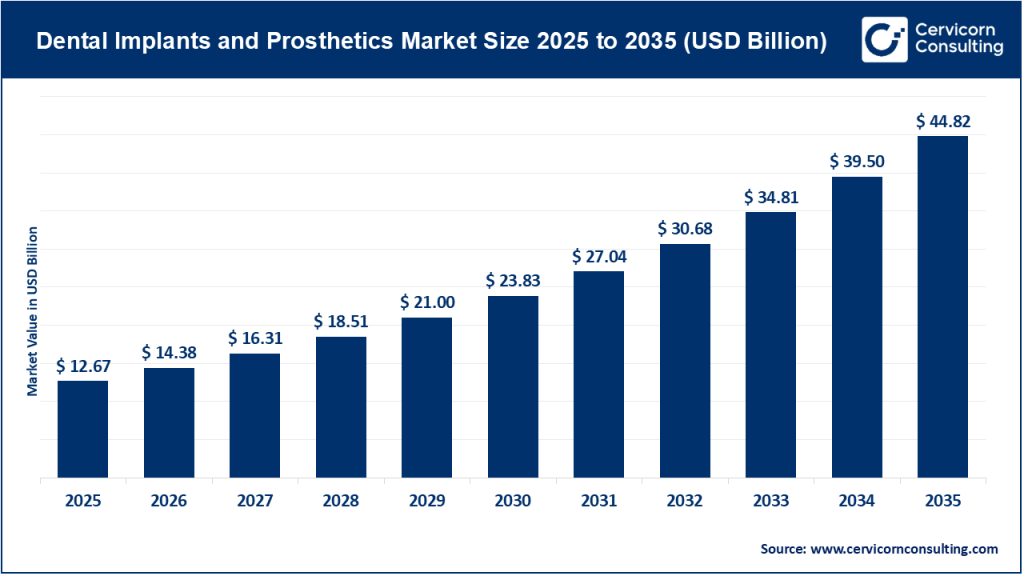

The global dental implants and prosthetics market size was worth USD 12.67 billion in 2025 and is anticipated to expand to around USD 44.82 billion by 2035, registering a compound annual growth rate (CAGR) of 13.5% from 2026 to 2035.

What Is the Dental Implants and Prosthetics Market?

The dental implants and prosthetics market includes all products, technologies, and services involved in replacing missing teeth or restoring damaged dental structures using artificial devices. This market primarily consists of dental implants — typically titanium or ceramic posts surgically placed into the jawbone — and prosthetic components such as crowns, bridges, dentures, abutments, and customized restorations.

Dental implants function as artificial tooth roots that anchor prosthetic teeth, while prosthetics restore chewing ability, speech, comfort, and aesthetics. Over the past two decades, this market has evolved significantly due to advances in digital dentistry, biomaterials, surgical precision, and patient expectations. Dental restoration is no longer viewed as purely functional; it is now deeply associated with cosmetic enhancement and overall quality of life.

Modern dental implants and prosthetic solutions rely heavily on digital workflows, including CAD/CAM systems, intraoral scanners, 3D imaging, guided surgery software, and additive manufacturing techniques. These innovations have transformed implantology into a highly predictable, minimally invasive, and patient-centric field.

Growth Factors Driving the Dental Implants and Prosthetics Market

The dental implants and prosthetics market is experiencing sustained global growth driven by multiple interconnected factors. A rapidly aging global population has led to increased incidences of tooth loss, periodontal disease, and edentulism, creating strong demand for restorative solutions. Rising awareness of oral health and aesthetics has encouraged patients to seek permanent and visually appealing tooth replacement options rather than traditional removable dentures. Advancements in digital dentistry — including CAD/CAM systems, intraoral scanning, guided implant surgery, and 3D printing — have significantly improved treatment precision, efficiency, and clinical outcomes.

Additionally, increasing disposable incomes, expanding dental insurance coverage, and the growing popularity of cosmetic dentistry procedures are further fueling adoption. The emergence of dental tourism, particularly in cost-competitive regions, has also expanded patient access to implant procedures. Together, these growth drivers continue to reshape the market landscape, supporting long-term expansion across both developed and emerging economies.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2896

Why Is the Dental Implants and Prosthetics Market Important?

1. Oral Health and Systemic Wellbeing

Tooth loss is not merely a cosmetic concern. Missing teeth can lead to bone resorption, impaired chewing function, speech difficulties, jaw misalignment, and nutritional challenges. Dental implants help preserve bone structure, while prosthetics restore essential oral functions.

2. Quality of Life Enhancement

Dental restoration directly affects confidence, comfort, and social interactions. Modern implants and prosthetics offer natural-looking, durable, and highly functional solutions that significantly improve patient quality of life.

3. Technological Innovation Driver

This market drives innovation in digital imaging, biomaterials, CAD/CAM design, robotics-assisted surgery, and 3D printing. Many of these technologies influence broader medical device and surgical industries.

4. Economic and Healthcare Impact

Restorative dentistry contributes significantly to healthcare spending, clinical training, dental research, and employment. As populations age, demand for long-lasting restorative solutions continues to grow.

5. Shift Toward Preventive and Restorative Care

Healthcare systems increasingly recognize oral health as an essential component of overall health. This shift supports investment in restorative technologies and treatment accessibility.

Key Companies in the Dental Implants and Prosthetics Market

Envista Holdings

Specialization:

Envista Holdings operates as a diversified dental solutions company with strong capabilities in dental implants, imaging systems, orthodontics, and restorative technologies. Its implant portfolio includes globally recognized brands that cater to a wide range of clinical applications.

Key Focus Areas:

- Dental implant systems and prosthetic components

- Digital dentistry workflows

- Imaging and diagnostic solutions

- Professional education and clinical training

Notable Features:

Envista benefits from a broad product ecosystem spanning surgical, restorative, and digital technologies. Its multi-brand strategy allows it to address premium, mid-range, and value-oriented segments.

2024 Revenue:

Envista’s revenue reflects strong contributions from implantology, orthodontics, and equipment segments.

Market Share:

Envista is widely regarded as one of the leading players in the global dental implant space.

Global Presence:

Extensive operations across North America, Europe, Asia-Pacific, and emerging markets.

Dentsply Sirona

Specialization:

Dentsply Sirona is a major dental technology company integrating dental equipment, digital workflows, imaging systems, and implant solutions. It is particularly known for advancing chairside digital restoration.

Key Focus Areas:

- Digital dentistry systems

- Implant and prosthetic solutions

- CAD/CAM technologies

- Clinical efficiency tools

Notable Features:

The company’s integrated digital ecosystem supports faster diagnosis, planning, and prosthetic fabrication, enabling clinicians to deliver highly precise restorations.

2024 Revenue:

Dentsply Sirona maintains strong revenue streams from equipment, consumables, and implantology.

Market Share:

Positioned among the top global dental technology providers with a meaningful presence in implants.

Global Presence:

Strong footprint across developed and emerging dental markets worldwide.

Henry Schein

Specialization:

Henry Schein functions primarily as a healthcare distribution and solutions provider, supplying dental implants, prosthetic materials, equipment, and value-added services.

Key Focus Areas:

- Dental product distribution

- Implant and prosthetic supplies

- Practice management solutions

- Professional education services

Notable Features:

Henry Schein’s competitive advantage lies in its vast distribution network, logistics infrastructure, and clinician support systems.

2024 Revenue:

Revenue contributions stem from broad dental and healthcare distribution activities.

Market Share:

Commands a substantial share of dental product distribution globally.

Global Presence:

Operates across numerous international markets with extensive supply chain reach.

Zimmer Biomet

Specialization:

Zimmer Biomet is a global medical device company with a focused dental division offering implant systems, biomaterials, and surgical solutions.

Key Focus Areas:

- Dental implant systems

- Surgical technologies

- Biomaterial innovation

- Digital integration partnerships

Notable Features:

The company leverages deep expertise from orthopedic and musculoskeletal implant technologies, enhancing material science and structural design capabilities.

2024 Revenue:

Dental revenues contribute strategically within its diversified medical device portfolio.

Market Share:

Maintains a respected position within the dental implant segment.

Global Presence:

Global operations spanning major healthcare markets.

Glidewell Dental

Specialization:

Glidewell Dental is widely recognized for dental laboratory services, prosthetic appliances, and restorative solutions.

Key Focus Areas:

- Dental prosthetics

- Implant-supported restorations

- Custom restorative appliances

- Digital lab workflows

Notable Features:

Glidewell’s strength lies in prosthetic manufacturing, customization capabilities, and laboratory innovation.

2024 Revenue:

Revenue leadership is particularly strong within prosthetic and lab service segments.

Market Share:

Highly influential within the prosthetic and restorative appliance space.

Global Presence:

Strongest in North America with growing international collaborations.

Leading Trends and Their Impact

Digital Dentistry Transformation

Digital workflows are revolutionizing implant planning, surgical precision, and prosthetic fabrication. Intraoral scanners, CAD/CAM design, and guided surgery systems reduce treatment times and improve predictability.

Impact:

- Greater procedural accuracy

- Reduced chair time

- Improved patient outcomes

- Enhanced clinical efficiency

Biomaterial Innovation

Advancements in titanium alloys, zirconia implants, and hybrid biomaterials are improving durability, aesthetics, and biocompatibility.

Impact:

- Improved osseointegration

- Better aesthetic outcomes

- Expanded patient preferences

Minimally Invasive Procedures

Flapless surgery and guided implant techniques are reducing surgical trauma and recovery time.

Impact:

- Higher patient acceptance

- Faster healing

- Reduced complications

Customization and Personalization

3D printing and digital design tools enable patient-specific implants and prosthetics.

Impact:

- Improved fit and comfort

- Enhanced clinical success

- Higher satisfaction rates

Growth of Dental Tourism

Patients increasingly travel internationally for cost-effective implant procedures.

Impact:

- Increased procedure volumes

- Expanded global competition

- Price optimization pressures

Successful Examples Around the World

United States

The U.S. remains a highly advanced market characterized by digital dentistry adoption, same-day implants, and integrated restorative workflows.

Western Europe

European markets benefit from strong dental education, regulatory frameworks, and reimbursement structures supporting restorative care.

Asia-Pacific

Asia-Pacific is among the fastest-growing regions, driven by rising incomes, expanding dental infrastructure, and growing awareness.

Latin America

Countries such as Brazil and Mexico are emerging as important dental tourism hubs with growing implant adoption.

Middle East

Healthcare investments and premium dental services are driving advanced implant procedures in urban centers.

Global Regional Analysis: Government Initiatives and Policies

North America

Policies promoting digital health technologies, quality standards, and patient safety continue to shape the implant ecosystem.

Europe

Reimbursement structures and healthcare innovation funding drive restorative dentistry adoption.

Asia-Pacific

Healthcare expansion, procurement reforms, and insurance coverage growth support wider access to implants.

Latin America

Government investments in oral healthcare infrastructure enhance restorative treatment availability.

Middle East & Africa

Healthcare modernization and private sector expansion drive gradual implant adoption growth.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Plant-Based Protein Market Drivers, Trends, Key Players and Regional Insights by 2035