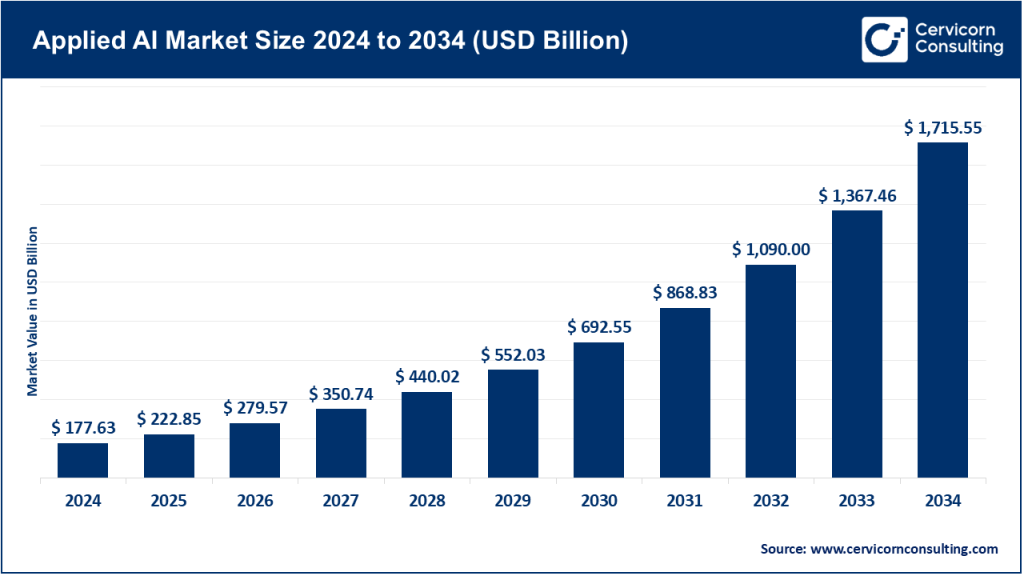

Applied AI Market Size

What is the applied AI market?

Applied AI denotes products, platforms, and services that embed AI (including machine learning, deep learning, natural language processing, computer vision, and related techniques) into concrete workflows and vertical solutions. Unlike basic-research AI or generic foundational models, applied AI packages modeling, data pipelines, user interfaces, integrations, governance, and domain knowledge to deliver measurable business outcomes: cost reduction, revenue uplift, improved safety, automation of repetitive tasks, faster decisioning, or higher personalization. The market spans vendors (cloud providers, AI platforms, specialized startups), system integrators, professional services, hardware vendors (accelerators & edge devices), and end users across verticals such as manufacturing, healthcare, finance, retail, logistics, and public sector.

Applied AI Market — Growth Factors

Demand for applied AI is being propelled by a convergence of factors: exploding availability of labeled and unlabeled data from sensors and digital systems; ubiquitous cloud and edge compute with scalable GPU/accelerator access; dramatic performance gains in models (especially foundation models and specialized transformers) that make many previously infeasible tasks practical; industry pressure to automate to cut costs and improve service levels; growing investor and corporate funding for AI R&D and commercialization; maturing MLOps and governance tooling that reduce deployment risk.

Rising acceptance of AI outcomes by users and regulators (when paired with explainability and safety practices); and, crucially, government incentives and regulatory clarity in many regions that reduce policy uncertainty while promoting trustworthy AI — together driving adoption across enterprises and fueling an applied AI market growing at double-digit CAGRs in the 2020s.

Why applied AI is important

Applied AI converts technical advances into tangible value. Where raw models are theory, applied AI is practice — shaving days off diagnosis time, predicting supply chain disruptions before they cascade, tailoring customer offers in real time, and automating repetitive back-office tasks that historically consumed expensive human time. This matters because business leaders increasingly judge technology by outcomes (efficiency, revenue, resilience), not novelty. Applied AI also acts as a multiplier: once domain-specific models are deployed, they generate data and feedback that make the next generation of models more accurate and cost-effective, enabling a virtuous cycle of continuous improvement.

Applied AI Market — Top Companies (profiles)

Below are concise profiles for the companies you listed. Where companies publish discrete “AI revenue” numbers that are public, I include them; for product focus and presence I summarize company disclosures and industry reporting.

Amazon Web Services (AWS) — Amazon

- Specialization: Cloud infrastructure and AI/ML platform services (SageMaker, Bedrock, AWS Inferentia/Trainium accelerators), integrated cloud data services.

- Key focus areas: Scalable model training and inference, MLOps, foundation model hosting, enterprise AI adoption, vertical solutions via AWS partners.

- Notable features: Deep integration with cloud services, variety of instance types and specialized chips, broad partner ecosystem.

- 2024 revenue: AWS reported approximately $107.6 billion in revenue for 2024 (AWS segment).

- Market share & global presence: Leading global IaaS/PaaS provider with large global data center footprint; strong in enterprise cloud and with ISVs.

Apple

- Specialization: On-device AI, personalization, privacy-preserving ML for consumer devices (iPhone, Mac, watchOS).

- Key focus areas: On-device inference, user privacy, hardware acceleration (Neural Engines), developer tools.

- Notable features: Tight hardware-software integration enabling fast, private inference on billions of devices.

- 2024 revenue: Apple’s 2024 total revenue exceeded $380 billion across all product lines.

Baidu

- Specialization: Chinese leader in search + AI; Ernie large models, autonomous driving, cloud AI services.

- Key focus areas: LLMs for Chinese language, cloud AI, autonomous vehicles (Apollo), enterprise adoption in China.

- Notable features: Strong Chinese language models and local market presence; developing domestic silicon/accelerators.

- 2024 revenue: Approximately $18.6 billion.

Google (Alphabet Inc.)

- Specialization: Cloud AI services (Vertex AI), generative AI models (Gemini), search & ads integration.

- Key focus areas: Large models, multimodal AI, MUM/Gemini in search, enterprise cloud AI tooling.

- Notable features: Research leadership, huge data and compute scale, integration of models into search and workspace products.

- 2024 revenue: Alphabet’s total revenue reached ~$318 billion in 2024.

IBM

- Specialization: Enterprise AI systems, Watson Health/history of vertical AI, hybrid cloud & explainable AI.

- Key focus areas: Regulated industries (healthcare, finance), AI governance, model risk management.

- Notable features: Strong consulting/services arm for enterprise transformation and regulated compliance.

- 2024 revenue: Approximately $62 billion.

Intel

- Specialization: AI accelerators (CPUs, Habana accelerators), edge compute silicon, embedded AI.

- Key focus areas: Edge inference, data center chips, silicon-software co-design.

- Notable features: Broad silicon portfolio for inference and edge, partnerships with cloud and OEMs.

- 2024 revenue: Around $55 billion.

Meta

- Specialization: Large-scale models for social media, content understanding, ads personalization, and VR/AR (Metaverse).

- Key focus areas: Foundation models, recommendation systems, multimodal content understanding.

- Notable features: Massive internal datasets, open research culture, investments in open models and tooling.

- 2024 revenue: ~$142 billion.

Microsoft

- Specialization: Cloud + AI platform (Azure AI), deep partnership with OpenAI, Office/Teams integration.

- Key focus areas: Enterprise copilots, cloud-based model hosting, productivity apps augmentation.

- Notable features: Large enterprise reach and commercial agreements to embed models into Microsoft 365 and Azure.

- 2024 revenue: $245 billion total revenue.

NVIDIA

- Specialization: GPUs and accelerators for training and inference; AI ecosystem (CUDA, SDKs).

- Key focus areas: Data center GPUs, AI software stacks, specialized Blackwell/Hopper architectures for generative AI.

- Notable features: Dominant supplier of accelerators for many large model training workloads; heavy growth tied to AI demand.

- 2024 revenue: ~$60.9 billion.

OpenAI

- Specialization: Large language and multimodal models (ChatGPT family, API products) and developer tools.

- Key focus areas: Foundation models as a platform, developer APIs, enterprise products (ChatGPT Enterprise).

- Notable features: Rapid adoption, heavy usage across consumer and enterprise segments, close cloud partnerships.

- 2024 revenue (estimate): Between $1.5–$2 billion with strong growth into 2025.

Leading trends in applied AI and their impact

- Foundation Models + Vertical Specialization: Large, general models act as “backbones” that get adapted to domain tasks. Impact: faster time-to-solution, but higher demand for domain data and governance.

- Democratization via MLOps and AutoML: Tooling lowers barriers to production. Impact: higher deployment velocity and improved governance, but potential technical debt.

- Edge & On-Device AI Growth: Privacy and latency requirements push workloads to devices. Impact: growth of inference hardware and distributed architectures.

- AI Governance & Explainability: Regulatory and customer expectations drive demand for transparency. Impact: higher compliance costs but stronger trust.

- Verticalized AI SaaS: Domain-tuned AI apps deliver faster ROI. Impact: new vendors emerge, incumbents embed AI across sectors.

- Compute & Supply Chain Dynamics: Access to high-end accelerators remains a chokepoint. Impact: geopolitical dynamics shape adoption pace and competition.

Successful examples of applied AI around the world

- Supply chain forecasting (global retail): Models reduce stockouts and optimize promotions.

- Predictive maintenance (manufacturing): Factories use anomaly detection to prevent costly downtime.

- Medical imaging (healthcare): AI triages scans, supporting radiologists in faster, more accurate diagnoses.

- Fraud detection (financial services): Real-time models cut fraudulent transactions.

- Agriculture yield prediction (India, Brazil): Satellite imagery boosts farm efficiency.

- Enterprise copilots and chatbots: Improve customer service and employee productivity worldwide.

Global regional analysis — government initiatives & policies shaping the market

United States

The U.S. has prioritized responsible AI development through executive actions, frameworks, and agency guidance. The 2023 Executive Order on Safe, Secure, and Trustworthy AI set principles for industry coordination, safety testing, and risk mitigation. NIST published an AI Risk Management Framework that many enterprises adopt voluntarily. These initiatives encourage adoption while emphasizing governance.

European Union

The EU AI Act (finalized in 2024) created a risk-based framework, imposing obligations on “high-risk” AI systems and requiring transparency and conformity. This ensures citizen rights protection while guiding vendors in building compliant applied AI.

China

China pursues an aggressive national AI strategy, funding AI research, computing capacity, and commercialization of models. Policies encourage rapid deployment in autonomous driving, healthcare, and smart cities while emphasizing sovereignty over data and compute.

Other regions

- India: Launched national AI programs focusing on healthcare, agriculture, and digital inclusion.

- UK & Canada: Strong initiatives in AI safety, governance, and talent development.

- Middle East & Southeast Asia: Sovereign funds and national strategies are catalyzing AI infrastructure and innovation ecosystems.

Regulatory & policy impacts on vendors and customers

- Compliance costs rise: Vendors invest in documentation and monitoring for regulatory adherence.

- Market segmentation: Audited and explainable AI vendors gain premium access in regulated industries.

- Localization & sovereignty: Some regions require local infrastructure or restrict cross-border data flows.

- Standardization pushes: International frameworks (ISO, NIST) increase trust and comparability for enterprise adoption.

To Get Detailed Overview, Contact Us: https://www.cervicornconsulting.com/contact-us

Read Report: Carbon Black Market Key Players, Trends, and Global Outlook by 2034