Cell and Gene Therapy Manufacturing Market Size

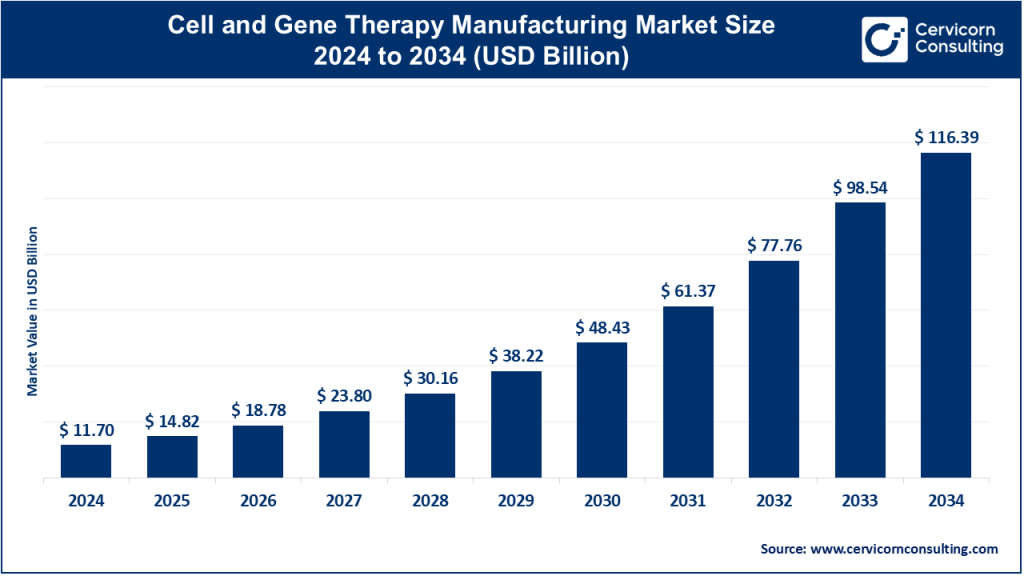

The global cell and gene therapy manufacturing market size was worth USD 11.70 billion in 2024 and is anticipated to expand to around USD 116.39 billion by 2034, registering a compound annual growth rate (CAGR) of 26.71% from 2026 to 2035.

Cell and Gene Therapy Manufacturing Market Growth Factors

The cell and gene therapy manufacturing market is propelled by rapid advancements in genetic engineering, including optimized viral vector platforms such as AAV and lentivirus, more precise genome editing tools like CRISPR/Cas systems, and improved cell processing technologies that increase yield and reduce contamination risk. Rising numbers of clinical candidates and therapy approvals are transitioning R&D demand into commercial manufacturing requirements. Investments into fully automated, closed-system bioprocessing tools and digitized quality systems are lowering production costs and enabling scalability.

Outsourcing to CDMOs continues to surge, reducing capital burden for small and mid-sized biotechs while accelerating time-to-clinic. Government incentives, regulatory guidance tailored for CGTs, and global expansion of GMP-grade vector production further support market growth. The shift from autologous therapies toward allogeneic and in vivo gene therapies, which offer batch manufacturing efficiencies, is amplifying demand for industrialized CGT production platforms.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2365

What Is the Cell and Gene Therapy Manufacturing Market?

The CGT manufacturing market encompasses the full ecosystem required to produce living medicines. It includes viral vector production, plasmid manufacturing, gene editing processes, cell expansion, purification, formulation, fill-finish, quality control, quality assurance, and regulatory compliance activities. Manufacturers operate within stringent Good Manufacturing Practice (GMP) guidelines due to the complexity, biological variability, and high-risk nature of these therapies. The market involves both in-house manufacturing by large pharmaceutical companies and outsourced development and production through specialized CDMOs.

CGT manufacturing differs from traditional biologics due to reliance on living starting materials, extremely tight timelines (e.g., autologous CAR-T cycles), and limited batch sizes. These therapies also require advanced cold-chain systems, contamination-resistant equipment, specialized analytical assays, and seamless chain-of-identity tracking. As the industry matures, manufacturing is becoming the critical enabler of commercialization and global patient access.

Why It Is Important

Cell and gene therapies offer potential cures or long-lasting treatments for diseases previously considered untreatable—including rare genetic disorders, hematological cancers, retinal diseases, and neurodegenerative conditions. However, their success is fundamentally constrained by manufacturing capacity and capabilities. Manufacturing determines:

- Product safety and sterility

- Therapeutic potency and consistency

- Time-to-patient delivery

- Cost-of-goods and commercial viability

- Global accessibility

The market is also economically significant. Regions that develop strong CGT manufacturing hubs benefit from job creation, R&D investment, infrastructure expansion, and international biotech partnerships. Manufacturing excellence is key to proving long-term sustainability, lowering therapy costs, and enabling scalable treatment platforms.

Top Cell and Gene Therapy Manufacturing Companies

Below are detailed profiles of the companies you requested, including specialization, key focus areas, notable features, revenue for 2024, market presence, and strategic activities.

1. Novartis AG

Specialization

Novartis is a leader in commercial cell and gene therapies, manufacturing CAR-T therapy Kymriah and participating in the commercialization of in vivo gene therapies such as Zolgensma. The company has extensive in-house GMP facilities and strategic partnerships for vector production.

Key Focus Areas

- Scaling autologous CAR-T production

- Improving turnaround times and logistics

- Global manufacturing capacity expansion

- Integration of automation and digital systems

Notable Features

Novartis was one of the first global pharmas to launch a commercial CAR-T therapy, setting benchmarks in cold-chain logistics, quality control, and global distribution of living cell products.

2024 Revenue

Approximately USD 51.7 billion.

Market Share & Global Presence

A significant contributor within the commercial CGT landscape with operations spanning North America, Europe, Asia-Pacific, and emerging markets.

2. Gilead Sciences, Inc. (Including Kite Pharma)

Specialization

Through its subsidiary Kite Pharma, Gilead is a global commercial leader in CAR-T therapies, with robust autologous cell processing capabilities.

Key Focus Areas

- CAR-T manufacturing optimization

- Global expansion of therapy availability

- Increasing production volume for Yescarta and Tecartus

- Integration of viral vector and cell-processing facilities

Notable Features

Kite Pharma has treated thousands of patients globally with CAR-T therapies, making it one of the most advanced organizations in commercial cell therapy manufacturing.

2024 Revenue

Gilead Sciences reported USD 28.8 billion in total revenue.

Kite’s CAR-T sales contributed roughly USD 2 billion.

Global Presence

Manufacturing facilities in the U.S. and Europe, and commercialization extending across multiple continents.

3. Bluebird Bio, Inc.

Specialization

Bluebird Bio focuses on lentiviral vector-based gene therapies for rare and severe genetic diseases. It is known for pioneering work in ex vivo gene therapy.

Key Focus Areas

- Rare disease gene therapy manufacturing

- Autologous cell-processing methods

- Optimizing CMC processes for commercialization

- Strengthening vector production partnerships

Notable Features

Bluebird has launched first-in-class gene therapies but has faced commercialization and financial hurdles, resulting in restructuring and strategic reevaluation.

2024 Revenue

Modest revenue in the low tens of millions, reflecting early commercial-stage activities.

Global Presence

Primarily U.S.-focused with selective international partnerships.

4. Kite Pharma, Inc. (A Gilead Company)

Although part of Gilead, Kite merits individual mention due to its specialized manufacturing footprint.

Specialization

Commercial CAR-T manufacturing at scale.

Key Focus Areas

- Optimizing autologous manufacturing cycle times

- Increasing production for Yescarta and Tecartus

- Global interoperability of processing facilities

Notable Features

Among the first organizations to successfully scale commercial CAR-T therapies, Kite’s best-in-class manufacturing turnaround times are industry benchmarks.

2024 Revenue

Revenue captured under Gilead’s broader financial reporting.

Global Presence

Commercial distribution across the U.S., EU, and select regions in Asia-Pacific.

5. Editas Medicine, Inc.

Specialization

A pioneer in CRISPR-based in vivo gene editing.

Key Focus Areas

- In vivo gene-editing programs

- Precision editing for ocular and hematological diseases

- Collaboration-based manufacturing initiatives

Notable Features

One of the few companies with clinical-stage CRISPR therapeutics, Editas emphasizes developing scalable manufacturing for gene editing components.

2024 Revenue

Approximately USD 32.3 million, primarily from partnerships and research collaborations.

Global Presence

Clinical collaborations across the U.S. with select international research partners.

Leading Trends and Their Impact

1. Rise of Allogeneic Therapies

Allogeneic products are shifting the industry toward batch-based manufacturing with economies of scale. This trend reduces per-dose cost and enables commercial viability for large patient populations.

2. Automation and Closed-System Processing

Automated systems reduce contamination risk, ensure consistency, and reduce labor dependency. This increases throughput and accelerates regulatory compliance.

3. Expansion of Specialized CDMOs

CDMOs are becoming essential partners as smaller biotech firms avoid the cost of building GMP suites. This has led to a dramatic increase in outsourcing for vector production, fill-finish, and analytical testing.

4. Potency and Analytical Standardization

Advanced assay development is becoming a major competitive advantage as regulators demand robust potency data, comparability analyses, and long-term characterization.

5. Regulatory Evolution

Agencies worldwide are issuing new guidelines for ATMPs, covering manufacturing changes, CMC expectations, comparability studies, and long-term follow-up. This drives greater investment in quality systems and traceability.

6. Pricing and Market Access Pressure

High therapy costs push manufacturers to optimize yields and reduce production timelines to lower cost-of-goods and improve payer acceptance.

Successful Examples of CGT Manufacturing Around the World

1. Novartis — Kymriah & Zolgensma

Demonstrated global-scale manufacturing and distribution of both CAR-T and gene therapy products. Their cold-chain logistics and quality control systems are considered reference models.

2. Gilead/Kite — Yescarta & Tecartus

Thousands of patients treated worldwide highlight the success of Kite’s distributed manufacturing model, enabling rapid autologous turnaround.

3. Leading CDMOs (Lonza, Catalent, WuXi AppTec)

These companies have scaled viral vector and cell therapy suites globally, supporting dozens of CGT developers and proving the viability of the outsourcing model.

4. UK Cell and Gene Therapy Catapult

A globally recognized government–industry initiative that provides manufacturing infrastructure, translational support, and regulatory expertise to accelerate CGT programs in the UK.

Global Regional Analysis — Government Initiatives and Policies

United States

- FDA actively releases guidelines specific to cell and gene therapies.

- Strong support for ATMP development through accelerated pathways.

- Federal and state-level grants promote manufacturing capacity expansion.

- The U.S. remains the largest market due to strong biotech presence and regulatory clarity.

European Union

- EMA offers centralized ATMP approval to streamline cross-border commercialization.

- Programs support academic and early-phase developers with scientific advice.

- EU countries, such as Germany and the UK, have invested heavily in GMP infrastructure.

- Long-term follow-up and post-market surveillance requirements influence manufacturing scale and lifecycle planning.

United Kingdom

- The Cell and Gene Therapy Catapult is a global model for public-private partnership.

- Government provides workforce training programs, GMP site funding, and translational research support.

Japan

- PMDA offers accelerated approval pathways for regenerative and gene therapies.

- Japan’s conditional approval framework enables earlier market entry with post-market obligations.

- Strong government investments in local manufacturing attract global partnerships.

China

- Rapid modernization of regulatory frameworks for CGTs.

- National strategies focus on building domestic vector production capacity.

- Increasing investment in clinical trial infrastructure and GMP suite expansion.

South Korea & Singapore

- Proactive regulations and incentives for advanced therapies.

- Investments in national biomanufacturing hubs.

- Strong alignment of government, academia, and industry.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Space Cloud Computing Market Growth Drivers, Trends, Key Players and Regional Insights by 2035