Automotive Software and Electronics Market Size

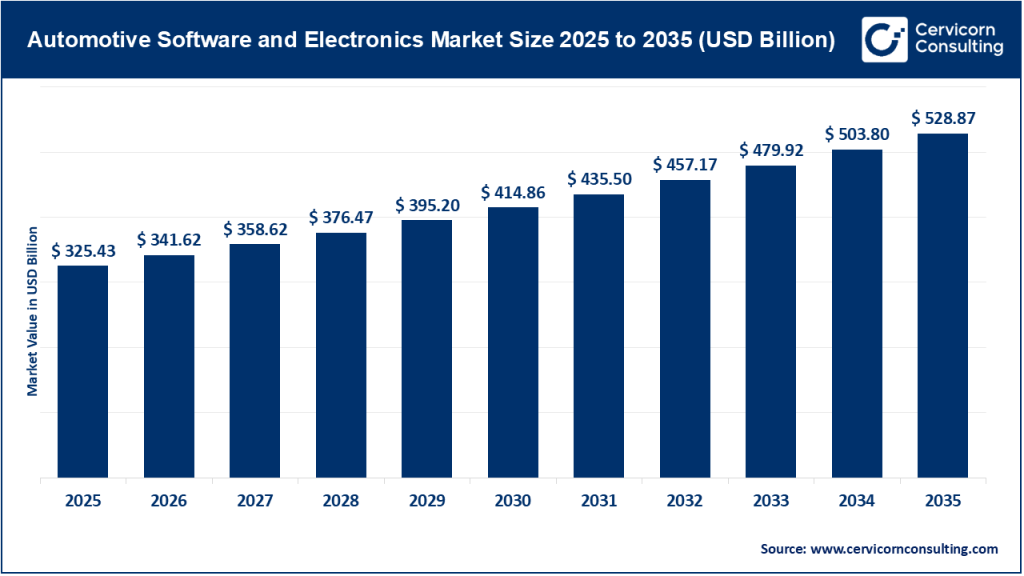

The global automotive software and electronics market size was worth USD 325.43 billion in 2025 and is anticipated to expand to around USD 528.87 billion by 2035, registering a compound annual growth rate (CAGR) of 5% from 2026 to 2035.

Automotive Software and Electronics Market Growth Factors

The growth of the automotive software and electronics market is driven by the accelerating adoption of electric vehicles that require sophisticated battery management and power electronics, rising demand for connected and autonomous vehicles supported by advanced sensors and artificial intelligence, increasingly stringent global safety and emission regulations mandating ADAS and digital monitoring systems, the transition toward software-defined vehicle architectures with centralized computing and OTA update capabilities, growing consumer preference for enhanced digital in-car experiences, and the expanding use of data-driven services such as predictive maintenance, vehicle diagnostics, and subscription-based features, all of which collectively fuel sustained investment and innovation across the automotive value chain.

What Is the Automotive Software and Electronics Market?

The automotive software and electronics market encompasses all digital and electronic components that enable vehicle intelligence, control, communication, and automation. This includes embedded software, semiconductors, sensors, actuators, microcontrollers, ECUs, connectivity modules, displays, and power electronics integrated into vehicles.

Key segments of this market include:

- Advanced Driver-Assistance Systems (ADAS): Software and electronic systems that support functions such as adaptive cruise control, lane-keeping assistance, automatic emergency braking, and parking assistance.

- Infotainment and Connectivity: Digital dashboards, touchscreen interfaces, navigation systems, smartphone integration, voice recognition, and cloud-connected services.

- Powertrain and Energy Management: Electronics and software that manage internal combustion engines, hybrid systems, and electric powertrains, including battery management systems and inverters.

- Vehicle Networking and Control: Communication protocols and controllers that allow various vehicle systems to operate seamlessly together.

- Telematics and Diagnostics: Systems that enable real-time data exchange, fleet management, remote diagnostics, and predictive maintenance.

As vehicles become increasingly autonomous, electrified, and connected, the role of software and electronics continues to expand, transforming vehicles into intelligent, upgradable platforms.

Get a Free Sample: https://www.cervicornconsulting.com/sample/2884

Why Is the Automotive Software and Electronics Market Important?

The importance of the automotive software and electronics market lies in its ability to redefine vehicle performance, safety, sustainability, and user experience. Software-driven systems play a crucial role in reducing accidents through ADAS, optimizing energy efficiency to meet environmental goals, and enabling seamless connectivity between vehicles and digital ecosystems.

From an industry perspective, software and electronics are also reshaping business models. Automakers are moving beyond one-time vehicle sales toward recurring revenue streams through software subscriptions, feature upgrades, and data-driven services. Additionally, regulatory compliance related to emissions, cybersecurity, and safety increasingly depends on advanced electronic systems.

At a broader level, automotive software and electronics are essential to enabling smart mobility solutions, including autonomous driving, shared transportation, and intelligent traffic management, making them foundational to the future of transportation worldwide.

Key Companies in the Automotive Software and Electronics Market

Robert Bosch GmbH

- Company Overview: Robert Bosch GmbH is one of the world’s largest automotive technology suppliers, with a long-standing presence in automotive electronics and embedded software.

- Specialization: Automotive electronics, ADAS, powertrain control systems, sensors, and mobility software.

- Key Focus Areas: Autonomous driving, electrification, artificial intelligence, vehicle control units, and cloud-connected mobility solutions.

- Notable Features: End-to-end system integration, strong R&D capabilities, advanced sensor technologies, and deep partnerships with global automakers.

- 2024 Revenue: Approximately USD 98 billion (total company revenue).

- Market Share: Holds a significant share in global automotive electronics and ADAS segments.

- Global Presence: Strong operations across Europe, North America, Asia-Pacific, and emerging markets.

Bosch’s ability to combine hardware, software, and systems engineering positions it as a cornerstone of next-generation automotive platforms.

Continental AG

- Company Overview: Continental AG is a leading Tier-1 automotive supplier with a strong emphasis on vehicle safety, connectivity, and electronics.

- Specialization: ADAS electronics, radar and sensor systems, vehicle networking, and power electronics.

- Key Focus Areas: Automated driving, intelligent vehicle architectures, braking and chassis control, and e-mobility solutions.

- Notable Features: Expertise in safety-critical systems, domain controllers, and vehicle communication technologies.

- 2024 Revenue: Approximately USD 46 billion.

- Market Share: Strong presence across automotive electronics and safety systems.

- Global Presence: Europe, North America, China, Japan, and other major automotive regions.

Continental’s strategic focus on software-defined vehicles reflects the growing importance of centralized computing and digital vehicle platforms.

Denso Corporation

- Company Overview: Denso Corporation is one of the world’s largest automotive component manufacturers and a key supplier to global OEMs.

- Specialization: Power electronics, ECUs, sensors, thermal systems, and vehicle control software.

- Key Focus Areas: Electrification, ADAS, embedded software development, and energy-efficient vehicle systems.

- Notable Features: Strong manufacturing excellence, reliability, and long-term OEM relationships.

- 2024 Revenue: Approximately USD 48 billion.

- Market Share: Holds a substantial share in automotive electronics, particularly in Asia-Pacific.

- Global Presence: Japan, North America, Europe, China, and Southeast Asia.

Denso’s continued investment in software engineering supports its strategy to meet the growing complexity of modern vehicle systems.

NVIDIA Corporation

- Company Overview: NVIDIA is a global technology leader specializing in high-performance computing and artificial intelligence, with a rapidly expanding automotive segment.

- Specialization: AI-based automotive computing platforms, autonomous driving software, and vehicle simulation tools.

- Key Focus Areas: Centralized vehicle computing, AI perception and planning, ADAS, and autonomous driving platforms.

- Notable Features: Scalable computing architecture, strong developer ecosystem, and advanced AI frameworks.

- 2024 Automotive Revenue: Approximately USD 1.7 billion.

- Market Share: A leading player in automotive AI and autonomous driving compute platforms.

- Global Presence: Strong adoption across North America, Europe, China, and other major automotive markets.

NVIDIA’s software-centric approach highlights the increasing convergence of the automotive and technology industries.

Aptiv PLC

- Company Overview: Aptiv PLC is a global automotive technology company focused on enabling future mobility through advanced electrical and electronic architectures.

- Specialization: Vehicle electrical systems, software platforms, connectivity, and ADAS solutions.

- Key Focus Areas: Smart vehicle architecture, zonal controllers, middleware software, and connected vehicle solutions.

- Notable Features: High-speed data architectures, modular software platforms, and strong systems integration expertise.

- 2024 Revenue: Approximately USD 20 billion.

- Market Share: A key contributor to advanced vehicle electronics and software architectures.

- Global Presence: Operations across North America, Europe, Asia-Pacific, and Latin America.

Aptiv plays a critical role in supporting the shift toward software-defined and electrified vehicles.

Leading Trends and Their Impact

Software-Defined Vehicles

Vehicles are transitioning from hardware-centric designs to software-defined architectures, enabling continuous feature upgrades, reduced complexity, and faster innovation cycles.

Electrification

Electric and hybrid vehicles require advanced electronics and software to manage batteries, power distribution, and energy efficiency, significantly expanding the market scope.

Over-The-Air Updates

OTA updates allow automakers to remotely enhance vehicle functionality, fix software issues, and introduce new features, transforming vehicle ownership experiences.

Artificial Intelligence Integration

AI is increasingly used for perception, driver monitoring, predictive maintenance, and autonomous decision-making, improving safety and efficiency.

Cybersecurity and Functional Safety

As vehicles become more connected, robust cybersecurity and compliance with functional safety standards are essential to protect systems and user data.

Successful Examples of Automotive Software and Electronics Around the World

- Tesla: Pioneered OTA updates and software-centric vehicle design, enabling continuous performance and feature enhancements.

- Mercedes-Benz: Integrated advanced computing platforms for automated driving and premium digital experiences.

- BMW: Leveraged advanced driver-assistance software and centralized computing for next-generation mobility.

- Chinese EV Manufacturers: Rapidly adopted software-defined vehicle platforms and smart connectivity solutions supported by strong domestic ecosystems.

These examples demonstrate how software and electronics drive competitive differentiation across global markets.

Global Regional Analysis Including Government Initiatives and Policies

Asia-Pacific

Asia-Pacific dominates the automotive software and electronics market due to high vehicle production, strong EV adoption, and government support. China’s policies promoting electric mobility, smart transportation, and digital infrastructure have accelerated adoption of vehicle electronics and software. Japan emphasizes functional safety, quality standards, and R&D investment, while South Korea benefits from early deployment of 5G-enabled vehicle connectivity. India’s government initiatives, including incentives for electronics manufacturing and electric mobility, are fostering domestic automotive electronics ecosystems.

North America

North America’s market growth is driven by strong demand for connected, autonomous, and premium vehicles. Government initiatives supporting semiconductor manufacturing, clean energy, and vehicle safety standards encourage innovation in automotive electronics and software. The region also leads in software monetization models and AI-driven mobility solutions.

Europe

Europe’s automotive software and electronics market is shaped by strict emission and safety regulations, strong EV incentives, and cybersecurity requirements. European governments actively support clean mobility, autonomous driving pilots, and digital vehicle standards, driving adoption of advanced electronics and embedded software.

Latin America, Middle East, and Africa

These regions represent emerging opportunities, with gradual adoption of advanced vehicle electronics driven by urbanization, infrastructure development, and regulatory alignment with global safety standards. Cost-effective electronics and connected features are increasingly incorporated into new vehicle models.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Spatial Computing Market Revenue, Trends, and Strategic Insights by 2035