Contract Development and Manufacturing Organization (CDMO) Market Size

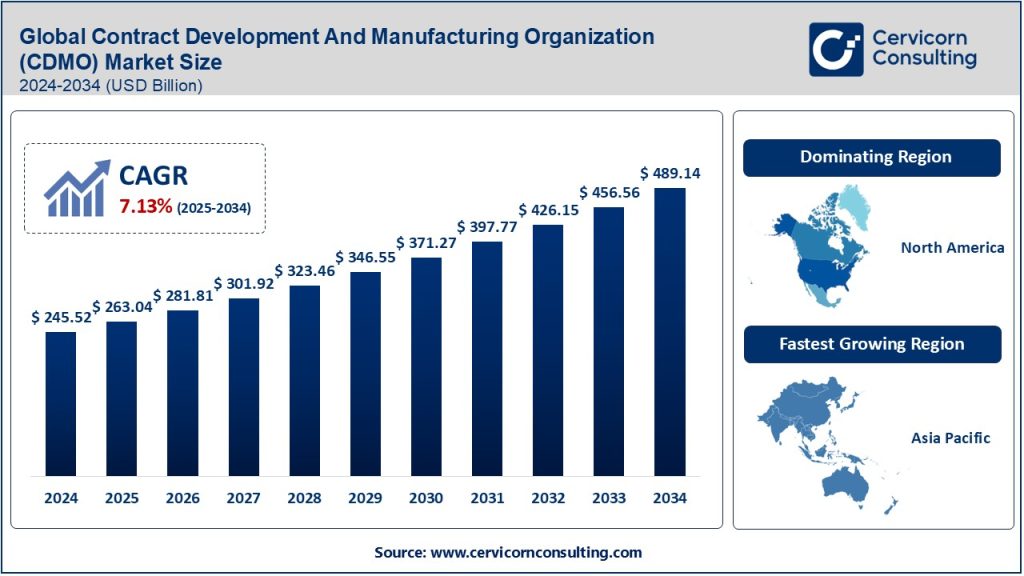

The global contract development and manufacturing organization (CDMO) market was worth USD 245.52 billion in 2024 and is anticipated to expand to around USD 489.14 billion by 2034, registering a compound annual growth rate (CAGR) of 7.13% from 2025 to 2034.

What is the Contract Development and Manufacturing Organization (CDMO) Market?

The Contract Development and Manufacturing Organization (CDMO) market refers to the outsourcing industry within the pharmaceutical, biotechnology, and medical device sectors. CDMOs provide comprehensive services that include drug development, clinical trials, commercial production, regulatory compliance, and packaging. These organizations help pharmaceutical and biotechnology companies accelerate drug development and reduce costs by offering specialized expertise, cutting-edge technologies, and manufacturing capabilities without the need for extensive in-house infrastructure.

Why is the Contract Development and Manufacturing Organization (CDMO) Market Important?

The CDMO market plays a crucial role in the pharmaceutical and biotechnology industries by enabling companies to focus on core research and innovation while outsourcing critical development and manufacturing processes. The importance of CDMOs stems from their ability to streamline drug development, ensure regulatory compliance, improve efficiency, and facilitate faster market entry. With increasing demand for personalized medicine, biopharmaceuticals, and complex drug formulations, CDMOs serve as strategic partners for pharmaceutical companies seeking scalable and flexible solutions.

Contract Development and Manufacturing Organization (CDMO) Market Growth Factors

The growth of the CDMO market is driven by factors such as increasing pharmaceutical R&D expenditures, rising demand for biologics and cell & gene therapies, stringent regulatory requirements, and the growing complexity of drug development. Additionally, the trend of pharmaceutical companies shifting towards virtual and asset-light business models further propels the demand for CDMO services. Emerging markets, technological advancements, and the rise of biosimilars also contribute to the expansion of the CDMO industry globally.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2577

Contract Development and Manufacturing Organization (CDMO) Market Top Companies

- IQVIA

- Specialization: Data analytics, clinical research, contract manufacturing

- Key Focus Areas: Real-world evidence, patient engagement, drug development

- Notable Features: AI-powered insights, global footprint in clinical trials

- 2024 Revenue (approx.): $14 billion

- Market Share (approx.): 10%

- Global Presence: North America, Europe, Asia-Pacific, Latin America

- ICON plc

- Specialization: Clinical research, regulatory services, laboratory testing

- Key Focus Areas: Oncology, rare diseases, real-world data services

- Notable Features: Strong clinical network, digital health integration

- 2024 Revenue (approx.): $7 billion

- Market Share (approx.): 5%

- Global Presence: U.S., Europe, Asia, Australia

- Syneos Health

- Specialization: Biopharmaceutical solutions, commercialization, consulting

- Key Focus Areas: Late-stage development, post-market surveillance

- Notable Features: End-to-end outsourcing solutions, AI-driven trials

- 2024 Revenue (approx.): $6.5 billion

- Market Share (approx.): 4%

- Global Presence: North America, Europe, Asia-Pacific

- Vetter

- Specialization: Fill & finish, aseptic manufacturing, packaging

- Key Focus Areas: Parenteral drugs, biologics, personalized medicine

- Notable Features: High-quality sterile manufacturing, extensive automation

- 2024 Revenue (approx.): $2.5 billion

- Market Share (approx.): 2%

- Global Presence: Europe, North America, Asia

- Parexel International (MA) Corporation

- Specialization: Clinical trials, regulatory compliance, commercial strategy

- Key Focus Areas: Oncology, rare diseases, regulatory submissions

- Notable Features: Patient-centric trials, advanced data analytics

- 2024 Revenue (approx.): $5 billion

- Market Share (approx.): 3%

- Global Presence: U.S., Europe, Asia-Pacific, Latin America

Leading Trends and Their Impact

- Adoption of Artificial Intelligence and Machine Learning

- AI and ML are revolutionizing clinical trials, predictive analytics, and quality control. CDMOs are leveraging these technologies to enhance drug discovery, optimize production, and streamline regulatory submissions.

- Rise of Biologics and Cell & Gene Therapies

- Increasing demand for biologics has led to investments in specialized biopharmaceutical CDMO services. Cell & gene therapy manufacturing requires complex processes, and CDMOs are expanding capabilities to meet growing demand.

- Expansion of Small and Virtual Pharma Partnerships

- Small and virtual pharma companies are increasingly outsourcing drug development and manufacturing to CDMOs, driving market growth. This trend allows innovative startups to bring novel therapies to market without infrastructure burdens.

- Regulatory and Quality Compliance Enhancements

- Stricter regulatory standards, such as GMP and FDA guidelines, are pushing CDMOs to invest in compliance-driven processes. Enhanced traceability and digital documentation are becoming industry standards.

- Sustainability and Green Manufacturing Initiatives

- Environmental sustainability is gaining traction in the CDMO industry. Companies are adopting eco-friendly production methods, reducing carbon footprints, and optimizing resource utilization.

Successful Examples of Contract Development and Manufacturing Organization (CDMO) Market Around the World

- Lonza Group (Switzerland)

- Lonza has played a pivotal role in manufacturing COVID-19 vaccines and biologics, leveraging its advanced production facilities.

- WuXi AppTec (China)

- WuXi AppTec provides integrated services for drug development, enabling pharmaceutical companies to accelerate innovation in Asian and Western markets.

- Samsung Biologics (South Korea)

- Samsung Biologics has emerged as a global leader in contract biologics manufacturing, collaborating with major pharmaceutical giants.

- Catalent (USA)

- Catalent specializes in advanced drug delivery technologies, supporting the rapid production of vaccines and biologics.

- Recipharm (Sweden)

- Recipharm focuses on specialized drug formulation, enhancing the production of complex pharmaceuticals and biologics.

Regional Analysis: Government Initiatives and Policies Shaping the Market

- North America

- The U.S. leads the CDMO market, with strong FDA regulations promoting quality manufacturing. Government funding for biotech innovations, tax incentives, and investment in biopharmaceuticals boost the market.

- Europe

- The European Medicines Agency (EMA) regulates CDMO operations, ensuring compliance with stringent quality standards. The EU’s push for self-sufficiency in drug manufacturing is leading to increased investments in domestic CDMOs.

- Asia-Pacific

- Countries like China, India, and South Korea are expanding CDMO capabilities, supported by government incentives, low-cost manufacturing advantages, and strategic international collaborations.

- Latin America

- Brazil and Mexico are emerging as CDMO hubs, with government-backed incentives for pharmaceutical outsourcing. Regulatory improvements and infrastructure development are driving market growth.

- Middle East & Africa

- Governments in the UAE and Saudi Arabia are investing in healthcare and pharmaceutical production, fostering partnerships with global CDMOs to enhance regional drug manufacturing capabilities.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Genetic Testing Market Size, Trends, Growth Drivers, and Key Players (2024-2033)