Data Center Infrastructure Market Size

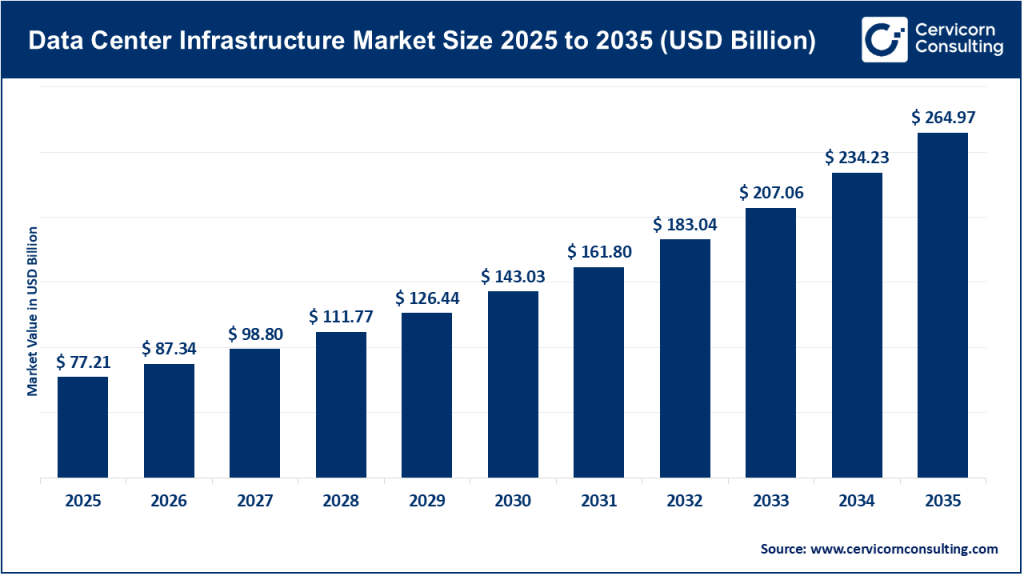

The global data center infrastructure market size was worth USD 77.21 billion in 2025 and is anticipated to expand to around USD 264.97 billion by 2035, registering a compound annual growth rate (CAGR) of 13.12% from 2026 to 2035.

What Is the Data Center Infrastructure Market?

The data center infrastructure market encompasses all hardware, software, and physical systems that support data processing, storage, networking, and IT operations within public, private, hybrid, and edge data centers. This includes compute servers (general-purpose and GPU-accelerated systems), enterprise storage arrays (all-flash, hybrid, object, file), data center networking equipment (switches, fabrics, SDN), power distribution units (PDUs), UPS systems, battery technologies, cooling and thermal management systems, racks, cabling, integrated systems (HCI), and management platforms like DCIM and AI-based monitoring.

The sector serves hyperscalers (Google, Microsoft, AWS), cloud providers, telecom operators, colocation providers, enterprises across banking, healthcare, retail, and government, as well as fast-growing edge environments supporting IoT, autonomous vehicles, and real-time analytics.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2842

Why Is Data Center Infrastructure Important?

Data center infrastructure is critical because it ensures the availability, performance, reliability, security, and scalability of digital operations. Every digital service — cloud computing, mobile apps, e-commerce, AI model training, banking transactions, remote work, streaming, enterprise software, and government platforms — relies on data centers functioning efficiently. Infrastructure decisions determine power usage, carbon footprint, operational costs, business continuity, and competitiveness. At a national level, data centers support digital sovereignty, cybersecurity, economic growth, and mission-critical public services. For enterprises, modern infrastructure is foundational for innovation, automation, and the ability to deploy AI at scale.

Data Center Infrastructure Market — Growth Factors

The data center infrastructure market is growing rapidly due to exploding demand for AI and GPU-intensive workloads, massive cloud adoption, hybrid-cloud modernization, rising enterprise data volumes, and widespread digital transformation. Hyperscaler expansions, increased colocation demand, and global edge deployments driven by 5G and IoT continue to accelerate capacity additions. Sustainability mandates and rising energy costs are pushing operators toward highly efficient power and cooling technologies, liquid cooling, renewable-powered facilities, and modular infrastructure. Governments are implementing data sovereignty laws, local hosting requirements, and incentives for domestic data center construction, boosting regional investments. Meanwhile, improved supply-chain stability and the need for high-density, AI-ready hardware are significantly reshaping the compute, storage, and networking landscape — collectively driving the market’s strong growth trajectory.

Company Profiles

1. Dell Technologies

Specialization:

Compute servers, enterprise storage, hyperconverged infrastructure (HCI), data center software, cloud and as-a-service solutions.

Key Focus Areas:

- PowerEdge high-performance servers

- PowerStore, PowerScale & PowerMax storage

- VxRail HCI systems

- Hybrid/multi-cloud data mobility solutions

- AI-optimized architectures and lifecycle services

Notable Features:

End-to-end portfolio covering compute, storage, HCI, and services; strong global supply chain; deep enterprise and hyperscaler relationships; rapid refresh cycles to support GPU workloads.

2024 Revenue:

Approximately $88.4 billion.

Market Share:

One of the top global leaders in servers and enterprise storage; consistently holding strong positions in global hardware spending categories.

Global Presence:

North America, Europe, Asia-Pacific, Middle East, and Latin America with extensive partner networks, service centers, and manufacturing locations.

2. Cisco Systems, Inc.

Specialization:

Networking infrastructure for data centers, cloud, and enterprise environments.

Key Focus Areas:

- Data center switching (Nexus series)

- Fabric architectures (spine-leaf, ACI)

- Network security, SD-WAN, and observability

- Network automation and AI-driven monitoring

Notable Features:

Large enterprise customer base; strong integration of hardware + software; focus on subscription revenue; deep channel and systems integrator ecosystems.

2024 Revenue:

Approximately $53.8 billion.

Market Share:

Market leader in enterprise and data center networking; dominant share in switching and multi-domain networking automation.

Global Presence:

Active across the U.S., Europe, Asia, and emerging markets, with one of the largest global partner ecosystems.

3. IBM Corporation

Specialization:

Hybrid cloud platforms, enterprise systems (mainframes, Power systems), storage, infrastructure software, and consulting.

Key Focus Areas:

- Hybrid cloud modernization

- Enterprise AI via watsonx

- Security and infrastructure automation

- Mainframe modernization

- Cloud management and consulting services

Notable Features:

Strong presence in regulated industries; deep consulting and integration capabilities; proprietary enterprise-grade hardware; long-term partnerships with governments and Fortune 500 enterprises.

2024 Revenue:

Approximately $62.8 billion.

Market Share:

Leading market share in mainframes, strong footprint in enterprise services and hybrid cloud integration.

Global Presence:

Worldwide operations across more than 170 countries; strong presence in government, BFSI, telecom, and healthcare segments.

4. Schneider Electric SE

Specialization:

Physical data center infrastructure — power, cooling, electrical distribution, microgrids, and data center infrastructure management (DCIM).

Key Focus Areas:

- UPS systems, PDUs, breakers

- Precision cooling and liquid cooling

- Modular/prefabricated data centers

- Sustainability and energy management

- EcoStruxure DCIM platform

Notable Features:

Industry leader in power & cooling; high innovation in sustainable designs; global expertise in prefabricated and modular infrastructure; major supplier to hyperscalers and colocation providers.

2024 Revenue:

Approximately €38 billion.

Market Share:

Top global share in power distribution, critical cooling, and modular data center infrastructure.

Global Presence:

Strong footprint in Europe, North America, China, India, and Latin America with major engineering and supply chain hubs worldwide.

5. Oracle Corporation

Specialization:

Enterprise databases, cloud infrastructure (OCI), engineered systems (Exadata), and application software.

Key Focus Areas:

- Oracle Cloud Infrastructure (OCI)

- Autonomous Database

- Exadata Engineered Systems

- Enterprise applications cloud

- High-performance database workloads in cloud/colo settings

Notable Features:

Deep specialization in mission-critical workloads, optimized hardware + cloud integration, global cloud region expansion, strong enterprise migration momentum.

2024 Revenue:

Approximately $53 billion.

Market Share:

A top player in enterprise database systems and rapidly expanding cloud infrastructure share.

Global Presence:

Data centers and cloud regions across North America, EMEA, APAC, Middle East, and Latin America, including government cloud partnerships.

Leading Trends in the Data Center Infrastructure Market and Their Impact

1. AI, GenAI & GPU-Accelerated Compute

The single biggest driver of new data center designs is generative AI. High-density GPU servers require significantly more power, cooling, and advanced networking. This pushes operators toward liquid cooling, high-bandwidth fabrics, larger electrical infrastructure, and redesigned layouts.

2. Sustainability & Energy Efficiency

Rising energy costs and carbon mandates are forcing operators to adopt:

- Liquid cooling

- Renewable energy PPA models

- Heat reuse systems

- High-efficiency UPS

- Advanced PUE monitoring

Sustainable data centers are no longer optional — they’re essential for regulatory compliance and cost control.

3. Hyperscaler & Colocation Expansion

Hyperscalers are building multi-gigawatt campuses worldwide. Colocation providers are developing AI-ready halls with 30–60 kW rack densities. This surge drives massive demand for modular builds, high-density racks, and intelligent power systems.

4. Growing Use of Hyperconverged & Integrated Systems

HCI and engineered systems simplify deployment, reduce footprint, and enhance scalability. Enterprises moving to hybrid cloud architectures prefer these systems for rapid modernization.

5. Edge Data Center Expansion

5G, IoT, autonomous vehicles, and smart cities require micro-data centers closer to users. Edge deployments demand ruggedized, compact, remotely managed infrastructure.

6. AI-Driven Automation & DCIM

Infrastructure-as-code, predictive maintenance, and AI-based workload optimization improve reliability and reduce downtime. DCIM platforms with real-time insights are becoming a core requirement.

7. Geo-Political Influence on Supply Chains

Tariffs, export restrictions, and regionalization are causing vendors to diversify manufacturing and adapt supply chains, affecting costs and product availability.

Examples of Successful Data Center Infrastructure Deployments Worldwide

Hyperscale AI Campuses (U.S., Europe, Asia)

Massive custom-built campuses using high-density racks, energy-efficient cooling, and dedicated substations designed for AI model training represent the future of large-scale infrastructure.

Colocation Hubs (Virginia, Frankfurt, London, Singapore)

These markets host some of the world’s most advanced colocation facilities, offering high-density workloads, modular hall designs, and advanced telco interconnect ecosystems.

Modular Data Centers in Emerging Markets

Prefabricated, containerized data centers enable fast deployment in regions with limited infrastructure, improving digital access in Africa, India, and parts of Southeast Asia.

Financial Sector Modernization (Global)

Banks and insurance companies continue upgrading mainframes, engineered systems, and hybrid cloud architectures to meet compliance, latency, and security requirements.

Energy-Efficient Nordic Data Centers

Countries like Norway, Sweden, and Denmark operate renewable-powered, extremely low-PUE data centers, showcasing optimal efficiency for AI and cloud operations.

Global Regional Analysis Including Government Initiatives & Policies

North America

- Home to the largest hyperscalers and cloud providers.

- Federal and state-level tax incentives, land grants, and power agreements influence data center site selection.

- Strong focus on energy grid upgrades, data sovereignty for regulated sectors, and clean energy procurement.

- Rapid expansion of AI-specific infrastructure.

Europe

- Highly regulated environment emphasizing sustainability and data protection.

- EU Green Deal and local emissions policies require low-PUE designs.

- Some countries impose moratoriums or strict caps on new data center construction to manage environmental impact.

- Growth strongest in the Nordics, Frankfurt, London, and Paris.

Asia-Pacific

- China drives massive domestic cloud and AI infrastructure.

- India offers incentives such as land subsidies, tax exemptions, and data localization rules supporting new builds.

- Southeast Asia (Singapore, Malaysia, Indonesia) is one of the fastest-growing regions due to cloud adoption and digital transformation.

- Japan and Korea invest heavily in edge and high-reliability enterprise data centers.

Middle East & Africa

- UAE, Saudi Arabia, and Qatar lead with large hyperscale zones and government-backed digital economy initiatives.

- Africa is experiencing new colocation and edge deployments, often supported by international investment.

- Power availability and cost remain constraints in some markets, driving interest in modular and renewable-powered designs.

Latin America

- Brazil, Mexico, and Chile lead regional data center growth.

- Governments encourage foreign investment through tax incentives and simplified zoning policies.

- Demand fueled by cloud adoption, fintech growth, and the need for local data storage and redundancy.

- Energy reliability influences site planning, boosting interest in green power and microgrids.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: IT Outsourcing Market Revenue, Global Presence, and Strategic Insights by 2035